Tag: auto

Experian Automotive Series | What Auto Marketers Are Prioritizing in the Second Half of 2025 As we close out our four-part series on what auto marketers are prioritizing in the second half of 2025, we’re shifting gears from strategy to execution. It’s time to explore how marketers are operationalizing data, seeking clarity, and building emotional connections that deepen relationships with customers. With the end of the year’s competitive automotive landscape, clarity and connection aren’t just buzzwords—they’re the cornerstones of growth and loyalty for 2026. Let’s start by exploring how clarity empowers today’s marketers to steer their strategies with control. Clarity: Putting marketers in the driver’s seat Data-guided auto marketers who leverage data insights have a clearer understanding of where consumers are on their car-buying journey. You can learn whether car buyers are gearing up for: A longer commute and want an electric vehicle (or a hybrid vehicle).1 Expanding their family and want a top-tier safety rating with cargo space. Factoring in market trends and wanting to be more economical.2 Creating a new and loyal customer base requires dealers, marketers, and OEMs to focus on clarity and connection. This will be more relevant than ever in the final days of 2025. Gone are the days when dealers and agencies used platforms and tools they did not understand. More businesses are simplifying their services and products by offering guides, Artificial Intelligence (AI) tools, tutorials, consultants, and webinars. At Experian Automotive, we're here to do just that, bringing clarity to our auto solutions, such as the Experian Marketing Engine (EME). While the EME tool has robust and dynamic data, two of our most widely used features — AutoAudiences and AutoInsights — stand out for their impact. Let’s break them down in the simplest way: AutoInsights helps marketers define where, what, and how. AutoAudiences helps reach who to target and when they might be in the market. For further clarification, savvy marketers leverage AutoInsights to strategize and understand their market, then activate AutoAudiences to curate marketing opportunities. With these tools empowering clarity, it’s equally important to focus on building genuine connections with car shoppers. Connection: Personalized experiences that drive sales Building a strong connection starts by truly understanding what consumers need and where they are on their car-buying journey. It’s important to know how consumers plan to use their vehicle and how they have serviced their cars in the past (or how they plan to service them in the future). By focusing on these details, marketers and dealerships can create more meaningful relationships and deliver helpful, relevant experiences that customers value. On the journey to better connections, consider your customers’ communication preferences, 2026 plans, and affordability.3 “Human connection...separates good stores from great ones,” notes Dealer Principal, Matt Birckhead at Sir Walter Chevrolet4 , while General Manager, Michael Wood at Jaguar Land Rover Virginia Beach collaborates with his Digital Director, Ryan Montville, to generate vehicle specs and feature descriptions that connect emotionally with target buyers 5 Key Takeaway: Automotive marketers who leverage data-informed clarity and authentic customer connection are best positioned to drive growth and loyalty in the final days of 2025 into 2026. By using innovative tools like Experian Marketing Engine, focusing on consumer needs, and personalizing every interaction, dealerships, agencies, and OEMs can optimize campaigns and foster lasting relationships. Mastering clarity with data and building emotional connections are the keys to success in automotive marketing today. Ready for clarity and connection with Experian data? Lead the way in creating customer-first experiences that fuel long-term growth. Connect with Experian Automotive and start driving measurable impact. Learn More https://www.coxautoinc.com/insights-hub/q3-2025-ev-sales-report-commentary/ https://www.experian.com/automotive/auto-credit-webinar-form https://news.dealershipguy.com/p/inside-q4-s-new-vehicle-trends-and-how-dealers-are-adjusting-2025-10-28 https://news.dealershipguy.com/p/one-price-vs-negotiation-what-four-operators-say-really-builds-trust-and-gross-2025-10-16 https://news.dealershipguy.com/p/5-powerful-chatgpt-hacks-car-dealers-are-using-to-supercharge-their-business-insights-2025-09-19

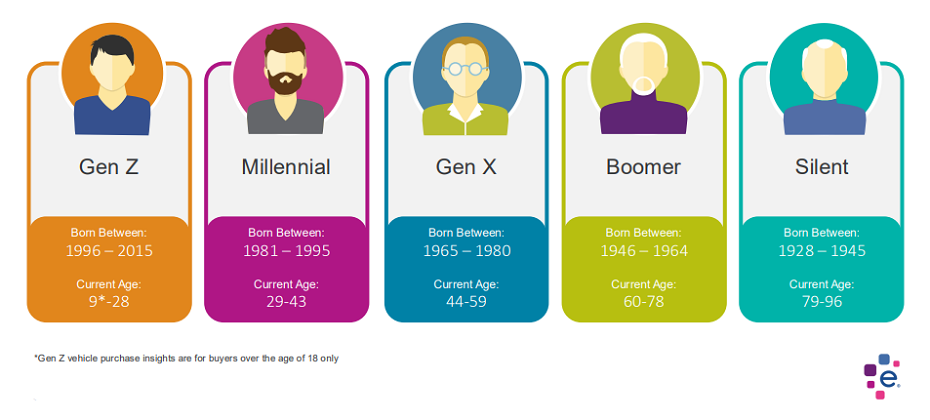

Quick Answer: New research on generational buying habits can help the auto industry better understand target audiences and improve marketing. The automotive industry is undergoing a rapid transformation, driven by technological advancements, changing consumer preferences, and a diverse marketplace. To navigate this complex landscape, understanding your target audience is key. This is where generational insights are indispensable. Why Generations Matter Each generation brings unique values, preferences, and buying behaviors to the table. Ignoring these differences can lead to ineffective marketing campaigns and missed opportunities. Different Needs and Priorities: Baby Boomers, Gen X, Millennials, and Gen Z have distinct needs and priorities when it comes to vehicles. For example, Baby Boomers may purchase more luxury vehicles, while Gen Z purchases a higher percentage of non-luxury vehicles. Communication Styles: Each generation responds differently to marketing messages. Traditional advertising might resonate with Baby Boomers, while social media and influencer marketing could be more effective for younger generations. Purchasing Behavior: The way people research and purchase cars has evolved significantly across generations. Understanding these differences can help you optimize your sales process. Leveraging Generational Insights To effectively leverage generational insights, consider the following: Conduct In-Depth Research: Gain a deep understanding of each generation's values, preferences, and buying habits. Use data analytics, surveys, and focus groups to gather insights. Create Targeted Messaging: Develop tailored messaging that resonates with each generation. Highlight the features and benefits that matter most to them. Choose the Right Channels: Select the most effective marketing channels for each generation. For example, television advertising might be less effective for Gen Z compared to social media. Personalize the Customer Experience: Offer personalized experiences that cater to the specific needs and preferences of each generation. Embrace Technology: Utilize technology to reach and engage different generations. For example, virtual showrooms or augmented reality experiences can appeal to younger consumers. Special Report: Generational Insights We've conducted in-depth research on generational buying habits for new and used vehicles. These insights can revolutionize your automotive marketing and sales strategies. Gain a competitive edge with our Automotive Consumer Trends Special Report: Generation Insights. Discover how to tailor your approach for maximum impact. Conclusion In today's competitive automotive market, understanding your target audience is essential for success. By incorporating generational insights into your marketing strategy, you can create more effective campaigns, build stronger customer relationships, and drive sales growth. Remember, a one-size-fits-all approach is unlikely to work. Embrace the diversity of your audience and tailor your message accordingly. Experian Automotive is here to help you with your marketing needs. If you’d like to learn more about our solutions and how we can support you, contact us below.

Quick Answer: Dealerships can avoid purchasing flood-damaged vehicles with Experian AutoCheck's Free Flood Risk Check. The used car market is tough right now. Unfortunately, recent floods in several areas have added another challenge: flood-damaged vehicles. These cars pose a big risk to dealerships. Buying one can lead to expensive repairs, unhappy customers, and damage to your reputation. Experian AutoCheck's Free Flood Risk Check can help. We've updated it with data from recent floods to give you a head start. Here's what the Free Flood Risk Check does: Quickly checks any car's flood risk with just the 17-digit VIN. Provides you with two levels of reporting: See if the car was registered in a region hit by a major FEMA disaster. Find potential flood damage based on Experian data (flood titles, auction records, etc.). Important things to remember: A "Yes" in the first report doesn't confirm flood damage, just that the car was in a flood zone. Even a clean second report isn't a guarantee - some flood damage goes unreported. For extra protection: Run a full Experian AutoCheck Vehicle History Report to uncover other issues like accidents or recalls. Have a mechanic thoroughly inspect any car before you buy it. By using Experian AutoCheck's Free Flood Risk Check and following these tips, you can dramatically reduce the risk of buying a flood-damaged car and protect your dealership. Ready to safeguard your dealership? Not an Experian AutoCheck subscriber?

It's 2024, and it has never been easier to buy a car in person or online, but automobiles are not quite as affordable as prior to the pandemic. While everyone is looking for the best car deal, some folks are pushing it too far and are falling for auto scams. What is auto lending fraud? Fraud perpetrators are drawn to sectors they perceive as highly lucrative. The accessibility of online vehicle financing and purchasing, coupled with the substantial financial magnitude associated with automotive transactions, renders the auto industry an optimal avenue for cash-out endeavors. Auto lending fraud refers to deceptive or fraudulent activities related to obtaining or processing auto finance. This can involve various schemes aimed at misleading lenders, financial institutions, or individuals involved in the lending process. Criminal networks now operate on social media sites like Facebook and Telegram, offering a unique car buying service using synthetic identities. They create synthetic identities, finance cars with no down payment, and deliver vehicles to addresses chosen by buyers. The process involves selecting a car online, sending a small amount of dollars and a photo against a white background, and receiving a fake driver's license. Those networks claim to exploit car sites' policies successfully. While appealing to those in urgent need of a car, the service poses significant risks as the synthetic identity may be used for other fraudulent activities beyond car purchase. Who is at risk? Everyone involved in the car buying process is at risk of falling victim to auto loan fraud. Car buyers looking to secure financing, as well as lenders, need to be aware of the potential red flags and take necessary precautions to safeguard their interests. Thieves leverage the internet and electronic transactions to perpetrate auto loan fraud. While the growth of online commerce has improved many aspects of trade, it has also made personally identifiable information and financial details vulnerable to data breaches. Unscrupulous individuals can gain unauthorized access to such information, providing the foundation for various identity theft schemes. The internet also facilitates the creation of seemingly legitimate documents that support auto loan fraud. Online services exist to help fraudsters fabricate income statements and fake employment verification from fictitious companies. This trend has made auto loan fraud an increasingly popular method for acquiring vehicles with minimal cash and risk. Another auto loan fraud trend is the increased use of CPN (Credit Privacy Number). Credit Repair firms introduced a novel strategy targeting consumers — the CPN (Credit Privacy Number). Marketed as a nine-digit alternative to a Social Security Number (SSN), CPNs are purportedly usable for obtaining credit. However, it is crucial to note that utilizing a CPN for credit applications constitutes a criminal offense, potentially leading to legal consequences, and car dealerships should not accept them. Detecting auto loan fraud There are several types of auto loan fraud worth noting to better understand the landscape: Income fabrication: Prospective buyers may falsify their income details to qualify for a larger loan or better terms. Lenders should verify income using documents like pay stubs, tax returns, or bank statements and watch out for inconsistencies. Employment misrepresentation: Applicants could lie about their job titles or employment status. Lenders should verify employment details through HR departments or by directly contacting the employer. Trade-in vehicle deception: Some individuals may overstate the value of their trade-in vehicle to secure a higher loan amount. Lenders should perform thorough appraisals or consult trusted sources to ascertain the accurate value of the trade-in. Identity fraud: Fraudsters can assume someone else's identity, commit first party fraud or create a fictitious persona to obtain an auto loan. Lenders must verify the applicant's identity using reliable identification documents and consider using identity verification tools. Forged documentation: Fraudsters may forge or alter documents like income statements, bank statements, or driver's licenses. Lenders should scrutinize documents carefully for discrepancies or signs of tampering. Straw borrower fraud: In this scenario, someone with poor credit convinces a friend or relative with better credit to front the deal, posing as the buyer. A better credit score allows for better terms or a more valuable vehicle. The actual buyer may continue to make payments to the friend, or the loan may become delinquent, negatively affecting the friend's credit score. In extreme cases, the straw buyer is part of a fraud ring, and the vehicle has already been sold in a foreign market. Synthetic identity fraud: Data breaches providing personally identifying information enable identity theft schemes. Perpetrators use illicitly acquired information to create false borrower profiles that appear authentic. These profiles typically have excellent credit, a social security number, an affluent home address, stable employment, and other attributes that make them seem like desirable borrowers. However, a detailed investigation reveals subtle inconsistencies indicative of high risk. How to prevent auto loan fraud To combat auto loan fraud and protect profitability, auto lenders can leverage technological advancements. By applying analytics and machine learning to millions of loan applications and histories, you can identify fraudulent patterns and inconsistencies. Machine learning can determine the type of suspected fraud and provide a confidence factor to guide further investigation and verification. Additionally, you should: Conduct thorough background checks on prospective buyers and verify their personal information and documents. and verify their personal information and documents. Implement a comprehensive loan underwriting process that includes income verification, employment verification, and collateral evaluation. Educate employees about common fraud schemes, warning signs, and best practices to ensure they remain vigilant during loan applications. Foster a culture of cooperation with local law enforcement agencies, sharing information about suspected fraudsters to help prevent future incidents. It is important for individuals and businesses to be vigilant and report any suspicious activity. Car dealerships and financial institutions work to prevent fraud through proper identification verification, credit checks, and adherence to legal and ethical standards. If you suspect fraudulent activity or identity theft, it is crucial to report it to the appropriate authorities immediately. Gearing-up Taking advantage of the latest fintech capabilities, such as cloud-based loan origination that integrates analytics, machine learning, and automated verification services, can significantly reduce the likelihood of fraudulent applications becoming another auto lending fraud statistic. By combining the best data with our automated ID verification checks, Experian helps you safeguard your business and onboard customers efficiently. Our best-in-class solutions employ device recognition, behavioral biometrics, machine learning, and global fraud databases to spot and block suspicious activity before it becomes a problem. Learn more about our automotive fraud prevention solutions *This article includes content created by an AI language model and is intended to provide general information.

The automotive industry is rapidly evolving and digital marketing is becoming increasingly important. To stay ahead of the competition, it’s essential to understand the top digital audiences in the automotive industry. To help you with this, we recently analyzed audience activation activity and compiled the Auto 2024 Digital Audience Report. The report highlights the top four digital audience categories for the automotive industry: Automotive Lifestyle and Interests Retail Shoppers Purchase Based Demographics For each of the top four categories, the report provides specific audience examples automotive marketers can leverage for specific marketing campaigns. Examples include likely frequent spenders at auto service and repair shops or consumers who are likely to be in the market to buy an Alternate Fuel Electric vehicle in the next 180 days. To learn more about where Experian is seeing the top third-party audience activation, read the Auto 2024 Digital Audience Report.

The AutoCheck FREE Flood Risk Check site has been updated with data from Kentucky, Colorado, Texas, and Missouri floods New cars continue to be in short supply due to the microchip shortage, so consumers quickly turned their attention to used cars. Unfortunately, dealers continue to struggle with obtaining enough used car inventory to meet demand. To add to an already challenging time, Mother Nature has brought record flooding in multiple areas of the United States. It’s more important than ever that dealers be careful about obtaining pre-owned cars that could potentially have flood damage. The best way to mitigate the risk of purchasing a flood damaged vehicle is to start by running an AutoCheck Free Flood Risk Check. Visitors simply enter any vehicle's 17-digit VIN and the tool will check for flood brands and provide information if the vehicle was registered in a region impacted by a FEMA disaster declaration. Two levels of reporting available The first level of reporting determines whether the vehicle has been titled/registered 12 months prior in a county that has been identified as requiring public and individual assistance (FEMA categories A and B) for a FEMA-declared major disaster. This would yield a “Yes” result. For instance, you would get a “Yes” result if the vehicle was registered in an impacted area during the time of a FEMA-declared major Hurricane disaster. The “Yes” result should not be interpreted as confirmation of flood damage or even possible flood damage. The data is provided merely as information regarding the location of the vehicle’s registration/title history so users can be aware of risk exposure. For example, the Hurricane Ida region had thousands of damaged cars, but some cars in the region may not have been damaged by the hurricane — the owner could have driven the car when they evacuated, or a child or other family member may have been out of town with the car when the hurricane hit. The second level of reporting is based on search results from Experian data such as flood title and problem records, including flood State title brands, auction flood announcements, salvage auction flood designations, and other vehicle records determined by Experian to relate to or suggest an increased likelihood of flood damage or risk exposure. It takes time for claims and updates to vehicle title information to appear on a vehicle’s history and although the DMV requires that title brands be issued for vehicles damaged by floods, not every vehicle flood event is reported by car owners. Unreported flood events may not appear on an AutoCheck Flood Risk Check or AutoCheck Vehicle History Report. Although Experian provides flood related records from available data sources, we cannot provide assurance that an AutoCheck Flood Risk Check that does not produce any records means that the subject vehicle has not experienced flood damage. That’s why it’s important to review a full AutoCheck Vehicle History Report, which—in addition to potential flood damage—includes reported accidents, branded titles, recalls, number of owners and more. Once you run the full Vehicle History Report we recommend an independent evaluation and inspection of the vehicle to determine and confirm a vehicle’s condition prior to purchase. Try the AutoCheck Flood Risk Check today to help mitigate the risk of purchasing flood damaged vehicles. Not an AutoCheck subscriber? Contact us to become an AutoCheck client.

Leasing has long been a popular choice among consumers who want to enjoy the latest vehicle models, but at a lower monthly payment. In fact, the average monthly lease payment was $127 less than a loan payment in Q2 2022. However, in recent quarters, we’ve seen leasing availability decline due to current market conditions. According to Experian’s State of the Automotive Finance Market Report: Q2 2022, leasing declined from 27.82% to 19.65% year-over-year, marking the lowest drop in quite some time. When analyzing previous data, leasing comprised 30.41% of all new vehicles in Q2 2018, decreasing to 30.04% in Q2 2019 and 26.58% in Q2 2020. There are likely a number of factors contributing to the decline of leasing over recent years, including the ongoing inventory shortages and OEMs not offering as many incentives, which may result in leasing opportunities becoming less common. Other scenarios can be consumers choosing to extend their lease, or purchase the vehicle once their lease has expired. In Q2 2022, the average monthly lease payment increased to $540, from $475 in Q2 2021. Though, the average monthly loan payment for a new vehicle surpassed $600 this quarter—coming in at $667, an $85 year-over-year increase. As automotive professionals continue to navigate through the inventory shortages and subsequent vehicle price increases, understanding the landscape and what options are available for consumers will be critical. One way to keep on top of the trends is analyzing the pricing options for the most popular leased models, which will enable more informed decisions in the months to come. Average monthly payment for top leased models As previously mentioned, there was an average payment difference of $127 between a lease and a loan in Q2 2022. However, that’s just an average, and these numbers can vary based on the vehicle type. For example, the average monthly lease payment for a Honda Civic was $363 in Q2 2022, as opposed to the average monthly loan payment of $476. In comparison, the average monthly lease payment for a Ford F-150 came in at $516 this quarter, compared to the average monthly loan payment of $832. While a pickup truck may typically have a higher average monthly lease payment than a sedan, consumers are continuing to choose larger vehicles, overall. In Q2 2022, there was only one sedan that made up the top leased vehicles—with the Ford F-150 having the highest leasing registration volume, comprising 2.3% this quarter. Rounding out the top five were Chevrolet Equinox (2.27%), Honda CR-V (2.16%), Honda Civic (2.09%), and Ram 1500 (1.81%). Despite the overall decline in leasing over the past year, it continues to be a financing option that consumers can consider amid vehicle prices increasing. Knowing what vehicles are most prevalent as well as their price points will allow professionals to create strategies that cater to the most current consumer financing preferences during their search for a vehicle that fits their needs. To learn more about leasing and other automotive finance trends, watch the entire State of the Automotive Finance Market: Q2 2022 presentation on demand.

Consumers are shifting to used vehicles over new, with a higher percentage of consumers financing used. The move comes as the industry continues to grapple with inventory shortages, driving vehicle values higher.

According to Experian’s Automotive Market Trends Report: Q1 2022, new vehicle registrations were down 19% from the prior year—declining to 3.4 million. Used registrations went from 11.4 million to 9.9 million year-over-year, decreasing 13.2%.

Whether a consumer has a brand-new or used vehicle, it’s inevitably going to need regular maintenance and require repairs. Fortunately for aftermarket professionals, the aftermarket “sweet spot” is continuously growing—a trend that should be watched closely. Vehicles in the sweet spot are typically between six- to 12-model-years-old and have aged out of general OEM manufacturer warranties for any repairs. Knowing the model year and type of vehicles that are in operation will be important for aftermarket professionals to determine what parts may be needed, and anticipate potential consumer needs. According to Experian’s Automotive Market Trends Report: Q1 2022, 35.8% of vehicles in operation (VIO) now fall within the aftermarket sweet spot, a 6.5% year-over-year increase. It is important to note that the aftermarket sweet spot max volume record of 104 million is expected to be broken over the next 12-18 months, considering the sweet spot volume was 100.3 million through Q1 2022 and the last time it exceeded that number was nine years ago. The increase will create more opportunities for aftermarket professionals as more vehicles will potentially need maintenance. Aftermarket “sweet spot” will continue to grow Right now, the aftermarket sweet spot consists of model years between 2011 and 2017. There were 10.5 million 2011 model year vehicles on the road through Q1 2022, this low volume will transition into the post-sweet spot next year. At the same time, there will be 16.5 million 2018 model year vehicles entering the sweet spot. Furthermore, an estimated 16.7 million vehicles in operation with a 2019 model year and almost 14.3 million vehicles in operation with a 2020 model year will be transitioning into the sweet spot in the next two years. When these model year vehicles enter the sweet spot, the current 12 million vehicles with a 2012 model year and an estimated 13.7 million 2013 model year vehicles will transition into the post-sweet spot, resulting in a notable increase. Watching this data closely will allow aftermarket professionals to continue assisting with maintenance and repairs for these vehicles that are currently on the road, as well as prepare for what’s to come to the aftermarket industry in approaching years. To learn more about other vehicle registration trends, watch the full Automotive Market Trends Report: Q1 2022 presentation on demand.

According to Experian's State of the Automotive Finance Market Report: Q1 2022, SUVs and CUVs made up 60.38% of total vehicle financing, an increase from 58.95% in Q1 2021.

According to Experian’s State of the Automotive Finance Market Report: Q1 2022, credit unions had their highest total share in five years

The State of the Automotive Finance Market: Q4 2021 report broke down alternative fuel financing trends—specifically how electric vehicle (EV) financing doubled year-over-year.

While many view Millennials and Gen Z through the same lens, savvy automotive marketers are adjusting their strategies to capture the market of this generation.

We conducted a study of thousands of online listings to better understand what details are crucial for VDPs, which Kirsten Von Busch will be debuting the results of at the NADA Show in March.