Latest Posts

Delinquency rates for auto loans moved up slightly in the last quarter of 2013, with the 30 to 59 days past due (DPD), 60 to 89 DPD and 90 to 180 DPD delinquency rates at 2.18 percent, 0.56 percent and 0.24 percent, respectively.

The volume of emails sent by marketers rose nearly 13 percent during the 2013 holiday season compared to 2012.

An employee who never uses a mobile device – personal or company-supplied – for business purposes is becoming a rare creature, indeed. Use of mobile devices is prevalent across virtually every industry, and the convenience and flexibility these devices offer professionals can be great for business. Provided, that is, those devices are secure. Mobile devices continue to be a significant source of data breaches, and a particular concern for anyone engaged in cyber security, according to eSecurity Planet’s Data Breach Roundup. Mobile-related data breaches stem from a range of circumstances, including loss or theft of devices, failure to use anti-malware, or failing to password-protect a device being used for business purposes. Devices can put your data at risk if an employee stores any proprietary information on a mobile device, or if workers use unsecured devices to access your network – even if you’ve taken steps to secure the network itself. Managing mobile devices can be one of the most challenging aspects of your overall cyber security program, but it’s imperative and – fortunately – not impossible. Minimizing mobile device risks CTIA, The Wireless Association, offers some guidelines for mobile device cyber security in its whitepaper “Today’s Mobile Cybersecurity: Blueprint for the Future.” The organization points to five cornerstones of mobile cyber security: Education about the importance of mobile security Devices with security features like anti-malware and anti-spam settings Strong, enforced network security policies Authentication for all network users Secure connections, from cloud to network Many tools exist to help your organization ensure secure footing on each of those cornerstones. CTIA cites options like risk management, security policies and monitoring. We would add to that list, and emphasize the importance of a data breach response plan that addresses the specific challenges and risks associated with a mobile-spurred data breach incident. While your organization can take strong, reasoned steps toward minimizing risks, it’s equally important to be ready to respond when a breach occurs. Mobile device security is sure to be a growing issue throughout 2014, as more people than ever use smartphones, tablets and other mobile devices to work more efficiently. With the right precautions, you can help ensure your employees work safely, as well. Learn more about our Data Breach solutions

In the days following the Target breach, both clarity and objectivity are in short supply. Everything that didn’t already exist became suddenly the cure-all – EMV being one. Retailers bristle, albeit in private – due to the asymmetry in blame they have come to share compared to banks – despite having equal ownership of the mess they have come to call payments. Issuers and Schemes scramble to find an empty deck chair on the Titanic, just to get a better view of the first of the lifeboats capsizing. Analogies aside, we may never fully eliminate breaches. Given an infinite amount of computing power and equal parts human gullibility – whether its via brute forcing encryption systems or through social engineering – a breach is only a matter of time. But we can shorten the half-life of what is stolen. And ensure that we are alerted when breaches occur – as fraudsters take care to leave little trace behind. Yet today our antiquated payments system offer up far too many attack vectors to a fraudster, that the sophistication in attempts of the likes of what we saw at Target, is the exception and not the norm. But are the retailers absolved of any responsibility? Hardly. Questions from a breach: According to Target, malware was found on Target’s PoS – presumably pushed by unauthorized outsiders or via compromised insiders. If so, how is it that unauthorized code managed to find its way to all or most of its PoS terminals? Could this have been uncovered by performing a binary or checksum comparison first, to ensure that files or packages are not tampered with, before they are deployed to the Point-of-Sale? Such a step could have certainly limited the attack vectors to a small group of people with administrative access – who would have the need to handle keys and checksums. Further, depending on the level of privilege accorded to every binary that gets deployed to the point of sale – Target could have prevented an unauthorized or remotely installed program from performing sensitive functions such as reading consumer data – either in transit or in RAM. That said – I am not sure if PoS manufacturers provide for such layered approach towards granting access and execution privileges to code that is deployed to their systems. If not, it should. Where DOES EMV come in? EMV helps to verify the card – indisputably. Beyond that, it offers no protection to either the consumer or the merchant. The risk of EMV, and it’s infallibility in the eyes of its true believers, is that it can lull the general public in to a sense of false security – much like what we have now under Reg E and Reg Z. With EMV, PAN and PIN continues to be passed in the clear, unencrypted. Retailers could deploy EMV terminals and still be riddled like cheese by fraudsters who can siphon off PANs in transit. Fraudsters who may find it nearly impossible to create counterfeit cards, instead will migrate online where inadequate fraud mitigation tools prevail – and those inadequacies will force both banks and retailers to be heavy handed when it comes to determining online fraud. Friction or Fraud should not be the only two choices. Solving Card Not Present Fraud: There are no silver bullets to solve Card Not Present fraud. Even with EMV Chip/Pin, there is an opportunity to put a different 16 digit PAN on the front of the card versus the one that is on the magstripe/chip. (I am told that Amex does this for its Chip/pin cards.) The advantage is that a fraudster using a fraudulently obtained PAN from the chip for an e-commerce purchase will standout to an card issuer compared to the legit customer using a different PAN on the front of the card for all her e-commerce purchases. This maybe one low tech way to address CNP fraud alongside of an EMV rollout. But if asking a consumer to enter his Zipcode or show his ID was enough for retail purchases, there exists equivalent friction-bound processes online. Authentication services like 3-D Secure are fraught with friction, and unfairly penalize the customer and indirectly – the retailer and issuer, for its blind attribution of trust in a user provided password or a token or a smart card reader. Where it may (in some cases) undeniably verifies consumer presence, it also overwhelms – and a customer who is frustrated with a multi-step verification will simply shop somewhere else or use Paypal instead. Ever had to input your Credit Card Verification code (CVV2 or CVC2) on an Amazon purchase? Me neither. Fraud in connected commerce: As connected devices outnumber us, there needs to be an approach that expands the notion of identity to look beyond the consumer and start including the device. At the core, that is what solutions like 41st Parameter – an Experian company, focuses on – which enables device attributes to collectively construct a more sophisticated indicator of fraud in an e-commerce transaction – using 100 or so anonymous device attributes. Further it allows for more nuanced policies for retailers and issuers, to mitigate fraud by not only looking at the consumer or device information in isolation – but in combination with transactional attributes. As a result, retailers and issuers can employ a frictionless, smarter, and more adaptive fraud mitigation strategy that relies less on what could be easily spoofed by a fraudster and more on what can be derived or implied. If you want to know more why this is a more sensible approach to fighting fraud, you should go here to read more about 41st Parameter. Remnants from a breach: Even though the material impact to Target is still being quantified, little doubt remains as to the harm done to its reputation. Target RED card remains largely unaffected, yet it is but a fleeting comfort. Though some, thus had been quick to call decoupled debit a more secure product, those claims choose to ignore the lack of any real consumer protection that is offered alongside of these products. Though Reg E and Reg Z have been largely instrumental in building consumer trust in credit and debit cards, they have also encouraged general public to care less about fraud and credit card security. And this affects more than any other – MCX, whose charter calls for reduction of payment acceptance costs first, and to whom – decoupled debit offered a tantalizing low cost alternative to credit. But when it launches this year, and plans to ask each customer to waive protections offered by Reg E and Reg Z and opt for ACH instead – those consumers will find that choice harder to stomach. Without offering consumers something equivalent, MCX Retailers will find it exceedingly difficult to convince customers to switch. Consumer loyalty to retailer brands was once given as the reason for creating a retailer friendly payment backbone, but with Target’s reputation in tatters – that is hardly something one can bank on these days – pun intended. Where does this leave us? To be completed… This blog post was originally featured at: http://www.droplabs.co/?p=964

According to Experian Marketing Services’ holiday peak week analysis, social media proved to be a key research tool for holiday shoppers and a crucial driver of traffic to retail Websites.

By: Teri Tassara In my blog last month, I covered the importance of using quality credit attributes to gain greater accuracy in risk models. Credit attributes are also powerful in strengthening the decision process by providing granular views on consumers based on unique behavior characteristics. Effective uses include segmentation, overlay to scores and policy definition – across the entire customer lifecycle, from prospecting to collections and recovery. Overlay to scores – Credit attributes can be used to effectively segment generic scores to arrive at refined “Yes” or “No” decisions. In essence, this is customization without the added time and expense of custom model development. By overlaying attributes to scores, you can further segment the scored population to achieve appreciable lift over and above the use of a score alone. Segmentation – Once you made your “Yes” or “No” decision based on a specific score or within a score range, credit attributes can be used to tailor your final decision based on the “who”, “what” and “why”. For instance, you have two consumers with the same score. Credit attributes will tell you that Consumer A has a total credit limit of $25K and a BTL of 8%; Consumer B has a total credit limit of $15K, but a BTL of 25%. This insight will allow you to determine the best offer for each consumer. Policy definition - Policy rules can be applied first to get the desirable universe. For example, an auto lender may have a strict policy against giving credit to anyone with a repossession in the past, regardless of the consumer’s current risk score. High quality attributes can play a significant role in the overall decision making process, and its expansive usage across the customer lifecycle adds greater flexibility which translates to faster speed to market. In today’s dynamic market, credit attributes that are continuously aligned with market trends and purposed across various analytical are essential to delivering better decisions.

With most lenders focused on growth as the top priority for the new year, having the ability to score more consumers is key.

According to the National Christmas Tree Association, approximately 25 to 30 million real Christmas trees are sold annually in the United States versus 8 to 11 million artificial trees.

By: Maria Moynihan Crime prevention and awareness techniques are changing and data, analytics and use of technology is making a difference. While law enforcement departments continue to face issues related to data - ranging from working with outdated information, inability to share data across departments, and difficulty in collapsing data for analysis - a new trend is emerging where agencies are leveraging outside data sources and analytic expertise to better report on crimes, collapse information, predict patterns of behavior and ultimately locate criminals. One best practice being implemented by law enforcement agencies is to skip trace an individual much like a debt collector would. Techniques involve using historic address information and individual connections to better track to a person’s current location. See the full write up from CollectionsandCreditRisk.com to see how this works. Another great example of effective use of data in investigations can be seen in this video, where one Experian client, Intellaegis of El Dorado Hills, CA, recently worked with local law enforcement to follow the digital data footprints of a particular suspect, finding her in in just five minutes of searching. p> And, yet another representation of improved data gathering, handling and sharing of information for crime prevention and awareness can be found on a site I was just made aware of by one of my neighbors - www.crimemapping.com. Information is collapsed across departments for greater insight into the crimes that are happening within a neighborhood, offering a more comprehensive option for the general public to turn to on local area crime activity. Clearly, data, analytics and technology are making a positive impact to law enforcement processes and investigations. What is your public safety organization doing to evolve and better protect and serve the public?

According to Experian’s latest State of the Automotive Finance Market report, interest rates for new auto loans dropped to 4.27 percent — the lowest rate on record. In addition to increasing new vehicle sales, the historically low interest rates helped consumers finance a larger balance, with the average new vehicle loan coming in at $26,719 for Q3 2013 — the highest average amount financed since 2008. Sign up to access our quarterly analysis of the latest automotive finance trends Source: Experian Automotive: Interest rates for auto loans hit all-time low, while average amount financed reaches highest point since 2008

Experian’s latest annual State of Credit analysis provides insight into the differences in credit habits by generation. While the youngest group, Millennials, appear to be novice credit managers, Generation Xers have the highest amount of average debt, are slowest to make payments on time and tied with Millennials for highest percentage of credit utilized. The results of the study reinforce the importance of lenders providing transparent consumer education on credit scores and responsible credit behavior. Snapshot of generational debt differences Baby Boomers (47 to 65) Generation X (30 to 46) Millennials (19 to 29) VantageScore® credit score 700 653 628 Average debt $29,317 $30,039 $23,332 Average balance of bankcards $5,347 $5,343 $2,682 Average revolving utilization 30% 37% 37% Late payments 0.33 0.61 0.58 Download our recent Webinar: It’s a new reality ... and time for a new risk score Source: Experian’s State of Credit infographic

Data quality should be a priority for retailers at any time of the year, but even more so as the holiday season approaches. According to recent research from Experian, organizations feel that, on average, 25 percent of their data is inaccurate and 12 percent of departmental budgets are wasted due to inaccuracies in contact data. During the 2013 holiday season, consumer spending is expected to increase by at least 11 percent. Retailers need to improve data quality early on in order to ensure that relevant holiday offers reach consumers and to take advantage of the expected increase in consumer spending. View our recent Webinar: Unique insights on consumer credit trends and the impact of consumer behavior on the economic recovery Source: View our data quality infographic: ’Twas the month before the holidays

The credit appetite for small businesses is strong and growing. Total outstanding balances have risen at their fastest rate in two years, and delinquency rates have fallen at a consistent pace. Only 10 percent of outstanding small-business credit balances were past-due in Q3 — the lowest level of delinquency seen since the recovery began. While this is an encouraging sign, it is important to note that these improvements have come at the cost of hiring new employees and investments. Sign up for the Quarterly Business Credit Review Webinar on Dec. 10 Source: Download the full Experian/Moody’s Analytics Small Business Credit Index report.

Credit trends from the most recent Experian–Oliver Wyman Market Intelligence Report point to a steady economic recovery. Bankcard charge-offs decreased 13 percent year over year (4.5 percent versus 3.9 percent) and delinquent dollars for the 90–180 day past due delinquencies decreased 17.5 percent for the same timeframe (1.6 percent to 1.3 percent). These trends are a positive sign for overall economic recovery and evidence that the current growth in bankcard originations is not coming at the expense of increased delinquencies. Sign up to attend our upcoming Webinar on Q3 credit trends and take a closer look at the impact of consumer behavior on the economic recovery. Source: Data for this article was sourced from Experian’s IntelliViewSM, a Web-based data query, analysis and reporting tool.

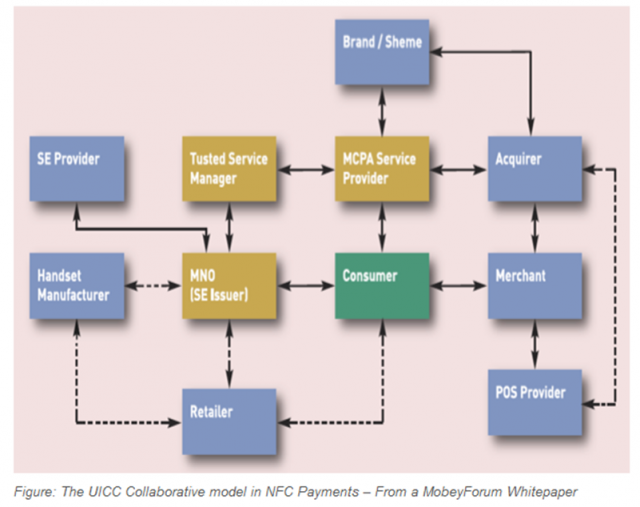

When I wrote about Host Card Emulation back in March, it provoked much debate around whether this capability will die on the cutting floor or be meaningfully integrated in to a future Android iteration. And now that it has, this post is an attempt to look forward, even though much of it is speculative. But I will provide some perspective from a number of conversations I had in the last week with Networks, Issuers, TSMs, Merchants, Platform Owners and EMV practitioners and provide some insight in to perceptions, impacts and the road ahead for NFC. And I will provide some context to why HCE matters to each of these players. First – if you haven’t read my previous post on HCE – this would be a good time to do so. Media has unfortunately focused yet again on the controversy in light of the KitKat HCE announcement – focusing on the end-run around Carriers rather than the upside this brings to those who have been disincentivized previously to consider NFC. What they all seem to have missed is that HCE allows for the following: it reduces the gap between merchants and card issuance, brings the topic of closed-loop and contactless in focus, and more tactically – allows for an easy deployment scenario that does not require them to change the software inside the terminal. I hope those three things do not get lost in translation. Google: Being a Platform Owner for once The Android team deserves much credit for enabling support for Host Card Emulation in KitKat. Beyond the case for platform support – something Blackberry already had – there were both altruistic and selfish reasons for going this route. The former – altruistic – had to do with throwing open another door that would invite third party developers to build on an open NFC stack – while firmly shutting other ones (read criticism from Ars that Android is quickly becoming a closed source – partly through its Play services approach). It was time it acted like a platform owner. And being one entailed democratizing access to tap-and-pay. Selfish – because for the more than 200M Android devices that shipped with NFC support – a fraction of these are tap-and-pay worthy. It had become absurd that one must enquire upon Carrier, Platform, Issuer and Device support before installing an NFC payment app, much less use it. Talk about fragmentation. This was a problem only Google could begin to fix – by removing the absurd limitations put in place in the name of security – but in truth existed because of profit, control and convenience. Google’s role hardly ends here. Today – Host Card Emulation – by definition alone, is reserved as a technical topic. Out of the gate, much needs to be done to educate Issuers and Merchants as to why this matters. For retailers – used to much cynicism in matters relating to NFC – Host Card Emulation offers an opportunity to develop and deploy a closed-loop contactless scheme using retailer’s preferred payment sources – private label, debit, credit and in that order. HCE to Merchants: Friend or Foe? In my opinion – merchants stand to benefit most from HCE. Which is another reason why Google really embraced this concept. Despite having certain benefits for Issuers to provision cards without having to pay the piper, Google had its eyes set on expanding the offline footprint for GoogleWallet and to successfully do so – needed to focus on the merchant value prop while dialing back on what retailers once called the “data donation agreement”. Where merchants primarily struggle today in mobile – is not in replicating the plastic model – it is to create a brand new loyalty platform where the customer sets a payment source and forgets it – preferably one that’s preferred by the merchant – for example a private label card or debit. Except, no open loop wallets had actually centered itself around this premise so far. Google Wallet launched with Citi, then reverted to a negative margin strategy – by charging the merchant CP rates while paying the Issuers CNP rates. It wasn’t ideal – as merchants did not want Google anywhere near the transaction value chain. Meanwhile – it gave Google quite the heartburn to see Apple being successful with Passbook – requiring merchants give nothing back in return for leveraging it to deliver geo-targeted offers and loyalty. This silent takedown must have forced Google’s hands in getting serious about building a complete offer, loyalty, payment scheme that is collaborative (HCE support was a collaborative effort introduced by SimplyTapp) and merchant friendly. I believe HCE support now represents a serious effort to help merchants commercialize a closed-loop advantage in contactless without requiring software changes inside the terminal. Contactless was out of bounds for merchants till now. Not anymore. Having fielded a number of calls from retailers as to what this means, I will distill retailer reactions down to this: measured optimism, casual pessimism and “network” cynicism. Retailers have always looked at EMV and terminalization as a head-fake for NFC – to further lay down the tracks for another three decades of control around pricing and what they see as anti-competitive behavior. Though HCE is in no way tethered to NFC (it’s agnostic of a communication method) – due to its current close association with NFC, merchants see the conversation as a non-starter – until there is a constructive dialogue with networks. At the same time, merchants are cautiously optimistic about the future of HCE – provided that there is a standards body that provides them equal footing with Platform owners, Issuers and networks – to dictate its scope and future. As the platform owner – Google should work with the merchant body, networks, issuers and other stakeholders to see this through. It was not a surprise that those who I talked to all agreed about one thing: that Carriers really should have no role to play in this framework. TSM’s/SE Providers: Where to from here? The nine party model is dead, or will be very soon – as the SE rental model has been shown as previously not being sustainable – and now with HCE – simply wasteful. TSM’s had been focused outside of US for the last several years – as the lack of meaningful commercial launches meant that the US market will simply not bring scale for many years. And with Google shifting away from using a Secure Element in its flagship Nexus models – the writing was already on the wall. TSM’s will look to extend their capabilities in to non-traditional partnerships (Gemalto/MCX) and in to non-hardware scenarios (competing with Cloud SE providers like SimplyTapp in the HCE model). Bell-ID is such an example – and quite likely the only example right now. Networks: Certify or Not? What does Host Card Emulation mean to V/MA? It is no secret that the networks had more than toyed with the idea of software card emulation these last couple of years – realizing the rapidly shrinking runway for NFC. Focus for networks should be now to certify the new approach, as a legitimate way to store and transfer credentials. It’s interesting to hear how our neighbors in the north have reacted to this news. There is still ambiguity among Canadian issuers and networks as to what this means – including debates as to whether an onboard SE is still required for secure storage. That ambiguity will not dissipate till V/MA step in and do their part. I must quote an EMV payments consultant from the north who wrote to me this week: “My boss calls the TSM model “traditional” and I remind him in NFC payments there is no tradition… I think for some people the Global Platform standards with the TSM smack in the middle are like a comfort food – you know what you are getting and it feels secure (with 1000′s of pages of documentation how could they not be!)” That should give GP and TSMs some comfort. Device Support for HCE: What does that look like? Google does not report sales figures on Nexus 4, Nexus 5, Google Play editions of Samsung Galaxy S4 and HTC One – the four devices that are slated to receive KitKat over the next few weeks (apart from the Nexus tablets). So if I would venture a guess – I would say approx 20M devices in total that has NFC capability that will support Host Card Emulation soon. That may not seem much – but it’s a strong base . There is also a possibility that post-Galaxy Nexus devices from Samsung may leapfrog 4.3 to go directly to KitKat. If that happens – just based on reported sales volumes for Galaxy S3 and S4 – that would be a total of 100M devices with NFC support. What does that mean for Samsung’s revenue model around SE – who has an embedded SE from Oberthur in the S3 & S4 devices, which it hopes to charge rent to Visa and others – that’s unclear at this point. Issuers: ISIS alternative or more? For those issuers who passed on Isis, or those who were scorned by Isis – this enables them to outfit their current mobile assets with a payment feature. I wrote about the absurdity in a contactless transaction where the consumer has to close his merchant or banking app and switch to Isis to tap-and-pay – instead of equipping merchant/bank apps with a tap-and-pay feature. HCE means a lot more for Private label Issuers – who have a very inspired base of merchants looking to bridge the gap between private label cards and mobile – and now have an alternative to clumsy, costly and complex orchestrations for provisioning cards – replaced with an easy integration and cheaper deployment. More about that later. Finally, Carriers & Isis: Fight or Flight? God Speed.