Latest Posts

This article was updated on February 13, 2024. Traditional credit data has long been a reliable source for measuring consumers' creditworthiness. While that's not changing, new types of alternative credit data are giving lenders a more complete picture of consumers' financial health. With supplemental data, lenders can better serve a wider variety of consumers and increase financial access and opportunities in their communities. What is alternative credit data? Alternative credit data, also known as expanded FCRA-regulated data, is data that can help you evaluate creditworthiness but isn't included in traditional credit reports.1 To comply with the Fair Credit Reporting Act (FCRA), alternative credit data must be displayable, disputable and correctable. Lenders are increasingly turning to new types and sources of data as the use of alternative credit data becomes the norm in underwriting. Today, lenders commonly use one or more of the following: Alternative financial services data: Alternative financial services (AFS) credit data can include information on consumers' use of small-dollar installment loans, single-payment loans, point-of-sale financing, auto title loans and rent-to-own agreements. Consumer permission data: With a consumer's permission, you can get transactional and account-level data from financial accounts to better assess income, assets and cash flow. The access can also give insight into payment history on non-traditional accounts, such as utilities, cell phone and streaming services. Rental payment history: Property managers, electronic rent payment services and rent collection companies can share information on consumers' rent payment history and lease terms. Full-file public records: Local- and state-level public records can tell you about a consumer's professional and occupational licenses, education, property deeds and address history. Buy Now Pay Later (BNPL) data: BNPL tradeline and account data can show you payment and return histories, along with upcoming scheduled payments. It may become even more important as consumers increasingly use this new type of point-of-sale financing. By gathering more information, you can get a deeper understanding of consumers' creditworthiness and expand your lending universe. From market segmentation to fraud prevention and collections, you can also use alternative credit data throughout the customer lifecycle. READ: 2023 State of Alternative Credit Data Report Challenges in underwriting today While unemployment rates are down, high inflation, rising interest rates and uncertainty about the economy are impacting consumer sentiment and the lending environment.2 Additionally, lenders may need to shift their underwriting approaches as pandemic-related assistance programs and loan accommodations end. Lenders may want to tighten their credit criteria. But, at the same time, consumers are becoming accustomed to streamlined application processes and responses. A slow manual review could lead to losing customers. Alternative credit data can help you more accurately assess consumers' creditworthiness, which may make it easier to identify high-risk applicants and find the hidden gems within medium-risk segments. Layering traditional and alternative credit data with the latest approaches to model building, such as using artificial intelligence, can also help you implement precise and predictive underwriting strategies. Benefits of using alternative data for credit underwriting Using alternative data for credit underwriting — along with custom credit attributes and automation — is the modern approach to a risk-based credit approval strategy. The result can offer: A greater view of consumer creditworthiness: Personal cash flow data and a consumer's history of making (or missing) payments that don't appear on traditional credit reports can give you a better understanding of their financial position. Improve speed and accuracy of credit decisions: The expanded view helps you create a more efficient underwriting process. Automated underwriting tools can incorporate alternative credit data and attributes with meaningful results. One lender, Atlas Credit, worked with Experian to create a custom model that incorporated alternative credit data and nearly doubled its approvals while reducing risk by 15 to 20 percent.3 Increase financial inclusion: There are 28 million American adults who don't have a mainstream credit file and 21 million who aren't scoreable by conventional scoring models.4 With alternative credit data, you may be able to more accurately assess the creditworthiness of adults who would otherwise be deemed thin file or unscorable. Broadening your pool of applications while appropriately managing risk is a measurable success. What Experian builds and offers Experian is continually expanding access to expanded FCRA-regulated data. Our Experian RentBureau and Clarity Services (the leading source of alternative financial credit data) have long given lenders a more complete picture of consumers' financial situation. Experian also helps lenders effectively use these new types of data. You can also incorporate the data into your proprietary marketing, lending and collections strategies. Experian is also using alternative credit data for credit scoring. The Lift Premium™ model can score 96 percent of U.S. adults — compared to the 81 percent that conventional models can score using traditional data.5 The bottom line Lenders have been testing and using alternative credit data for years, but its use in underwriting may become even more important as they need to respond to changing consumer expectations and economic uncertainty. Experian is supporting this innovation by expanding access to alternative data sources and helping lenders understand how to best use and implement alternative credit data in their lending strategies. Learn more 1When we refer to “Alternative Credit Data," this refers to the use of alternative data and its appropriate use in consumer credit lending decisions, as regulated by the Fair Credit Reporting Act. Hence, the term “Expanded FCRA Data" may also apply and can be used interchangeably. 2Experian (2024). State of the Economy Report 3Experian (2020). OneAZ Credit Union [Case Study] 4Oliver Wyman (2022). Financial Inclusion and Access to Credit [White Paper] 5Ibid.

The automotive industry is rapidly evolving and digital marketing is becoming increasingly important. To stay ahead of the competition, it’s essential to understand the top digital audiences in the automotive industry. To help you with this, we recently analyzed audience activation activity and compiled the Auto 2024 Digital Audience Report. The report highlights the top four digital audience categories for the automotive industry: Automotive Lifestyle and Interests Retail Shoppers Purchase Based Demographics For each of the top four categories, the report provides specific audience examples automotive marketers can leverage for specific marketing campaigns. Examples include likely frequent spenders at auto service and repair shops or consumers who are likely to be in the market to buy an Alternate Fuel Electric vehicle in the next 180 days. To learn more about where Experian is seeing the top third-party audience activation, read the Auto 2024 Digital Audience Report.

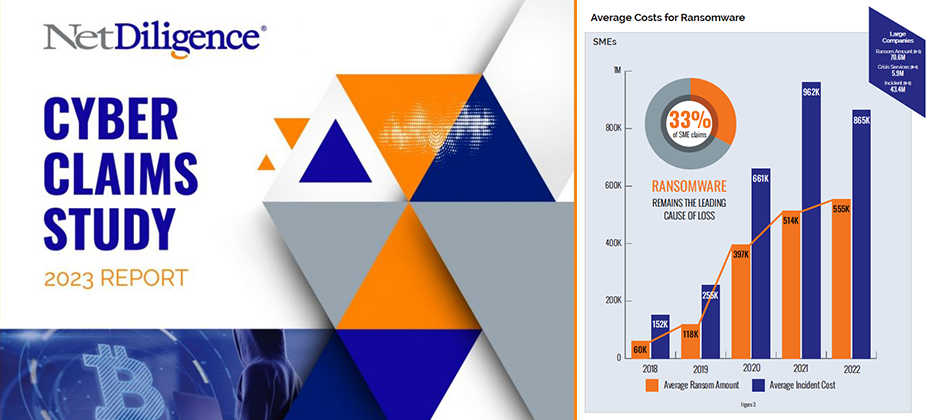

Review of Findings & Front-line Insights Panel Participants: Richard Goldberg (Moderator) – Constangy, Brooks, Smith & Prophete, LLP Michael Bruemmer – Experian Sean Renshw – RSM US, LLP Mark Greisiger – NetDiligence About NetDiligence Cyber Claims Study It is NetDiligence’s 13th year of doing this Cyber Claims Study. A total of 9,028 claims were analyzed during the past five years 2018-2022.An observation from the over 9,000 Cyber Claims (5000 of which are brand new claims this past year in 2023) analyzed is while many of the categories over the last five years have remained the same, the data has changed, sometimes dramatically. About Experian We provide call center coverage, notification coverage, as well as, identity theft protection, and all the consumer resolutions that go along with it for about 5000 data breaches every year, and I was delighted to be on the panel. Key Insights Experian has proudly sponsored the annual NetDiligence Cyber Claims Study for three years. During this time, I’ve witnessed companies adapt and transform their operations to confront the growing tide of cyber threats. The evolution of their infrastructure to anticipate and respond to these challenges has been remarkable and necessary. However, despite my front-row seat in this fast-changing landscape, the results of each study never fail to surprise and intrigue me. The insights from the latest study, conducted in 2023, continue to shape our understanding of the evolving cyber landscape. Ransomware’s Dominance Mark kicked off the discussion by shedding light on the escalating costs associated with cyber incidents. In 2022, the average incident cost for SME organizations remained stable at $169,000 (similar to the combined five-year window from 2018 to 2022 at about 175,000). However, there was a substantial increase for large companies, reaching $20.3 million in 2022 (and if you look at the five-year average, it was about 13 million). This surge raised eyebrows and set the stage for a deep dive into ransomware, a leading cause of concern. Examining Ransomware Trends The conversation swiftly shifted to ransomware, a pervasive threat in the cyber insurance landscape. As I stated, at Experian we see a correlation between the rise in ransomware and third-party breaches. Most of the industry experts on the panel participate in a Ransomware Advisory Group together. Mark brought up a good insight from our advisory group on the brazen tactics employed by threat actors lately, showcasing their intimate knowledge of the cyber insurance world. Business Sectors Under Siege Richard and Sean added to the discussion the top ten business sectors affected by ransomware, with professional services leading the pack. The impact on technology, with a payout of $830,000, stood out as well. Beyond Ransomware The conversation broadened to encompass other types of losses, such as social engineering and business email compromise. The focus on business interruption emerged as a key concern for cyber insurance claims, with the industry grappling with criminal acts versus non-criminal acts. Looking Ahead As the discussion unfolded, industry experts, including myself, expressed eagerness to anticipate the future cyber landscape. Predictions range from the industry mutating to the emergence of new players in the nation-state game. The role of artificial intelligence and innovative solutions from new vendors becomes a focal point of interest. In conclusion, the NetDiligence Cyber Claims Study 2023 Report paints a vivid picture of the challenges and transformations within the cyber insurance domain. The increasing sophistication of threat actors, coupled with evolving business strategies, sets the stage for continuous adaptation and innovation in the fight against cyber threats. As we look ahead, the resilience of businesses and the collaboration between industry stakeholders will play a pivotal role in shaping the cybersecurity landscape. I invite you to access the report and view the discussion replay for a deeper understanding of the challenges and transformations within the cyber insurance claims domain. Get NetDiligece Cyber Claims Study resources on-demand now! Download the report Watch the webinar NetDiligence’s latest Cyber Claims Study and Webinar, sponsored by Experian Data Breach, is available on-demand. This report serves as a resounding call to action, prompting businesses to ready themselves against cyber threats. Dive in to get insights and stay one step ahead of cyber adversaries.

This article was updated on February 12, 2024. The Buy Now, Pay Later (BNPL) space has grown massively over the last few years. But with rapid growth comes an increased risk of fraud, making "Buy Now, Pay Never" a crucial fraud threat to watch out for in 2024 and beyond. What is BNPL? BNPL, a type of short-term financing, has been around for decades in different forms. It's attractive to consumers because it offers the option to split up a specific purchase into installments rather than paying the full total upfront. The modern form of BNPL typically offers four installments, with the first payment at the time of purchase, as well as 0% APR and no hidden fees. According to an Experian survey, consumers cited managing spending (34%), convenience (31%), and avoiding interest payments (23%) as main reasons for choosing BNPL. Participating retailers generally offer BNPL at point-of-sale, making it easy for customers to opt-in and get instantly approved. The customer then makes a down payment and pays off the installments from their preferred account. BNPL is on the rise The fintech and online-payment-driven world is seeing a rise in the popularity of BNPL. According to Experian research, 3 in 4 consumers have used BNPL in 2023, with 11% using BNPL weekly to make purchases. The interest in BNPL also spans generations — 36% of Gen Z, 43% of Millennials, 32% of Gen X, and 12% of Baby Boomers have used this payment method. The risks of BNPL While BNPL is a convenient, easy way for consumers to plan for their purchases, experts warn that with lax checkout and identity verification processes it is a target for digital fraud. Experian predicts an uptick in three primary risks for BNPL providers and their customers: identity theft, first-party fraud, and synthetic identity fraud. WATCH: Fraud and Identity Challenges for Fintechs Victims of identity theft can be hit with charges from BNPL providers for products they have never purchased. First-party and synthetic identity risks will emerge as a shopper's buying power grows and the temptation to abandon repayment increases. Fraudsters may use their own or fabricated identities to make purchases with no intent to repay. This leaves the BNPL provider at the risk of unrecoverable monetary losses and can impact the business' risk tolerance, causing them to narrow their lending band and miss out on properly verified consumers. An additional risk lies with fraudsters who may leverage account takeover to gain access to a legitimate user's account and payment information to make unauthorized purchases. READ: Payment Fraud Detection and Prevention: What You Need to Know Mitigating BNPL risks Luckily, there are predictive credit, identity verification, and fraud prevention tools available to help businesses minimize the risks associated with BNPL. Paired with the right data, these tools can give businesses a comprehensive view of consumer payments, including the number of outstanding BNPL loans, total BNPL loan amounts, and BNPL payment status, as well as helping to detect and apply the relevant treatment to different types of fraud. By accurately identifying customers and assessing risk in real-time, businesses can make confident lending and fraud prevention decisions. To learn more about how Experian is enabling the protection of consumer credit scores, better risk assessments, and more inclusive lending, visit us or request a call. And keep an eye out for additional in-depth explorations of our Future of Fraud Forecast. Learn more Future of Fraud Forecast

Companies depend on quality information to make decisions that move their business objectives forward while minimizing risk exposure. And in today’s modern, tech-driven, innovation-led world, there’s more information available than ever before. Expansive datasets from sources, both internal and external, allow decision-makers to leverage a wide range of intelligence to fuel how they plan, forecast and set priorities. But how can business leaders be sure that their data is as robust, up-to-date and thorough as they need — and, most importantly, that they’re able to use it to its fullest potential? That’s where the power of advanced analytics comes in. By making use of cutting-edge datasets and analytics insights, businesses can stay on the vanguard of business intelligence and ahead of their competitors. What is advanced analytics? Advanced analytics is a form of business intelligence that takes full advantage of the most modern data sources and analytics tools to create forward-thinking analysis that can help businesses make well-informed, data-driven decisions that are tailored to their needs. Simply put, advanced analytics is an essential component of any proactive business strategy that aims to maximize the future potential of both customers and campaigns. These advanced business intelligence and analytics solutions help leaders make profitable decisions no matter the state of the current economic climate. They use both traditional and non-traditional data sources to provide businesses with actionable insights in the formats best suited to their needs and goals. One key aspect of advanced analytics is the use of AI analytics solutions. These efficient and effective tools help businesses save time and money by harnessing the power of cutting-edge technologies and deploying them in optimal use-case scenarios. These AI and machine-learning solutions use a wide range of tools, such as neural network methodologies, to help organizations optimize their allocation of resources, expediting and automating some processes while creating valuable insights to help human decision-makers navigate others. Benefits of advanced analytics Traditional business intelligence tends to be limited by the scope and quality of available data and ability of analysts to make use of it in an effective, comprehensive way. Modern business intelligence analytics, on the other hand, integrates machine learning and analytics to maximize the potential of data sets that, in today's technology-driven world, are often overwhelmingly large and complex: think not just databases of customer decisions and actions but behavioral data points tied to online and offline activity and the internet of things. What's more, advanced analytics does this in a way that's accessible to an entire organization — not just those who know their way around data, like IT departments and trained analysts. With the right advanced analytics solution, decision-makers can access convenient cloud-based dashboards designed to give them the information they want and need — with no clutter, noise or confusing terminology. Another key advantage of advanced analytics solutions is that they don't just analyze data — they optimize it, too. Advanced analytics offers the ability to clean up and integrate multiple data sets to remove duplicates, correct errors and inaccuracies and standardize formats, leading to high-quality data that creates clarity, not confusion. The result? By analyzing and identifying relationships across data, businesses can uncover hidden insights and issues. Advanced analytics also automate some aspects of the decision-making process to make workflows quicker and nimbler. For example, a business might choose to automate credit scoring, product recommendations for existing customers or the identification of potential fraud. Reducing manual interventions translates to increased agility and operational efficiency and, ultimately, a better competitive advantage. Use cases in the financial services industry Advanced analytics gives businesses in the financial world the power to go deeper into their data — and to integrate alternative data sources as well. With predictive analytics models, this data can be transformed into highly usable, next-level insights that help decision-makers optimize their business strategies. Credit risk, for instance, is a major concern for financial organizations that want to offer customers the best possible options while ensuring their credit products remain profitable. By utilizing advanced analytics solutions combined with a broad range of datasets, lenders can create highly accurate credit risk scores that forecast future customer behavior and identify and mitigate risk, leading to better lending decisions across the credit lifecycle. Advanced analytics solutions can also help businesses problem-solve. Let's say, for instance, that uptake of a new loan product has been slower than desired. By using business intelligence analytics, companies can determine what factors might be causing the issue and predict the tweaks and changes they can make to improve results. Advanced analytics means better, more detailed segmentation, which allows for more predictive insights. Businesses taking advantage of advanced analytics services are simply better informed: not only do they have access to more and better data, but they're able to convert it into actionable insights that help them lower risk, better predict outcomes, and boost the performance of their business. How we can help Experian offers a wide range of advanced analytics tools aimed at helping businesses in all kinds of industries succeed through better use of data. From custom machine learning models that help financial institutions assess risk more accurately to self-service dashboards designed to facilitate more agile responses to changes in the market, we have a solution that's right for every business. Plus, our advanced analytics offerings include a vast data repository with insights on 245 million credit-active individuals and 25 million businesses, as well as the industry's largest alternative data set from non-traditional lenders. Ready to explore? Click below to learn about our advanced analytics solutions. Learn more

Are you ready to talk football? And read some Taylor Swift puns? And hear about a big automotive ad measurement success story? 'Don’t Blame Me’, I warned you…. As we are all aware, Travis Kelce will be playing for the Chiefs on Superbowl Sunday. Whether you are cheering for the Chiefs, the 49er’s, or you’re just there to watch the commercials and half-time show, ‘You Need to Calm Down’ and just expect to hear a couple references during the game about Taylor and Travis’ ‘Love Story’. Ad Measurement at the Top of Its Game Before the final match-up of this season though, let’s go ‘Back to December’ and talk about a “Red” hot advertising success story from Thursday Night Football. An automotive advertiser wanted to better understand the impact of advertising frequency on vehicle purchase activity. To do this, the advertiser initiated an Amazon Prime streaming advertising campaign to reach Thursday Night Football (TNF) audience viewers. They reached these viewers by leveraging in-game media to raise awareness with new and TNF-engaged audience viewers. In addition, the advertiser used remarketing techniques and other Amazon ads to re-engage the previously exposed TNF viewers. Campaign Results—More Than Just Karma! After the campaign was over, the automotive advertiser wanted to learn whether the results were more than just ‘Karma’. They used Experian’s Vehicle Purchase Insights data within Amazon Marketing Cloud (AMC) to fill in the ‘Blank Space’ and attribute vehicle sales to the exposed TNF audience. Customers exposed 2-3 times to their ads were 1.3X more likely to purchase a vehicle than viewers who were exposed to the advertising only once Customers exposed to their ads 4 times were 1.6X more likely to purchase a vehicle than viewers who were exposed to the advertising only once The advertiser understood ‘All Too Well’ the results, the campaign was a success! Even if you’re over all the pop culture references and the Swift romance, ‘Shake it Off’, there’s no reason for any ‘Bad Blood.” The ‘Fearless’ leader of the scoreboard will have their ‘Wildest Dreams’ come true and be named the Super Bowl LVIII champion. To read more about this case study, (without the Taylor Swift song title puns), click here.

This article was updated on February 6, 2024. Lenders looking to gain a competitive edge need to improve their credit underwriting process in the coming years. The most obvious developments are the advances in artificial intelligence (AI) — machine learning in particular — the increased available computing capacity, and access to vast amounts of data. But when it comes to credit underwriting models, those are tools you can use to reach your goals, not a strategy for success. The evolution of credit underwriting Credit underwriters have had the same goal for millennia — assess the creditworthiness of a borrower to determine whether to offer them a loan. But the process has changed immensely, and the pace of change has recently increased. Fewer than 50 years ago, an underwriter might consider an applicant's income, occupation, marital status, and sex to make a decision. The Equal Credit Opportunity Act didn't pass until 1974. And it wasn't expanded to prohibit lending discrimination based on other factors, such as color, age, and national origin, until two years later. Regulatory changes can have an immediate and immense impact on credit underwriting, but there were also slower changes developing. As credit bureaus centralized and computers became more readily available, credit decisioning systems offered new insights. The systems could segment groups and help lenders make more complex and profitable decisions at scale, such as setting risk-appropriate credit limits and terms. INFOGRAPHIC: Data-driven decisioning journey map With access to more data and computing power, lenders get a more complete picture of applicants and their current customers. Technological advances also lead to automated decisions, which can improve lenders' workflows and customer satisfaction. In the late 2000s, fintech lenders entered the scene and disrupted the ecosystem with a completely online underwriting and funding process. More recently, AI and machine learning started as buzzwords, but quickly became business necessities. In fact, 66% of businesses believe advanced analytics, including machine learning and artificial intelligence, are going to rapidly change the way they do business.1 The latest explainable machine learning models can increase automation and efficiency while outperforming traditional modeling approaches. Access to increased computing power is, once again, helping power this shift.2 But it's also only possible because of the lenders access to alternative credit data.* WATCH: Why Advanced Analytics is Now Available for All Future-proofing your credit underwriting strategy Today's leading lenders use innovative technology and comprehensive data to improve their credit decisioning — including fraud detection, underwriting, account management, and collections. To avoid getting left behind, you need to consider how you can incorporate new tools and processes into your strategy. Get comfortable with machine learning models Although machine learning models have repeatedly shown they can offer performance improvements, lenders may hesitate to adopt them if they can't explain how the models work. It's smart to be cautious as so-called “black box" models generally don't pass regulatory muster — even if they can offer a greater lift. But there is a middle ground, and credit modelers use machine learning techniques to develop more effective models that are fully explainable. READ MORE: Explainability: ML and AI in credit decisioning Explore new data sources Machine learning models are great at recognizing patterns, but you need to train them on large data sets if you want to unlock their full potential. Lenders' internal data can be important, especially if they're developing custom models. But lenders should also try leveraging various types of alternative credit data to train models and more accurately assess an applicant's creditworthiness. This can include data from public records, rental payments, alternative financial services, and consumer-permissioned data. READ MORE: 2023 State of Alternative Credit Data Report Focus on financial inclusion Using new data sources can also help you more accurately understand the risk of an applicant who isn't scorable with traditional models. For example, Lift Premium™ uses machine learning and a combination of traditional consumer bureau credit data and alternative credit data to score 96 percent of U.S. consumers — 15 percent more than conventional scores.3 As a result, lenders can expand their lending universe and offer right-sized terms to people and groups who might otherwise be overlooked. Use AI to fuel automation Artificial intelligence can accelerate automation throughout the credit life cycle. Machine learning models do this within underwriting by more precisely estimating the creditworthiness of applicants. The more accurate a model is, the better it will be at identifying applicants who lenders want to approve or deny. Consider your decisioning strategy Although a machine learning model might offer more precise insight, lenders still need to set their decisioning strategy and business rules, including the cutoff points. Credit decisioning software can help lenders implement these decisions with speed, accuracy, and scalability. CASE STUDY: Experian partnered with OneAZ Credit Union to upgrade to an advanced credit decisioning platform and automate its underwriting strategy. The credit union increased load funding rates by 26 percent within one month and reduced manual reviews by 25 percent. Use underwriting as a component of strategic optimization Advanced analytics allow companies to move away from simpler rule-based decisions and toward strategies that take the business's overall goals into account. For example, lenders may be able to optimize decisions that involve competing goals — such as targets for volume and bad debt — to help the business reach its goals. Test and benchmark Underwriting is an iterative process. Lenders can use machine learning techniques to build and test challenger models and see how well they perform. You can also compare the results to industry benchmarks to see if there's likely room for more improvement. Why lenders choose Experian Lenders have used Experian's consumer and business credit data to underwrite loans for decades, but Experian is also a leader in advanced analytics. As lenders try to figure out how they'll approach underwriting in the coming years, they can partner with Experian's data scientists, who understand how to develop and deploy the latest types of compliant and explainable credit underwriting models. Experian also offers credit underwriting software and cloud-based and integrated decisioning platforms, along with modular solutions, such as access to alternative credit data, predictive attributes and scores. And lenders can explore collaborative approaches to developing ML-aided models that incorporate internal and third-party data. If you're not sure where to start, a business review can help you identify a few quick wins and create a road map for future improvements. Explore our credit decisioning solutions. * When we refer to “Alternative Credit Data," this refers to the use of alternative data and its appropriate use in consumer credit lending decisions as regulated by the Fair Credit Reporting Act (FCRA). Hence, the term “Expanded FCRA Data" may also apply in this instance and both can be used interchangeably. 1Experian (2022). Explainability: ML and AI in credit decisioning2Experian (2022). Webinar: Driving Growth During Economic Uncertainty with AI/ML Strategies 3Experian (2022). Lift Premium

Insights from the Cyber Risk Summit Beverly Hills – October 2023 Authored by Ryan Coyne I recently participated in a panel with industry experts, delving into third-party cyber risks. The panel shed light on best practices, challenges, and strategies to mitigate the impact of third-party incidents. Panel Participants: Stu Panensky (Moderator) – FisherBroyles, LLP Ryan Coyne – Experian Tom Egglestone – Resilience Mark Grazman – Fenix24 Matthew Saidel – FTI Consulting Agenda: Incident Best Practices: Collaboration & Coordination on IR Action Items Upstream Risk of Third Parties: Vendors, Suppliers & Business Partners Downstream Risk in the Policyholder Supply Chain The Cyber Risk Summit held in Beverly Hills provided valuable insights into the risks of engaging unsecured third parties. Key Takeaways Understanding the Significance Tom emphasized the longstanding nature of cyber risk exposure tied to third-party relationships. The increasing reliance on external vendors in a tech-enabled world has heightened this risk, especially with the surge in outsourcing and software adoption. Tom highlighted that, even in 2019, Gartner research indicated that 60% of surveyed companies worked with over 1000 third parties in their supply chain, setting the stage for the escalated risk environment post-pandemic. Crisis Communications in Third-Party Incidents Matt shared insights into the challenges faced when third-party incidents unfold. The necessity of involving crisis communications consultants early in the process, especially for upstream and downstream, was stressed. Preserving the right to operate and maintaining client trust amid incidents were key points Matt made.Hands-On Restoration PerspectiveMark, providing a hands-on restoration perspective, discussed the rarity of involvement at the inception of an event. His emphasis on locking down infrastructure, understanding the threat actor’s persistency, and encouraging robust backup strategies showcased the intricacies involved in restoration efforts.“Restoration efforts often kick in when patient zero is unidentified. Locking down the infrastructure and focusing on repairing affected elements are essential” – Mark Grazman, Fenix24 Notification Strategies and Legal Implications Representing Experian, I shared my perspective on notification complexities that the average consumer may not be aware of, such as notifying everyone upfront versus opt-in processes. The legal implications of notifying on behalf of others and coordinating with multiple parties. The nuanced approach to call center communication and the crucial factor of making details clear in notification letters in minimizing confusion for recipients.I want to emphasize a point I made earlier in the panel on the downstream impact of notification strategies and the need to customize communication for recipients.“For these incidents, it’s most important to minimize complexity on the notification side and minimize confusion for the recipient of your notification letter.” – Ryan Coyne, Experian Insights from an Insurance Claims Handler Tom, as an insurance claims handler, underscored the importance of understanding vendor contracts, particularly clauses related to defense and indemnity. He highlighted the need for transparency in the vendor’s incident response process, especially when the insured isn’t in control, adding a layer of complexity to communication and expectation setting. Crafting a Seamless Notification Process: Public-Private Partnerships Stu Panensky, Moderator: Public-private partnerships emerged as a recurring theme during the panel discussions. The need for collaboration between law enforcement, insurance companies, and businesses became evident. Stu emphasized the role of public-private partnerships in influencing better outcomes and impacting data protection, regulation, and litigation. The insights from the 2023 Beverly Hills Cyber Risk Summit underline the interconnected nature of cyber risks and the critical importance of proactive measures. Stakeholders are urged to adopt a collaborative approach, navigate legal complexities, and stay vigilant in the face of evolving challenges. I welcome you to watch the full discussion on-demand. Watch the panel session on-demand now

This article was updated on February 5, 2024. Identity management can refer to how a company creates, verifies, stores, and uses its customers' digital identities. Traditionally, many large organizations relied on a highly segmented and siloed approach. For example, marketing, risk, and support departments might each have a limited view of a customer, and the tools and systems that support their specific purpose. Organizations are now shifting to a more holistic approach to enterprise identity management. By working together, departments help contribute to building a more complete, single view of a customer. Some companies have renewed or increased their focus on the transformation during the pandemic, and the transition to an enterprise-wide identity management strategy can have long-lasting benefits. But it isn't always easy. Challenges of an enterprise-wide identity management strategy Gathering the initial momentum needed to break out of a siloed approach can be particularly challenging for large organizations when each business unit has an ingrained identity system that meets the unit's needs. Smaller organizations might have an easier time gathering consensus, but budget or technological limitations may be serious constraints. Even after a decision is made and the budget gets set aside, organizations need to think through how they'll create and manage a new enterprise-wide identity management system. It's not a one-and-done upgrade. For the strategy to succeed, you'll need to have processes in place to onboard, verify, secure, and activate the new digital identities. READ: What is Effective Multifactor Identity Authentication? Why use an enterprise-wide approach? Motivations and specifics can vary depending on an organization's size and structure, but some companies find a more holistic approach to customer identity management helps them: Improve customer experiences Save money by removing redundancies Boost sales with better-targeted marketing Better understand customers' needs Provide faster and more relevant support Make more informed decisions Detect and prevent fraud These benefits can play out across the entire customer lifecycle, and identity management systems are able to achieve this by pulling in data from various sources to build robust consumer identities and systems. Your internal, first-party data will be the most valuable and insightful, but you can append multidimensional data from third-party sources, such as consumer credit databases, demographic data or device data. And second-party data from partner brands or organizations. READ: Experian 2023 Identity and Fraud Report Consider the regulatory and security challenges An enterprise identity data management approach can also mean re-evaluating the applicable regulations and security challenges. The passage of the E.U.'s General Data Protection Regulation and California Consumer Privacy Act marked an important shift in how companies need to handle consumers' personal information — but that was only the start. Some U.S. states have also passed or are currently considering data privacy laws. Industry-specific regulations can apply as well, particularly in the healthcare and financial services industries. It's not as if a siloed approach lets an organization avoid regulation, but keeping current and upcoming laws in mind can be important during a large digital transformation. Additionally, consider how going beyond the minimum requirements could be beneficial. In a 2023 Experian white paper, we found that 61 percent of consumers want complete control over how companies use their personal data.1 Security also needs to be top of mind for any organization that collects and stores consumers' personal information. An enterprise-wide identity management system may make managing increasing amounts of data easier, which could help decrease fraud risks. And your customers may be willing to help — 67 percent are open to sharing data if it will increase security and help prevent fraud.2 Keeping customers' desires front and center Experian partnered with Aite-Novarica to study enterprise-wide identity management. All but one of the 12 executives interviewed said client experience is a primary or predominant driver in the transformation of their identity management programs.3 Once implemented, a holistic view of customers can increase the experience in many ways: Meaningful engagement: You can deliver relevant and timely offers if you understand when, where and why consumers are interested in your products and services. Similarly, you'll know who isn't a good fit and won't bother them (or waste money) by showing them ads. Verification: Using a single, persistent identity could make the initial and ongoing identity verification an easier process that doesn't disrupt consumers' lives or lead to frustration. Ongoing recognition: Nearly 70 percent of all consumers want businesses to recognize them across multiple visits.3 But you'll need to study your customers to determine how much friction is acceptable. Some people prefer security over convenience and are willing to trade a little time to use extra verification methods. Customer service: Having more insight into a customer's entire history and interactions with your organization can help you quickly respond when an issue arises, or even anticipate and solve potential problems. Security: Nearly two-thirds (64 percent) of consumers say they're very or somewhat concerned with online security.4 Companies that can quickly and accurately identify consumers can also help keep them safe from fraud and identity theft. While these may be some consumers' top concerns today, continue listening to your customers to better understand their wants and needs. WATCH: Webinar: Identity Evolved — Building consumer trust and engagement Implementing an enterprise-wide identity management strategy Identity management can become a daunting task, particularly as new data sources begin to flow. As a result, many organizations turn to outside partners who can help manage part, or all, of the process. For example, an identity management solution may offer identity resolution and help create and host an identity graph (the database that stores the unique digital identities). A more robust offering may also help with other parts of identity management, including ongoing data hygiene and helping you turn your unique customer insights into actionable marketing campaigns. Experience managing vast amounts of data is also important, as is access to additional offline and online data sources. In 2023, Experian found that 85 percent of companies said poor quality customer contact data negatively impacted their operation's processes and efficiency.5 An enterprise-wide system that allows business units to update a single customer profile with the latest contact information might help. But working with a data provider that appends the latest info from outside databases could be a better way to ensure you have customers' latest contact info. When researching potential partners, also consider how their offerings and approach align with your goals. If, like others, improving the customer experience is a priority, make sure the solution provider also has a customer-first approach. In turn, this means security is a top priority — it's what customers want and it's important for protecting you and your reputation. Learn more about Experian's identity management solutions and how you can benefit from working with a company that understands identities are personal. Learn more 1Experian (2023). White paper: Making identities personal 2Ibid. 3Aite-Novarica and Experian (2022). Enterprise Identity Management: Evolving Aspirations and Improved Collaboration Are Transforming the Discipline 4Experian (2023). Identity and Fraud Report 5Experian (2023). White paper: Making identities personal

Auto dealerships may sell dreams of open roads and freedom, but unfortunately, they also attract a different kind of customer: the identity thief. With high-value transactions and access to sensitive personal information, auto dealerships are prime targets for various fraudulent schemes. So, buckle up as we explore the most common types of identity fraud impacting dealerships and how to keep your wheels safe. Four common fraud schemes dealers need to be aware of 1. Third-Party Identity Fraud (Stolen Identities): Hijacking the Identity Highway This method doesn't involve creating new identities; it steals existing ones. Thieves steal personal information, often through data breaches or phishing scams, and use it to apply for auto loans under the victim's name. The dealership unwittingly approves the loan, leaving the real person saddled with the debt and a ruined credit score. 2. Synthetic Identity (Fabricated Credentials): Frankenstein Fraud on the Fast Lane Think of synthetic identity fraud as identity theft with a twist. Criminals combine real and fake information, like stolen Social Security numbers and fabricated addresses, to create entirely new personas. These fabricated identities then build clean credit histories, allowing them to qualify for high-value loans like car financing. By the time the dealership realizes the fraud, the car, and the fake persona have vanished. 3. First Party: No Way Will I Pay This method doesn't involve creating new identities; rather it is when a person knowingly misrepresents their identity or gives false information for financial or material gain. Fraudsters often have no plans to pay for their vehicle. 4. Document Fraud: Paper Trails of Deception Fraudsters can also manufacture fake or altered documents like driver's licenses, proof of income and employment verification. These forged documents create a veneer of legitimacy, allowing them to bypass dealership verification checks and secure loans based on fabricated information. Four ways dealerships can keep their brakes on fraud 1. Robust verification: Implementing multi-factor authentication, cross-referencing information with reliable sources, and verifying documents with advanced technology can significantly reduce the risk of deception. Fraud Protect™ from Experian Automotive leverages license scanning and selfie capture to verify identity. Dealers can find the true person and verify the activity through device, behavior, and step-up services. 2. Employee vigilance: Training staff to identify suspicious behavior and report potential fraud attempts can create a strong internal defense system. Fraud Protect fits within your current systems and processes. The software integrates with your CRM and does not require heavy software training or any additional hardware simplifying employee usage. 3. Secure data: Investing in data security measures like encryption and access controls can significantly deter hackers and minimize the damage from data breaches. Fraud Protect leverages Experian’s world-class data to handle the customer relationship carefully and detect errors and discrepancies. 4. Partnerships: Collaborating with credit bureaus, law enforcement agencies and fraud prevention systems can provide valuable insights and resources for fighting fraud. Experian is the world’s leading information services company. Fraud Protect from Experian Automotive offers a unique partnership for dealers through seamless CRM integration. This simple process makes multiple levels of risk identification quick and efficient for busy buyers. By acknowledging the various forms of identity fraud and implementing proactive measures, dealerships can protect themselves and their consumers from the impact of identity fraud. Fraud Protect empowers dealers with our leading fraud, identity and verification capabilities, integrated within your unique workflows. Whether on your website, leveraged before test drives, initiating out-of-state & and remote closings, or before contracting, Fraud Protect quickly uncovers potential fraud. The entire process is a quick and painless way to address risk while establishing customer trust. Take the first step in protecting profits and preventing fraud by visiting our auto fraud prevention solutions webpage.

This article was updated on January 31, 2024. Debt. For many, it’s a struggle – and a constant one. In fact, total consumer debt balances have increased year-over-year.1 High inflation and fears of a recession aren't letting up either. Successful third-party debt collections can be achieved by investing in the right data and technologies. Overcoming debt collections challenges While third-party debt collectors may take a more specialized approach to collections, they face unique challenges. Debt collectors must find the debtor, get them to respond, collect payment, and stay compliant. With streamlined processes and enhanced strategies, lending institutions and collection agencies can recoup more costs. Embrace automationAutomation, artificial intelligence, and machine learning are at the forefront of the continued digital transformation within the world of collections. When implemented well, automation can ease pressure on call center agents and improve the customer experience. Automated systems can also help increase recovery rates while minimizing the risk of human error and the corresponding liability. READ: Three Tips for Successful Automated Debt CollectionsMaximize digitalizationIntegrating and expanding digital technologies is mandatory to be successful in the third-party debt collections space. Third-party debt collectors must be at the forefront of adopting digital communication tools (i.e., email, text, chatbots, and banking apps), to connect more easily with debtors and provide a frictionless customer experience. A digital debt recovery solution helps third-party debt collectors streamline processes, maintain debt collection compliance, and maximize collections efforts. READ: The Ultimate Guide to Successful Debt Collection TechniquesLeverage the best data Consumer data is ever-changing, especially during times of economic distress. Capturing accurate consumer information through a combination of data sources — and continually evaluating the data’s validity — is key to reducing risk throughout the consumer life cycle. By gaining a fresher, more complete view of existing and potential customers, third-party debt collectors can better determine an individual’s propensity to pay and enhance their overall decisioning. Keep pace with changing regulations With increasing scrutiny on the financial services industry and ever-evolving consumer protection and privacy regulations, remaining compliant is a top priority for third-party debt collections departments and agencies. The increased focus on regulations and compliance has also brought to the surface the need for teams to include debt collectors with soft skills who can communicate effectively with indebted consumers. With the right processes and third-party debt collections tools, you can better develop a robust compliance management strategy that works to prevent reputational risk and minimize costly violations. Finding the right debt collections partner In today's climate, it's never been more important to build the right third-party debt collections strategies for your business. By creating a more effective, consumer-focused collections process, you can maximize your recovery efforts, make more profitable decisions and focus your resources where they’re needed most. Our third-party debt management solutions empower your organization to see the complete behavioral, demographic, and emerging view of customer portfolios through extensive data assets, debt collection predictive analytics innovative platforms. For more insights to strengthen your debt collection strategy, download our tip sheet. Access tip sheet

This article was updated on January 30, 2024. Income verification is a critical step in determining a consumer’s ability to pay. The challenge is verifying income in a way that’s seamless for both lenders and consumers. While many businesses have already implemented automated solutions to streamline operations, some are still relying on manual processes built on older technology. Let’s take a closer look at the drawbacks of traditional verification processes and how Experian can help businesses deliver frictionless verification experiences. The drawbacks of traditional income verification Employment and income verification provides lenders with greater visibility into consumers’ financial stability. But it often results in high-touch, high-friction experiences when done manually. This can be frustrating for both lenders and potential borrowers: For lenders: Manual verification processes are extremely tedious and time-consuming for lenders as it requires physically collecting and reviewing documents. Additionally, without reliable income data, it can be difficult for lenders to accurately determine a consumer’s ability to pay, leading to higher origination risk. For borrowers: Today’s consumers have grown accustomed to digital experiences that are fast, simple, and convenient. A verification process that is slow and manual may cause consumers to drop off altogether. How can this process be optimized? To accelerate the verification process and gain a more complete view of consumers’ financial stability, lenders must look to automated solutions. With automated income verification, lenders obtain timely income reports to accurately verify consumers’ income in minutes rather than days or weeks. Not only does this allow lenders to approve more applicants quickly, but it also enables them to devote more time and resources toward improving their strategies and enhancing the customer experience. The right verification solution can also capture a wider variety of income scenarios. With the click of a button, consumers can give lenders permission to access their financial accounts, including checking, savings, 401k, and brokerage accounts. This creates a frictionless verification experience for consumers as their income information is quickly extracted and reviewed. Retrieving data directly from financial accounts also provides lenders with a fuller financial picture of consumers, including those with thin or no credit files. This helps increase the chances of approval for underserved communities and allows lenders to expand their customer base without taking on additional risk.1 Learn more 1 Experian Income Verification Product Sheet (2017).

In the fast-paced world of cybersecurity, the ability to anticipate and adapt to emerging threats is not just a competitive advantage—it’s a business imperative. As we release our 11th annual “Experian 2024 Data Breach Industry Forecast,” we invite you to embark on a journey into the future of data breaches, a journey that promises to empower data breach professionals, cyber experts, and industry leaders alike. A Glimpse into Tomorrow’s Threat Landscape Our team of experts has meticulously examined the current cybersecurity landscape to identify the trends that will shape the industry in the coming year. The “Experian 2024 Data Breach Industry Forecast” provides a roadmap for staying ahead of these challenges, arming you with the insights needed to fortify your organization’s defenses. Six Pivotal Predictions: Decoding the Future Within the report, we unveil six pivotal predictions that promise to redefine the landscape of data breaches. While we can’t reveal all the details here, we’ll offer a sneak peek to whet your appetite: Six Degrees of Separation: There’s no question that third-party data breaches this year made headlines. Delve into the intricacies of supply chain security and discover why addressing vulnerabilities in the supply chain is the next frontier in cybersecurity. Little by Little Becomes A Lot: When trying to achieve a goal, it’s said that taking small steps can lead to big results. See how hackers could apply that same rule. Not a Third Wheel: It’s widely known who the main players are globally that sponsor attacks and a new country in South Asia may join the international stage. No, not Mother Earth! Plutonium, terbium, silicon wafers — these rare earth materials present an intriguing opportunity for hackers looking to disrupt an enemy’s economy. The Scarface Effect: Like drug cartels, cybergangs are forming sophisticated organizations. Winning from the Inside: In 2024, we may see enterprising threat actors target more publicly traded companies, leveraging data extraction and their talents in plain sight as everyday investors. This is just a glimpse into the dynamic and evolving landscape detailed in our full report. Download the complete “Experian 2024 Data Breach Industry Forecast” to explore these predictions in-depth and stay ahead of the curve. Expert Analysis: Navigating Complexity with Confidence Backed by extensive research and the expertise of our seasoned analysts, the report provides more than just predictions; it offers a deep dive into the complexities of the modern cybersecurity landscape. Our experts share their insights on how these predictions will impact organizations and individuals, providing actionable intelligence that goes beyond the theoretical. Whether you’re a CISO, a Compliance Officer, or a Cyber Risk Insurer, the “Experian 2024 Data Breach Industry Forecast” equips you to navigate the challenges of tomorrow with confidence. Empowering You to Lead in Data Breach Response As you read through the report, you’ll find that our approach goes beyond merely highlighting problems; we provide solutions. Each prediction is accompanied by practical recommendations and best practices, ensuring that you not only understand the evolving landscape but also possess the tools to proactively address the challenges that lie ahead.Now, more than ever, it’s crucial to be proactive in your approach to cybersecurity. Download the full “Experian 2024 Data Breach Industry Forecast” to unlock the insights and strategies that will set you apart in the realm of data breach response. Your journey into the future starts here. The Future is Now. Are you ready to take the first step toward a more secure tomorrow? Download the report now and lead the way in data breach response. Read more

This series will dive into our monthly State of the Economy report, providing a snapshot of the top monthly economic and credit data for those in financial services to proactively shape their business strategies. As 2024 unfolds, the economy is beginning to shift from last year’s trends. Instead of focusing on rate hikes, we’re looking at the potential for rate cuts. Our labor market is beginning to ease, and inflation is moving closer to the Federal Reserve’s 2% mark. Each month’s data gives us a clearer picture of our economic trajectory and the Federal Reserve’s (Fed) policy moving forward, as well as new and direct implications on credit metrics. Data highlights from this month’s report include: The U.S. economy added 216,000 jobs in December, but after November and October levels were revised, three-month average job creation now sits below the pre-pandemic level. While there was no change in November, annual core inflation, which excludes the volatile food and energy components, cooled in December from 4.0% to 3.9%. Consumer sentiment rose 14% in December, reversing the past four monthly declines, driven by increased optimism toward the trajectory of inflation. Check out our report for a deep dive into the rest of this month’s data, including student loans, consumer spending, the housing market, and delinquencies. To have a holistic view of our current environment, we must understand our economic past, present, and future. Keep an eye out for this year’s chartbook for a comprehensive view of the past year and download our latest forecast for a view of what’s to come. Download report View forecast For more economic trends and market insights, visit Experian Edge.

This article was updated on January 26, 2024. Marketers are facing new challenges as third-party cookies crumble, and people use more devices throughout the day. Someone might comparison shop on their laptop in the morning, do more research on a tablet in the afternoon and finally decide to make a purchase on their phone before falling asleep at night. Being able to track these movements and insert yourself where appropriate can be difficult, but it's not impossible. One solution that's becoming increasingly attractive is creating a unified identity for each customer — and matching every piece of data and touchpoint to the single profile. For this to work, you need identity resolution. What is identity resolution? Identity resolution is the ongoing process of linking various identifying elements to create and expand a unique identity. The multi-step process can include: Securely onboarding data into a system Hashing or tokenizing personal information to improve security and privacy Setting aside information that can't be matched to an identity yet Matching or linking identifiers to a known unique identity Verifying that the identities and identifiers are accurate An identity graph (ID graph) is an essential part of identity resolution. It's the proprietary database that can pull in and store data from different sources and link them to a unique identifier — also known as a persistent identification number. Depending on the system and purpose, identity resolution may focus on creating a single identity for a person, household, or business. The information can come from internal sources, including a customer relationship management (CRM) tool, email marketing platforms, event management platforms, social media accounts, point-of-sales systems, and other digital and offline touchpoints. Additionally, third-party data sources, such as credit or demographic data, can contribute to building a more complete identity. And second-party data — information that's shared between brands or companies — can also be helpful. As new digital and offline information is created or found, it's linked to the existing persistent identification number in the ID graph. The process can happen in different ways. The resolution system could accurately match an engagement to a person with deterministic data, such as a hashed email address, assuming they logged in. If the person didn't log in, a probabilistic model may be able to accurately attribute the session to the person's identity based on indicators that it's likely the same person, such as a device ID or behavioral data. A hybrid approach combines deterministic and probabilistic approaches, which could be important for scaling. The goal and end result is often called a holistic, single-unified, or 360-degree view of a customer. READ MORE: Making identities personal Why does identity resolution matter? Identity resolution lets you know with whom you're connecting, which can be important throughout a customer's lifecycle. From marketing to collections, you want to be able to engage the right person on the right channel with the right offer. And that's only possible when you can accurately identify people. Consistent and accurate identity resolution is difficult, though. Experian's 2023 Identity and Fraud Report found that 92% of businesses have a strategy in place for identifying consumers online. But 63% of consumers are either "somewhat confident" or "not very confident" that businesses can accurately recognize them online. What are the benefits of identity resolution? It's a worthy goal to push toward, because you can use identity resolution solutions to: Consolidate your view of customers Companies may have multiple profiles of the same customer — one from an email list, another from their loyalty program and a third from an outdated system. Your customers are also interacting with you in different ways, perhaps logging into an account from their laptop in the morning while visiting your site from a phone at night. Identity resolution lets you connect all these elements to create a single profile. Build targeted and measurable marketing campaigns Once you have a single and consistent view of your customers, you can more accurately segment and target your marketing campaigns. Personalizing messages can increase engagement and effectiveness. And, equally important, knowing to who you don't want to send messages can help you avoid wasting marketing spending. Some identity resolution services can also help you track anonymous visitors and customize your marketing with look-alike models, which can identify people who are likely part of your target audience. You'll also be able to more accurately measure the effectiveness of a campaign. With a single customer view, it's easier to know if and how a targeted social media ad, television spot and emailed coupon worked together to create a sale. Increase customer experiences across brands When implemented throughout an organization, you can also use the single view of a customer to create a consistent experience across brands and business units. Each can benefit from a more holistic understanding of the customer and can contribute to building out customers' profiles. Seamlessly confirm identities Identity resolution can also create a more frictionless experience for customers who want to create or log into your site, and it can help with detecting fraud and high-risk consumers. But keep data security top of mind. Consumers rank privacy (79%) and security (78%) much higher than login convenience (38%) when considering their online experience. What does an identity resolution solution look like? The need for and type of identity resolution can vary depending on a business' challenges and goals. For instance, large retailers often have a lot of first-party data — so much that it may be overwhelming. For them, an identity resolution solution that can organize internal data while enhancing it with external data points could be a priority. In contrast, a business with infrequent touchpoints might not have as much first-party data and could benefit from a solution that offers as much external information as possible. Some organizations are building their own internal identity resolution services to address these challenges, but many are looking to outside partners for identity resolution. When comparing partners, consider: Flexibility and scalability: Understand which data the solution can onboard and how quickly it can onboard data. Consider whether you'll want to be able to use real-time APIs or batch processing, and the limitations on how much data the provider can process at a time. Additionally, consider whether the ID graph will use persistent IDs that can change as you scale. Matching and analysis: Ask about the solution's approach and success with matching online and offline data and the options to integrate or append second and third-party data. If you want to be able to securely and privately share anonymized identities internally or with partners, make sure that's an option as well. Integration: Research whether the provider can easily integrate your existing services and vendors. Privacy: 73% of consumers say it's a business's responsibility to protect them online. Ask about the provider's experience and approach to storing and anonymizing data. Some solutions also have built-in activation tools. These let you build and launch omni-channel campaigns. They also analyze and report on how well your campaigns are performing. Get started today To learn more about the importance of digital identity and Experian's identity solutions, visit us today. Learn more