Tag: automotive

We’re excited to share that Experian Automotive’s client Hamlin & Associates and Honda World have been named winners of the 2025 Automotive News / Ad Age Global Automotive Marketing Award for Best Use of Data — an honor that celebrates meaningful, measurable impact. Why this work stood out Hamlin & Associates' client, Honda World of Louisville, KY, faced a clear challenge: re-engage customers and recover declining service revenue, particularly for vehicles with open recalls. Hamlin & Associates approached the problem with a simple belief: clean, accurate data leads to better outcomes for customers and dealerships alike. They began with data hygiene, then enriched each vehicle record using Experian Automotive’s Recall VIN Verification solution. This created a precise view of who owned which vehicles, which recalls were still open, and when repairs could be completed — all essential to a smooth customer experience. A smarter, more human outreach strategy Over the course of a year, Hamlin delivered four waves of direct mail designed to cut through the noise. Each letter: Spoke directly to the customer Highlighted their specific vehicle Explained the recall in clear language Showed how easy it was to book a free repair The result was a data-driven communication plan grounded in trust and simplicity — and it worked Results that show what’s possible 26% response rate 1,953 repair orders $811,834 in service revenue Thousands of customers are now driving safer vehicles These outcomes reflect more than campaign performance. They demonstrate what happens when dealers, agencies, and data partners collaborate to guide individuals toward safer, more informed decisions. In their words John Hamlin, Hamlin & Associates:“Clean data builds trust. When we combine our hygiene process with Experian Automotive insights, dealers uncover opportunities they never knew they had.” Mike Porro, Honda World:“They keep it simple, and data-driven ‘simple’ gets done. We follow the process, train our staff, and see the results.” Looking ahead We’re proud to celebrate Hamlin & Associates and Honda World for showing what’s achievable when data, insight, and clear communication come together. Their work helps people stay safe, strengthens customer relationships, and sets a new standard for recall outreach. Congratulations to the entire team — and here’s to helping even more drivers move forward Learn more about how to enrich your first-party data with Recall VIN Verification insights!

Experian Automotive Series | What Auto Marketers Are Prioritizing in the Second Half of 2025 As we close out our four-part series on what auto marketers are prioritizing in the second half of 2025, we’re shifting gears from strategy to execution. It’s time to explore how marketers are operationalizing data, seeking clarity, and building emotional connections that deepen relationships with customers. With the end of the year’s competitive automotive landscape, clarity and connection aren’t just buzzwords—they’re the cornerstones of growth and loyalty for 2026. Let’s start by exploring how clarity empowers today’s marketers to steer their strategies with control. Clarity: Putting marketers in the driver’s seat Data-guided auto marketers who leverage data insights have a clearer understanding of where consumers are on their car-buying journey. You can learn whether car buyers are gearing up for: A longer commute and want an electric vehicle (or a hybrid vehicle).1 Expanding their family and want a top-tier safety rating with cargo space. Factoring in market trends and wanting to be more economical.2 Creating a new and loyal customer base requires dealers, marketers, and OEMs to focus on clarity and connection. This will be more relevant than ever in the final days of 2025. Gone are the days when dealers and agencies used platforms and tools they did not understand. More businesses are simplifying their services and products by offering guides, Artificial Intelligence (AI) tools, tutorials, consultants, and webinars. At Experian Automotive, we're here to do just that, bringing clarity to our auto solutions, such as the Experian Marketing Engine (EME). While the EME tool has robust and dynamic data, two of our most widely used features — AutoAudiences and AutoInsights — stand out for their impact. Let’s break them down in the simplest way: AutoInsights helps marketers define where, what, and how. AutoAudiences helps reach who to target and when they might be in the market. For further clarification, savvy marketers leverage AutoInsights to strategize and understand their market, then activate AutoAudiences to curate marketing opportunities. With these tools empowering clarity, it’s equally important to focus on building genuine connections with car shoppers. Connection: Personalized experiences that drive sales Building a strong connection starts by truly understanding what consumers need and where they are on their car-buying journey. It’s important to know how consumers plan to use their vehicle and how they have serviced their cars in the past (or how they plan to service them in the future). By focusing on these details, marketers and dealerships can create more meaningful relationships and deliver helpful, relevant experiences that customers value. On the journey to better connections, consider your customers’ communication preferences, 2026 plans, and affordability.3 “Human connection...separates good stores from great ones,” notes Dealer Principal, Matt Birckhead at Sir Walter Chevrolet4 , while General Manager, Michael Wood at Jaguar Land Rover Virginia Beach collaborates with his Digital Director, Ryan Montville, to generate vehicle specs and feature descriptions that connect emotionally with target buyers 5 Key Takeaway: Automotive marketers who leverage data-informed clarity and authentic customer connection are best positioned to drive growth and loyalty in the final days of 2025 into 2026. By using innovative tools like Experian Marketing Engine, focusing on consumer needs, and personalizing every interaction, dealerships, agencies, and OEMs can optimize campaigns and foster lasting relationships. Mastering clarity with data and building emotional connections are the keys to success in automotive marketing today. Ready for clarity and connection with Experian data? Lead the way in creating customer-first experiences that fuel long-term growth. Connect with Experian Automotive and start driving measurable impact. Learn More https://www.coxautoinc.com/insights-hub/q3-2025-ev-sales-report-commentary/ https://www.experian.com/automotive/auto-credit-webinar-form https://news.dealershipguy.com/p/inside-q4-s-new-vehicle-trends-and-how-dealers-are-adjusting-2025-10-28 https://news.dealershipguy.com/p/one-price-vs-negotiation-what-four-operators-say-really-builds-trust-and-gross-2025-10-16 https://news.dealershipguy.com/p/5-powerful-chatgpt-hacks-car-dealers-are-using-to-supercharge-their-business-insights-2025-09-19

Electric vehicle (EV) registrations are re-gaining momentum as a wave of more affordable models hit the market, pushing more consumers than ever to make the transition. According to Experian’s State of the Automotive Finance Market Report: Q3 2024, EVs made up 10.1% of new vehicle financing this quarter, increasing more than 30% from last year. Furthermore, 45% of EV consumers leased their vehicle in Q3 2024—resulting in EVs accounting for 17.3% of all new vehicle leasing. Of the top five transacted EV models this quarter, Tesla accounted for three—with the Tesla Model Y leading at 31.8%, followed by the Tesla Model 3 (14.3%) and Tesla Cybertruck (4.9%). Rounding out the top five were the Ford Mustang Mach-E (3.9%) and Hyundai IONIQ 5 (3.7%). Interestingly, data in the third quarter of 2024 found that consumers’ financing decisions vary based on the EV model they’re looking at. For example, 76.5% of consumers purchased the Tesla Model Y with a loan and 13.1% opted for a lease; on the other hand, only 8.5% of consumers bought the Hyundai IONIQ 5 with a loan and 78.7% chose to lease. Despite the rising interest in leasing as more incentives and rebate programs roll out, some consumers still prefer to purchase their EV with a loan. Understanding financing patterns based on different models is key for professionals as they cater to the diverse preferences and determine the long-term viability of certain EVs and their potential for leasing renewals. Snapshot of the overall vehicle finance market As the finance market continues to stabilize, it’s notable that the average interest rate for a new vehicle fell year-over-year, going from 7.1% to 6.6%, respectively. However, average new vehicle loan amounts increased $736 from last year, reaching $41,068 in Q3 2024, and average monthly payments went from $732 to $737 in the same time frame. On the used side, average interest rates saw a slight uptick to 11.7% in Q3 2024, from 11.6% last year. Meanwhile, the average loan amount dropped from $1,195 over the last year to $26,091 this quarter and the average monthly payment declined from $538 to $520 year-over-year. With the overall market shifting and EVs re-sparking interest, automotive professionals should leverage how consumers are purchasing their vehicles based on average payments and the fuel type as more incentives are being offered. Monitoring these insights can unlock opportunities for tailored financing solutions that meet the needs of consumers as preferences continue to evolve. To learn more about automotive finance trends, view the full State of the Automotive Finance Market: Q3 2024 presentation on demand.

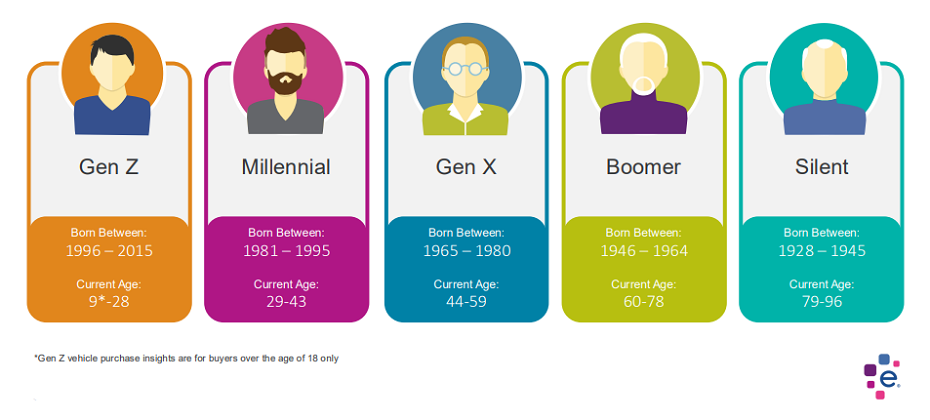

Quick Answer: New research on generational buying habits can help the auto industry better understand target audiences and improve marketing. The automotive industry is undergoing a rapid transformation, driven by technological advancements, changing consumer preferences, and a diverse marketplace. To navigate this complex landscape, understanding your target audience is key. This is where generational insights are indispensable. Why Generations Matter Each generation brings unique values, preferences, and buying behaviors to the table. Ignoring these differences can lead to ineffective marketing campaigns and missed opportunities. Different Needs and Priorities: Baby Boomers, Gen X, Millennials, and Gen Z have distinct needs and priorities when it comes to vehicles. For example, Baby Boomers may purchase more luxury vehicles, while Gen Z purchases a higher percentage of non-luxury vehicles. Communication Styles: Each generation responds differently to marketing messages. Traditional advertising might resonate with Baby Boomers, while social media and influencer marketing could be more effective for younger generations. Purchasing Behavior: The way people research and purchase cars has evolved significantly across generations. Understanding these differences can help you optimize your sales process. Leveraging Generational Insights To effectively leverage generational insights, consider the following: Conduct In-Depth Research: Gain a deep understanding of each generation's values, preferences, and buying habits. Use data analytics, surveys, and focus groups to gather insights. Create Targeted Messaging: Develop tailored messaging that resonates with each generation. Highlight the features and benefits that matter most to them. Choose the Right Channels: Select the most effective marketing channels for each generation. For example, television advertising might be less effective for Gen Z compared to social media. Personalize the Customer Experience: Offer personalized experiences that cater to the specific needs and preferences of each generation. Embrace Technology: Utilize technology to reach and engage different generations. For example, virtual showrooms or augmented reality experiences can appeal to younger consumers. Special Report: Generational Insights We've conducted in-depth research on generational buying habits for new and used vehicles. These insights can revolutionize your automotive marketing and sales strategies. Gain a competitive edge with our Automotive Consumer Trends Special Report: Generation Insights. Discover how to tailor your approach for maximum impact. Conclusion In today's competitive automotive market, understanding your target audience is essential for success. By incorporating generational insights into your marketing strategy, you can create more effective campaigns, build stronger customer relationships, and drive sales growth. Remember, a one-size-fits-all approach is unlikely to work. Embrace the diversity of your audience and tailor your message accordingly. Experian Automotive is here to help you with your marketing needs. If you’d like to learn more about our solutions and how we can support you, contact us below.

For auto dealerships, the roar of engines and the clink of deals used to be the only sounds associated with financial risk. But in today's world, a silent threat lurks in every showroom: identity fraud. This insidious crime is costing dealerships millions, leaving a trail of financial and reputational wreckage in its wake. The Numbers Don't Lie: Reports of the impact of identity fraud on auto dealerships are becoming more common as the industry leans more heavily on digital retailing. According to the Federal Trade Commission, nearly 80,000 cars were stolen in 2023 via fraud. Who's Behind the Wheel? The perpetrators of fraud come in all shapes and sizes. While classic ID theft with stolen documents still exists, the real menace lies in synthetic identities: Frankenstein accounts cobbled together from stolen data and fake documents. These sophisticated creations can fool even the most vigilant dealership, resulting in high-value car loans taken out on non-existent people. The Ripple Effect: The consequences of identity fraud extend far beyond lost cars. Dealerships face: Financial losses: Wrecked credit and repossessions add up quickly. Operational headaches: Investigations and legal proceedings are time-consuming and costly. Reputational damage: News of fraud breaches trust and scares away potential customers. So, What Can Dealerships Do? Arming themselves with the right tools and practices is crucial. Here are some key steps: Invest in identity verification technology: Advanced document scanning, and facial recognition can crack down on fake licenses. Experian's Fraud ProtectTM leverages cutting-edge technology to compare licenses to selfies to confirm consumers are who they say they are AND their license is valid. Train staff on fraud detection: Fraud Protect takes the challenge out of identifying fraud in a very simple way. There is no hardware or extensive training. It is as simple as sharing a URL and reading the results in your CRM. Implement stringent verification procedures: Fraud Protect allows dealers to implement fraud identification measures in a frictionless manner. As simple as one-time passcodes, selfies, and taking pictures, the consumer experience is very smooth. For automotive dealers, the results are returned to their CRM within a few moments including all the information they need for proper decisioning. Fighting Back, One Mile at a Time: Identity fraud is a growing problem, but auto dealerships are not powerless. By raising awareness, investing in security, and embracing vigilance, dealers can protect themselves and drive this silent threat off the road. With Fraud Protect, dealers can verify documents and identity in a frictionless manner that does not interrupt the sales process. Learn more about auto fraud prevention solutions available or contact us to get started. *This article includes content created by an AI language model and is intended to provide general information.

The automotive industry is rapidly evolving and digital marketing is becoming increasingly important. To stay ahead of the competition, it’s essential to understand the top digital audiences in the automotive industry. To help you with this, we recently analyzed audience activation activity and compiled the Auto 2024 Digital Audience Report. The report highlights the top four digital audience categories for the automotive industry: Automotive Lifestyle and Interests Retail Shoppers Purchase Based Demographics For each of the top four categories, the report provides specific audience examples automotive marketers can leverage for specific marketing campaigns. Examples include likely frequent spenders at auto service and repair shops or consumers who are likely to be in the market to buy an Alternate Fuel Electric vehicle in the next 180 days. To learn more about where Experian is seeing the top third-party audience activation, read the Auto 2024 Digital Audience Report.

Vehicles with recalls are on the road. In fact, as of July 2023, there were over 15M vehicles on the road in the United States that have a recall that was reported for that vehicle between January and June 2023². Awareness of Open Recalls and the availability of remedies is important for our Automotive clients. As a result, we have added the National Highway Transportation Safety Administration (NHTSA) number and remedy availability flag to three of our Vehicle History Data Solutions: AutoCheck Vehicle History Report Dealers and consumers will be aware of open recalls and if there is a remedy available for the recall. This can alleviate consumer concern over an open recall if there is no remedy available facilitating consumer confidence in a vehicle purchase. AutoCheck Triggers Clients will be aware of any open recalls and the remedy viability in their vehicle portfolio. Many clients use AutoCheck Triggers to make business decisions regarding their vehicle portfolio. Auto AccuSelect Adding the NHTSA recall number and remedy availability flag to Auto AccuSelect allows clients to be aware and take action regarding the vehicles they are evaluating. It is critical to know open recall information, as well as the overall history of a vehicle before buying or selling a used car. Experian Automotive’s vehicle history data solutions, such as a the AutoCheck vehicle history report, can help you buy and sell vehicles with confidence. AutoCheck has 98.96% of manufacturer coverage for recall data based on vehicles in operation. If you’d like to learn more about a recent analysis Experian Automotive conducted about the number of recalls reported for the first half of 2023, where those events were reported and where those vehicles are currently in operation, click to view our Recall Insights Infographic.

In a recent episode of the Used Car Dealer Podcast, host Zach Klempf, sat down with Jim Maguire, Experian’s senior director of product marketing for automotive, to discuss the prevalence of fraud in the automotive industry. During their conversation, Jim highlighted the findings in Experian’s 2023 Identity and Fraud Report, giving listeners a deeper understanding into the evolving dynamics of fraud, with data and insights on the current landscape and what actionable strategies dealers can take to prevent it. The episode is now available across all major podcast platforms, click the link below to watch: YouTube For more information on the Used Car Dealer Podcast, visit - https://www.sellyautomotive.com/podcast Facebook - @SellyAutomotive Twitter - @SellyAutomotive LinkedIn - @SellyAutomotive

Experian’s State of the Automotive Finance Market Report: Q4 2022 found that the year-over-year (YOY) average new loan amount increased 4.04%, a smaller growth rate compared to 12.46% YOY in Q4 2021

According to Experian’s State of the Automotive Finance Market Report: Q2 2022, the average new vehicle interest loan rate for consumers with a credit score between 501 and 600, also referred to as subprime, was 9.75%—compared to prime consumers with a credit score between 661 and 780, who had an average new vehicle interest loan rate of 4.03% this quarter.

Leasing has long been a popular choice among consumers who want to enjoy the latest vehicle models, but at a lower monthly payment. In fact, the average monthly lease payment was $127 less than a loan payment in Q2 2022. However, in recent quarters, we’ve seen leasing availability decline due to current market conditions. According to Experian’s State of the Automotive Finance Market Report: Q2 2022, leasing declined from 27.82% to 19.65% year-over-year, marking the lowest drop in quite some time. When analyzing previous data, leasing comprised 30.41% of all new vehicles in Q2 2018, decreasing to 30.04% in Q2 2019 and 26.58% in Q2 2020. There are likely a number of factors contributing to the decline of leasing over recent years, including the ongoing inventory shortages and OEMs not offering as many incentives, which may result in leasing opportunities becoming less common. Other scenarios can be consumers choosing to extend their lease, or purchase the vehicle once their lease has expired. In Q2 2022, the average monthly lease payment increased to $540, from $475 in Q2 2021. Though, the average monthly loan payment for a new vehicle surpassed $600 this quarter—coming in at $667, an $85 year-over-year increase. As automotive professionals continue to navigate through the inventory shortages and subsequent vehicle price increases, understanding the landscape and what options are available for consumers will be critical. One way to keep on top of the trends is analyzing the pricing options for the most popular leased models, which will enable more informed decisions in the months to come. Average monthly payment for top leased models As previously mentioned, there was an average payment difference of $127 between a lease and a loan in Q2 2022. However, that’s just an average, and these numbers can vary based on the vehicle type. For example, the average monthly lease payment for a Honda Civic was $363 in Q2 2022, as opposed to the average monthly loan payment of $476. In comparison, the average monthly lease payment for a Ford F-150 came in at $516 this quarter, compared to the average monthly loan payment of $832. While a pickup truck may typically have a higher average monthly lease payment than a sedan, consumers are continuing to choose larger vehicles, overall. In Q2 2022, there was only one sedan that made up the top leased vehicles—with the Ford F-150 having the highest leasing registration volume, comprising 2.3% this quarter. Rounding out the top five were Chevrolet Equinox (2.27%), Honda CR-V (2.16%), Honda Civic (2.09%), and Ram 1500 (1.81%). Despite the overall decline in leasing over the past year, it continues to be a financing option that consumers can consider amid vehicle prices increasing. Knowing what vehicles are most prevalent as well as their price points will allow professionals to create strategies that cater to the most current consumer financing preferences during their search for a vehicle that fits their needs. To learn more about leasing and other automotive finance trends, watch the entire State of the Automotive Finance Market: Q2 2022 presentation on demand.

Consumers are shifting to used vehicles over new, with a higher percentage of consumers financing used. The move comes as the industry continues to grapple with inventory shortages, driving vehicle values higher.

According to Experian’s Automotive Market Trends Report: Q1 2022, new vehicle registrations were down 19% from the prior year—declining to 3.4 million. Used registrations went from 11.4 million to 9.9 million year-over-year, decreasing 13.2%.

Whether a consumer has a brand-new or used vehicle, it’s inevitably going to need regular maintenance and require repairs. Fortunately for aftermarket professionals, the aftermarket “sweet spot” is continuously growing—a trend that should be watched closely. Vehicles in the sweet spot are typically between six- to 12-model-years-old and have aged out of general OEM manufacturer warranties for any repairs. Knowing the model year and type of vehicles that are in operation will be important for aftermarket professionals to determine what parts may be needed, and anticipate potential consumer needs. According to Experian’s Automotive Market Trends Report: Q1 2022, 35.8% of vehicles in operation (VIO) now fall within the aftermarket sweet spot, a 6.5% year-over-year increase. It is important to note that the aftermarket sweet spot max volume record of 104 million is expected to be broken over the next 12-18 months, considering the sweet spot volume was 100.3 million through Q1 2022 and the last time it exceeded that number was nine years ago. The increase will create more opportunities for aftermarket professionals as more vehicles will potentially need maintenance. Aftermarket “sweet spot” will continue to grow Right now, the aftermarket sweet spot consists of model years between 2011 and 2017. There were 10.5 million 2011 model year vehicles on the road through Q1 2022, this low volume will transition into the post-sweet spot next year. At the same time, there will be 16.5 million 2018 model year vehicles entering the sweet spot. Furthermore, an estimated 16.7 million vehicles in operation with a 2019 model year and almost 14.3 million vehicles in operation with a 2020 model year will be transitioning into the sweet spot in the next two years. When these model year vehicles enter the sweet spot, the current 12 million vehicles with a 2012 model year and an estimated 13.7 million 2013 model year vehicles will transition into the post-sweet spot, resulting in a notable increase. Watching this data closely will allow aftermarket professionals to continue assisting with maintenance and repairs for these vehicles that are currently on the road, as well as prepare for what’s to come to the aftermarket industry in approaching years. To learn more about other vehicle registration trends, watch the full Automotive Market Trends Report: Q1 2022 presentation on demand.

According to Experian's State of the Automotive Finance Market Report: Q1 2022, SUVs and CUVs made up 60.38% of total vehicle financing, an increase from 58.95% in Q1 2021.