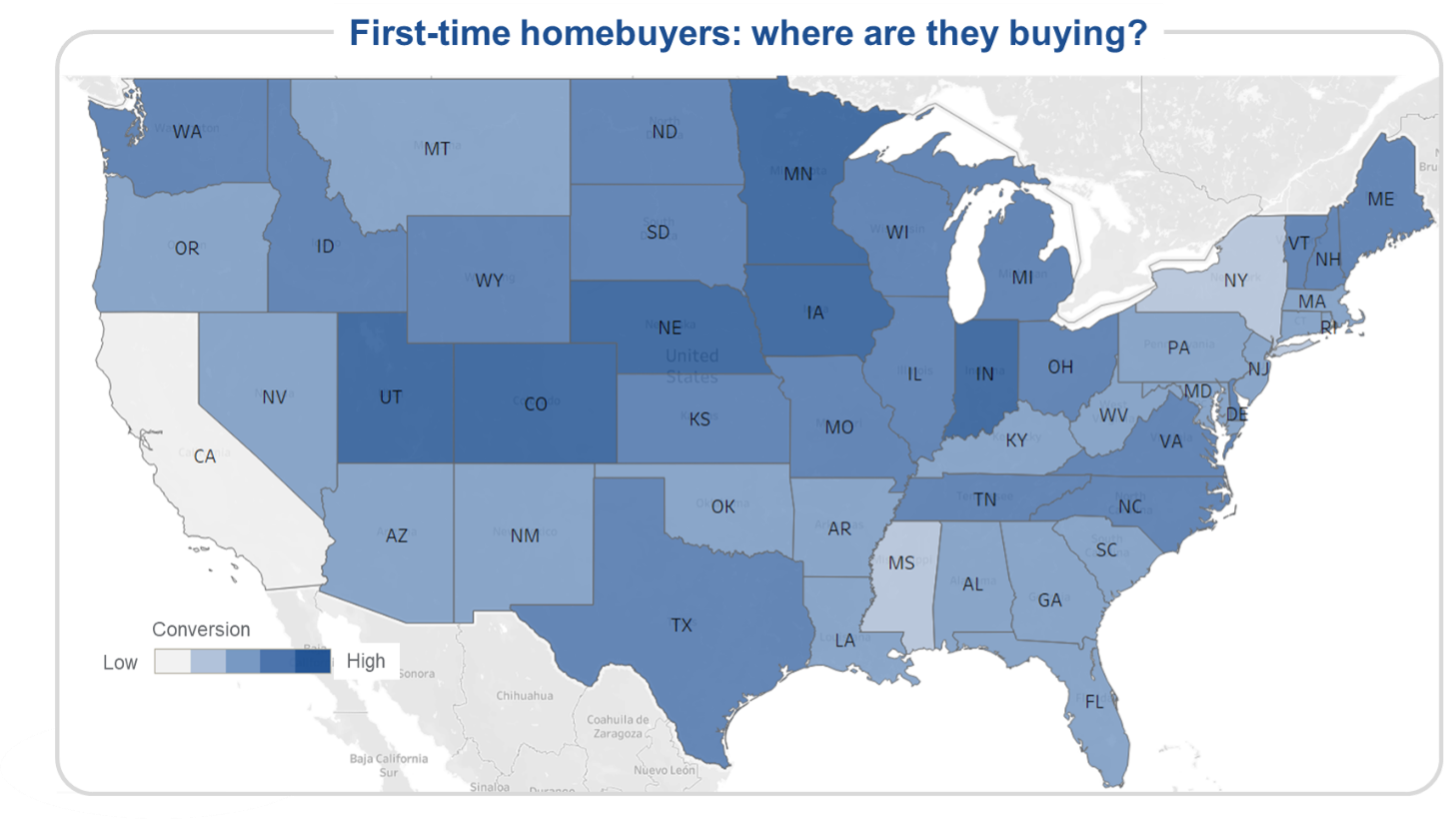

Where in the U.S. would you guess first-time homebuyers are having the most success securing a mortgage? The answer may surprise you.

While over one-third of first-time homebuyers reside in our most populous states, California, Texas, Florida, and New York, research from Experian Mortgage reveals they are having greater success securing a mortgage in more affordable locations, such as Minnesota, Iowa, and Indiana.

Understanding who is buying properties around the nation and what drives their decision provides insight into where they are buying and why. This knowledge paves the way for mortgage lenders to create more targeted and effective marketing strategies to gain trust and win loyal borrowers.

As discussed in a recent blog post on generational behaviors, Generation Z (Gen Z) and Generation Y (Gen Y) account for a sizeable majority of first-time homebuyers and nearly half of repeat buyers. Mortgage lenders who understand what motivates these young buyers and meet them where they are will be better positioned to win.

Why understanding buyer traits and their motivations matters

Nearly 70% of all renters are in their early 40s or younger. With rents up more than 30% since before the COVID-19 pandemic, many Americans yearn for the stability that homeownership brings to their financial well-being.

Younger buyers are increasingly focusing on their overall financial health. Experian’s survey of more than 2,000 millennial and Gen Z consumers across the United States revealed:

- ‘Better understanding personal finance’ is a goal for most consumers within both groups.

- Nearly 70% are actively searching for a trusted source for personal finance information.

Over 30% of first-time homebuyers have a household income under $90,000 annually. They want to make decisions that align with their financial goals and position themselves well for the future, which is likely why we are seeing a higher concentration of first-time homebuyers converting in lower cost of living areas, such as the mid-west.

Even for a mortgage lender outside of the geographically preferred states, those who understand their areas with minute specificity and know where opportunity and affordability meet will be best positioned for these buyers.

Why strategically positioned lenders will win the day

Affordability remains the operative word. The housing supply shortage heavily impacts affordability. A lack of new housing construction and limited existing home sale inventory contributed largely to the limited for sale stock.

Lower interest rates can influence the affordability outlook, but rising inflation and the Federal Reserve not yet moving to lower rates has resulted in mortgage interest rates creeping upward this year.1 Additionally, overall economic indicators influence the housing market. While the Federal Reserve does not directly dictate mortgage interest rates, mortgage rates are influenced by the actions they take. Federal Reserve Chairman Jerome Powell’s recent remarks that the Fed will not likely lower rates until much later in the year due to inflation signals mortgage rates are unlikely to decrease soon.2

Mortgage lenders who dive into buyer behaviors, geographical nuances, and truly service these potential buyers will benefit. By employing market and buyer savvy strategies that resonate, you can drive both short and longer-term business growth.

For more information about the lending possibilities for first-time homebuyers, read our latest white paper and visit us online.

Download white paper Learn more

1 “Mortgage Rates Move Toward Seven Percent as Markets Digest Incoming Data,” freddiemac.com

2 “Federal Reserve Issues FOMC Statement,” March 20, 2024, federalreserve.gov