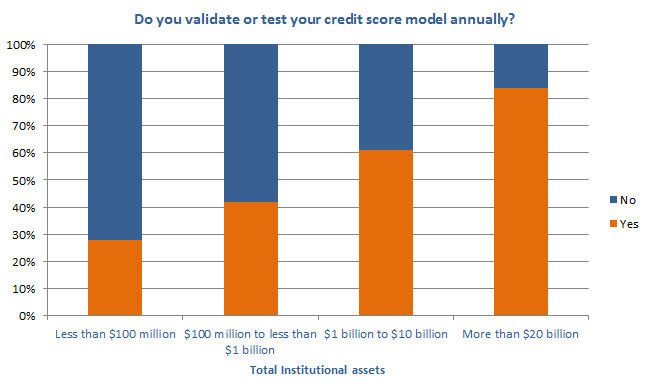

As part of its guidance, the Office of the Comptroller of the Currency recommends that lenders perform regular validations of their credit score models in order to assess model performance. The guidelines apply to both custom and bureau scoring models. A recent survey of lenders commissioned by SourceMedia Research LLC found that only 40 percent of lenders validate their models annually. While the majority of larger lenders perform validations annually, smaller lenders tend to validate less frequently, as noted in the chart below.

In addition to meeting regulatory guidelines, validating scoring models on a regular basis verifies that scorecards continue to work as intended and also can serve as an early warning system for identifying when changes may be necessary, whether it be an adjustment to a score cut-off strategy or a full model redevelopment.

The Score, April 2014: The importance of regular credit score validations.