Tag: alternative credit data

Millions of consumers lack credit history and/or have difficulty obtaining credit from mainstream financial institutions. As a result, the use of expanded Fair Credit Reporting Act (FCRA) – or alternative – data has continued to gain popularity among lenders and financial intuitions to enrich decisions across the entire lending lifecycle to meet the financial needs of their consumers. Experian presented in a recent webinar hosted by AFSA, where Alpa Lally, Vice President of Product Management, and David Elmore, Automotive Solutions Consultant, had a chance to speak about the benefits of FCRA data, and ways lenders can leverage this data to ease access to credit for “invisible” and below prime consumers. Watch the full webinar, “FCRA Data: The Key to Unlocking Credit Universe” and learn more about: How expanded FCRA data is being used throughout the lending lifecycle The benefits of leveraging FCRA data including providing a more holistic view of a consumer’s credit profile and behavior beyond financial services, leading to smarter, more informed lending decisions The lift FCRA data can offer when augmented with traditional credit data This webinar is a part of AFSA’s partner webinar series. To learn more about FCRA data and explore related content, please visit our FCRA Alternative Credit Data Resources Page. Learn More About FCRA-Alternative Credit Data

For credit unions, having the right income and employment verification tools in place helps to create an application process that is easy and low friction for both new and existing members. Digital first is member first The digital evolution created an expectation for online experiences that are simple, fast, and convenient. Attracting and building trusted, loyal relationships and paving the way for new revenue-generating opportunities now hinges on a lender's ability to provide experiences that meet those expectations. At the same time, market volatility and economic uncertainty are driving catalysts behind the need for credit unions to gain a more holistic view of a member’s financial stability. To gain a competitive advantage in today’s lending environment, credit unions need income and employment verification solutions that balance two often polarizing business drivers: member experience and risk management. While verified income and employment data is key to understanding stability, it’s equally important to streamline the verification process and make it as frictionless as possible for borrowers. With these things in mind, here are three considerations to help credit unions ensure their income and employment verification process creates a favorable member experience. The more payroll records, the better Eliminate friction for members by tapping into a network of millions of unique employer payroll records. Gaining instant access into a database of this scale helps enable decisions in real-time, eliminates the cost and complexity of many existing verification processes, and allows members to skip cumbersome steps like producing paystubs. Create a process with high configuration and flexibility Verification is not a one-size-fits-all process. In some cases, it might be advantageous to tailor a verification process. Make sure your program is flexible, scalable and highly configurable to meet your evolving business needs. It should also have seamless integration options to plug and play into your current operations with ease. The details are in the data When it comes to income and employment verification, make sure that you are leveraging the most comprehensive source of consumer information. It’s important that your program is powered by quality data from a wealth of datasets that extend beyond traditional commercial businesses to ensure you are getting the most comprehensive view. Additionally, look to leverage a network of exclusive employer payroll records. With both assets, make sure you understand how frequently the data is refreshed to be certain your decisioning process is using the freshest and highest-quality data possible. Implementing the right solution By including a real-time income and employment verification solution in your credit union’s application process, you can improve the member experience, minimize cost and risk, and make better and faster decisions. To learn more about Experian’s income and employment verification solutions, or for a complimentary demo, feel free to contact an expert today. Learn more Contact us

Experian recently announced its expansion into Employer Services and the release of a new suite of real-time income and employment verification products, Experian Verify™. The COVID-19 pandemic amplified lenders' need for deeper insights into a consumer's financial situation. At the same time, employers were flooded with record-breaking unemployment claims, while managing stay-at-home orders, income and employment verification fulfillment requests, and more. "We're committed to helping employers, businesses, lenders, and consumers on the road to recovery from the pandemic and beyond," said Alex Lintner, Group President Experian Consumer Information Services. "To support this, we're building two businesses: Experian Employer Services and Verification Solutions. These businesses will create meaningful change and provide our clients with competitive options to achieve their verification needs while helping improve access to credit for consumers." With Experian Verify, lenders can quickly and easily create a more complete picture of a consumer's financial situation by verifying an applicant's income and employment status. Powered by our growing network of payroll and proprietary employer data, Experian Verify offers lenders flexible and secure access to income and employment records. With a consumer's consent, lenders can request the information from Experian and an income and employment report can be delivered to lenders through an API, online Experian dashboard, or paired with an Experian credit report. "As we begin to recover from the COVID-19 pandemic and employers are reopening their doors, we're confident we have assembled the best-of-the-best to help employers overcome their toughest challenges. We're committed to leveraging our combined capabilities and focus on high-touch customer service to deliver secure, scalable and transparent services to employers," said Michele Bodda, President of Experian Mortgage, Employer Services and Verification solutions. Visit us for more information on Experian Verify and Experian's Employer Services. Contact us

Big data is bringing changes to the way credit scores are reported and making it easier for lenders to find creditworthy consumers, and for consumers to qualify for the financing they need. Since last year’s annual report, alternative credit data1 has continued to gain in popularity. In Experian’s latest 2020 State of Alternative Credit Data report, we take a closer look at why alternative credit data is supplemental and essential to consumer lending and how it’s being adopted by both consumers and financial institutions. While the topic of alternative credit data has become more well known, its capabilities and benefits are still not widely discussed. For instance, did you know that … 89% of lenders agree that alternative credit data allows them to extend credit to more consumers. 96% of lenders agree that in times of economic stress, alternative credit data allows them to more closely evaluate consumer’s creditworthiness and reduce their credit risk exposure. 3 out of 4 consumers believe they are a better borrower than their credit score represents. Not only do consumers believe they’re more financially astute than their credit score depicts – but they’re happy to prove it, with 80% saying they would share various types of financial information with lenders if it meant increased chances for approval or improved interest rates. This year’s report provides a deeper look into lenders’ and consumers’ perceptions of alternative credit data, as well as an overview of the regulatory landscape and how alternative credit data is being used across the lending marketplace. Lenders who incorporate alternative credit data and machine learning techniques into their current processes can harness the data to unlock their portfolio’s growth potential, make smarter lending decisions and mitigate risk. Learn more in the 2020 State of Alternative Credit Data white paper. Download now

In today’s uncertain economic environment, the question of how to reduce portfolio volatility while still meeting consumers’ needs is on every lender’s mind. With more than 100 million consumers already restricted by traditional scoring methods used today, lenders need to look beyond traditional credit information to make more informed decisions. By leveraging alternative credit data, you can continue to support your borrowers and expand your lending universe. In our most recent podcast, Experian’s Shawn Rife, Director of Risk Scoring and Alpa Lally, Vice President of Data Business, discuss how to enhance your portfolio analysis after an economic downturn, respond to the changing lending marketplace and drive greater access to credit for financially distressed consumers. Topics discussed, include: Making strategic, data-driven decisions across the credit lifecycle Better managing and responding to portfolio risk Predicting consumer behavior in times of extreme uncertainty Listen in on the discussion to learn more. Experian · Effective Lending in the Age of COVID-19

Account management is a critical strategy during any type of economy (pro-cycle, counter-cycle, cycle neutral). In times like these, marked by economic volatility, it is an effective way to identify which parts of your portfolio and which of your consumers need the most attention. Check out this podcast where Cyndy Chang, Senior Director of Product Management, and Craig Wilson, Senior Director of Consulting, discuss the foundational elements of account management, best practices and use cases. Account management today looks very different than what it has been during over a decade of growth proactive; account review is a critical part of navigating the path forward. Questions that need to be addressed include: Do you have the right data? Are you monitoring between data loads? Are you reviewing accounts at the frequency that today’s changing demands require? Listen in on the discussion to learn more. Experian · Look Ahead Podcast

To combat the growing threat of synthetic identity fraud, Experian recently announced the launch of Sure ProfileTM, a revolutionary change to the credit profile that gives lenders peace of mind with Experian’s commitment to share in losses that result from an identity we’ve assured. “Experian has always been a leader in combatting fraud, and with Sure Profile, we’re proud to deliver an industry-first fraud offering integrated into the credit profile that mitigates lender losses while protecting millions of consumers’ identities,” said Robert Boxberger, President of Decision Analytics, Experian North America. Synthetic identity fraud is expected to drive $48 billion in annual online payment fraud losses by 2023. Between opportunistic fraudsters and a lack of a unified definition for synthetic identity theft it can be nearly impossible to detect—and therefore prevent—this type of fraud. This breakthrough solution provides a composite history of a consumer’s identification, public record, and credit information and determines the risk of synthetic fraud associated with that consumer. It’s not just a fraud tool, it’s a comprehensive credit profile that utilizes premium data so lenders can make positive credit decisions. Sure Profile leverages the capabilities of the Experian Ascend Identity PlatformTM and uses Experian’s industry-leading data assets and data quality to drive advanced analytics that set a higher level of protection for lenders. It’s powered by newly-developed machine learning and AI models. And it offers a streamlined approach to define and detect synthetic identities early in the originations process. Most importantly, Sure Profile differentiates between real people and potentially risky applicants so lenders can increase application approvals with greater assurance and less risk. “Experian can confidently define and help detect synthetic fraud. That's why we can help stop it,” said Craig Boundy, CEO of Experian North America. “Experian stands behind our data with assurance given to our clients. It’s better for lenders and it’s better for consumers.” Sure Profile is a complement to our robust set of identity protection and fraud management capabilities, which are designed to address fraud and identity challenges including account openings, account takeovers, e-commerce fraud and more. This first-of-its kind profile is the future of underwriting and portfolio protection and it’s here now. Read press release Learn More About Sure Profile

The current pandemic will affect the way financial institutions lend and provide credit. Shawn Rife, Experian’s Director of Product Scoring, discusses the ways that financial institutions can navigate the COVID-19 crisis. Check out what he had to say: What implications does the global pandemic have on financial institutions’ analytical needs? SR: In the customer lifecycle, there are 4 different stages: prospecting, acquisitions, portfolio management, and collections. During times of economic uncertainty, lenders typically take additional actions to ensure that there’s a first line of defense against delinquencies and payment stress. Expanding their focus to incorporate account review/portfolio management becomes particularly important. During this time, clients will be looking for leadership, early warning signs, and ways to recession-proof their portfolios (account management), while growing and maintaining their approvals in a healthy way (originations). Lenders may be well advised to delay any focus on collections, since many consumers may be facing major payment stress through no mismanagement of their own doing. Another critical component is with the rollout of government stimulus packages, which lenders can use to identify people in stress who could benefit for second chance opportunities they may not have otherwise been able to receive. As more consumers seek credit, from an analytics perspective, what considerations should financial institutions be making during this time? SR: Financial institutions should be assessing and pre-identifying situations that might place consumers in positions of elevated financial stress. That way, organizations can implement solutions to identify and help at-risk consumers before they fall delinquent. The recent Coronavirus Aid, Relief, and Economic Security Act (CARES Act) – coupled with Experian’s score treatment, are designed to protect consumers against score declines during times of crisis. Furthermore, lenders can provide forbearance and loan deferment programs to help consumers. For lenders, credit risk scores, models, and attributes are the best ways to identify – and even predict - delinquency risk. The FICO® Resilience Index can also identify consumers who are particularly susceptible to delinquency risk directly due to macroeconomic uncertainty. This gives lenders the opportunity to evaluate their portfolios for loss and connect with consumers who may be in need of further support. What is the smartest next play for financial institutions? SR: For financial institutions, the smart play is to add alternative data into their data-driven decisioning strategies as much as possible. Alternative data works to enhance your ability to see a consumer’s entire credit portfolio, which gives lenders the confidence to continue to lend – as well as the ability to track and monitor a consumer’s historical performance (which is a good indicator of whether or not a consumer has both the intention and ability to repay a loan). How will the new attribute subset list benefit financial institutions during this time? SR: Experian’s series of crisis attributes is an example of attributes that can be predictive in times of a crisis. These lists were designed to follow the 3 E’s – Expand, Enhance, and provide Ease of use. Enhance – With these attributes, lenders aren’t limited to traditional data. These attributes allow lenders to look at the entirety of a consumer’s credit or repayment behavior and use more data to make better lending decisions. This becomes crucial in a challenging environment. Expand – This data can also help lenders identify consumers who are in the market for products and services, even if there the lending criteria becomes more stringent. This can open doors and new opportunities for 40-50 million new customers, particularly ones that may not fit initial lending criteria. Ease of Use – Experian has put together the most predictive elements that can identify consumer resilience and potential financial stress in this challenging economy. Experian is committed to helping your organization during times of uncertainty. For more resources, visit our Look Ahead 2020 Hub. Learn more Shawn M. Rife, Director of Risk Scoring, Experian Consumer Information Services, North America Shawn Rife manages Experian’s credit risk scoring models, focused on empowering clients to maximize the scope and influence of their lending universe - while minimizing risk - and complying with ever-changing regulatory standards. Shawn also leads the implementation of Alternative Data within the lending environment, as well as key product implementation initiatives. Prior to Experian, Shawn held key consumer insights and predictive analytics roles for Consumer Packaged Goods and internet companies. Over his career, Shawn has focused on market segmentation, competitive research, new product development and consumer advocacy. He also holds a Master’s degree from Harvard University and a Bachelor’s degree in Political Science and Economics.

Today’s lending market has seen a significant increase in alternative business lending, with companies utilizing new data assets and technology. As the lending landscape becomes increasingly competitive, consumers have more choices than ever when it comes to lending products. To drive profitable growth, lenders must find new ways to help applicants gain access to the loans they need. How Spring EQ is leveraging Experian BoostTM Home equity lender Spring EQ turned to Experian’s first-of-its-kind financial tool that empowers consumers to add positive payments directly into their credit file to assist applicants with attaining the best loan opportunities and rates. By using Experian BoostTM, which captures the value of consumer’s utility and telecom trade lines, in their current lending process, Spring EQ can help applicants near approval or risk thresholds move to higher risk tiers and qualify for better loan terms and conditions. Driving growth with consumer-permissioned data Over 40 million consumers in the U.S. either have no credit file or have insufficient information in their files to generate a traditional credit score. Consumer-permissioned data empowers these individuals to leverage their online financial data and payment histories to gain better access to loans and other financial services while providing lenders with a more comprehensive view of their creditworthiness. According to Experian research, 70% of consumers see the benefits of sharing additional financial information and contributing positive payment history to their credit file if it increases their odds of approval and helps them access more favorable credit terms. Read our case study for more insight on using Experian Boost to: Make better lending decisions Offer or underwrite credit to more people Promote the right credit products Increase conversion and utilization rates Read case study Learn more about Experian Boost

In the face of severe financial stress, such as that brought about by an economic downturn, lenders seeking to reduce their credit risk exposure often resort to tactics executed at the portfolio level, such as raising credit score cut-offs for new loans or reducing credit limits on existing accounts. What if lenders could tune their portfolio throughout economic cycles so they don’t have to rely on abrupt measures when faced with current or future economic disruptions? Now they can. The impact of economic downturns on financial institutions Historically, economic hardships have directly impacted loan performance due to differences in demand, supply or a combination of both. For example, let’s explore the Great Recession of 2008, which challenged financial institutions with credit losses, declines in the value of investments and reductions in new business revenues. Over the short term, the financial crisis of 2008 affected the lending market by causing financial institutions to lose money on mortgage defaults and credit to consumers and businesses to dry up. For the much longer term, loan growth at commercial banks decreased substantially and remained negative for almost four years after the financial crisis. Additionally, lending from banks to small businesses decreased by 18 percent between 2008-2011. And – it was no walk in the park for consumers. Already faced with a rise in unemployment and a decline in stock values, they suddenly found it harder to qualify for an extension of credit, as lenders tightened their standards for both businesses and consumers. Are you prepared to navigate and successfully respond to the current environment? Those who prove adaptable to harsh economic conditions will be the ones most poised to lead when the economy picks up again. Introducing the FICO® Resilience Index The FICO® Resilience Index provides an additional way to evaluate the quality of portfolios at any point in an economic cycle. This allows financial institutions to discover and manage potential latent risk within groups of consumers bearing similar FICO® Scores, without cutting off access to credit for resilient consumers. By incorporating the FICO® Resilience Index into your lending strategies, you can gain deeper insight into consumer sensitivity for more precise credit decisioning. What are the benefits? The FICO® Resilience Index is designed to assess consumers with respect to their resilience or sensitivity to an economic downturn and provides insight into which consumers are more likely to default during periods of economic stress. It can be used by lenders as another input in credit decisions and account strategies across the credit lifecycle and can be delivered with a credit file, along with the FICO® Score. No matter what factors lead to an economic correction, downturns can result in unexpected stressors, affecting consumers’ ability or willingness to repay. The FICO® Resilience Index can easily be added to your current FICO® Score processes to become a key part of your resilience-building strategies. Learn more

In today’s rapidly changing economic environment, the looming question of how to reduce portfolio volatility while still meeting consumers' needs is on every lender’s mind. So, how can you better asses risk for unbanked consumers and prime borrowers? Look no further than alternative credit data. In the face of severe financial stress, when borrowers are increasingly being shut out of traditional credit offerings, the adoption of alternative credit data allows lenders to more closely evaluate consumer’s creditworthiness and reduce their credit risk exposure without unnecessarily impacting insensitive or more “resilient” consumers. What is alternative credit data? Millions of consumers lack credit history or have difficulty obtaining credit from mainstream financial institutions. To ease access to credit for “invisible” and subprime consumers, financial institutions have sought ways to both extend and improve the methods by which they evaluate borrowers’ risk. This initiative to effectively score more consumers has involved the use of alternative credit data.1 Alternative credit data is FCRA-regulated data that is typically not included in a traditional credit report and helps lenders paint a fuller picture of a consumer, so borrowers can get better access to the financial services they need and deserve. How can it help during a downturn? The economic environment impacts consumers’ financial behavior. And with more than 100 million consumers already restricted by the traditional scoring methods used today, lenders need to look beyond traditional credit information to make more informed decisions. By pulling in alternative credit data, such as consumer-permissioned data, rental payments and full-file public records, lenders can gain a holistic view of current and future customers. These insights help them expand their credit universe, identify potential fraud and determine an applicant’s ability to pay all while mitigating risk. Plus, many consumers are happy to share additional financial information. According to Experian research, 58% say that having the ability to contribute positive payment history to their credit files makes them feel more empowered. Likewise, many lenders are already expanding their sources for insights, with 65% using information beyond traditional credit report data in their current lending processes to make better decisions. By better assessing risk at the onset of the loan decisioning process, lenders can minimize credit losses while driving greater access to credit for consumers. Learn more 1When we refer to “Alternative Credit Data,” this refers to the use of alternative data and its appropriate use in consumer credit lending decisions, as regulated by the Fair Credit Reporting Act. Hence, the term “Expanded FCRA Data” may also apply in this instance and both can be used interchangeably.

Update: After closely monitoring updates from the WHO, CDC, and other relevant sources related to COVID-19, we have decided to cancel our 2020 Vision Conference. If you had the chance to experience tomorrow, today, would you take it? What if it meant you could get a glimpse into the future technology and trends that would take your organization to the next level? If you’re looking for a competitive edge – this is it. For more than 38 years, Experian’s premier conference has connected business leaders to data-driven ideas and solutions, fueling them to target new markets, grow existing customer bases, improve response rates, reduce fraud and increase profits. What’s in it for you? Everything to gain and nothing to lose. Are you a marketer? These sessions were made to drive your conversion rates to new heights: Know your customers via omnichannel marketing: Your customers are everywhere, but can you reach them? Learn how to drive business-expansion strategy, brand affinity and customer engagement across multiple channels. Plus, gain insight into connecting with customers via one-to-one messaging. By invitation only, the future of ITA marketing: An evolving landscape means marketers face new challenges in effectively targeting consumers while staying compliant. In this session, we’ll explore how you can leverage fair lending-friendly marketing data for targeting, analysis and measurement. Want the latest in technology trends? Dive into discussions to transform your customer experience: Credit in the age of technology transformation: Machine learning and artificial intelligence are the current darlings of big data, but the platform that drives the success of any big data endeavor is crucial. This session will dive into what happens behind the curtain. Put away your plastic – next-generation identity: An industry panel of experts discusses the newest digital identity and authentication capabilities – those in use today and also exciting solutions on the horizon. How about for the self-proclaimed data geeks? Analyze these: Alternative data: Listen in on an in-depth conversation about creative and impactful examples of using emerging data assets, such as alternative and consumer-permissioned data, for improved consumer inclusion, risk assessment and verification services. The next wave in open data: Experian will share their views on the potential of advanced data and models and how they benefit the global value chain – from consumer scores to business opportunities – regardless of local regulations. And the risk masters? Join us as we kick fraud to the curb: Understanding and tackling synthetic ID fraud: Synthetic IDs present a serious challenge for our entire industry. This expert panel will explore the current landscape – what’s working and what’s not, the expected impact of the next generation SSA eCBSV service, and best practice prevention methods. You are your ID – the new reality of biometrics: Consumers are becoming increasingly comfortable with biometrics. Just as CLEAR has transformed how we use our biometric identity to move through airports, sports venues and more, financial transactions can also be made friction-free. The point is, there’s something for everyone at Vision 2020. It’s not just another conference. Trade in stuffy tradeshow halls and another tri-fold brochure for the insights and connections you need to take your career and organization to the next level. Like technology itself, Vision 2020 promises to connect us, unify us and enable us all to create a better tomorrow. Join us for unique networking opportunities, one-on-one conversations with subject-matter experts and more than 50 breakout sessions with the industry’s most sought-after thought leaders.

It may be a new decade of disruption, but one thing remains constant – the consumer is king. As such, customer experience (and continually evolving digital transformations necessary to keep up), digital expansion and all things identity will also reign supreme as we enter this new set of Roaring 20s. Here are seven of the top trends to keep tabs of through 2020 and beyond. 1. Data that does more – 100 million borrowers and counting Traditional, alternative, public record, consumer-permissioned, small business, big business, big, bigger, best – data has a lot of adjectives preceding it. But no matter how we define, categorize and collate data, the truth is there’s a lot of it that’s untapped, which is keeping financial institutions from operating at their max efficiency levels. Looking for ways to be bigger and bolder? Start with data to engage your credit-worthy consumer universe and beyond. Across the entire lending lifecycle, data offers endless opportunities – from prospecting and acquisitions to fraud and risk management. It fuels any technology solution you have or may want to implement over the coming year. Additionally, Experian is doing their part to create a more holistic picture of consumer creditworthiness with the launch of Experian LiftTM in November. The new suite of credit score products combines exclusive traditional credit, alternative credit and trended data assets, intended to help credit invisible and thin-file consumers gain access to fair and affordable credit. "We're committed to improving financial access while helping lenders make more informed decisions. Experian Lift is our latest example of this commitment brought to life,” said Greg Wright, Executive Vice President and Chief Product Officer for Experian Consumer Information Services. “Through Experian Boost, we're empowering consumers to play an active role in building their credit histories. And, with Experian Lift, we're empowering lenders to identify consumers who may otherwise be excluded from the traditional credit ecosystem,” he said. 2. Identity boom for the next generation Increasingly digital lifestyles have put personalization and frictionless transactions on hyperdrive. They are the expectation, not a nice-to-have. Having customer intelligence will become a necessary survival strategy for those in the market wanting to compete. Identity is not just for marketing purposes; it must be leveraged across the lending lifecycle and every customer interaction. Fragmented customer identities are more than flawed for decisioning purposes, which could potentially lead to losses. And, of course, the conversation around identity would be incomplete without a nod to privacy and security considerations. With the roll-out of the California Consumer Privacy Act (CCPA) earlier this month, we will wait to see if the other states follow suit. Regardless, consumers will continue to demand security and trust. 3. All about artificial intelligence and machine learning We get it – we all want the fastest, smartest, most efficient processes on limited – and/or shrinking – budgets. But implementing advanced analytics for your financial institution doesn’t have to break the bank. And, when it comes to delivering services and messaging to customers the way they want it, how to do that means digital transformation – specifically, leveraging big data and actionable analytics to evaluate risk, uncover industry intel and improve decisioning. One thing’s for certain, financial institutions looking to compete, gain traction and pull away from the competition in this next decade will need to do so by leveraging a future-facing partner’s expertise, platforms and data. AI and machine learning model development will go into hyperdrive to add accuracy, efficiency, and all-out speed. Real-time transactional processing is where it’s at. 4. Customer experience drives decisioning and everything Faster, better, more frictionless. 2020 and the decade will be all about making better decisions faster, catering to the continually quickening pace of consumer attention and need. Platforms and computing language aside, how do you increase processing speed at the same time as increasing risk mitigation? Implementing decisioning environments that cater to consumer preferences, coupled with best-in-class data are the first two steps to making this happen. This can facilitate instant decisioning within financial institutions. Looking beyond digital transformation, the next frontier is digital expansion. Open platforms enable financial institutions to readily add solutions from numerous providers so that they can connect, access and orchestrate decisions across multiple systems. Flexible APIs, single integrations and better strategy and design build the foundation of the framework to be implemented to enhance and elevate customer experience as it’s known today. 5. Credit marketing that keeps up with the digital, instant-gratification age Know your customer may be a common acronym for the financial services industry, but it should also be a baseline for determining whether to send a specific message to clients and prospects. From the basics, like prescreen, to omni-channel marketing campaigns, financial institutions need to leverage the communication channels that consumers prefer. From point of sale to mobile – there are endless possibilities to fit into your consumers’ credit journey. Marketing is clearly not a one-and-done tactic, and therefore multi-channel prequalification offers and other strategies will light the path for acquisitions and cross-sell/up-sell opportunities to come. By developing insights from customer data, financial institutions have a clear line of sight into determining optimal strategies for customer acquisition and increasing customer lifetime value. And, at the pinnacle, the modern customer acquisition engine will continue to help financial institutions best build, test and optimize their customer channel targeting strategies faster than ever before. From segmentation to deployment, and the right data across it all, today and tomorrow’s technology can solve many of financial organizations’ age-old customer acquisition challenges. 6. Three Rs: Recession, regulatory and residents of the White House Last March, the yield curve inverted for the first time since 2007. Though the timing of the next economic correction is debated, messaging is consistent around making a plan of action now. Whether it’s arming your collections department, building new systems, updating existing systems, or adjusting rules and strategy, there are gaps every organization needs to fill. By leveraging the stability of the economy now, financial institutions can put strategies in place to maximize profitability, manage risk, reduce bad debt/charge-offs, and ensure regulatory compliance among their list of to-do’s, ultimately resulting in a more efficient, better-performing program. Also, as we near the election later this year, the regulatory landscape will likely change more than the usual amount. Additionally, we will witness the first accounts of what CECL looks like for SEC-filing financial institutions (and if that will suggest anything for how non-SEC-filing institutions may fare as their deadline inches closer), as well as see the initial implications of the CCPA roll out and whether it will pave a path for other states to follow. As system sophistication continues to evolve, so do the risks (like security breaches) and new regulatory standards (like GDPR and CCPA) which provide reasons for organizations to transform. 7. Focus on fraud (in all forms) With evolving technology, comes evolved fraudsters. Whether it’s loyalty and rewards programs, account openings, breaches, there are so many angles and entry points. Synthetic identity fraud is the fastest-growing type of financial crime in the United States. The cost to businesses is estimated to grow to $1.2 billion by 2020, according to the Aite Group. To ensure the best protection for your business and your customers, a layered, risk-based approach to fraud management provides the highest levels of confidence in the industry. Balance is key – while being compliant with regulatory requirements and conscious of user experience, ensuring consumers’ peace of mind is priority one. Not a new trend, but recognizing fraud and recognizing good consumers will save continue to save financial institutions money and reputational harm, driving significant improvement in key performance indicators. Using the right data (and aggregating multiple data sets) and digital device intelligence tools is the one-two punch to protect your bottom line. For all your needs in 2020 and throughout the next decade, Experian has you covered. Learn more

Retailers are already starting to display their Christmas decorations in stores and it’s only early November. Some might think they are putting the cart ahead of the horse, but as I see this happening, I’m reminded of the quote by the New York Yankee’s Yogi Berra who famously said, “It gets late early out there.” It may never be too early to get ready for the next big thing, especially when what’s coming might set the course for years to come. As 2019 comes to an end and we prepare for the excitement and challenges of a new decade, the same can be true for all of us working in the lending and credit space, especially when it comes to how we will approach the use of alternative data in the next decade. Over the last year, alternative data has been a hot topic of discussion. If you typed “alternative data and credit” into a Google search today, you would get more than 200 million results. That’s a lot of conversations, but while nearly everyone seems to be talking about alternative data, we may not have a clear view of how alternative data will be used in the credit economy. How we approach the use of alternative data in the coming decade is going to be one of the most important decisions the lending industry makes. Inaction is not an option, and the time for testing new approaches is starting to run out – as Yogi said, it’s getting late early. And here’s why: millennials. We already know that millennials tend to make up a significant percentage of consumers with so-called “thin-file” credit reports. They “grew up” during the Great Recession and that has had a profound impact on their financial behavior. Unlike their parents, they tend to have only one or two credit cards, they keep a majority of their savings in cash and, in general, they distrust financial institutions. However, they currently account for more than 21 percent of discretionary spend in the U.S. economy, and that percentage is going to expand exponentially in the coming decade. The recession fundamentally changed how lending happens, resulting in more regulation and a snowball effect of other economic challenges. As a result, millennials must work harder to catch up financially and are putting off major life milestones that past generations have historically done earlier in life, such as homeownership. They more often choose to rent and, while they pay their bills, rent and other factors such as utility and phone bill payments are traditionally not calculated in credit scores, ultimately leaving this generation thin-filed or worse, credit invisible. This is not a sustainable scenario as we enter the next decade. One of the biggest market dynamics we can expect to see over the next decade is consumer control. Consumers, especially millennials, want to be in the driver’s seat of their “credit journey” and play an active role in improving their financial situations. We are seeing a greater openness to providing data, which in turn enables lenders to make more informed decisions. This change is disrupting the status quo and bringing new, innovative solutions to the table. At Experian, we have been testing how advanced analytics and machine learning can help accelerate the use of alternative data in credit and lending decisions. And we continue to work to make the process of analyzing this data as simple as possible, making it available to all lenders in all verticals. To help credit invisible and thin-file consumers gain access to fair and affordable credit, we’ve recently announced Experian Lift, a new suite of credit score products that combines exclusive traditional credit, alternative credit and trended data assets to create a more holistic picture of consumer creditworthiness that will be available to lenders in early 2020. This new Experian credit score may improve access to credit for more than 40 million credit invisibles. There are more than 100 million consumers who are restricted by the traditional scoring methods used today. Experian Lift is another step in our commitment to helping improve financial health of consumers everywhere and empowers lenders to identify consumers who may otherwise be excluded from the traditional credit ecosystem. This isn’t just a trend in the United States. Brazil is using positive data to help drive financial inclusion, as are others around the world. As I said, it’s getting late early. Things are moving fast. Already we are seeing technology companies playing a bigger role in the push for alternative data – often powered by fintech startups. At the same time, there also has been a strong uptick in tech companies entering the banking space. Have you signed up for your Apple credit card yet? It will take all of 15 seconds to apply, and that’s expected to continue over the next decade. All of this is changing how the lending and credit industry must approach decision making, while also creating real-time frictionless experiences that empower the consumer. We saw this with the launch of Experian Boost earlier this year. The results speak for themselves: hundreds of thousands of previously thin-file consumers have seen their credit scores instantly increase. We have also empowered millions of consumers to get more control of their credit by using Experian Boost to contribute new, positive phone, cable and utility payment histories. Through Experian Boost, we’re empowering consumers to play an active role in building their credit histories. And, with Experian Lift, we’re empowering lenders to identify consumers who may otherwise be excluded from the traditional credit ecosystem. That’s game-changing. Disruptions like Experian Boost and newly announced Experian Lift are going to define the coming decade in credit and lending. Our industry needs to be ready because while it may seem early, it’s getting late.

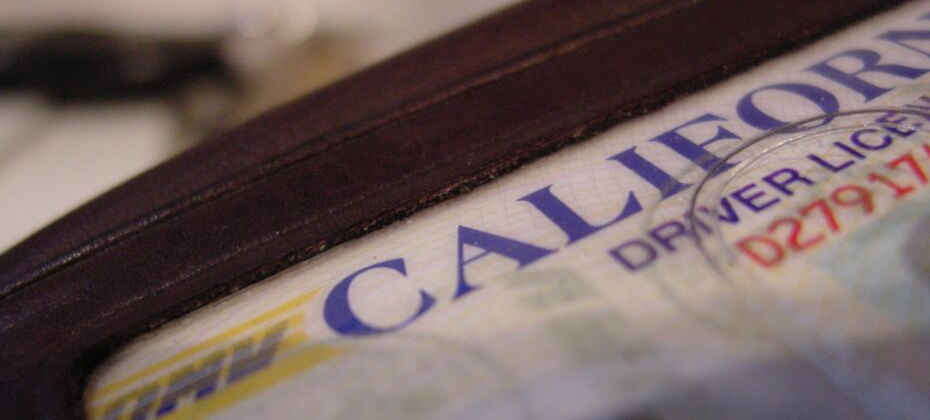

A few months ago, I got a letter from the DMV reminding me that it was finally time to replace my driver’s license. I’ve had it since I was 21 and I’ve been dreading having to get a new one. I was especially apprehensive because this time around I’m not just getting a regular old driver’s license, I’m getting a REAL ID. For those of you who haven’t had this wonderful experience yet, a REAL ID is the new form of driver’s license (or state ID) that you’ll need to board a domestic flight starting October 1, 2020. Some states already offered compliant IDs, but others—like California, where I’m from—didn’t. This means that if I want to fly within the U.S. using my driver’s license next year, I can’t renew by mail. It’s Easier Than It Looks Imagine my surprise when I started the process to schedule my appointment, and the California DMV website made things really easy! There’s an online application you can fill out before you get to the DMV and they walk you through the documents to bring to the appointment (which I was able to schedule online). Despite common thought that the DMV and agencies like it are slow to adopt technology, the ease of this process may indicate a shift toward a digital-first mindset. As financial institutions embrace a similar shift, they’ll be better positioned to meet the needs of customers. Case in point, the electronic checklist the DMV provided to prepare me for my appointment. I sailed through the first two parts of the checklist, confirming that I’ll bring my proof of identity and social security number, but I paused when I got to the “Two Proofs of Residency” screen. Like many people my age—read: 85% of the millennial population, according to a recent Experian study—I don’t have a mortgage or any other documents relating to property ownership. I also don’t have my name on my utilities (thanks, roomie) or my cell phone bill (thanks Mom). I do however have a signed lease with my name on it, plus my renter’s insurance, both of which are acceptable as proof of residency. And just like that, I’m all set to get my REAL ID, even though I don’t have some of the basic adulting documents you might expect, because the DMV took into account the fact that not all REAL ID applicants are alike. Imagine if lenders could adopt that same flexibility and create opportunities for the more than 45 million U.S. consumers1 who lack a credit report or have too little information to generate a credit score. The Bigger Picture By removing some of the usual barriers to entry, the DMV made the process of getting my REAL ID much easier than it might have been and corrected my assumptions about how difficult the process would be. Experian has the same line of thought when it comes to helping you determine whether a borrower is credit-worthy. Just because someone doesn’t have a credit card, auto loan or other traditional credit score contributor doesn’t mean they should be written off. That’s why we created Experian BoostTM, a product that lets consumers give read-only access to their bank accounts and add in positive utility and telecommunications bill payments to their credit file to change their scores in real time and demonstrate their stability, ability and willingness to repay. It’s a win-win for lenders and consumers. 2 out of 3 users of Experian Boost see an increase in their FICO Score and of those who saw an increase, 13% moved up a credit tier. This gives lenders a wider pool to market to, and thanks to their improved credit scores, those borrowers are eligible for more attractive rates. Increasing your flexibility and removing barriers to entry can greatly expand your potential pool of borrowers without increasing your exposure to risk. Learn more about how Experian can help you leverage alternative credit data and expand your customer base in our 2019 State of Alternative Data Whitepaper. Read Full Report 1Kenneth P. Brevoort, Philipp Grimm, Michelle Kambara. “Data Point: Credit Invisibles.” The Consumer Financial Protection Bureau Office of Research. May 2015.