Tag: alternative credit data

In today’s age of digital transformation, consumers have easy access to a variety of innovative financial products and services. From lending to payments to wealth management and more, there is no shortage in the breadth of financial products gaining popularity with consumers. But one market segment in particular – unsecured personal loans – has grown exceptionally fast. According to a recent Experian study, personal loan originations have increased 97% over the past four years, with fintech share rapidly increasing from 22.4% of total loans originated to 49.4%. Arguably, the rapid acceleration in personal loans is heavily driven by the rise in digital-first lending options, which have grown in popularity due to fintech challengers. Fintechs have earned their position in the market by leveraging data, advanced analytics and technology to disrupt existing financial models. Meanwhile, traditional financial institutions (FIs) have taken notice and are beginning to adopt some of the same methods and alternative credit approaches. With this evolution of technology fused with financial services, how are fintechs faring against traditional FIs? The below infographic uncovers industry trends and key metrics in unsecured personal installment loans: Still curious? Click here to download our latest eBook, which further uncovers emerging trends in personal loans through side-by-side comparisons of fintech and traditional FI market share, portfolio composition, customer profiles and more. Download now

Would you hire a new employee strictly by their resume? Surely not – there’s so much more to a candidate than what’s written on paper. With that being said, why would you determine your consumers’ creditworthiness based only on their traditional credit score? Resumes don’t always give you the full picture behind an applicant and can only tell a part of someone’s story, just as a traditional credit score can also be a limited view of your consumers. And lenders agree – findings from Experian’s 2019 State of Alternative Credit Data revealed that 65% of lenders are already leveraging information beyond the traditional credit report to make lending decisions. So in addition to the resume, hiring managers should look into a candidate’s references, which are typically used to confirm a candidate’s positive attributes and qualities. For lenders, this is alternative credit data. References are supplemental but essential to the resume, and allow you to gain new information to expand your view into a candidate – synonymous to alternative credit data’s role when it comes to lending. Lenders are tasked with evaluating their consumers to determine their stability and creditworthiness in an effort to prevent and reduce risk. While traditional credit data contains core information about a consumer’s credit data, it may not be enough for a lender to formulate a full and complete evaluation of the consumer. And for over 45 million Americans, the issue of having no credit history or a “thin” credit history is the equivalent of having a resume with little to no listed work experience. Alternative credit data helps to fill in the gaps, which has benefits for both lenders and consumers. In fact, 61% of consumers believe adding payment history would have a positive impact on their credit score, and therefore are willing to share their data with lenders. Alternative credit data is FCRA-compliant and includes information like alternative finance data, rental payments, utility payments, bank account information, consumer-permissioned data and full-file public records. Because this data shows a holistic view of the customer, it helps to determine their ability to repay debts and reveals any delinquent behaviors. These insights help lenders to expand their consumer lending universe– all while mitigating and preventing risk. The benefits can also be seen for home-based and small businesses. Fifty percent of all US small businesses are home-based, but many small business owners lack visibility due to their thin-file nature – making it extremely difficult to secure bank loans and capital to fund their businesses. And, younger generations and small business owners account for 58% of business owners who rely on short term lending. By leveraging alternative credit data, lenders can get greater insights into a small business owner’s credit profile and gauge risk. Entrepreneurs can also benefit from this information being used to build their credit profiles – making it easier for them to gain access to investment capital to fund their new ventures. Like a hiring manager, it’s important for lenders to get a comprehensive view to find the most qualified candidates. Using alternative credit data can expand your choices – read our 2019 State of Alternative Credit Data Whitepaper to learn more and register for our upcoming webinar. Register Now

Alex Lintner, Group President at Experian, recently had the chance to sit down with Peter Renton, creator of the Lend Academy Podcast, to discuss alternative credit data,1 UltraFICO, Experian Boost and expanding the credit universe. Lintner spoke about why Experian is determined to be the leader in bringing alternative credit data to the forefront of the lending marketplace to drive greater access to credit for consumers. “To move the tens of millions of “invisible” or “thin file” consumers into the financial mainstream will take innovation, and alternative data is one of the ways which we can do that,” said Lintner. Many U.S. consumers do not have a credit history or enough record of borrowing to establish a credit score, making it difficult for them to obtain credit from mainstream financial institutions. To ease access to credit for these consumers, financial institutions have sought ways to both extend and improve the methods by which they evaluate borrowers’ risk. By leveraging machine learning and alternative data products, like Experian BoostTM, lenders can get a more complete view into a consumer’s creditworthiness, allowing them to make better decisions and consumers to more easily access financial opportunities. Highlights include: The impact of Experian Boost on consumers’ credit scores Experian’s take on the state of the American consumer today Leveraging machine learning in the development of credit scores Expanding the marketable universe Listen now Learn more about alternative credit data 1When we refer to "Alternative Credit Data," this refers to the use of alternative data and its appropriate use in consumer credit lending decisions, as regulated by the Fair Credit Reporting Act. Hence, the term "Expanded FCRA Data" may also apply in this instance and both can be used interchangeably.

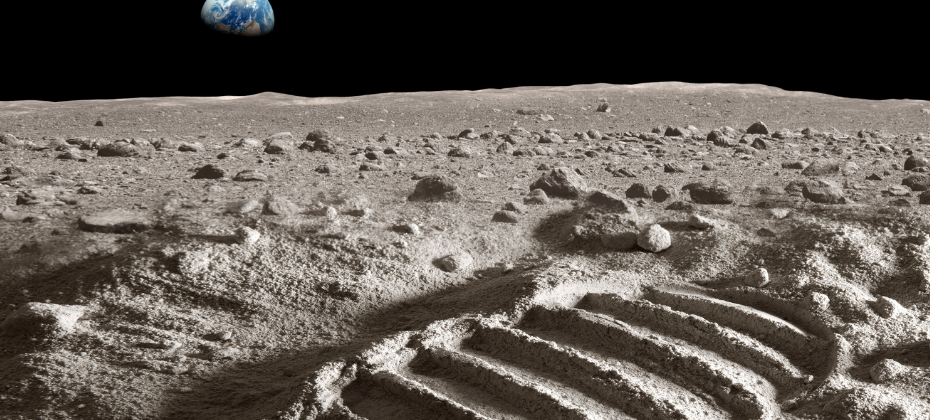

The universe has been used as a metaphor for many things – vast, wide, intangible – much like the credit universe. However, while the man on the moon, a trip outside the ozone layer, and all things space from that perspective may seem out of touch, there is a new line of access to consumers. In Experian's latest 2019 State of Alternative Credit Data report, consumers and lenders alike weigh in on the growing data set and how they are leveraging the data in use cases across the lending lifecycle. While the topic of alternative credit data is no longer as unfamiliar as it may have been a year or two ago, the capabilities and benefits that can be experienced by financial institutions, small businesses and consumers are still not widely known. Did you know?: - 65% of lenders say they are using information beyond the traditional credit report to make a lending decision. - 58% of consumers agree that having the ability to contribute payment history to their credit file make them feel empowered. - 83% of lenders agree that digitally connecting financial account data will create efficiencies in the lending process. These and other consumer and lender perceptions of alternative credit data are now launched with the latest edition of the State of Alternative Credit Data whitepaper. This year’s report rounds up the different types of alternative credit data (from alternative financial services data to consumer-permissioned account data, think Experian BoostTM), as well as an overview of the regulatory landscape, and a number of use cases across consumer and small business lending. In addition, consumers also have a lot to say about alternative credit data: With the rise of machine learning and big data, lenders can collect more data than ever, facilitating smarter and more precise decisions. Unlock your portfolio’s growth potential by tapping into alternative credit data to expand your consumer universe. Learn more in the 2019 State of Alternative Credit Data Whitepaper. Read Full Report View our 2020 State of Alternative Credit Data Report for an updated look at how consumers and lenders are leveraging alternative credit data.

Millions of consumers lack credit history and/or have difficulty obtaining credit from mainstream financial institutions. To ease access to credit for “invisible” and below prime consumers, financial institutions have sought ways to both extend and improve the methods by which they evaluate borrowers’ risk. This initiative to effectively score more consumers has involved the use of alternative credit data.1 Alternative credit data is FCRA-compliant data that is typically not included in a traditional credit report and is used to deliver a more complete view into a consumer’s creditworthiness. “Alternative credit data helps us paint a fuller picture of a consumer so they can get better access to the financial services they need and deserve,” said Alpa Lally, Vice President of Data Business at Experian. Experian recently sponsored the FinovateSpring conference in San Francisco, where Alpa had a chance to sit down with Jacob Gaffney, Editor-in-Chief of the HousingWire News Podcast, to discuss ways consumers can improve their credit scores. As an immigrant, Alpa spoke personally about the impact of having a limited credit history and how alternative credit data can help drive greater access to credit for consumers and profitable growth for lenders through more informed lending decisions. Highlights include: How alternative and traditional credit data differ Types of alternative credit data being used by lenders How “credit-invisibles” can best leverage alternative credit data Alternative credit data product solutions, including Experian BoostTM Listen now 1When we refer to “Alternative Credit Data,” this refers to the use of alternative data and its appropriate use in consumer credit lending decisions, as regulated by the Fair Credit Reporting Act. Hence, the term “Expanded FCRA Data” may also apply in this instance and both can be used interchangeably.

“Experian is transforming our business from a traditional credit bureau to a true technology and software provider,” said Craig Boundy, CEO of Experian, North America, as part of his opening remarks Monday morning to kick off the 2019 Experian Vision Conference. “We are committed to working as a force of good.” Covering the themes of financial inclusion, giving consumers control of their lives and better outcomes, a digital-first society, and the latest trends in fraud and security, Boundy addressed a crowd of over 850. Alex Lintner, Experian’s Group President, gave a quick history of the past 3,000 years, from the first credit card, to the addition of wheels to a suitcase, to the iPhone and artificial intelligence. “Innovation is not invention,” Lintner said. He gave the example of the iPhone and how a tear down analysis revealed there were no new elements; however, it was the translation of an idea into a good or service that benefited everyone (as the entire audience raised their hand when asked who had a smart phone). Lintner’s mainstage presentation also featured three live demos, including how the Ascend Technology Platform takes complex model building and outputs from days and weeks to a few clicks, to the incorporation of Small Business Financial Exchange (SBFE) data into the Ascend Analytical Sandbox (incorporating more than 17 years of small business tradeline data and 150 predictive attributes) and lastly, Experian Boost, which according to a live tracker, has boosted consumer credit scores by a total of 3.2 million points, as of this morning, since its launch eight weeks ago. Keynote Speaker: Gary D. Cohn Gary D. Cohn, Former Director of the U.S. National Economic Council, was Monday morning’s keynote speaker. He weighed in on the domestic and global economy, policy issues, financial institutions’ responsibilities and some of his predictions. Cohn brought attention to the ever-changing financial services space, including new forms of encryption and the world of biometric security, calling the financial services industry the “tip of the spear” when it comes to the digitization of the world. Session Highlights - Day 1 Machine Learning From the building blocks of neural networks to artificial intelligence, machine learning has been used in the areas of financial services that do not have adverse actions – think fraud, ID, collections. As we look to harness machine learning for models and other spaces (including adverse action), it’s important to delineate descriptive data (what’s happening now); predictive data (what’s happening in the future); prescriptive data (what am I going to do now); and cognitive data (are we asking the right question?). In addition, it’s necessary to address the five advanced analytic drivers including customer experience, cost, risk and loss, growth and compliance. Home Equity & Lending US macroeconomic trends show consumer confidence is still on an upward trend. While investor confidence is a little volatile, the GDP remains strong (though slightly slowing down) and unemployment is low and forecasted to remain low. Since 2006, the US hasn’t returned in the HELOC space. Mortgage and personal loans are up 20% and 13% respectively, while mortgages have dropped 1% and HELOCs have dropped 2%. With an estimated market potential of over $700 billion, HELOCs may be an untapped credit line given the strength of the economy. Identity Evolution From dumpster divers, aka pulling receipts out of dumpsters behind businesses, to today’s identity-based authentication, there’s been an evolution of how identity is defined as well as its corresponding risks. According to Experian’s Global Fraud & Identity Report, 74% of consumers value security as the most important part of the online experience (over convenience and personalization). However, 74% of consumers abandoned a shopping session that required too much information, and 72% of consumers said they were willing to share more data if it meant a seamless experience. What does this mean? Consumers want it all. Identity today now includes proxies and activity, which can also mean greater risk. Because of aggregators and other associated entities acting on a consumer’s behalf, there are lots of nuances that will need to be looked through. Consumer-Permissioned Data In order to be more consumer-centric, there are four levers through which consumers are given control: data accuracy, knowing their financial profile, the ability to improve their scores (via Experian BoostTM and UltraFICOTM) and protecting consumers when they permission access to their identity credentials. Using Experian Boost, consumers have seen an average increase of 13 points for consumers with positive changes. Additionally, using alternative credit data, financial institutions can score more people and score more accurately. One hundred million consumers could gain greater access to credit with consumer-permissioned data sources. --- Meanwhile, the tech showcase featured over 20 demos covering alternative data, digital credit marketing, consumer empowerment, fraud and identity, integrated decisioning and technology. More insights from Vision to come. Follow @ExperianVision and #ExperianVision on Twitter to see more of the action.

Experian’s 38th annual Vision Conference kicks off on Sunday, May 5 in San Antonio, Texas. The sold-out thought leadership conference, is known for driving discussions on the industry’s hard-hitting topics as well as introducing the latest and greatest in technology, innovation and data science. “For 38 years, Experian’s Vision Conference has connected business leaders to new ideas and solutions through cutting edge data and insights. Our goal is to power opportunities for you to target new markets, grow existing customer bases, improve response rates, reduce fraud and increase profits by using our data, analytics and technology. The intimate setting of the conference allows for unique networking opportunities with the industry’s most sought-after thought leaders,” said Klaudette Christensen, Experian’s Chief Operations Officer. A few spotlight sessions include: Several sessions about machine learning and artificial intelligence, highlighting opportunities related to best practices, underwriting and fraud detection A deep dive into the modern mortgage, leveraging insights on home equity and how to leverage data and analytics to redefine the process as it’s known today Sessions on credit delinquency, collections and the Great Recession Marketing analytics and the latest releases from Experian’s Ascend Platform Sessions on advanced analytics and integrated decisioning as they relate to commercial and consumer insights The event, which runs through Tuesday evening, continues its tradition of featuring several noteworthy keynote speakers. On Monday, Gary D. Cohn, American business leader, philanthropist and former Director of the U.S. National Economic Council, will kick off the event. On Tuesday, Aimée Mullins will take the stage discussing what is “possible” by drawing from her experiences as a record-breaking Olympic athlete, model and actress. The closing keynote will feature five-time NBA Champion and two-time Olympic Gold Medalist, Kobe Bryant. The event will also include a Tech Showcase, featuring hands-on demos for attendees to experience. Stay tuned for additional highlights and insights on our social media platforms throughout the course of the conference. Follow Experian Insights on Twitter and LinkedIn and check out #ExperianVision.

Your consumers’ credit score plays an important role in how lenders and financial institutions measure their creditworthiness and risk. With a good credit score, which is generally defined as a score of 700 or above, they can quickly be approved for credit cards, qualify for a mortgage, and have easier access to loans with lower interest rates. In the spirit of Financial Literacy Month, we’ve rounded up what it takes for consumers to have a good credit score, in addition to some alternative considerations. Pay on Time Life gets busy and sometimes your consumers miss the “credit card payment due” note on their calendar squished between their work meetings and doctor’s appointment. However, payment history is one of the top factors in most credit scoring models and accounts for 35% of their credit score. As the primary objective of your consumers’ credit score is to illustrate to lenders just how likely they are to repay their debts, even one missed payment can be viewed negatively when reviewing their credit history. However, if there is a missed payment, consider checking their alternative financial services payments. They may have additional payment histories that will skew their creditworthiness more so than just their record according to traditional credit lines alone. Limit Credit Cards When your consumers apply for a new loan or credit card, lenders “pull” their credit report(s) to review their profile and weigh the risk of granting them credit or loan approval. The record of the access to their credit reports is known as a “hard” inquiry and has the potential to impact their credit score for up to 12 months. Plus, if they’re already having trouble using their card responsibly, taking on potential new revolving credit could impact their balance-to-limit ratio. For your customers that may be looking for new cards, Experian can estimate your consumers spend on all general-purpose credit and charge cards, so you can identify where there is additional wallet share and assign their credit lines based on actual spending need. Have a Lengthy Credit History The longer your consumers’ credit history, the more time they’ve spent successfully managing their credit obligations. When considering credit age, which makes up 21% of their credit score, credit scoring models evaluate the ages of your consumers’ oldest and newest accounts, along with the average age of all their accounts. Every time they open new credit cards or close an old account, the average age of their credit history is impacted. If your consumer’s score is being negatively affected by their credit history, consider adding information from alternative credit data sources for a more complete view. Manage Debt Wisely While some types of debt, such as a mortgage, can help build financial health, too much debt may lead to significant financial problems. By planning, budgeting, only borrowing when it makes sense, and setting themselves up for unexpected financial expenses, your consumers will be on the path to effective debt management. To get a better view of your consumers spending, consider Experian’s Trended3DTM, a trended attribute set that helps lenders unlock valuable insights hidden within their consumers’ credit scores. By using Trended3DTM data attributes, you’ll be able to see how much of your consumers’ credit line they typically utilize, whether they tend to revolve or transact, and if they are likely to transfer a balance. By adopting these habits and making smart financial decisions, your consumers will quickly realize that it’s never too late to rebuild their credit score. For example, they can potentially instantly improve their score with Experian Boost, an online tool that scans their bank account transactions to identify mobile phone and utility payments. The positive payments are then added to their Experian credit file and increase their FICO® Score in real time. Learn More About Experian Boost Learn More About Experian Trended 3DTM

Alternative credit data and trended data each have advantages to lenders and financial institutions. Is there such a thing as the MVD (Most Valuable Data)? Get Started Today When it comes to the big game, we can all agree the score is the last thing standing; however, how the two teams arrived at that score is arguably the more important part of the story. The same goes for consumers’ credit scores. The teams’ past records and highlight reels give insight into their actual past performance, while game day factors beyond the stat sheets – think weather, injury rehab and personal lives – also play a part. Similarly, consumers’ credit scores according to the traditional credit file may be the dependable source for determining credit worthiness. But, while the traditional credit file is extensive, there is a playbook of other, additional information you can arm yourself with for easier, faster and better lending decisions. We’ve outlined what you need to create a win-win data strategy: Alternative credit data and trended data each have unique advantages over traditional credit data for both lenders and consumers alike. How do you formulate a winning strategy? By making sure you have both powerhouses on your roster. The results? Better than that game-winning touchdown and hoisting the trophy above your head – universe expansion and the ability to lend deeper. Get Started Today

Are You #TeamTrended or #TeamAlternative? There’s no such thing as too much data, but when put head to head, differences between the data sets are apparent. Which team are you on? Here’s what we know: With the entry and incorporation of alternative credit data into the data arena, traditional credit data is no longer the sole determinant for credit worthiness, granting more people credit access. Built for the factors influencing financial health today, alternative credit data essentially fills the gaps of the traditional credit file, including alternative financial services data, rental payments, asset ownership, utility payments, full file public records, and consumer-permissioned data – all FCRA-regulated data. Watch this video to see more: Trended data, on the other hand shows actual, historical credit data. It provides key balance and payment data for the previous 24 months to allow lenders to leverage behavior trends to determine how individuals are utilizing their credit. Different splices of that information reveal particular behavior patterns, empowering lenders to then act on that behavior. Insights include a consumer’s spend on all general purpose credit and charge cards and predictive metrics that identify consumers who will be in the market for a specific type of credit product. In the head-to-head between alternative credit data and trended data, both have clear advantages. You need both on your roster to supplement traditional credit data and elevate your game to the next level when it comes to your data universe. Compared to the traditional credit file, alternative credit data can reveal information differentiating two consumers. In the examples below, both consumers have moderate limits and have making timely credit card payments according to their traditional credit reports. However, alternative data gives insight into their alternative financial services information. In Example 1, Robert Smith is currently past due on his personal loan, whereas Michelle Lee in Example 2 is current on her personal loan, indicating she may be the consumer with stronger creditworthiness. Similarly, trended data reveals that all credit scores are not created equal. Here is an example of how trended data can differentiate two consumers with the same score. Different historical trends can show completely different trajectories between seemingly similar consumers. While the traditional credit score is a reliable indication of a consumer’s creditworthiness, it does not offer the full picture. What insights are you missing out on? Go to Infographic Get Started Today

From the time we wake up to the minute our head hits the pillow, we make about 35,000 conscious and unconscious decisions a day. That’s a lot of processing in a 24-hour period. As part of that process, some decisions are intuitive: we’ve been in a situation before and know what to expect. Our minds make shortcuts to save time for the tasks that take a lot more brainpower. As for new decisions, it might take some time to adjust, weigh all the information and decide on a course of action. But after the new situation presents itself over and over again, it becomes easier and easier to process. Similarly, using traditional data is intuitive. Lenders have been using the same types of data in consumer credit worthiness decisions for decades. Throwing in a new data asset might take some getting used to. For those who are wondering whether to use alternative credit data, specifically alternative financial services (AFS) data, here are some facts to make that decision easier. In a recent webinar, Experian’s Vice President of Analytics, Michele Raneri, and Data Scientist, Clara Gharibian, shed some light on AFS data from the leading source in this data asset, Clarity Services. Here are some insights and takeaways from that event. What is Alternative Financial Services? A financial service provided outside of traditional banking institutions which include online and storefront, short-term unsecured, short-term installment, marketplace, car title and rent-to-own. As part of the digital age, many non-traditional loans are also moving online where consumers can access credit with a few clicks on a website or in an app. AFS data provides insight into each segment of thick to thin-file credit history of consumers. This data set, which holds information on more than 62 million consumers nationwide, is also meaningful and predictive, which is a direct answer to lenders who are looking for more information on the consumer. In fact, in a recent State of Alternative Credit Data whitepaper, Experian found that 60 percent of lenders report that they decline more than 5 percent of applications because they have insufficient information to make a loan decision. The implications of having more information on that 5 percent would make a measurable impact to the lender and consumer. AFS data is also meaningful and predictive. For example, inquiry data is useful in that it provides insight into the alternative financial services industry. There are also more stability indicators in this data such as number of employers, unique home phone, and zip codes. These interaction points indicate the stability or volatility of a consumer which may be helpful in decision making during the underwriting stage. AFS consumers tend to be younger and less likely to be married compared to the U.S. average and traditional credit data on File OneSM . These consumers also tend to have lower VantageScore® credit scores, lower debt, higher bad rates and much lower spend. These statistics lend themselves to seeing the emerging consumer; millennials, immigrants with little to no credit history and also those who may have been subprime or near prime consumers who are demonstrating better credit management. There also may be older consumers who may have not engaged in traditional credit history in a while or those who have hit a major life circumstance who had nowhere else to turn. Still others who have turned to nontraditional lending may have preferred the experience of online lending and did not realize that many of these trades do not impact their traditional credit file. Regardless of their individual circumstances, consumers who leverage alternative financial services have historically had one thing in common: their performance in these products did nothing to further their access to traditional, and often lower cost, sources of credit. Through Experian’s acquisition and integration of Clarity Services, the nation’s largest alternative finance credit bureau, lenders can gain access to powerful and predictive supplemental credit data that better detect risk while benefiting consumers with a more complete credit history. Alternative finance data can be used across the lending cycle from prospecting to decisioning and account review to collections. Alternative data gives lenders an expanded view of consumer behavior which enables more complete and confident lending decisions. Find out more about Experian’s alternative credit data: www.experian.com/alternativedata.

2019 is here — with new technology, new regulations and new opportunities on the docket. What does that mean for the financial services space? Here are the five trends you should keep your eye on and how these affect your credit universe. 1. Credit access is at an all-time high With 121 million Americans categorized as credit-challenged (subprime scores and a thin or nonexistent credit file) and 45 million considered credit-invisible (no credit history), the credit access many consumers take for granted has appeared elusive to others. Until now. The recent launch of Experian BoostTM empowers consumers to improve their credit instantly using payment history from their utility and phone bills, giving them more control over their credit scores and making them more visible to lenders and financial institutions. This means more opportunities for more people. Coupled with alternative credit data, which includes alternative financial services data, rental payments, and full-file public records, lenders and financial institutions can see a whole new universe. In 2019, inclusion is key when it comes to universe expansion goals. Both alternative credit and consumer-permissioned data will continue to be an important part of the conversation. 2. Machine learning for the masses The financial services industry has long been notorious for being founded on arguably antiquated systems and steeped in compliance and regulations. But the industry’s recent speed of disruption, including drastic changes fueled by technology and innovation, may suggest a changing of the guard. Digital transformation is an industry hot topic, but defining what that is — and navigating legacy systems — can be challenging. Successfully integrating innovation is the convergence at the center of the Venn diagram of strategy, technology and operations. The key, according to Deloitte, is getting “a better handle on data to extract the greatest value from technology investments.” How do you get the most value? Risk managers need big data, machine learning and artificial intelligence strategies to deliver market insights and risk evaluation. Between the difficulty of leveraging data sets and significant investment in time and money, it’s impossible for many to justify. To combat this challenge, the availability and access to an analytical sandbox (which contains depersonalized consumer data and comparative industry intel) is crucial to better serve clients and act on opportunities in lenders’ credit universe and beyond. “Making information analysis easily accessible also creates distinct competitive advantages,” said Vijay Mehta, Chief Innovation Officer for Experian’s Consumer Information Services, in a recent article for BAI Banking Strategies. “Identifying shifts in markets, changes in regulations or unexpected demand allows for quick course corrections. Tightening the analytic life cycle permits organizations to reach new markets and quickly respond to competitor moves.” This year is about meaningful metrics for action, not just data visualization. 3. How to fit into the digital-first ecosystem With so many things available on demand, the need for instant gratification continues to skyrocket. It’s no secret that the financial services industry needs to compete for attention across consumers’ multiple screens and hours of screen time. What’s in the queue for 2019? Personalization, digitalization and monetization. Consumers’ top banking priorities include customized solutions, omnichannel experience improvement and enhancing the mobile channel (as in, can we “Amazonize” everything?). Financial services leaders’ priorities include some of the same things, such as enhancing the mobile channel and delivering options to customize consumer solutions (BAI Banking Strategies). From geolocation targeting to microinteractions in the user experience journey to leveraging new strategies and consumer data to send personalized credit offers, there’s no shortage of need for consumer hyper-relevance. 33 percent of consumers who abandon business relationships do so because personalization is lacking, according to Accenture data for The Financial Brand. This expectation spans all channels, emphasizing the need for a seamless experience across all devices. 4. Keeping fraudsters out Many IT professionals regard biometric authentication as the most secure authentication method currently available. We see this technology on our personal devices, and many companies have implemented it as well. Biometric hacking is among the predicted threats for 2019, according to Experian’s Data Breach Industry Forecast, released last month. “Sensors can be manipulated and spoofed or deteriorate with too much use. ... Expect hackers to take advantage of not only the flaws found in biometric authentication hardware and devices, but also the collection and storage of data,” according to the report. 5. Regulatory changes and continued trends Under the Trump Administration, the regulatory front has been relatively quiet. But according to the Wall Street Journal, as Democrats gain control of the House of Representatives, lawmakers may be setting their sights on the financial services industry — specifically on legislation in response to the credit data breach in 2017. The Democratic Party leadership has indicated that the House Financial Services Committee will be focused on protecting consumers and investors, preserving sector stability, and encouraging responsible innovation in financial technology, according to Deloitte. In other news, the focus on improving accuracy in data reporting, transparency for consumers in credit scoring and other automated decisions can be expected to continue. Consumer compliance, and specifically the fair and responsible treatment of consumers, will remain a top priority. For all your needs in 2019 and beyond, Experian has you covered. Learn more

What if you had an opportunity to boost your credit score with a snap of your fingers? With the announcement of Experian BoostTM, this will soon be the new reality. As part of an increasingly customizable and instant consumer reality in the marketplace, Experian is innovating in the space of credit to allow consumers to contribute information to their credit profiles via access to their online bank accounts. For decades, Experian has been a leader in educating consumers on credit: what goes into a credit score, how to raise it and how to maintain it. Now, as part of our mission to be the consumer’s bureau, Experian is ushering in a new age of consumer empowerment with Boost. Through an already established and full-fledged suite of consumer products, Experian Boost is the next generation offering a free online platform that places the control in the consumers’ hands to influence their credit scores. The platform will feature a sign-in verification, during which consumers grant read-only permission for Experian Boost to connect to their online bank accounts to identify utility and telecommunications payments. After they verify their data and confirm that they want the account information added to their credit file, consumers will receive an instant updated FICO® Score. The history behind credit information spans several centuries from a group of London tailors swapping information on customers to keeping credit files on index cards being read out to subscribers over the telephone. Even with the evolution of the credit industry being very much in the digital age today, Experian Boost is a significant step forward for a credit bureau. This new capability educates the consumer on what types of payment behavior impacts their credit score while also empowering them to add information to change it. This is a big win-win for consumers and lenders alike. As Experian is taking the next big step as a traditional credit bureau, adding these data sources is a new and innovative way to help consumers gain access to the quality credit they deserve as well as promoting fair and responsible lending to the industry. Early analysis of Experian’s Boost impact on the U.S. consumer credit scores showed promising results. Here’s a snapshot of some of those findings: These statistics provide an encouraging vision into the future for all consumers, especially for those who have a limited credit history. The benefit to lenders in adding these new data points will be a more complete view on the consumer to make more informed lending decisions. Only positive payment histories will be collected through the platform and consumers can elect to remove the new data at any time. Experian Boost will be available to all credit active adults in early 2019, but consumers can visit www.experian.com/boost now to register for early access. By signing up for a free Experian membership, consumers will receive a free credit report immediately, and will be one of the first to experience the new platform. Experian Boost will apply to most leading consumer credit scores used by lenders. To learn more about the platform visit www.experian.com/boost.

As our society becomes ever more dependent on everything mobile, criminals are continually searching for and exploiting weaknesses in the digital ecosystem, causing significant harm to consumers, businesses and the economy. In fact, according to our 2018 Global Fraud & Identity Report, 72 percent of business executives are more concerned than ever about the impact of fraud. Yet, despite the awareness and concern, 54 percent of businesses are only “somewhat confident” in their ability to detect fraud. That needs to change, and it needs to change right away. Our industry has thrived by providing products and services that root out bad transactions and detect fraud with minimal consumer friction. We continue to innovate new ways to authenticate consumers, apply new cloud technologies, machine learning, self-service portals and biometrics. Yet, the fraud issue still exists. It hasn’t gone away. How do we provide effective means to prevent fraud without inconveniencing everyone in the process? That’s the conundrum. Unfortunately, a silver bullet doesn’t exist. As much as we would like to build a system that can detect all fraud, eliminate all consumer friction, we can’t. We’re not there yet. As long as money has changed hands, as long as there are opportunities to steal, criminals will find the weak points – the soft spots. That said, we are making significant progress. Advances in technology and innovation help us bring new solutions to market more quickly, with more predictive power than ever, and the ability to help clients to turn these services on in days and weeks. So, what is Experian doing? We’ve been in the business of fraud detection and identity verification for more than 30 years. We’ve seen fraud patterns evolve over time, and our product portfolio evolves in lock-step to counter the newest fraud vectors. Synthetic identity fraud, loan stacking, counterfeit, identity theft; the specific fraud attacks may change but our solution stack counters each of those threats. We are on a continuous innovation path, and we need to be. Our consumer and small business databases are unmatched in the industry for quality and coverage, and that is an invaluable asset in the fight against fraud. It used to be that knowing something about a person was the same as authenticating that same person. That’s just not the case today. But, just because I may not be the only person who knows where I live, doesn’t mean that identity information is obsolete. It is incredibly valuable, just in different ways today. And that’s where our scientists come into their own, providing complex predictive solutions that utilize a plethora of data and insight to create the ultimate in predictive performance. We go beyond traditional fraud detection methods, such as knowledge-based authentication, to offer a custom mix of passive and active authentication solutions that improve security and the customer experience. You want the latest deep learning techniques? We have them. You want custom models scored in milliseconds alongside your existing data requests. We can do that. You want a mix of cloud deployment, dedicated hosted services and on-premise? We can do that too. We have more than 20 partners across the globe, creating the most comprehensive identity management network anywhere. We also have teams of experts across the world with the know how to combine Experian and partner expertise to craft a bespoke solution that is unrivaled in detection performance. The results speak for themselves: Experian analyzes more than a billion credit applications per year for fraud and identity, and we’ve helped our clients save more than $2 billion in annual fraud losses globally. CrossCore™, our fraud prevention and identity management platform, leverages the full breadth of Experian data as well as the data assets of our partners. We execute machine learning models on every decision to help improve the accuracy and speed with which decisions are made. We’ve seen CrossCore machine learning result in a more than 40 percent improvement in fraud detection compared to rules-based systems. Our certified partner community for CrossCore includes only the most reputable leaders in the fraud industry. We also understand the need to expand our data to cover those who may not be credit active. We have the largest and most unique sets of alternative credit data among the credit bureaus, that includes our Clarity Services and RentBureau divisions. This rich data helps our clients verify an individual’s identity, even if they have a thin credit file. The data also helps us determine a credit applicant’s ability to pay, so that consumers are empowered to pursue the opportunities that are right for them. And in the background, our models are constantly checking for signs of fraud, so that consumers and clients feel protected. Fraud prevention and identity management are built upon a foundation of trust, innovation and keeping the consumer at the heart of every decision. This is where I’m proud to say that Experian stands apart. We realize that criminals will continue to look for new ways to commit fraud, and we are continually striving to stay one step ahead of them. Through our unparalleled scale of data, partnerships and commitment to innovation, we will help businesses become more confident in their ability to recognize good people and transactions, provide great experiences, and protect against fraud.

Every morning, I wake up and walk bleary eyed to the bathroom, pop in my contacts and start my usual routine. Did I always have contacts? No. But putting on my contacts and seeing clearly has become part of my routine. After getting used to contacts, wearing glasses pales in comparison. This is how I view alternative credit data in lending. Are you having qualms about using this new data set? I get it, it’s like sticking a contact into your eye for the first time: painful and frustrating because you’re not sure what to do. To relieve you of the guesswork, we’ve compiled the top four myths related to this new data set to provide an in-depth view as to why this data is an essential supplement to your traditional credit file. Myth 1: Alternative credit data is not relevant. As consumers are shifting to new ways of gaining credit, it’s important for the industry to keep up. These data types are being captured by specialty credit bureaus. Gone are the days when alternative financing only included the payday store on the street corner. Alternative financing now expands to loans such as online installment, rent-to-own, point-of-sale financing, and auto-title loans. Consumers automatically default to the financing source familiar to them – which doesn’t necessarily mean traditional financial institutions. For example, some consumers may not walk into a bank branch anymore to get a loan, instead they may search online for the best rates, find a completely digital experience and get approved without ever leaving their couches. Alternative credit data gives you a lens into this activity. Myth 2: Borrowers with little to no traditional credit history are high risk. A common misconception of a thin-file borrower is that they may be high risk. According to the CFPB, roughly 45 million Americans have little to no credit history and this group may contain minority consumers or those from low income neighborhoods. However, they also may contain recent immigrants or young consumers who haven’t had exposure to traditional credit products. According to recent findings, one in five U.S. consumers has an alternative financial services data hit– some of these are even in the exceptional or very good credit segments. Myth 3: Alternative credit data is inaccurate and has poor data quality. On the contrary, this data set is collected, aggregated and verified in the same way as traditional credit data. Some sources of data, such as rental payments, are monthly and create a consistent look at a consumer’s financial behaviors. Experian’s Clarity Services, the leading source of alternative finance data, reports their consumer information, which includes application information and bank account data, as 99.9% accurate. Myth 4: Using alternative credit data might be harmful to the consumer. This data enables a more complete view of a consumer’s credit behavior for lenders, and provides consumers the opportunity to establish and maintain a credit profile. As with all information, consumers will be assessed appropriately based on what the data shows about their credit worthiness. Alternative credit data provides a better risk lens to the lender and consumers may get more access and approval for products that they want and deserve. In fact, a recent Experian survey found 71% of lenders believe alternative credit data will help consumers who would have previously been declined. Like putting in a new pair of contact lenses the first time, it may be uncomfortable to figure out the best use for alternative credit data in your daily rhythm. But once it’s added, it’s undeniable the difference it makes in your day-to-day decisions and suddenly you wonder how you’ve survived without it so long. See your consumers clearly today with alternative credit data. Learn More About Alternative Credit Data