Latest Posts

The data to create synthetic identities is available. And the marketplace to exchange and monetize that data is expanding rapidly. The fact that hundreds of millions of names, addresses, dates of birth, and Social Security numbers (SSNs) have been breached in the last year alone, provides an easy path for criminals to surgically target new combinations of data. Armed with an understanding of the actual associations of these personally identifiable information (PII) elements, fraudsters can better navigate the path to perpetrate identity theft, identity manipulation, or synthetic identity fraud schemes on a grand scale. Using information such as birth dates and addresses in combination with Social Security numbers, criminals can target new combinations of data to yield better results with lower risk of detection. Some examples of this would be: identity theft, existing account takeovers, or the deconstruction and reconstruction of those PII elements to better create effective synthetic identities. Experian has continued to evolve and innovate against fraud risks and attacks with an understanding of attack rates, vectors, and the shifting landscape in data availability and security. In doing so, we’ve historically operated under the assumption that all PII is already compromised in some way or is easily done so. Because of this, we employ a layered approach, providing a more holistic view of an identity and the devices that are used over time by that identity. Relying solely on PII to validate and verify an identity is simply unwise and ineffective in this era of data compromise. We strive to continuously cultivate the broadest and most in-depth set of traditional, innovative and alternative data assets available. To do this, we must enable the integration of diverse identity attributes and intelligence to balance risk, while maintaining a positive customer experience. It’s been quite some time since the use of basic PII verification alone has been predictive of identity risk or confidence. Instead, validation and verification is founded in the ongoing definition and association of identities, the devices commonly used by those individuals, and the historical trends in their behavior. Download our newest White Paper, Synthetic Identities: Getting real with customers, for an in-depth Experian perspective on this increasingly significant fraud risk.

If someone asked you for stats on your retail card portfolio, would you respond with the number of accounts? Average spend per month? Or maybe you know the average revolving balance and profitability. Notice something about that list? Too many lenders think of their portfolio and customers as numbers when in reality these are individuals expressing themselves through their transactions. In an age where consumers increasingly expect customized experiences, marketing to account #5496115149251 is likely to fall on deaf ears. Credit card transaction data including bankcard, retail, and debit cards holds a wealth of information about your consumers' tastes and preferences. Think about all the purchases you made using a credit card this past month. Did you shop at high-end retail stores or discount stores? Expensive restaurants or fast food? Did you buy new clothes for your kids? Maybe you went to the movies, or met friends at a bar. How you use your card paints a picture of who you are. The trick is turning all those numbers into insights. You may have been swept up in all the excitement around Apple’s announcement of the iPhone X in August. However, you may have overlooked the incorporation of Neural Embedding, or machine learning, as one of the most powerful features of the new phone. Experian DataLabs has developed an innovative approach to analyzing transaction data using similar techniques. Unstructured machine learning is applied and patterns begin to emerge around customer spending. The patterns are highly intuitive and give personality to what was previously an indecipherable stream of data. For example, one group may be more likely to spend on children’s clothing, child care services, and theme parks while another spends on expensive restaurants, airlines, and golf courses. If these two consumers happened to spend approximately the same each month on your card, you’d probably treat them as category. But understanding one is a young family and their other is jet setter allows you to tailor messaging, offers, and terms to their needs and use of your products. Further, you can ensure they have the best product based on their lifestyle to minimize silent attrition as their needs evolve. But it’s not just about marketing. When your latest attrition dashboard is updated, what period are you measuring? Do you analyze account closures from the previous month? Maybe a few months back? Understanding churn is important, but it’s inherently reactive and backward looking. You wouldn’t drive a car looking in the rearview mirror, would you? Experian enables clients to actively monitor the portfolio for attrition risk by analyzing usage patterns and predicting future spend. Transactions are then monitored up to daily and, when spend doesn’t occur as expected, an alert is sent so you can proactively attempt to save the account before it closes. These algorithms are finely tuned to reduce false positives that can come from seasonality or predictable gaps in spend such as only using a card at certain times during the week. Most importantly, it gives you an opportunity to manage each account and address changing customer needs instead of waiting for customers to call to cancel. So how well do you know your customers? If you’re still looking at them as numbers, it may be time to explore new capabilities that allow you to act small, no matter how large your portfolio. Transaction Data Insights brings cutting-edge machine learning capabilities to lenders of all sizes. By digging into behavioral segments and having tools to monitor and send alerts when a consumer is showing signs of attrition risk, card portfolios can suddenly treat customers like people, providing the customized experience they increasingly expect.

Despite rising concerns about identity theft, most Americans aren’t taking basic steps to make it harder for their information to be stolen, according to a survey Experian conducted in August 2017: Nearly 3 in 4 consumers said they’re very or somewhat concerned their email, financial accounts or social media information could be hacked. This is up from 69% in a similar survey Experian conducted in 2015. Nearly 80% of survey respondents are concerned about using a public Wi-Fi network. Yet, barely half said they take the precaution of using a password-protected Wi-Fi network when using mobile devices. 59% of respondents are annoyed by safety precautions needed to use technology — up 12% from 2015. When your customer’s identity is stolen, it can negatively impact the consumer and your business. Leverage the tools and resources that can help you protect both. Protect your customers and your business>

Synthetic identity fraud is on the rise across financial services, ecommerce, public sector, health and utilities markets. The long-term impact of synthetic identity remains to be seen and will hinge largely upon forthcoming efforts across the identity ecosystem made up of service providers, institutions and agencies, data aggregators and consumers themselves. Making measurement more challenging is the fact that much of the assumed and confirmed losses are associated with credit risk and charge offs, and lack of common and consistent definitions and confirmation criteria. Here are some estimates on the scope of the problem: Losses due to synthetic identity fraud are projected to reach more than $800 million in 2017.* Average loss per account is more than $10,000.* U.S. synthetic credit card fraud is estimated to reach $1.257 billion in 2020.* As with most fraud, there is no miracle cure. But there are best practices, and topping that list is addressing both front- and back-end controls within your organization. Synthetic identity fraud webinar> *Aite Research Group

In 2017, 81 percent of U.S. Americans have a social media profile, representing a five percent growth compared to the previous year. Pick your poison. Facebook. Instagram. Twitter. Snapchat. LinkedIn. The list goes on, and it is clear social media is used by all. Grandma and grandpa are hooked, and tweens are begging for accounts. Factor in the amount of data being generated by our social media obsession – one report claims Americans are using 2,675,700 GB of Internet data per minute – and it makes some lenders wonder if social media insights can be used to assess credit risk. Can banks, credit unions and online lenders look at social media profiles when making a loan decision and garner intel to help them make a credit decision? After all, in some circles, people believe a person’s character is just as important as their income and assets when making a lending decision. Certainly, some businesses are seeing value in collecting social media insights for marketing purposes. An individual’s interests, likes and click-throughs reveal a lot about their lifestyle and potential brand linkages. But credit decisions are different. In fact, there are two key concerns when considering social media data as it pertains to financial decisions. There is that little rule called the Equal Credit Opportunity Act, which states credit must be extended to all creditworthy applicants regardless of race, religion, gender, marital status, age and other personal characteristics. A quick scan of any Facebook profile can reveal these things, and more. Credit applications do not ask for these specific details for this very reason. Social media data can also be manipulated. One can “like” financial articles, participate in educational quizzes and represent themselves as if they are financially responsible. Social media can be gamed. On the flip side, a consumer can’t manipulate their payment history. There is no question that data is essential for all aspects of the financial services industry, but when it comes to making credit decisions on a consumer, FCRA data trumps everything. In the consumer’s best interest, it is essential that credit data be both displayable and disputable. The right data must be used. For lenders, their primary goal is to assess a consumer’s stability, ability and willingness to pay. Today, social media can’t address those needs. It’s not to say that social media data can’t be used in the future, but financial institutions are still grappling with how it can be predictive of credit behavior over time. In the meantime, other sources of data are being evaluated. Everything from including on-time utility and rental payments, insights on smaller dollar loans and various credit attributes can help to provide a more holistic view of today’s credit consumer. There is no question social media data will continue to grow exponentially. But in the world of credit decisioning, the “like” button cannot be given quite yet.

Our national survey found that consumers struggle to find a credit card that meets their needs. They say there are too many options and it’s too time-consuming to research. What do consumers want? With 53% of survey respondents not satisfied with their current cards and 1 in 3 saying they’re likely to get a new card within 6 months, now’s the time to start personalizing offers and growing your portfolio. Start personalizing offers today>

Earlier this week, Javelin Strategy & Research announced its inaugural edition of the 2017 Identity Proofing Platform Awards. We were honored to see CrossCore as the leader – taking the award for the best overall identity proofing platform. According to the report, “Experian’s identity proofing platform is a strong performer in every category of Javelin’s FIT model. It is functional. It is innovative. And, most important, it is tailored toward the advisory’s expectations. The comprehensive nature of CrossCore makes it the market-leading solution for identity proofing.” It’s harder than ever to confidently identify your customers in today’s digital economy. You have lots of vendor solutions to choose from in the identity proofing space. And, now Javelin has made it much easier for you to select the partner that is right for your needs. Javelin’s newly minted Identity Proofing Platform Scorecard assesses current capabilities in the market to help you make that decision. And they have done a lot of the heavy lifting, looking across 23 vendors and scoring them based on three categories of their FIT model – functional, innovative, and tailored. Protecting customers is a priority for you – and for us. Here at Experian, we have a range of capabilities to help businesses manage identity proofing, and our CrossCore platform brings them all together. We launched CrossCore last year, with the goal of making the industry’s fraud and identity solutions work better for everyone. CrossCore delivers a future-proof way to modify strategies quickly, catch fraud faster, improve compliance and enhance the customer experience. We’re proud of the work we’ve done so far, integrating our products as well as adding more than 10 partners to the program. We’re pleased to see so many of our partners included in Javelin’s report. We’re working closely with our clients to pull in more partner capabilities, and further enhance our own platform to create a layered approach that supports a risk-based, adaptable strategy. As highlighted in the Javelin report, a reliance on traditional identity verification approaches are no longer sufficient or appropriate for digital channels. With CrossCore, our clients can choose the capabilities they want, when they want them, to dial in the right confidence level for each and every transaction. This is because CrossCore supports a layered approach to managing risk, allowing companies to connect multiple disparate services through a common access point. We are committed to making it easier for you to protect consumers against fraud. CrossCore is helping us all do just that.

The collections space has been migrating from traditional mail and outbound calls to electronic payment portals, digital collections and virtual negotiators. Now that collectors have had time to test virtual collections, we’ve collected some data points. Here are a few: On average, 52% of consumers who visit a digital site will proceed to a payment schedule if the right offer is made. 21% of the visits were outside the core hours of 8 a.m. to 8 p.m., an indication that traditional business hours don’t always work. Of the consumers who committed to a payment plan, only 56% did it in a single visit. The remaining 44% did so mostly later that day or on a subsequent day. As more financial institutions test this new virtual approach, we anticipate customer satisfaction and resolutions will continue to climb. Get your debt collections right>

Everyone loves a story. Correction, everyone loves a GOOD story. A customer journey map is a fantastic tool to help you understand your customer’s story from their perspective. Perspective being the operative word. This is not your perspective on what YOU think your customer wants. This is your CUSTOMER’S perspective based on actual customer feedback – and you need to understand where they are from those initial prospecting and acquisition phases all the way through collections (if needed). Communication channels have expanded from letters and phone calls to landlines, SMS, chat, chat bots, voicemail drops, email, social media and virtual negotiation. When you create a customer journey map, you will understand what channel makes sense for your customer, what messages will resonate, and when your customer expects to hear from you. While it may sound daunting, journey mapping is not a complicated process. The first step is to simply look at each opportunity where the customer interacts with your organization. A best practice is to include every department that interacts with the customer in some way, shape or form. When looking at those touchpoints, it is important to drill down into behavior history (why is the customer interacting), sociodemographic data (what do you know about this customer), and customer contact patterns (Is the customer calling in? Emailing? Tweeting?). Then, look at your customer’s experience with each interaction. Again, from the customer’s viewpoint: Was it easy to get in touch with you? Was the issue resolved or must the customer call back? Was the customer able to direct the communication channel or did you impose the method? Did you offer self-serve options to the right population? Did you deliver an email to someone who wanted an email? Do you know who prefers to self-serve and who prefers conversation with an agent, not an IVR? Once these two points are defined: when the customer interacts and the customer experience with each interaction, the next step is simply refining your process. Once you have established your baseline (right channel, right message, right time for each customer), you need to continually reassess your decisions. Having a system in place that allows you to track and measure the success of your communication campaigns and refine the method based on real-time feedback is essential. A system that imports attribute – both risk and demographic – and tracks communication preferences and campaign success will make for a seamless deployment of an omnichannel strategy. Once deployed, your customer’s experience with your company will be transformed and they will move from a satisfied customer to one that is a fan and an advocate of your brand.

With 1 in 6 U.S. residents being Hispanic, now is a great time for financial institutions to reflect on their largest growth opportunity. Here are 3 misconceptions about the multifaceted Hispanic community that are prevalent in financial institutions: Myth 1: Hispanic consumers are only interested in transaction-based products. In truth, product penetration increases faster among Hispanic members compared with non-Hispanic members when there’s a strategic plan in place. Myth 2: Most Hispanics are undocumented. The facts show that of the country’s more than 52 million Hispanics, most are native-born Americans and nearly 3 in 4 are U.S. citizens. Myth 3: The law prevents us from serving immigrants. Actually, financial institutions can compliantly lend to individuals who have an Individual Taxpayer Identification Number. There are many forms of acceptable government-issued identification, such as passports and consular identification cards. Solidifying the right organizational mentality, developing a comprehensive strategy based on segmentation, and defining what success truly looks like. These are all part of laying the foundation for success with the Hispanic market. Learn more>

Direct mail is dead. It’s so 90s. Digital is the way to reach consumers. Marketers have heard this time and again, and many have shifted their campaign focus to the digital space. But as our lives become more and more consumed by digital media, consumers are giving less time and attention to the digital messages they receive. The average lifespan of an email is now just two seconds and brand recall directly after seeing a digital ad is just 44%, compared to direct mail which has a brand recall of 75%. Further research shows direct mail marketing is one of the most effective tools for customer acquisition and loan growth. The current Data & Marketing Association (DMA) response rate report reveals the direct mail response rates for 2016 were at the highest levels since 2003. Additionally, while mailing volume has trended down since October 2016, response rates have trended up, and reached 0.68% in March 2017, up from 0.56% in October 2016. Using data and insights to tailor a direct mail campaign can yield big results. Here are some attention-grabbing tips: Identify Your Target Market: Before developing your offer and messaging strategy, begin with the customer profile you are trying to attract. Propensity models and estimated interest rates are great tools for identifying consumers who are more likely to respond to an offer. Adding them as an additional filter to a credit-qualified population can help increase response rates. Verify your Mailing List: Experian’s address verification software validates the accuracy and completeness of a physical address, flags inaccuracies, and corrects errors before they can negatively impact your campaign. Personalize the Offer: Consumers are more likely to open offers that are personalized, and appeal to their life stage, organizational affiliations or interests. Experian’s Mosiac profile report is a simple, inexpensive way to gather data-based insight into the lifestyle and demographics of your audience. Time the Offer: Timing your campaign with peak market demand is key. For example, personal loan demand is highest in the first quarter after the holidays, while student loans demand peaks in the Spring. Direct mail can help overcome digital fatigue that many consumers are experiencing, and when done right, it’s the printed piece that helps marketers boost response rates.

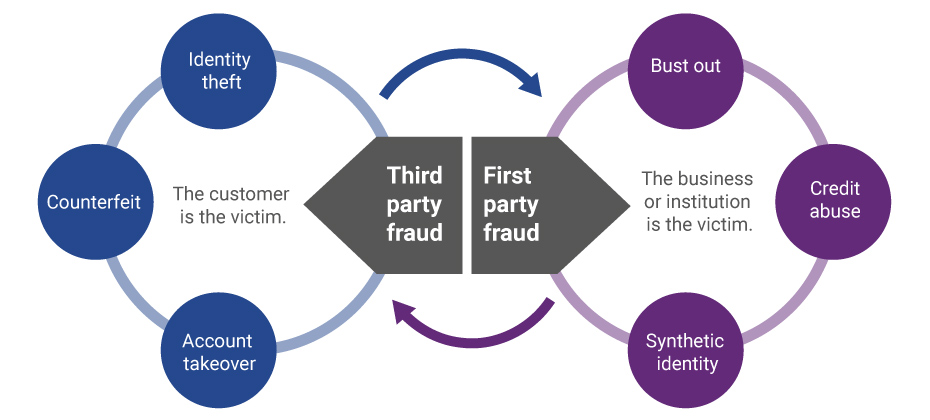

Evolution of first-party fraud to third Third-party and first-party schemes are now interchangeable, and traditional fraud detection practices are less effective in fighting these evolving fraud types. Fighting this shifting problem is a challenge, but it isn’t impossible. To start, incorporate new and more robust data into your identity verification program and provide consistent fraud classification and tagging. Learn more>

It should come as no surprise that the process of trying to collect on past-due accounts has been evolving. We’ve seen the migration from traditional mail and outbound calls, to offering an electronic payment portal, to digital collections and virtual negotiators. Being able to get consumers who have past-due debt on the phone to discuss payments is almost impossible. In fact, a recent informal survey divulged a success rate of a 15% contact rate to be considered the best by several first-party collectors; most reported contact rates in the 8%-range. One can only imagine what it must be like for collection agencies and debt buyers. Perhaps, inviting the consumer to establish a non-threatening dialog with an online system can be a better approach? Now that collectors have had time to test virtual collections, we’ve collected some data points. Conversion rates, revisits, and time of day An analysis of several clients found that on average 52% of consumers that visit a digital site will proceed to a payment schedule if the right offer is made. 21% of the visits were outside the core hours of 8 a.m. to 8 p.m., an indication that consumers were taking advantage of the flexibility of reaching out at any time of the day or night to explore their payment and settlement options. The traditional business hours don’t always work. Here is where it really gets interesting, and invites a clear comparison to the traditional phone calls that collectors make trying to get the consumer to commit to a payment plan on the line. Of the consumers that committed to a payment plan, only 56% did it in a single visit. The remaining 44% that committed to payments did so mostly later that day, or on a subsequent day. This strongly suggests they either took time to check their financial status, or perhaps asked a friend or family to help with the payment. In other words, rather than refusing to agree to an instantaneous agreement pressured by a collector, the consumer took time to reflect and decide what was the best course of action to settle the amount due. On a similar note, the attrition rate of “Promises to Pay” were 24% lower using online digital solutions versus the traditional collector phone call. This would be consistent with more time to agree to a payment plan that could be met, rather than weakly agreeing to a collector phone call just to get the collector off the phone. Another possible reason for a lower attrition rate may be that a well-defined digital collection solution can send out reminders to consumers via email or text in advance of the next scheduled payment, so that the consumer can be reminded to have the funds available when the next payment hits their account. For accounts where settlement offers are part of the mix, a higher percentage of balances is being resolved versus the collection floor. In fact, the average payment improvement is 12% over what collectors tend to get on the collections floor. The reason for this significant change is unclear, but the suspicion is that a digital collection solution will negotiate stronger than a collector, who is often moving to the bottom of an acceptable range too soon. What's next? Further assessing the consumer’s needs and capabilities during the negotiation session will undoubtedly be a theme going forward. Logical next steps will include a “behind-the-scenes” look at the consumer’s entire credit picture to help the creditor craft an optimal settlement amount that both the consumer can meet, and at the same time optimizes recovery. Potential impact to credit scores will also come into the picture. Depending on where the consumer and his past-due debt is in the credit lifecycle, being able to reasonably forecast the negative impact of a missed payment can act as an additional argument for making a past-due or delinquent payment now. As more financial institutions test this new virtual approach, we anticipate customer satisfaction and resolutions will continue to climb.

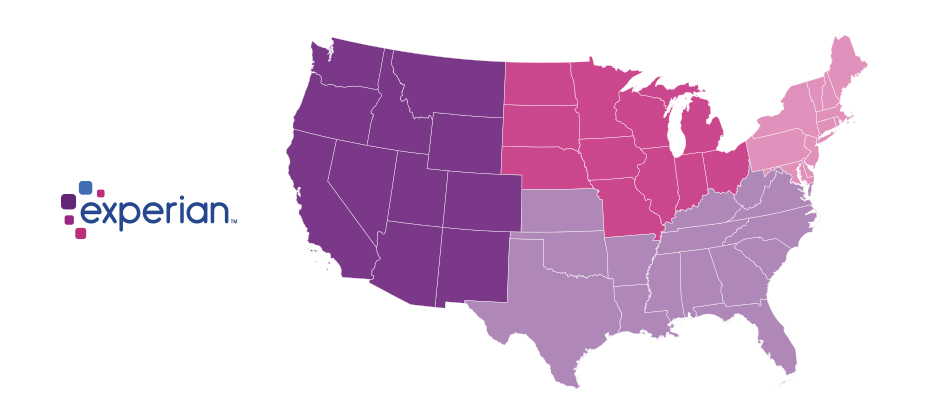

We recently analyzed millions of online transactions from the first half of 2017 to identify fraud attack rates. Here are the top 3 riskiest states for e-commerce billing and shipping fraud for H1 2017: Riskiest states for billing fraud Oregon Delaware Washington, D.C. Riskiest states for shipping fraud Oregon Delaware Florida Fraudsters are extremely creative, motivated and often connected. Protect all points of contact with your customers to prevent this growing type of fraud. Is your state in the top 10?

Businesses may be increasingly aware of identity theft threats to their customers, but an Experian survey shows that many consumers still seriously underestimate their risk of falling victim to identity thieves. In fact, the persistent and harmful myth that the majority of consumers are not vulnerable to identity theft is badly in need of debunking. Consumer misconceptions The online Experian survey of 1,000 Americans, age 18 and older, found many consumers have a false sense of security about identity theft, even those who regularly engage in behaviors that can dramatically elevate their risk of having their identities stolen. For example: Sixty-two percent of consumers said the security of their personal information online is a minor concern that doesn’t worry them much, and 17 percent never worry about it at all. The top reason for their lack of concern? Twenty-seven percent said it was because they didn’t share that much personal identifiable information (PII) online. Yet consumers store an average of 3.4 types of PII online, and have a large digital footprint that can make it easy for cybercrooks to track and steal their information. Half believe poor credit means identity thieves won’t be interested in stealing their PII. Twelve percent believe they’re safe because they take security precautions, and 9 percent think using only secure websites insulates them from identity theft risks. Risky behaviors When identity theft occurs, consumers are likely to blame any business they associate with the theft. A Gemalto survey found that consumers said protecting their data is 70 percent the responsibility of the companies they do business with, and just 30 percent their own responsibility, Infosecurity Magazine reports. What’s more, 29 percent said they don’t think businesses take their responsibilities seriously enough when it comes to protecting consumer data. Yet the survey found consumers are probably far more responsible for identity theft than they think because they continue to engage in behaviors that put them at greater risk. These include: Shopping online over a public Wi-Fi connection (43 percent) Allowing others to use online account names and passwords (33 percent) Letting others know their mobile device passwords (29 percent) Sharing payment card numbers and/or PINs (25 percent) Letting others use their PII to secure a job or credit (20 percent) Failing to enroll in credit monitoring or identity theft protection services (82 percent) Leaving it up to their banks and credit card companies to catch signs of fraud (81 percent) These dangerous habits can expose consumers’ PII to cybercriminals, even though half of those we surveyed didn’t think they were likely to become victims of identity theft. Impact of identity theft When consumers become identity theft victims, they experience a range of negative emotions and real consequences that affect them personally and financially. According to a survey by the Identity Theft Resource Center, identity theft victims reported feeling frustrated, fearful, angry and stressed. Many had trouble concentrating, lost sleep and felt physically ill because of the crime. They also reported the identity theft overshadowed their personal relationships, their personal and professional credibility, and even affected their ability to get jobs. Some even lost their jobs as a result. What companies can do Clearly, identity theft can be devastating and consumers need to do more to protect themselves. When it occurs, identity theft also undermines the consumer’s trust in companies and institutions, especially if the identity theft occurred in connection to or following a data breach. Helping consumers protect themselves from identity theft benefits everyone. Consumers can avoid the financial and emotional turmoil identity theft causes, and companies can help preserve their relationship with customers. As part of an effective data breach response plan, companies should include a consumer care element that provides breached consumers with: Free identity theft protection and credit monitoring services Dark web and internet records scanning Fraud resolution services Identity theft insurance Myth debunked Year after year, identity theft statistics demonstrate that most consumers are at risk of falling prey to identity thieves, no matter what they believe to the contrary. Unfortunately, consumers continue to take actions that can place their identities at risk. While you can’t force your customers to stop accessing their bank accounts over airport Wi-Fi or using the same password for all their financial accounts, you can take steps to reduce the risk they’ll experience identity theft because of something your organization did or didn’t do. Helping consumers protect themselves from identity theft makes good business sense, and it’s the right thing to do. Plus, consumers expect it; according to the Ponemon Institute’s “Mega Data Breach: Consumer Sentiment” survey, 63 percent of consumers believe a company that experiences a data breach should offer free identity protection to customers affected by the breach. Learn more about our Data Breach solutions