Latest Posts

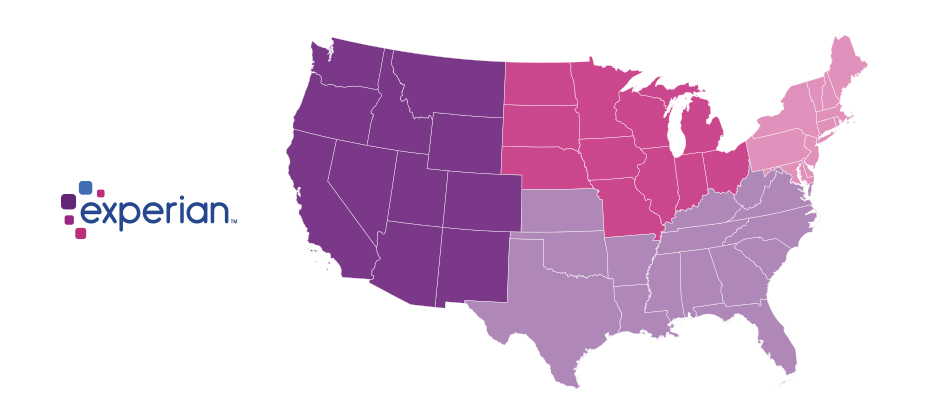

National Hispanic Heritage Month is observed each year from Sept. 15 to Oct. 15, by celebrating the histories, cultures and contributions of American citizens whose ancestors came from Spain, Mexico, the Caribbean and Central and South America. With one in six U.S. residents being Hispanic, all communities are impacted by the contributions of Hispanics—and now is a great time for financial institutions to reflect upon their largest growth opportunity. What is the best way to reach Hispanic consumers? What are the nuances of the Hispanic market? What are some of the myths FIs have about the Hispanic community? Miriam De Dios Woodward, CEO of Coopera, a Hispanic market strategy firm that helps credit unions reach and serve the Hispanic consumer segment, recently chatted with Experian about serving the Hispanic market. Here she shares her thoughts: Are there special considerations or insights credit unions should know when serving the Hispanic market? It’s very important to understand the Hispanic market is nuanced. There are 22 Spanish-speaking Latin American countries from which prospective Hispanic credit union members may hail. Add to that the fact, many U.S.-born Hispanics think, speak and behave differently than their parents and grandparents. Layer over this the existence of segments like small business owners or Millennials and you can begin to see the complexities involved with targeting and serving a multi-faceted Hispanic market. A smart Hispanic membership growth strategy will be based on segmentation, so credit unions should be willing to invest upfront in good market research. You have to understand what your local Hispanic community really looks like before you can mobilize your teams and leadership around serving them well. Are there particular consumer trends you have seen in the Hispanic community that impact the financial services space? The increasing digitization of financial services is a trend that definitely impacts Hispanic consumers. That’s because Hispanics typically over-index in studies that look at consumer use of connected devices, online banking and social media. A good Hispanic membership growth strategy will take mobile and digital products and services into account and will be tailored to the specific needs of local Hispanic communities. People often assume the Hispanic market is largely centered in states like California, Arizona, Texas and New Mexico. Are you finding that credit unions outside of these southwestern states are discovering they too need to build out a strategy in partnering with this consumer base? Absolutely. Hispanic population growth is happening far beyond so-called “gateway states” like those you mention above. In fact, states such as North Dakota, Kentucky, Louisiana, Delaware and Maryland actually saw the largest Hispanic population growth between 2007 and 2014. Midwestern states, too, are discovering just as many opportunities for engagement with their own growing numbers of Hispanic residents. Iowa and Wisconsin, for instance, each experienced explosive growth rates and now count Hispanics among one of the largest, fastest-growing and youngest groups in their cities. With a comprehensive and strategic approach to Hispanic membership growth, credit unions in unexpected places can become the preferred financial institution for this important segment. That’s because a great number of Hispanics in the U.S. are not tethered to an existing financial relationship. For more on this, check out our recent white paper Hispanic Member Growth Not Just for 'Gateway States' Anymore. What are the biggest myths financial services companies have about the Hispanic community? While there continue to be many misconceptions about the multifaceted Hispanic community, the following three continue to prevail most heavily. Myth: Hispanic consumers are only interested in transaction-based products. Check cashing and remittances are necessary services for many first generation Hispanic segments. At the same time, many of these consumers are interested in long-term relationships. Our own research indicates product penetration increases at a faster rate among Hispanic members as compared to non-Hispanic members when credit unions execute a strategic plan. Myth: The majority of Hispanics are undocumented. This misperception has been somewhat renewed this year with all the political back and forth on the subject of immigration. That’s why it’s so important for credit unions to educate – from the inside out – stakeholders on the facts. Many people do not know, for instance, that of the country's more than 52 million Hispanics, most are native-born Americans, and nearly three in four are U.S. citizens. Myth: The law prevents us from serving immigrants. There are many forms of acceptable government issued identification, such as passports and consular cards that are in full compliance with the Patriot Act and Customer Identification Program rules. In addition, financial institutions can compliantly lend to individuals who have Individual Taxpayer Identification Numbers. In fact, the NCUA wants credit unions to serve Hispanic members, including Hispanic immigrants. For more on this, check out the recording of the NCUA hosted panel, “Unique Challenges and Opportunities Serving Hispanic Credit Union Members.” For a credit union seeking to build a relationship with this community, what are your recommendations? Are there particular products or touchpoints they should focus on? Solidifying the right organizational mentality first is an important best practice. Building buy-in, doing the market research, developing a comprehensive strategy based on segmentation and defining what success truly looks like – these are all a part of laying the foundation for success with the Hispanic market. Credit unions should also be smart about talking to and partnering with local organizations that already know – and are trusted by – Hispanic residents. Conducting focus groups with the leaders of these groups and the people they serve can give credit unions a wealth of information about the makeup of their local Hispanic community and the value they might bring to the community.

Cybersecurity cannot be successful if siloed. The entire organization must be part of the effort. Take these steps to ensure a more engaged relationship between cybersecurity teams, C-suite executives and other departments: Make the company’s chief information officer accountable directly to the chief executive officer and/or the board. Train employees at every level to spot security risks and to understand their role in protecting the entire organization from cyberattacks. Put cybersecurity on the agenda for every board and executive-level meeting, and incorporate it into quarterly state-of-the-company, all-hands meetings. With cybersecurity threats evolving and escalating daily, companies need to make engagement a priority that starts at the top and continues through every level of the organization. Increasing engagement in cybersecurity >

We use our laptops and mobile phones every day to communicate with our friends, family, and co-workers. But how do software programs communicate with each other? APIs--Application Programming Interfaces--are the hidden backbone of our modern world, allowing software programs to communicate with one another. Behind the scenes of every app and website we use, is a mesh of systems “talking” to each other through a series of APIs. Today, the API economy is quickly changing how the world interacts. Everything from photo sharing, to online shopping, to hailing a cab is happening through APIs. Because of APIs, technical innovation is happening at a faster pace than ever. We caught up with Edgar Uaje, senior product manager at Experian, to find out more about APIs in the financial services space. What exactly are APIs and why are they so important? And how do they apply to B2B? APIs are the building blocks of many of our applications that exist today. They are an intermediary that allows application programs to communicate, interact, and share data with various operating systems or other control programs. In B2B, APIs allow our clients to consume our data, products, and services in a standard format. They can utilize the APIs for internal systems to feed their risk models or external applications for their customers. As Experian has new data and services available, our clients can quickly access the data and services. Are APIs secure? APIs are secure as long as the right security measures are put in place. There are many security measures that can be utilized such as authentication, authorization, channel encryption and payload encryption. Experian takes security seriously and ensures that the right security measures are put in place to protect our data. For example, one of the recent APIs that was built this year utilizes OAuth, channel encryption, and payload encryption. The central role of APIs is promoting innovation and rapid but stable evolution, but they seem to only have taken hold selectively in much of the business world. Is the world of financial services truly ready for APIs? APIs have been around for a long time, but they are getting much more traction recently. Financial tech and online market place lending companies are leading the charge of consuming data, products, and services through APIs because they are nimble and fast. With standard API interfaces, these companies can move as fast as their development teams can. The world of financial services is evolving, and the time is now for them to embrace APIs in day-to-day business. How can APIs benefit a bank or credit union, for example? APIs can benefit a bank or credit union by allowing them to consume Experian data, products, and services in a standard format. The value to them is faster speed to market for applications (internal/external), ease of integration, and control over the user’s experience. APIs allow a bank or credit union to quickly develop new and innovative applications quickly, with the support of their development teams. Can you tell us more about the API Developer Portal? Experian will publish the documentation of our available APIs on our Developer Portal over time as they become available. Our clients will have a one-stop shop to view available APIs, review API documentation, obtain credentials, and test APIs. This is simplifying data access by utilizing REST API, making it easier for our clients.

Since the advent of the internet, our lives have changed drastically for the better. We can perform many of life’s daily activities from the comfort of our own home. According to Aite, in 2016 alone 36 million Americans made some form of mobile payment — paying a bill, purchasing something online, paying for fast food or making a mobile wallet purchase at a retailer. Simply put, the internet has made our lives easier. But with the good also comes the bad. While most consumers have moved to the digital world, so have fraudsters. With minimal risk and high reward at stake, e-commerce fraud attacks have increased dramatically over the last few years, with no signs of slowing down. We recently analyzed millions of transactions from the first half of 2017 to identify fraud attack rates based on billing and shipping addresses and broke down the findings into various geographic trends. Fraud attack rates represent the attempted fraudulent e-commerce transactions against the population of overall e-commerce orders. Consumers living out West and in the South have experienced more than their fair share of fraud. During the first half of 2017, the West and the South were the top two regions for both billing and shipping attacks. While both regions were at the top during the same time last year, the attacks themselves have increased substantially. Given the proximity to seaports and major international airports, this is somewhat unsurprising — particularly for shipping fraud — as many fraudsters will leverage reshippers to transport goods soon after delivery. .dataTb{margin:20px auto;width:100%}.dataTb:after{clear:both}.dataTb table{}.dataTb td,.dataTb th{border:1px solid #ddd;padding:.8em}.dataTb th{background:#F4F4F4}.tbL{float:left;width:49%}.tbR{float:right;width:49%;margin:0 0 0 2%} Shipping: Riskiest Regions Region Attack rate West 38.1 South 32.1 Northeast 27.0 North Central 20.7 Billing: Riskiest Regions Region Attack rate West 37.2 South 32.9 Northeast 27.3 North Central 24.0 At the state level, the top three shipping fraud states remained the same as 2016 — Delaware, Oregon and Florida — but the order changed. Oregon was the most targeted, with a fraud rate of 135.2 basis points, more than triple its rate at in the end of 2016. Though no longer in the top spot, Delaware saw alarming spikes as well, with shipping attack rates nearly triple last year’s rate at 128.6 basis points and billing attacks at 79.6 basis points. .dataTb{margin:20px auto;width:100%}.dataTb:after{clear:both}.dataTb table{}.dataTb td,.dataTb th{border:1px solid #ddd;padding:.8em}.dataTb th{background:#F4F4F4}.tbL{float:left;width:49%}.tbR{float:right;width:49%;margin:0 0 0 2%} Shipping: Riskiest States State Attack rate Oregon 135.2 Delaware 128.2 Florida 57.4 New York 45.0 Nevada 36.9 California 36.9 Georgia 33.5 Washington, D.C 30.8 Texas 29.6 Illinois 29.4 Billing: Riskiest States Region Attack rate Oregon 87.5 Delaware 79.6 Washington, D.C. 63.0 Florida 47.4 Nevada 38.8 California 36.9 Arkansas 36.6 New York 35.5 Vermont 34.2 Georgia 33.4 Diving a bit deeper, ZIPTM codes in Miami, Fla., make up a significant portion of the top 10 ZIP CodeTM lists for shipping and billing attacks — in fact, many of the same ZIP codes appear on both lists. The other ZIP Code that appears on both lists is South El Monte, Calif., which has a high percentage of industrial properties — common targets for fraudsters to ship packages, then reship overseas. You can download the top 100 riskiest Zip Codes in the U.S. for H1 2017. .dataTb{margin:20px auto;width:100%}.dataTb:after{clear:both}.dataTb table{}.dataTb td,.dataTb th{border:1px solid #ddd;padding:.8em}.dataTb th{background:#F4F4F4}.tbL{float:left;width:49%}.tbR{float:right;width:49%;margin:0 0 0 2%} Shipping: Top 10 riskiest ZIP™ Codes ZIP Code Attack rate 33122 [Miami, Fla.] 2409.4 91733 [South El Monte, Calif.] 1655.5 33198 [Miami, Fla.] 1295.2 33166 [Miami, Fla.] 1266.0 33195 [Miami, Fla.] 1037.3 33192 [Miami, Fla.] 893.9 97251 [Portland, Ore.] 890.6 07064 [Port Reading, NJ] 808.9 89423 [Minden, Nev.] 685.5 77072 [Houston, Tex.] 629.3 Billing: Top 10 riskiest ZIP™ Codes ZIP Code Attack rate 77060 [Houston, Tex.] 1337.6 33198 [Miami, Fla.] 1215.6 33122 [Miami, Fla.] 1106.2 33166 [Miami, Fla.] 1037.4 91733 [South El Monte, Calif.] 780.1 33195 [Miami, Fla.] 713.7 97252 [Portland, Ore.] 670.8 33191 [Miami, Fla.] 598.8 33708 [St. Petersburg, Fla.] 563.6 33792 [Miami, Fla.] 493.0 As e-commerce fraud continues to grow, businesses need to be proactive to keep themselves and their customers safe. That means incorporating multiple, layered fraud prevention strategies that work together seamlessly — for example, understanding details about users and their devices, knowing how users interact with the business and evaluating previous transaction history. This level of insight can help businesses distinguish real customers from nefarious ones without impacting the customer experience. While businesses are ultimately responsible for the safety of customers and their data, the onus doesn’t rest solely with them. Consumers should also be vigilant when it comes to protecting their digital identities and payment information. That means creating strong, unique passwords; actively monitoring online accounts; and using two-factor authentication to secure account access. At the end of the day, e-commerce fraud is a challenge that businesses and consumers will experience for the foreseeable future. But rising attack rates don’t have to spell doom and gloom for the industry. E-commerce growth is still extremely strong, as consumers interact through multiple channels (in-store, mobile and web) and expect a personalized experience. Establishing trust and verifying digital identities are key to meeting these latest expectations, which provide new opportunities for businesses and consumers to interact seamlessly and transact securely. With multiple safeguards in place, businesses have a variety of options to protect their customers and their brand reputation. Experian is a nonexclusive full-service provider licensee of the United States Postal Service®. The following trademarks are owned by the United States Postal Service®: ZIP and ZIP Code. The price for Experian’s services is not established, controlled or approved by the United States Postal Service.

We regularly hear from clients that charge-offs are increasing and they’re struggling to keep up with the credit loss. Many clients use the same debt collection strategy they’ve used for years – when businesses or consumers can’t repay a loan, the creditor or collection agency aggressively contacts them via phone or mail to obtain repayment – never considering the customer experience for the debtor. Our data shows that consumers accounted for $37.24 billion in bankcard charge-offs in Q2 2017, a 17.1 percent increase from Q2 2016. Absorbing credit losses at such a high rate can impact the sustainability of the institution. Clearly the process could use some adjusting. Traditionally, debt collection has been solely about the money. The priority was ensuring that as much of the outstanding debt as possible was repaid. But collecting needs to be about more than that. It also should focus on the customer and his or her individual situation. When it comes to debt collection, customers should not all be treated the same way. I recently shared some tips in Credit Union Business Magazine about how to actively engage and collect from members. The same holds true for other financial institutions – they need to know the difference between a customer who has simply forgotten to make a payment and one who is dealing with financial hardship. As an example, if a person is current on his or her mortgage payment but has slipped behind on his or her credit card payment, that doesn’t necessarily signify financial hardship. It’s an opportunity to work with the customer to manage the debt and get back to current. Modern financial institutions build acquisition and customer management strategies targeted at individuals, so why should the collection process be any different? The challenge is keeping the customer at the center while also managing against potential increases in delinquencies. This holistic approach may be slightly more complex, but technology and analytics will simplify the process and bring about a more engaging experience for customers. The Power of Data and Technology Instead of relying on the same outdated collections approach – which results in uncomfortable exchanges on the phone that don’t ensure repayment –leverage data to your advantage. The data and technology exists to help you make more informed decisions, such as: What’s the most effective communication channel to reach the defaulting customer? When should you contact him or her? How often? The best course of action could be high-touch outreach, but sometimes doing nothing is the right approach. It all depends on the situation. Data and analytics can help uncover which customers are most likely to pay on their own and those who may need a little more help, allowing you to adjust your treatment strategy accordingly. By catering to the preferences of the customer, there’s a greater chance for a positive experience on both sides. The results: less charge-off debt, higher customer satisfaction and a stronger relationship. Explore the Digital Age In 2016, 36 million Americans made some form of mobile payment—paying a bill, purchasing something online, or paying for fast food, or making a Mobile Wallet purchase at a retailer. By 2020, nearly 184 million consumers will have done so, according to Aite. Consumers expect and deserve convenience. In the digital world, financial institutions have an opportunity to provide that expectation and then some. Imagine a customer being able to negotiate and manage his or her past-due account virtually, in the privacy of his or her own home, when it’s most convenient, to set their payment dates and terms. Luckily, the technology exists to make this vision a reality. Customers, not money, need to be at the heart of every debt collections strategy. Gone are the days of mass phone calls to debtors. That strategy made consumers unhappy, embarrassed and resentful. Successful debt collection comes down to a basic philosophy: Treat customers and his or her unique situation individually rather than as a portfolio profile. The creditors who live by that philosophy have an opportunity to reap the rewards on the back-end.

There’s a consensus that too many C-suite executives are disengaged with their organization’s cybersecurity efforts. That indifference can seriously hamper an organization’s ability to quickly and effectively respond to an incident. To best protect the organization, cybersecurity professionals should take the following steps to increase engagement: Pinpoint the greatest cybersecurity issues your organization faces and create descriptive verbiage that simplifies these risks. Engage in one-on-one meetings with key leaders to help them understand how cybersecurity risks affect not only the overall organization, but their domain as well. Stage a cybersecurity simulation exercise for your C-suite executives in which members role-play a data breach scenario. Leadership is not the only department that should be invested in protecting the organization. Next week, we’ll look at how to engage the entire organization in cybersecurity efforts. If you’d like, you can jump ahead and read it now. Increasing engagement in cybersecurity

Leadership and Cybersecurity Multiple studies suggest many executives aren’t as engaged as they should be when ensuring their organizations are prepared to mitigate and manage cybersecurity risks. Insights from our Fourth Annual Data Breach Preparedness Survey, conducted by the Ponemon Institute, support this sentiment. Of the privacy, compliance and IT professionals polled: 57% said their company’s board, chairman and chief executive officer were not informed about or involved in data breach response planning. 60% have leadership who don’t want to know immediately when a material breach occurs. 66% have a board that doesn’t understand the specific cybersecurity threats their organization faces. 74% said their board isn’t willing to take ownership for successful incident response plan implementation. For organizations to protect themselves, cybersecurity professionals need to create greater engagement among the organization’s leadership. Next week, we’ll look at how they can accomplish this. If you’d like, you can jump ahead and read it now. Fourth Annual Data Breach Preparedness Survey

School is nearly back in session. You know what that means? The next wave of college students is taking out their first student loans. It’s a milestone moment – and likely the first trade on the credit file for many of these individuals. According to the College Board, the average cost of tuition and fees for the 2016–2017 school year was $33,480 at private colleges, $9,650 for state residents at public colleges, and $24,930 for out-of-state residents attending public universities. So really, regardless of where students go, the cost of a college education is big. In fact, from January 2006 to July 2016, the Consumer Price Index for college tuition and fees increased 63 percent. So, unless mom and dad did a brilliant job saving, chances are many of today’s students will take on at least some debt to foot the college bill. But it’s not just the young who are consumed by student loan debt. In Experian’s latest State of Student Lending report, we dive into how the $1.4 trillion in student loan debt for Americans is impacting all generations in regards to credit scores, debt load and delinquencies. The document additionally looks at geographical trends, noting which states have the most consumers with student loan debt and which ones have the least. Overall, we discovered 13.4% of U.S. consumers have one or more student loan balances on their credit file with an average total balance of $34k. Additionally, these consumers have an average of 3.7 student loans with 1.2 student loans in deferment. The average VantageScore® credit score for student loan carriers is 650. As we looked across the generations, every group – from the Silents (age 70+) to Gen Z (oldest are between 18 to 20) had some student loan debt. While we can make assumptions that the Silents and Boomers are likely taking out these loans to support the educational pursuits of their children and grandchildren, it can be mixed for Gen X, who might still be paying off their own loans and/or supporting their own kids. Gen X members also reported the largest average student loan total balance at $39,802. Gen Z, the newest members to the credit file, have just started to attend college, thus their generation has the largest percent of student loan balances in deferment at 77%. Their average student loan total balance is also the lowest of all generations at $11,830, but that is to be expected given their young ages. In regards to geographical trends, the Northern states tended to sport the highest average student loan total balances, with consumers in Washington D.C. winning that race with $52.5k. Southern states, on the other hand, reported higher percentages of consumers with student loan balances 90+ days past due. South Carolina, Louisiana, Mississippi, Arkansas and Texas held the top spots in the delinquency category. Access the complete State of Student Lending report. Data from this report is representative of student loan data on file as of June 2017.

There’s no shortage of headlines alluding to a student loan crisis. But is there a crisis brewing or is this just a headline grab? Let’s look at the data over the past 4 years to find out. Outstanding student loan (should be loan) debt grew 21%, reaching a high of $1.49 trillion in Q4 2016. Over the past 4 years, student loan trades grew 4%, with a slight decline from 2015 to 2016. Average balance per trade grew 17% to reach $8,210. Number of overall student loan trades per consumer is down 5% to just 3.85. The average person with a student loan balance had just over $32,000 outstanding at the end of 2016 — a rise of 15%. While we’re seeing some increases, the data tells us this is a media headline grab. If students are educated about the debt they’re acquiring and are confident they can repay it, student loan debt shouldn’t be a crippling burden. More student loan insights

Did you know that 80% of all data migrations fail? Like any large project, data migration relies heavily on many variables. Successful data migration depends on attention to detail, no matter how small. Here are 3 items essential to a successful data migration: Conduct a Pre-Migration Impact Assessment to identify the necessary people, processes and technology needed. Ensure accurate, high-quality data to better streamline the migration process and optimize system functionality. Assemble the right team, including an experienced leader and business users, to ensure timely and on-budget completion. 35% of organizations plan to migrate data this year. If you’re among them, use this checklist to create the right plan, timeline, budget, and team for success.

We live in a digital world where online identities are ubiquitous. But with the internet’s inherent anonymity, how do you know you’re interacting with a legitimate individual rather than an imposter? Too often we hear stories about consumers who see unauthorized purchases on their credit cards, enable access to their devices based on an imposter claiming to be a security vendor or send money to someone they met online only to learn they’ve been “catfished” by a fraudster. These are growing problems, as more consumers transition to digital services and look to businesses to protect them, enable seamless trusted interactions and maintain their privacy. I recently chatted with MarketWatch about how consumers can protect themselves and their privacy when using online dating apps, as well as what businesses are doing to safeguard digital data. As part of the discussion, I mentioned that a simple, standard verification process companies of all sizes can leverage is vital to our rapidly evolving digital economy. Today, companies have their own policies, processes and definitions of identity verification, depending on the services they offer. This ranges from secure access requiring strong identity proofing, document verification, multifactor authentication and biometric enrollment to new social profiles that do little more than validate receipt of an email to establish an online account. To satisfy those diverse risk-based needs, more organizations are turning to federated identity verification options. A federated system allows businesses to leverage trusted, reputable, third-party sources to validate identity by cross-referencing the information they’ve received from a consumer against these sources to determine whether to establish an account or allow a transaction. While some organizations have attempted to develop similar identity verification capabilities, many lack a trusted identity source. For example, there are solutions that leverage data from social media accounts or provide multifactor fraud and authentication options, but they often become easily compromised because of the absence of verifiable data. A trusted solution aggregates data across multiple providers that have undergone thorough security and data quality vetting to ensure the identity data is accurately submitted in accordance with business and compliance requirements. In fact, there are only a handful of trusted identity sources with this level of due diligence and oversight. At Experian, we assess verification requests against an aggregate of hundreds of millions of records that include identity relationships, profile risk attributes, historical usage records and demographic data assets. With decades of knowledge about identity management and fraud prevention, we help companies of all sizes balance risk mitigation and maintain compliance requirements — all while ensuring consumer data privacy. Trust takes years to build and mere seconds to lose, and the industry has made undeniable progress in security. But there is much left to do. Consumers are increasingly involved in the protection and use of their data. However, they often don’t realize downloading a hot new app and entering personal details or linking to their friends exposes them to unnecessary risk. It’s important for businesses to be clear about their identity verification processes so consumers can make educated decisions before electing to provide invaluable identity data. The most effective fraud prevention and identity strategy is one that quickly establishes trust without inconveniencing the consumer. By staying up to date on verification methods, businesses can ensure customers have a smooth, personalized and engaging online experience.

When a cybersecurity incident occurs, will your organization’s data breach response contribute to customer retention or undermine it? Multiple studies and surveys illustrate that how well a company supports consumers in the wake of a security event directly affects customers’ perceptions of and loyalty to the breached company. Consumers expect companies to help them manage the potential and real fallout of a data breach. Failing to do so can increase post-breach churn, whereas successfully helping consumers can equate to greater retention. In particular, offering monitoring services to customers affected by a cybersecurity incident could make the difference between retaining those customers and their good will, or losing them to the competition. Consumer impact Research by Experian Data Breach Resolution and our partners reveals how data breaches affect consumers: 76 percent of consumers who’ve experienced a data breach cite stress as the primary consequence. 39 percent cite the time they had to spend resolving problems caused by the breach as the worst consequence. Nearly half of those affected by a data breach feel it will put their identities at risk for years to come. Consumers want companies to step up after a breach and provide identity theft protection (63 percent), credit monitoring (58 percent) and even compensation in the form of cash, products or services (67 percent). Four out of every five consumers who received a data breach notification continued to do business with the company through which their information was compromised, but they didn’t necessarily stay because they were satisfied. Just 45 percent of consumers say they continued doing business with the company because they were happy with the way the company resolved the data breach. Instead, 67 percent said they stayed because going elsewhere was just too difficult, and 61 percent thought moving their business wouldn’t give them access to any greater security since data breaches are unavoidable. If you provide it… Even more compelling for the case in favor of offering post-breach monitoring services to affected consumers is this statistic from our research: Nearly three quarters (72 percent) of breached consumers take action after being notified of a breach, including updating their anti-virus software and reviewing online account activity or security policies. Twenty-nine percent accepted offers of free identity protection services. Consumers are increasingly aware that being caught up in a data breach can increase their risk of experiencing identity theft, either immediately following the event or in the future. They are willing to take steps to protect themselves, and they want breached companies to help them. Providing post-breach monitoring services can help protect consumers from the possibility of identity theft related to the breach, and help protect companies from the loss of business that can result when customers feel the organization hasn’t done enough to aid them. Learn more about our Data Breach services

The economic expansion just passed the eight-year mark, and consumer credit defaults across mortgages, bankcards and auto loans are at pre–financial crisis levels. More specifically: The first-mortgage default rate dropped 4 basis points from May to 0.60%. The bankcard default rate experienced its first drop in 9 months, with a decrease of 4 basis points bringing it to 3.49%. Auto loan defaults decreased 3 basis points from the previous month to 0.82%. With inflation at 1% to 2%, debt service levels close to record lows, and disposable income increasing and supporting spending growth, consumers are in good financial shape nationally. Lenders should take this opportunity to review and adjust their acquisition strategies accordingly. Can your originations platform capitalize on this?

Create a better consumer experience during the debt collection process When most people think about debt collection, unpleasant images may come to mind, like relentless phone calls or collections notices. Whatever the case may be, the collections process often ends in a less than desirable experience for consumers. And, quite frankly, it needs to change. Steve Platt, Experian’s Group President of Decision Analytics, recently spoke with American Banker regarding how banks and other financial institutions can create a better consumer experience during the debt collection process. While balancing consumer needs and managing rising delinquencies can be a complex challenge, Steve conveyed that the technology and analytics exist to simplify the process. As an industry, we’re at a point where customer acquisition costs far exceed the costs to nurture existing customers through the entire life-cycle - from application to repayment. So, suffice to say, lenders need to rethink how they engage and communicate with their customers. Technology to the rescue Luckily, we live in an era where troves and troves of data are made available every day. We just need to help lenders leverage it to its fullest extent. For example, the right data and technology can help answer questions, such as: What’s the most effective communication channel to reach a customer? When should you contact them? How often? There isn’t a one-size-fits-all approach to debt collection. Each customer is different. Each has their own unique situation. Effective debt collection is about knowing the difference between a customer who has simply forgotten to pay and those who may be struggling financially, and communicating with them accordingly. Go digital Part of knowing how to engage consumers is also understanding we live in a digital world. We perform many of our daily tasks through our mobile devices, desktops or tablets. So, it would make sense for lenders to help their customers manage their past-due accounts virtually. Imagine being able to negotiate payment dates and terms from the privacy of your own home. It just so happens that technology can make this a reality. At the end of the day, the customer needs to be at the heart of the collections strategy. Each customer needs to be communicated with on a case-by-case basis depending on their unique circumstances. The resources exist to make customers feel like individuals, rather than numbers in a spreadsheet. And the lenders that appeal to the customer’s experience will see lower charge-offs and higher customer retention.

Many institutions take a “leap of faith” when it comes to developing prospecting strategies as it pertains to credit marketing. But effective strategies are developed from deep, analytical analysis with clearly identified objectives. They are constantly evolving – no setting and forgetting. So what are the basics to optimizing your prospecting efforts? Establish goals Unfortunately, far too many discussions begin with establishing targeting criteria before program goals are set. But this leads to confusion. Developing targeting criteria is kind of like squeezing a balloon; when you restrict one end, the other tends to expand. Imagine the effect of maximizing response rates when soliciting new loans. If no other criteria are considered, you could end up targeting high-risk individuals who cannot get approved elsewhere. Obviously, we’re not interested in increasing originations at all cost; risk must be understood as well. But this is where things get complicated. Lower-risk consumers tend to be the most coveted, get the best offers, and therefore have lower response rates and margins. Simplicity is best The US Navy developed the KISS acronym (keep it simple, stupid) in the 1960s on the philosophy that complexity increases the probability of error. This is largely true in targeting methodologies, but don’t mistake limiting complexity for simplicity. Perhaps the most simplistic approach to prescreen credit marketing is using only risk criteria to set an eligible population. Breaking a problem down to this single dimension generally results in low response rates and wasted budget. Propensity models and estimated interest rates are great tools for identifying consumers that are more likely to respond. Adding them as an additional filter to a credit-qualified population can help increase response rates. But what about ability to pay? So far we’ve considered propensity to open and risk (the latter being based on current financial obligations). Imagine a consumer with on-time payment behavior and a solid credit score who takes a loan only to be unable to meet their obligations. You certainly don’t want to extend debt that will cause a consumer to be overextended. Instead of going through costly income verification, income estimation models can assist with identifying the ability to repay the loan you are marketing. Simplicity is great, but not to the point of being one-dimensional. Take off the blindfold Even in the days of smartphones and GPS navigation, most people develop a plan before setting off on a road trip. In the case of credit marketing, this means running an account review or archive analysis. Remember that last prescreen campaign you ran? What could have happened with a more sophisticated targeting strategy? Having archive data appended to a past marketing campaign allows for “what if” retrospective analysis. What could response rates have been with a propensity tool? Could declines due to insufficient income have been reduced with estimated income? Archive data gives 20/20 hindsight to what could have been. Just like consulting a map to determine the shortest distance to a destination or the most scenic route, retrospective analysis on past campaigns allows for proactive planning for future efforts. Practice makes perfect Even with a plan, you probably still want to have the GPS running. Traffic could block your planned route or an unforeseen detour could divert you to a new path. Targeting strategies must continually be refined and monitored for changes in customer behavior. Test and control groups are essential to continued improvement of your targeting strategies. Every campaign should be analyzed against the goals and KPIs established at the start of the process. New hypotheses can be evaluated through test populations or small groups designed to identify new opportunities. Let’s say you typically target consumers in a risk range of 650-720, but an analyst spots an opportunity where consumers with a range of 625-649 with no delinquencies in the past 12 months performs nearly at the rate of the current population. A small test group could be included in the next campaign and studied to see if it should be expanded in future campaigns. Never “place bets” Assumptions are only valid when they are put to the test. Never dive into a strategy without testing your hypothesis. The final step in implementing a targeting strategy should be the easiest. If goals are clearly understood and prioritized, past campaigns are analyzed, and hypotheses are laid out with test and control groups, the targeting criteria should be obvious to everyone. Unfortunately, the conversation usually starts at this phase, which is akin to placing bets at the track. Ever notice that score breaks are discussed in round numbers? Consider the example of the 650-720 range. Why 650 and not 649 or 651? Without a test and learn methodology, targeting criteria ends up based on conventional wisdom – or worse, a guess. As you approach strategic planning season, make sure you run down these steps (in this order) to ensure success next year. Establish program goals and KPIs Balance simplicity with effectiveness Have a plan before you start Begin with an archive Learn and optimize In God we trust, all others bring data