Latest Posts

The discovery of Heartbleed earlier this year uncovered a large-scale threat that exploits security vulnerability in OpenSSL posing a serious security concern. This liability gave hackers access to servers for many Websites and put consumers’ credentials and private information at risk. Since the discovery, most organizations with an online presence have been trying to determine whether their servers incorporate the affected versions of OpenSSL. However, the impact will be felt even by organizations that do not use OpenSSL, as some consumers could reuse the same password across sites and their password may have been compromised elsewhere. The new vulnerabilities online and in the mobile space increase the challenges that security professionals face, as fraud education is a necessity for companies. Our internal fraud experts share their recommendation in the wake of the Heartbleed bug and what companies can do to help mitigate future occurrences. Here are two suggestions on how to prevent compromised credentials from turning into compromised accounts: Authentication Adopting layered security strategy Authentication The importance of multidimensional and risk-based authentication cannot be overstated. Experian Decision Analytics and 41st Parameter® recommend a layered approach when it comes to responding to future threats like the recent Heartbleed bug. Such methods include combining comprehensive authentication processes at customer acquisition with proportionate measures to monitor user activities throughout the life cycle. "Risk-based authentication is best defined and implemented in striking a balance between fraud risk mitigation and positive customer experience," said Keir Breitenfeld, Vice President of Fraud Product Management for Experian Decision Analytics. "Attacks such as the recent Heartbleed bug further highlight the foundational requirement of any online business or agency applications to adopt multifactor identity and device authentication and monitoring processes throughout their Customer Life Cycle." Some new authentication technologies that do not rely on usernames and passwords could be part of the broader solution. This strategic change involves the incorporation of broader layered-security strategy. Using only authentication puts security strategists in a difficult position since they must balance: Market pressure for convenience (Note that some mobile banking applications now provide access to balances and recent transactions without requiring a formal login.) New automated scripts for large-scale account surveillance. The rapidly growing availability of compromised personal information. Layered security "Layered security through a continuously refined set of ‘locks’ that immediately identify fraudulent access attempts helps organizations to protect their invaluable customer relationships," said Mike Gross, Global Risk Strategy Director for 41st Parameter. "Top global sites should be extra vigilant for an expected rush of fraud-related activities and social engineering attempts through call centers as fraudsters try to take advantage of an elevated volume of password resets." By layering security consistently through a continuously refined set of controls, organizations can identify fraudulent access attempts, unapproved contact information changes and suspicious transactions. Learn more about fraud intelligence products and services from 41st Parameter, a part of Experian.

The security world was taken by surprise earlier this month when researchers discovered Heartbleed, a new large-scale threat that exploits a security vulnerability in OpenSSL.

By: Maria Moynihan In less than a year, my information has been compromised twice by a data breach. The companies involved varied significantly by way of size and type, yet both reacted expeditiously to inform me of the incident. As much as I appreciated the quick response and notification, I couldn’t help but wonder how well prepared we all are to handle these types of incidents within our own organizations. I recently read somewhere that data breaches are to be expected – like death and taxes. Can this be true? A recent Ponemon Institute Study, 2013 Cost of a Data Breach, highlighted alarming statistics around the typical impact a breach has on an organization. With costs amounting to approximately $5.4M and impact to brands ranging anywhere from $184M to $330M in losses, organizations cannot afford to pass breaches off as inevitable. Organizations must tighten their security standards, understand the evolving data breach environment and ensure their response plans are continuously enhanced to address emerging issues. To better understand what may lie ahead, Experian has developed six key predictions for how concerns about data breaches will evolve: 1. Data breach cost will be down – but still impactful The cost per record of a data breach will continue to decline, however security incidents and other breaches may still cause significant business disruption if not properly managed. 2. Will the Cloud and Big Data = Big International Breaches? With the rise of the cloud, data is now moving seamlessly across borders making the potential for complex, international breaches more possible. 3. Healthcare Breaches: Opening the Floodgates With the addition of the Healthcare Insurance Exchanges, millions of individuals will be introduced into the healthcare system and as a result, will increase the vulnerability of the already susceptible healthcare industry. 4. A Surge in Adoption of Cyber Insurance Many companies will look beyond investing in technology to protect against attacks and towards the insurance market to manage financial ramifications of breaches. 5. Breach Fatigue – Rise in Consumer Fraud? As the number of reported breaches in the media increases and the frequency of notifications that consumers receive grow, they may become apathetic towards the subject, thereby exposing themselves to greater risk. 6. Beyond the Regulatory Check Box State regulators and law enforcement will turn a new leaf this year, devoting significant attention to helping organizations better manage breaches. What is your organization doing to improve its data breach preparedness plan? Check out our 2014 Data Breach Industry Forecast and guide to handling data breach response. Check out other related content on data breach resolution.

A recent survey focusing on the credit behavior of Millennials (age group 18 to 30) shows that 90 percent are familiar with cosigning and two-thirds have used a cosigner in the past.

Bankcard originations had a 32 percent year-over-year increase in Q4 2013 ($61 billion to $81 billion).

In an effort to understand consumer needs better and help lenders educate their customers, VantageScore® Solutions surveyed more than 200 lenders nationwide on the topic of score reason codes.

Auto financing became easier to obtain in Q4 2013 and the market share for new vehicle loans in the nonprime, subprime and deep-subprime credit tiers increased slightly to 34.1 percent of all new loans, up from 32.8 percent in Q4 2012.

According to Experian Marketing Services' annual Email Market Study, personalized promotional emails have 29 percent higher unique open rates and 41 percent higher unique click rates than nonpersonalized mailings.

The most recent Experian State of the Automotive Finance Market report shows more consumers are leasing vehicles. Leases accounted for 28.4 percent of all new vehicles financed in Q4 2013 - the highest level on record since 2006.

While access to small-business credit is improving and credit balances are increasing, key differences still remain across the United States.

Using a risk model based on older data can result in reduced predictive power.

Findings from the most recent Experian State of the Automotive Finance Market report show outstanding automotive loan balances increased 11 percent from Q4 2012, reaching $798.5 billion in Q4 2013 — the highest level since 2007.

The housing market continues to recover, with mortgage originations increasing 12 percent year over year, moving from $508 billion to $570 billion.

Small-business credit conditions wrapped up the year by showing continued improvement for the fourth consecutive quarter.

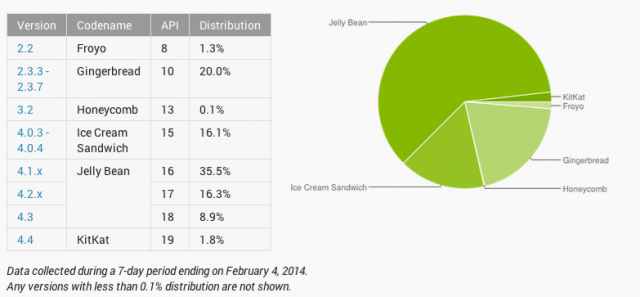

Both Visa and MasterCard announced their support for Host Card Emulation (HCE) and their intent to release HCE specifications soon. I have been talking about HCE from late 2012 (partly due to my involvement with SimplyTapp) and you could read as to why HCE matter and what Android KitKat-HCE announcement meant for payments. But in light of the network certification announcements yesterday, this post is an attempt to provide some perspective on what the Visa/MasterCard moves mean, how do their approaches differ in certifying payments using cloud hosted credentials, what should issuers expect from a device and terminal support perspective, why retailers should take note of the debate around HCE and ultimately – the role I expect Google to continue to play around HCE. All good stuff. First, what do the Visa/MasterCard announcements mean? It means that it’s time for banks and other issuers to stop looking for directions. The network announcements around HCE specifications provide the clarity required by issuers to meaningfully invest in mobile contactless provisioning and payment. Further, it removes some of the unfavorable economics inherited from a secure element-centric model, who were forced to default to credit cards with higher interchange in the wallet. Renting space on the secure element cost a pretty penny and that is without taking operational costs in to consideration, and as an issuer if you are starting in the red out of the gate, you were not about to put a Durbin controlled debit card in the wallet. But those compulsions go with the wind now, as you are no longer weighed down by these costs and complexities on day one. And further, the door is open for retailers with private label programs or gift cards to also look at this route with a lot more interest. And they are. MasterCard mentioned bank pilots around HCE in its press release, but MCX is hardly the only retailer payment initiative in town. Let me leave it at that. How do the Visa/MasterCard specs differ? From the press releases, some of those differences are evident – but I believe they will coalesce at some point in the future. MasterCard’s approach speaks to mobile contact-less as the only payment modality, whereas Visa refers to augmenting the PayWave standard with QR and in-app payments in the future. Both approaches refer to payment tokens (single or multi-use) and one can expect them to work together with cloud provisioned card profiles, to secure the payment transaction and verify transactional integrity. To MasterCard’s benefit – it has given much thought to ensuring that these steps – provisioning the card profile, issuing payment tokens et al – are invisible to the consumer and therefore refrains from adding undue friction. I am a purist at heart – and I go back to the first iteration of Google Wallet – where all I had to do to pay was turn on the screen and place the device on the till. That is the simplicity to beat for any issuer or retailer payment experiences when using contactless. Otherwise, they are better off ripping out the point-of-sale altogether. MasterCard’s details also makes a reference to a PIN. The PIN will not be verified offline as it would have been if a Secure Element would have been present in the device, rather – it would be verified online which tells me that an incorrect PIN if input would be used to create an “incorrect cryptogram” which would be rejected upstream. Now I am conflicted using a PIN at the point of sale for anything – to me it is but a Band-Aid, it reflects the inability to reduce fraud without introducing friction. Visa so far seems to be intentionally light on details around mandating a PIN, and I believe not forcing one would be the correct approach – as you wouldn’t want to constrain issuers to entering a PIN as means to do authentication, and instead should have laid down the requirements but left it to the market to decide what would suffice – PIN, biometrics et al. Again – I hope these specs will continue to evolve and move towards a more amenable view towards customer authentication. Where do we stand with device and terminal support? All of this is mute if there are not enough devices that support NFC and specifically – Android KitKat. But if you consider Samsung devices by themselves (which is all one should consider for Android) they control over 30% of the NA market – 44.1 million devices sold in 2013 alone. Lion share of those devices support NFC out of the box – including Galaxy Note II and 3, Galaxy S3 and S4 – and their variants mini, Active, Xoom et al. And still, the disparity in their approach to secure elements, continuing lack of availability in standards and Android support – Tap and Pay was largely a dream. What was also worrisome is that 3 months after the launch of Android KitKat – it still struggles under 2% in device distribution. That being said, things are expected to get markedly better for Samsung devices at least. Samsung has noted that 14 of its newer devices will receive KitKat. These devices include all the NFC phones I have listed above. Carriers must follow through quickly (tongue firmly in cheek) to deliver on this promise before customers with old S3 devices see their contracts expire and move to a competitor (iPhone 6?). Though there was always speculation as to whether an MNO will reject HCE as part of the Android distribution, I see that as highly unlikely. Even carriers know a dead horse when they see one, and Isis’s current model is anything but one. Maybe Isis will move to embrace HCE. And then there is the issue of merchant terminals. When a large block of merchants are invested in upending the role of networks in the payment value chain – that intent ripples far and wide in the payments ecosystem. Though it’s a given that merchants of all sizes can expect to re-terminalize in the next couple of years to chip & pin (with contactless under the hood) – it is still the prerogative of the merchant as to whether the contactless capability is left turned on or off. And if merchants toe Best Buy’s strategy in how it opted to turn it off store-wide, then that limits the utility of an NFC wallet. And why wouldn’t they? Merchants have always viewed “Accept all cards” to also mean “Accept all cards despite the form factor” and believes that contactless could come to occupy a higher interchange tier in the future – as questions around fraud risk are sufficiently answered by the device in real-time. This fear is though largely unsubstantiated, as networks have not indicated that they could come to view mobile contact-less as being a “Card Present Plus” category that charges more. But in the absence of any real assurances, fear, uncertainty and doubt runs rampant. But what could a retailer do with HCE? If re-terminalization is certain, then retailers could do much to explore how to leverage it to close the gap with their customer. Private label credit, closed loop are viable alternatives that can be now carried over contactless – and if previously retailers were cut out of the equation due to heavy costs and complexity for provisioning cards to phones, they have none of those limitations now. A merchant could now fold in a closed loop product (like a gift card) in to their mobile app – and accept those payments over contact-less without resorting to clunky QR or barcode schemes. There is a lot of potential in the closed loop space with HCE, that Retailers are ignoring due to a “scorched earth” approach towards contactless. But smarter merchants are asking ‘how’. Finally, what about Google? Google deserves much praise for finally including HCE in Android and paving the way for brands to recognize the opportunity and certify the approach. That being said, Google has no unequal advantage with HCE. In fact, Google has little to do with HCE going forward, despite GoogleWallet utilization of HCE in the future. I would say – HCE has as much to do with Google going forward, as Amazon’s Kindle Fire has to do with Android. Banks and Retailers have to now decide what this means for them – and view HCE as separate to Google – and embrace it if they believe it has potential to incent their brands to remain top of wallet, and top of mind for the consumer. It is a level playing field, finally. Where do you go next? Indeed – there is a lot to take in – starting with HCE’s role, where it fit in to your payment strategy, impact and differences in Visa/MasterCard approaches, weaving all of these in to your mobile assets while not compromising on customer experience. Clarity and context is key and we can help with both. Reach out to us for a conversation. HCE is a means to an end – freeing you from the costs and complexities of leveraging contactless infrastructure to deliver an end-to-end mobile experience, but there is still the question of how your business should evolve to cater to the needs of your customers in the mobile channel. Payment is after all, just one piece of the puzzle.