Latest Posts

Every few months we hear in the news about a fraud ring that has been busted here in the U.S. or in another part of the world. In May, I read about a fraud ring based in Georgia and Louisiana that bought 13,000 stolen identities of children who were on the Louisiana Medicaid program and billed the government for services not rendered. This group defrauded the Medicaid program of more than $500,000. This is just one of many stories that we hear about fraud rings, and given the rapidly changing economic environment, now is the time for businesses to think about how to protect against fraud rings. There are a number of challenges that organizations may have when it comes to sharing trends and collaborations, understanding the ways to tie fraud rings together, creating treatments for identifying fraud rings and ways to store and catalogue fraud ring experiences so they can be easily recognized. The trouble with identifying fraud rings It’s important to understand the challenges that organizations have because they see the fraud rings through their own internal lens. Here are a few of the top things businesses should work on: Think like a fraudster. This will help businesses become more creative in their approach to fraud prevention. Facilitate internal collaboration. Share with in-organization partners. Sometimes this can be difficult due to organizational structure. Promote external collaboration. Intel-sharing groups are a great way for businesses to network within their industries and learn about the fraud that others are seeing. An organization that I’ve worked with in the past is the National Cyber Forensic and Training Alliance (NCFTA). Putting the pieces together How do businesses identify a fraud ring? There are three steps to get started. The first is reviewing and understanding the data. Fraudsters are lazy and want to replicate the process over and over again, and because of this there is always some piece of information that is repeated. It could be a name, an email address, device fingerprint, or similar. The second step is tying the fraud ring together. This is done by creating rules to help identify the trends. Having rules in place to identify fraud rings allows businesses to easily pull stats together for their leadership. Lastly, applying an acronym or name to the particular fraud ring and adding comments to the cases associated with a particular ring will help with post-investigation analysis. Learning from the past Before I became a consultant, I remember identifying a fraud ring that was submitting events with the same language pack and where the device fingerprint was staying consistent. Those events were being referred out for review and marked with the same note. At a post-mortem review, I was able to talk to the fraud ring we had seen, and it was easy to pull all events associated with this fraud ring because my team had marked the events with the same comments. Another fraud ring example happened a few years ago. A client called me and said that they were under a fraud attack and this fraud ring was rotating the email handle. I reviewed the data and came up with a rule to catch this activity. Fraud rings will use email handle rotation to help them keep track of accounts that are opened or what emails they used in the past. By coupling the email handle rotation with an email verification service like Emailage, this insight could be very telling. I would assume that when fraud rings use email handle rotation these emails are new and have just been created. These are just a few of the many fraud rings that I’ve encountered over the course of my career and I’m sure there will be a lot more in the years to come. The best advice I can give to anyone that reads this post is to understand the data that you are reviewing, look for anomalies within the data, ask questions and test your theories by running queries on the data that you’re reviewing. I would love to hear about the different fraud rings that you’ve encountered over your career. Stay safe. Contact us

Experian’s own Chris Ryan and Bobbie Paul recently joined David Mattei from Aite to discuss the latest research and insights into emerging fraud schemes and how businesses can combat them in light of COVID-19 and the resulting economic changes. Between them, Chris, Bobbie, and David have more than 60 years of experience in the world of fraud prevention. Listen in as they discuss how businesses can shape their fraud prevention plan in the short term, including: The impacts of the health crisis and physical distancing The rise of e-commerce and consumer digital engagement Changes in criminal activity Fraud attack vectors 2020 fraud loss projections Critical next steps for the 30-60 day time frame Experian · Make Your Fraud Plan Recession-Ready: 2020 Fraud Trends

Account management is a critical strategy during any type of economy (pro-cycle, counter-cycle, cycle neutral). In times like these, marked by economic volatility, it is an effective way to identify which parts of your portfolio and which of your consumers need the most attention. Check out this podcast where Cyndy Chang, Senior Director of Product Management, and Craig Wilson, Senior Director of Consulting, discuss the foundational elements of account management, best practices and use cases. Account management today looks very different than what it has been during over a decade of growth proactive; account review is a critical part of navigating the path forward. Questions that need to be addressed include: Do you have the right data? Are you monitoring between data loads? Are you reviewing accounts at the frequency that today’s changing demands require? Listen in on the discussion to learn more. Experian · Look Ahead Podcast

In Q1 2020, 30-day delinquencies decreased from 1.98 percent in Q1 2019 to 1.93 percent, while 60-day delinquencies dropped from 0.68 percent to 0.67.

Today, Experian and Oliver Wyman launched the Ascend Portfolio Loss ForecasterTM, a solution built to help lenders make better decisions – during COVID-19 and beyond – with customized forecasts and macroeconomic data. Phrases like “the new normal,” “unprecedented times,” and “extreme economic volatility” have flooded not only media for the last few months, but also financial institutions’ strategic discussions regarding plans to move forward. What has largely been crisis response is quickly shifting to an urgent need to answer the many questions around “Will we survive this crisis?,” let alone “What’s next?” And arguably, we’ve entered a new era of loss forecasting. After the longest period of economic growth in post-war U.S. history, previously built models are not sufficient for the unprecedented and sudden changes in economic conditions due to COVID-19. Lenders need instant insights to assess impact and losses to their portfolios. The Ascend Portfolio Loss Forecaster combines advanced modeling from Oliver Wyman, pandemic-specific insights and macroeconomic scenarios from Oxford Economics, and Experian’s quality data to analyze and produce accurate loan loss forecasts. Additionally, all of the data, including the forecasts and models, are regularly updated as macroeconomic conditions change. “Experian’s agility and innovative technologies allow us to help lenders make informed decisions in real time to mitigate future risk,” said Greg Wright, chief product officer of Experian’s Consumer Information Services, in a recent press release. “We’re proud to work with our partners, Oxford Economics and Oliver Wyman, to bring lenders a product powered by machine learning, comprehensive data and macroeconomic forecast scenarios.” Built using advanced modeling and expert scenarios, the web-based application maximizes the more than 15 years of Experian’s loan-level data, including VantageScore® credit score, bankruptcy scores and customer-level attributes. Financial institutions can gauge loan portfolio performance under various scenarios. “It is important that the banks take into account the evolving credit behaviors due to the COVID-19 pandemic, in addition to the robust modeling technique for their loss forecasting and strategic decisioning,” said Anshul Verma, senior director of products at Oliver Wyman, also in the release. “With the Ascend Portfolio Loss Forecaster, lenders get robust models that work in the current conditions and take into account evolving consumer behaviors,” Verma said. To watch Experian’s webinar on portfolio loss forecasting, please click here and to learn more about the Ascend Portfolio Loss Forecaster, click the button below. Learn More

The COVID-19 pandemic and resulting rush to transition to a remote lifestyle made it clear that many businesses need a refreshed digital authentication and fraud prevention strategy that includes an investment in technology and provides consumer assurance. This is particularly important when it comes to identity, as many of the standard in-person verification methods and tools are currently unavailable. The meaning of identity is growing and shifting Technology trends are intersecting with social trends to create heightened awareness, and a whole new public conversation has emerged around customer trust and privacy. Attitudes and ideas are changing—even to the point of what we mean by “identity.” An identity is no longer just a name, date of birth, and SSN. Now, there are digital manifestations everywhere you look: screen names, email addresses, mobile phone numbers, device identifiers, and the other “exhaust” we leave behind as we travel the internet. This leads to concerns about what an identity is, who owns it, and who manages and protects it. Businesses have to be able to prove to their ability to protect their customers’ identities through investment in technology and a robust fraud strategy. Consumer attitudes are changing Several years ago, consumers were excited by all the new digital capabilities and the speed, ease, and convenience they provided. Last year, Experian found that consumers still wanted those things, with 70% willing to provide more information to businesses if there was a perceived benefit. However, they also wanted more security in the balance. In Experian’s most recent Global Identity and Fraud Report, we found that 74% of consumers say that security is the most important factor when deciding to engage with a business. Consumers are particularly more tolerant of friction during the enrollment process—as a means of building trust. But, when they return to the app or website, they want to be recognized. This means achieving a balance by using layered technologies, some of which are active and visible to the consumer, and some of which are invisibly working in the background to confirm the identity of returning consumers. Consumer attitudes vs. regulatory pressure The drivers behind the business changes are twofold: shifting consumer attitudes and regulatory changes. While regulations are becoming stricter on a national and global level, they’re not keeping pace with technology and social change. The digital world is evolving at a rapid pace, opening up more new ways for companies to collect information about consumers and use it to identify and verify, and also to target goods and services. With all of this data available, it’s important for businesses to use the tools in the market to help protect identity information. Next steps in technology The bottom line is, businesses can’t wait for regulations to dictate how best to protect information. Instead, they should be looking to technologies like physical and behavioral biometrics to help provide identity authentication and protection – layering those solutions with information from the user and from third parties to give a holistic consumer view. Businesses should adopt a platform approach for identity and fraud in order to be able to adapt quickly, whether to incorporate new kinds of technology or to prevent emerging types of fraud. By investing in technology now, even in the midst of the COVID-19 pandemic, businesses can build the flexibility needed to respond to future crises and help offset future fraud losses. In turn, those fraud-loss savings can then be used to help grow the business in the future. Learn more about Experian’s commitment to helping businesses maximize their investment in technology to safeguard against fraud. Learn more

To combat the growing threat of synthetic identity fraud, Experian recently announced the launch of Sure ProfileTM, a revolutionary change to the credit profile that gives lenders peace of mind with Experian’s commitment to share in losses that result from an identity we’ve assured. “Experian has always been a leader in combatting fraud, and with Sure Profile, we’re proud to deliver an industry-first fraud offering integrated into the credit profile that mitigates lender losses while protecting millions of consumers’ identities,” said Robert Boxberger, President of Decision Analytics, Experian North America. Synthetic identity fraud is expected to drive $48 billion in annual online payment fraud losses by 2023. Between opportunistic fraudsters and a lack of a unified definition for synthetic identity theft it can be nearly impossible to detect—and therefore prevent—this type of fraud. This breakthrough solution provides a composite history of a consumer’s identification, public record, and credit information and determines the risk of synthetic fraud associated with that consumer. It’s not just a fraud tool, it’s a comprehensive credit profile that utilizes premium data so lenders can make positive credit decisions. Sure Profile leverages the capabilities of the Experian Ascend Identity PlatformTM and uses Experian’s industry-leading data assets and data quality to drive advanced analytics that set a higher level of protection for lenders. It’s powered by newly-developed machine learning and AI models. And it offers a streamlined approach to define and detect synthetic identities early in the originations process. Most importantly, Sure Profile differentiates between real people and potentially risky applicants so lenders can increase application approvals with greater assurance and less risk. “Experian can confidently define and help detect synthetic fraud. That's why we can help stop it,” said Craig Boundy, CEO of Experian North America. “Experian stands behind our data with assurance given to our clients. It’s better for lenders and it’s better for consumers.” Sure Profile is a complement to our robust set of identity protection and fraud management capabilities, which are designed to address fraud and identity challenges including account openings, account takeovers, e-commerce fraud and more. This first-of-its kind profile is the future of underwriting and portfolio protection and it’s here now. Read press release Learn More About Sure Profile

Rays of hope are beginning to shine in the economy that suggest the U.S. may have moved beyond the most acute phase of the economic crisis. The housing sector, in particular, looks poised to regain momentum and perhaps lead the path towards stabilization in the second half of 2020. A “V-Shaped” rebound in mortgage applications Despite record levels of unemployment and widespread economic uncertainty, homebuyers have returned to the market with conviction. After shelter-in-place restrictions curtailed open-house visits and crimped buyer demand in early April, applications to purchase a home have risen for six consecutive weeks, according to the Mortgage Bankers Association. The latest data for the week of May 22nd, indicate that purchase applications were 9% higher than during the same period in 2019. If this trend continues, it will show that significant pent-up demand exists in the housing market that may be able to offset some of the lost spring buying season. April new home sales far exceed expectations After declining by 13.7% in March, new home sales rose a modest 0.6% in April. While this was only a slight gain, it was considerably above economists’ projections of a fall of 20% and may mark the turning point in the downtrend. Since the recording of new home sales data occurs when the purchase contract is signed or a deposit is accepted – and is typically for a house that hasn’t been built yet or is currently under construction – it provides a gauge of how buyers feel about their future economic prospects. Building a home also requires hiring new construction workers, buying building supplies, and supporting a host of ancillary industries, thus making it an indicator of further economic activity. Some of the increase in demand for new homes may have been driven by coronavirus quirks. The number of existing homes on the market is at record lows and many people may have been reluctant to put their home up for sale and have buyers tour as health concerns remain. Buyers, as well, may have preferred to steer clear of occupied homes or were unable to make in-person visits due to shelter-in-place restrictions. This lack of options for home buyers, coupled with record-low mortgage rates, likely drove sales of new homes higher. However, for the same reasons why new home sales rose, pending sales for existing homes fell sharply. In April, the National Association of Realtors reported that sales declined by 21.8%, which is the largest drop in ten years. Home prices continue to gain ground Even with shelter-in-place restrictions dampening buyer demand in early April, home values have continued to rise. This is because the supply of homes on the market also contracted, resulting in a simultaneous drop of demand and supply. According to Zillow Research, the total inventory of homes for sale is down roughly 20% from this time last year. With fewer competing homes on the market, sellers have been reluctant to slash prices and are betting that the lack of options and low mortgage rates will keep buyers on the hook. In April, U.S. home values rose 4.3% from the year before. The states with the strongest growth were Idaho (9.8%), Arizona (8.5%), Maine (7.6%), and Washington (7.4%). It will be interesting to see if this pattern of growth changes as newly implemented work from home policies may shift where people prefer to live and work. Why it matters The housing market has an outsized influence on the overall direction of the U.S. economy. Housing is not only is a big contributor to economic growth, but many owners have a large portion of their wealth tied up in their home. If the housing market can find its footing in the second half of 2020, then it could set the stage for an eventual economic recovery. Learn more

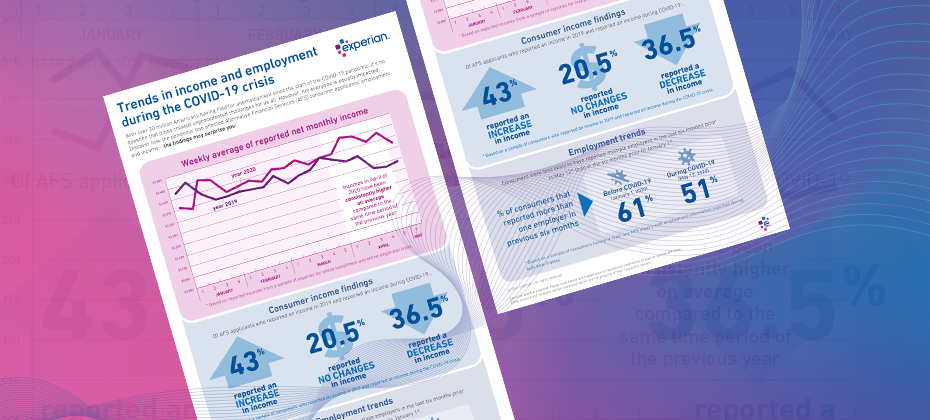

With many individuals finding themselves in increasingly vulnerable positions due to COVID-19, lenders must refine their policies based on their consumers’ current financial situations. Alternative Financial Services (AFS) data helps you gain a more comprehensive view of today's consumer. The COVID-19 pandemic has had far-reaching economic consequences, leading to drastic changes in consumers’ financial habits and behavior. When it comes to your consumers, are you seeing the full picture? See if you qualify for a complimentary hit rate analysis Download AFS Trends Report

The COVID-19 pandemic has created unprecedented challenges for the utilities industry. This includes the need to plan for – and be prepared to respond to – changing behaviors and a sudden uptick in collections activities. As part of our recently launched Q&A perspective series, Mark Soffietti, Experian’s Senior Manager of Analytics Consulting and Tom Hanson, Senior Energy Consultant, provided insight on how utility providers can evolve and refine their collections and recovery processes. Check out what they had to say: Q: How has COVID-19 impacted payment behavior and debt collections? TH: Consumer payment behavior is changing. For example, those who paid as agreed, may not currently have the means to pay and are now distressed borrowers. Or those who were sloppy payers before the pandemic may now be defaulting on a more consistent basis. MS: As we saw with the last recession when faced with economic stress, consumer and commercial payment behavior changes based on their needs and current cash flow. For example, people prioritize their car, as they need it to get to and from work, so they’ll likely pay their auto bills on time. The same goes for their credit cards, which they need to make ends meet. We expect this will also be true with COVID-19. The commercial segment will face more dramatic and challenging circumstances, where complete or partial business closures and lack of federal relief could have severe ramifications. Q: What new restrictions have been put in place surrounding debt collection efforts and outbound calls? TH: To protect consumers who may be experiencing financial distress, most states have imposed new, stringent restrictions to prevent utilities from engaging in certain collections activities. Utilities are currently not charging any late payment fees and are instead structuring payment plans. Additionally, all outbound collections efforts have been suspended and there is fieldwork being executed of services for both commercial and consumer properties. As of now, consumer and commercial fieldwork will likely not commence until after the first year or when the winter moratorium concludes. MS: The new restrictions imposed upon collections activities will likely drive consumer payment behavior. If consumers know that their utilities (i.e. energy and water) will not be shut off if they miss a payment, they will make these bills less of a priority. This will dramatically increase the amount owed when these restrictions are lifted next year. Q: Can we predict how the utilities industry will fare post-COVID-19? TH: The volume of accounts in collections and eligible for disconnect will be overwhelming. Many utility providers fear the unpaid balances consumers and commercial entities accumulate will be nearly impossible to fit into a repayment schedule. Both analyzing internal payment segments and overlaying external factors may be the best way to optimize the most critical go-forward plan. MS: The amount of people who fall into collections is going to greatly increase and utility providers need to start planning for it now to weather the storm. They will need to use data, analytics and tools to help them optimize their tasks, so they can be more efficient with their resources. Like many other industries, the utilities sector will look to increasing digitalization of their processes and having less social interaction where possible. This could mean the need and drive for expediting current smart meter programs where possible to enable remote fieldwork to assist in managing this unprecedented level of activity that is sure to overwhelm field operations (where allowed by state regulators). Q: What should utility providers be doing to plan for an uptick in collections activities post-COVID-19? TH: With regulatory mandated suspensions of collections activities for utility providers and self-selected reductions due to stay at home orders and staff protection, the backlog of payments, calls and inquiries once business resumes as normal is set to overwhelm existing capacity. More than ever, self-service options (text/web), Q&A and alternative communication methods will be needed to shepherd consumers through the collections process and minimize the strain on call center agents. Many utility providers are asking for external data points to segment their consumers by industry or by those whose employment would have been adversely impacted by COVID-19. MS: Utility providers should be monitoring consumer data in order to prepare for when they are able to collect. This will help them strategize the number of resources they will need in their call centers and out in the field performing shut off activities. Given that the rise in cases will be more volume than their call centers can handle, they will need to use their resources wisely and plan to use them efficiently when they are able to resume collections. Q: How can Experian help utility providers reduce collections costs and maximize recovery? TH: Experian can help revise collections tactics and segmentation strategies by providing insight on how consumers are paying other creditors and identifying new segmentation opportunities as we emerge from the freeze on collections activities. Collections cases will be complex, and many factors and constraints will need to balanced against changing goals, making optimization key. MS: Utilizing Experian’s credit data and models can help ensure that resources are being used efficiently (i.e. making successful calls). There is also a need to leverage ability to pay models as well as prioritization models. By using these models and tools, utility providers can optimize their treatment strategies, reduce costs and maximize dollars collected. Learn more About our Experts: Tom Hanson, Senior Energy Consultant, Experian CEM, North America Tom is a Senior Consultant within the Energy Vertical at Experian, supporting regulated energy companies throughout the U.S. He brings over 25 years of experience in the energy field and supports his clients throughout the customer lifecycle, providing expertise in ID verification, account treatment, fraud solutions, analytics, consulting and final bill/field optimization strategies and techniques. Mark Soffietti, Analytics Consulting Senior Manager, Experian Decision Analytics, North America Mark has over 15 years of experience transforming data into actionable knowledge for effective decision management. Mark’s expertise includes solution development for consumer and commercial lending across the credit spectrum – from marketing to collections.

The largest industry disruptor was a surprise to everyone. Where bets may have been placed on digital transformation, automated decisioning, or better omnichannel programs, no one foresaw the global pandemic of COVID-19 and the corresponding economic fall out that ensued. As financial institutions have spent the past two months scattered and then regrouping, whether with pivoted downturn contingency strategies or with a business-focused Hail Mary, some might argue that the dust is beginning to settle. While the world and the majority of businesses are working to manage and stabilize a new normal against a background of some form of chaos, once federal and state regulations are loosened, the world – and financial institutions in particular – will need a plan forward. So, what comes after COVID-19? With stimulus checks and what everyone hopes will soon be a re-stimulating of the economy, consumers will seek credit. And when that influx comes, there will be a need to strategize what is the right offer for the right consumer. How do you take on more customers while minimizing risk? Non-existent and/or shrinking budgets Many marketing budgets were already small prior to the global pandemic, so coming out of it, to say every marketing dollar counts is an understatement. Traditional prescreen, while a pillar in acquisition operations, is an antiquated strategy. Using hyper-segmentation via a true end-to-end marketing service, pumped up by the right data for decision making, enables financial institutions to not only build the right audience but tailor quality experiences that increase engagement and loyalty. That means ultimately reducing operating costs while improving experiences and take rates. Work from home turned life from home Going virtual has gone viral. Seemingly overnight, most brick and mortar operations went online. Some versions of digital transformation became a need to have, versus a nice to have, and the gap between the financial institutions who were equipped to pivot online, versus those who were not, spread further. As the vast majority of consumers are at home – whether by way of work from home or furlough – our society has quickly embraced everything being online. Reach your consumers where they are, in the digital-first channels to which they have become familiar with and accustomed. As consumers are at the center of every marketing strategy, engaging omnichannel delivery enhances reach across critical touchpoints. Inclusive of social media, email, direct mail, TV, and more, the campaign should provide a seamless experience, all working together in a synchronized fashion. Consistency has always been key, but especially during these volatile times, to reflect stability, empathy and constant messaging is an undertone that can only help strengthen consumers’ view of your organization. Learn fast, grow faster For marketing financial products, it’s a matter of connecting the dots between consumer touchpoints and results data. By making these critical connections, financial institutions will be better positioned to identify the most effective elements in the campaign. By gleaning more insights from campaign performance, organizations can optimize future campaigns and minimize wasted ad spend. These key learnings, delivered at the end of every campaign cycle, help your organization to remain nimble, pivot quickly and execute campaigns that get increasingly better ROI as you hone in on the nuances revealed by data on consumer behavior, preferences, motivations and more. Changing times and even faster-changing needs There’s always been a need for faster decisioning and more results with increasingly fewer resources. The need for speed has been put on hyperdrive as the economy has entered the current environment. How do you keep up with the changing needs of your consumers? Get your marketing right from the start and see results through to the end. Incorporating the right data, advanced analytics and constant access ultimately enable more strategic focus and shorter campaign cycles. As we all navigate the ever-changing “normal,” offering the right support to your consumers is the right thing to do for them and for you. Managing rising consumer needs, while also minimizing risk to your bottom line, is also the right thing to do for your business. Once plans move from managing business operations through the crisis to moving forward, make sure your marketing – how you are reaching out to existing customers and prospective customers for the next steps in their financial journey – is data-driven. To learn more about how Experian can help you execute data-driven marketing that fuels customer acquisition, visit our website. Learn More

Including vehicle history reports in online vehicle listings create a more complete picture of the vehicle a consumer is looking at online.

While an overdue economic downturn has been long discussed, arguably no one could have foreseen the economic disruption from COVID-19 to the extent that’s been witnessed thus far. But now that we’re here, is there a line of sight to financial institutions’ next move? With the current situation marked by a history-making rise in unemployment, massive amounts of uncertainty within the market as well as for consumers and small businesses and consumer spending changes, loss forecasting is more important now than ever before. After the longest period of economic growth in history, financial institutions are caught off guard. While large banks are more prepared as they have stress testing capabilities in place and are estimating the potential large impact on their loss allowances, the since-delayed CECL requirements emphasized forecasting for the masses, and yet many are still under-equipped. Loss forecasting has evolved from a need for a small few to now a necessary strategy for all. While some financial institutions will look to loss forecasting to potentially reduce the severity of impact for the path ahead during these times (or even how they might come out stronger than their competition), for many, loss forecasting is the key to survival. Bare necessities. Understanding the possible outcomes of the pandemic’s impact is necessary to make critical business decisions. Lenders are likely receiving numerous questions about their portfolios and possible outcomes. These questions include, but are not limited to: What could the range of outcomes to my portfolio based on expert forecasts of macroeconomic conditions? How will I make lending decisions in the short term? Do my models need to change? How bad could charge offs be for my portfolio? If I have reduced marketing and application flows, at what point do I need to begin opening new accounts or consider portfolio acquisitions? How can lenders get answers? Loss forecasting. As Mohammed Chaudhri, Experian Chief Economist, said, “Loss forecasting is more pivotal than ever…existing models are not going to be up to the task of accurately predicting losses.” Whatever questions you’re receiving, you need certain necessary pieces of information to navigate this new era of loss forecasting. Those pieces are frequently updated client and industry data; ongoing access to expert macroeconomic forecasts; and sophisticated and evolved forecasting models. Client and Industry Data Loan-level data, bankruptcy scores and customer-level attributes are key insights to fueling loss forecasting models. By combining several data sets and scores (and a comprehensive history of both) your organization can see greater benefits. Macroeconomic Forecasts As has been mentioned numerous times, the economic impact resulting from COVID-19 is not at all like the Great Recession. As such, leveraging macroeconomic forecasts, and specifically COVID-19 forecasts, is critical to analyzing the potential impacts to your organization. Sophisticated Models Whether building models on your own or leveraging an expert, the key ingredients include the innerworkings of the model, leveraging historical data and making sure that both the models and the data are updated regularly to ensure you have the most accurate, thorough forecasts available. Also, leveraging machine learning tools is imperative for model specification and evaluation. Fortunately, while model building and loss forecasting used to be synonymous with countless resources and dollar signs, innovation and digital transformation have made these strategies within reach for financial institutions of all sizes. Incorporating the right data (and ensuring that data is regularly updated), with the right tools and macroeconomic scenarios (including COVID-19, upside, baseline, adverse and severely adverse scenarios) enables you to get a line of sight into the actions you need to take now. Empowered with insights to compare and benchmark results, discover the cause of changes in results, explore result scenarios in advance, and access recommended optimizations, loss forecasting enables you to focus on the critical decisions your business depends on. Experian helps you with loss forecasting for now and the future. For more information, including an on-demand webinar Experian presented with Oliver Wyman as well as the opportunity to engage Experian experts into your loss forecasting strategy, please click the button below. Learn More

This is the third in a series of blog posts highlighting optimization, artificial intelligence, predictive analytics, and decisioning for lending operations in times of extreme uncertainty. The first post dealt with optimization under uncertainty and the second with predicting consumer payment behavior. In this post I will discuss how well credit scores will work for consumer lenders during and after the COVID-19 crisis and offer some recommendations for what lenders can be doing to measure and manage that model risk in a time like this. Perhaps no analytics innovation has created opportunity for more individuals than the credit score has. The first commercially available credit score was developed by MDS (now part of Experian) in 1987. Soon afterwards FICO® popularized the use of scores that evaluate the risk that a consumer would default on a loan. Prior to that, lending decisions were made by loan officers largely on the basis on their personal familiarity with credit applicants. Using data and analytics to assess risk not only created economic opportunity for millions of borrowers, but it also greatly improved the financial soundness of lending institutions worldwide. Predictive models such as credit scores have become the most critical tools for consumer lending businesses. They determine, among other things, who gets a loan and at what price and how an account such as a credit line is managed through its life cycle. Predictive models are in many cases critical for calculating loan and loss reserves, for stress testing, and for complying with accounting standards. Nearly all lenders rely on generic scores such as the FICO® score and VantageScore® credit score. Most larger companies also have a portfolio of custom scorecards that better predict particular aspects of payment behavior for the customers of interest. So how well are these scorecards likely to perform during and after the current pandemic? The models need to predict consumer credit risk even as: Nearly all consumers change their behaviors in response to the health crisis, Millions of people—in America and internationally—find their income suddenly reduced, and Consumers receive large numbers of accommodations from creditors, who have in turn temporarily changed some of their credit reporting practices in response to guidelines in the federal CARES Act. In an earlier post, I pointed out that there is good reason to believe that credit scores will tend to continue to rank order consumers from most likely to least likely to repay their debts even as we move from the longest economic expansion in history to a period of unforeseen and unexpected challenges. But the interpretation of the score (for example, the log odds or the bad rate) may need to be adjusted. Furthermore, that assumes that the model was working well on a lender’s population before this crisis started. If it has been a long time since a scorecard was validated, that assumption needs to be questioned. Because experts are considering several different scenarios regarding both the immediate and long-term economic impacts of COVID-19, it’s important to have a plan for ongoing monitoring as long as necessary. Some lenders have strong Model Risk Management (MRM) teams complying with requirements from the Federal Reserve, Federal Deposit Insurance Corporation (FDIC), the Office of the Comptroller of the Currency (OCC). Those resources are now stretched thin. Other institutions, with fewer resources for MRM, are now discovering gaps in their model inventories as they implement operational changes. In either case, now’s the time to reassess how well scorecards are working. Good model validation practices are especially critical now if lenders are to continue to make the sound data-driven decisions that promote fairness for consumers and financial soundness for the institution. If you’re a credit risk manager responsible for the generic or custom models driving your lending, servicing, or capital allocation policies, there are several things you can do--starting now--to be sure that your organization can continue to make fair and sound lending decisions throughout this volatile period: Assess your model inventory. Do you have good documentation showing when each of the models in your organization was built? When was it last validated? Assign a level of criticality to each model in use. Starting with your most critical models, perform a baseline validation to determine how the model was performing prior to the global health crisis. It may be prudent to conduct not only your routine validation (verifying that the model was continuing to perform at the beginning of the period) but also a baseline validation with a shortened performance window (such as 6-12 months). That baseline validation will be useful if the downturn becomes a protracted one—in which case your scorecard models should be validated more frequently than usual. A shorter outcome window will allow a timelier assessment of the relationship between the score and the bad rate—which will help you update your lending and servicing policies to prevent losses. Determine if any of your scorecards had deteriorated even before the global pandemic. Consider recalibrating or rebuilding those scorecards. (Use metrics such as the Population Stability Index, the K-S statistic and the Gini Coefficient to help with that decision.) Many lenders chose not to prioritize rebuilding their behavioral scorecards for account management or collections during the longest period of economic growth in memory. Those models may soon be among the most critical models in your organization as you work to maintain the trust of your accountholders while also maintaining your institution’s financial soundness. Once the CARES accommodation period has expired, it will be important to revalidate your models more frequently than in the past—for as long as it takes until consumer behavior normalizes and the economy finds its footing. When you find it appropriate to rebuild a scorecard model, consider whether now is the time to implement ethical and explainable AI. Some of our clients are finding that Machine Learned models are more predictive than traditional scorecards. Early Experian research using data from the last recession indicates this will continue to be true for the foreseeable future. Furthermore, Experian has invested in Research and Development to help these clients deliver FCRA-compliant Adverse Action reasons to their consumers and to make the models explainable and transparent for model risk governance and compliance purposes. The sudden economic volatility that has resulted from this global health crisis has been a shock to all organizations. It is important for lenders to take the pulse of their predictive models now and throughout the downturn. They are especially critical tools for making sound data-driven business decisions until the economy is less volatile. Experian is committed to helping your organization during times of uncertainty. For more resources, visit our Look Ahead 2020 Hub. Learn more

The economic impact of the COVID-19 health crisis is ever-evolving and requires great flexibility and planning from lenders. Shannon Lois, Experian’s Senior Vice President, Analytics, Consulting and Operations, discusses what lenders can expect and next steps to take. Q: Though COVID-19 is catalyzing a sharp economic slowdown, many experts expect it to be temporary and liken it more to a global natural disaster than the prior financial crisis. What are your reactions? SL: There is still debate as to whether we will have a U-shaped or a V-shaped recession and its probable severity and longevity. Regardless, we are in a recession caused by a health pandemic with uncertainty of what it will mean for our global economy and without a clear view as to when it will end. The sooner we can contain the virus the more it will help to curtail the size of the recession. The unemployment rates and the consumer lack of confidence in the future will continue to contract spending which in turn will continue to propagate the recession. Our ability to limit COVID-19 over the coming months will have a direct impact in the economy, although the effects will probably linger on for six or more months. Q: From an economic perspective, what are the current trends we’re seeing? SL: Unemployment has skyrocketed and every business sector has been impacted although with different degrees of severity. In particular, tourism/hospitality, airlines, automotive, consumer products and retail have suffered. Consumers’ financial status varies and will continue to fluctuate, and credit conditions tighten while welfare payments increase. The government programs that have started will help, but they’re not enough to counter a prolonged recession. As some states seek to reopen and others extend their shelter in place orders, we will continue to see economic changes, with different sectors bouncing back or dipping further depending on their geographic location. Q: How does the economic slowdown compare to what we may have expected previously? SL: This recession is different than anything we have encountered previously not only because of the health concerns and implication of our population but because of the uncertainty of it all. As an example, social distancing has significantly and immediately impacted consumer demand but overall it is their low confidence in the future that will cause a continuous drop in discretionary and non-discretionary spending. Not only do we have challenges on the demand side, we also are seeing the same on the supply side with no automotive manufacturing occurring in the USA, and international oil flooding the market causing negative impact on domestic oil and the broad energy market. Q: How do the unemployment and liquidity challenges come into play? SL: The unemployment rate has already jumped to a record high. Most consumers are facing liquidity and affordability challenges and businesses do not have enough cash reserves to sustain them. Consumer activity has shifted drastically across all channels while lenders are exercising more caution. If this is a V-shaped recession (and hopefully it will be), then most activity is bound to spring back quickly in Q3. With companies safeguarding some jobs and the help of governments’ supplemental programs, businesses will restore supply and consumer demand will get a kick start. Q: What is the smartest next play for financial institutions? SL: The path forward requires several steps. First, understand your customers, existing and new. Refine your policies with the right information around your customers’ financial situations and extend programs (forbearance and loan payment forgiveness) as needed under the right guidelines. It’s also important to use refreshed data to lend to consumers and businesses who need it now more than ever, with the proper policies and fraud checks in place. Finally, increase your agility to operate effectively and dynamically with automation, interactive communication and self-serving digital tools. Experian is committed to helping lenders throughout these uncertain times. For more resources, visit our Look Ahead 2020 Resource Hub. Learn more About Our Expert Shannon Lois, Senior Vice President, Analytics, Consulting and Operations, Decision Analytics Shannon and her team of analysts, scientists, credit, fraud and marketing risk management experts provide results-driven consulting services and state-of-the-art advanced analytics, science and data products to clients in a wide range of businesses, including banking, auto, credit, utility, marketing and finance. Prior to her current role, she founded the Advisory Services practice at Experian, driving to actionable and proven solutions for our clients’ most pressing business problems.