Current economic conditions present genuine challenges for mortgage lenders. In this environment, first-time homebuyers offer exciting, perhaps unexpected, business growth potential.

Market uncertainties have kept potential borrowers anxious and on the sidelines. The Federal Reserve’s recent announcement that interest rates will remain steady for now has added to borrower anxiety. First-time homebuyers are no exception. They are concerned about the “right” time to jump in, buy a home, and own a mortgage. Despite worries over high interest rates and low inventory, many first-time homebuyers are tired of waiting for rates to drop and inventory to blossom.

First-time buyers are eager to explore all avenues necessary to achieve homeownership. They show a willingness to be flexible when it comes to finding a house, considering options like a fixer upper or expanding their search to more affordable locations.

The desire to escape the uncertainty and financial burden of renting is a strong driving force for first-time buyers. They see homeownership as a way to establish stability and build equity for their future. Despite the obstacles renters face in the competitive housing market, these potential buyers are motivated. Lenders who take time to understand who these buyers are and what matters to them will be ahead of the game.

Notwithstanding stubbornly high interest rates, first-time homebuyers historically have shown remarkable resilience amid market fluctuations.

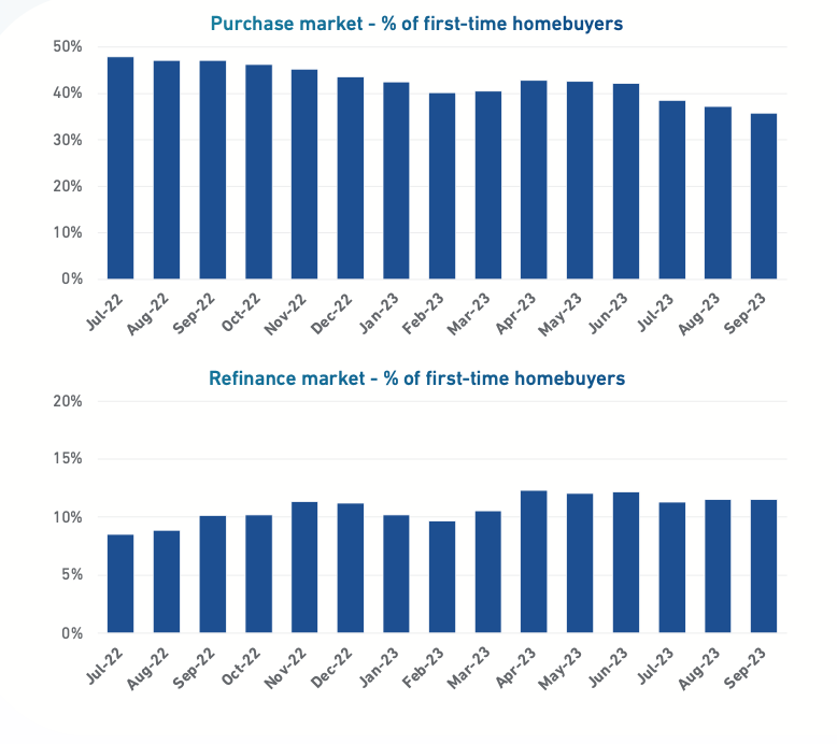

According to a recent deep dive by Experian Mortgage experts into the buying patterns of first-time homebuyers, this group made 35-48% of all new purchases and 8-12% of all refinances between July 2022 and September 2023. First-time buyers represent both immediate potential and long-term client opportunities.

How can lenders attract first-time homebuyers and drive growth from this market?

The first-time homebuyer market largely consists of individuals in their early 40s and younger, also known as Gen Y and Gen Z. Rising costs of renting a home frustrate these individuals who are trying to save money for a down payment on a house and ultimately, buy their dream home. They want to settle down and look ahead to the future.

For mortgage lenders who focus on understanding this younger first-time buyer market and developing targeted business strategies to attract them, great growth potential exists. Often, younger people feel locked out of buying opportunities, which creates uncertainty and apprehension about entering the market. This presents mortgage industry professionals with an incredible opportunity to show their value and grow their client base.

To attract this market segment, lenders must adapt. Lenders must develop a comprehensive picture of this younger generation. Who are they? How do they shop? Where do they want to live? What is their financial situation? What are their financial and personal goals? Acknowledging difficulties in the housing market and showing them a well-conceived path forward to home ownership will win the day for the lender and the buyer.

As interest rates are poised to decrease in 2024-2025, there is potential for a surge in demand from first-time homebuyers. Lenders should prepare for these potential buyers, now. It is crucial to reevaluate how to approach first-time buyers to identify new opportunities for expansion.

Experian Mortgage examined first-time homebuyer trends to pinpoint prospects with good credit and provide analysis on potential areas of opportunity. For more information about the lending possibilities for first-time homebuyers, download our white paper.