Data is one of the most powerful tools that lenders and dealers can use to inform their decision making. Looking at trends on a national level is informative, but it can be even more impactful when analyzed at the regional level. When combined, a comprehensive view of data can make all the difference for lenders and dealers when making decisions for their businesses.

New and Used Financing See a Shift in Q1

On a national level, one standout year-over-year change is the breakdown of new and used financing. According to the Q1 2021 State of the Automotive Finance Market report, new vehicles represent a larger portion of the total finance market, increasing from 38.24% in Q1 2020 to 43.20% in 2021. Meanwhile, used financing decreased from 61.76% to 56.80% in the same period.

Loans Remain Most Popular New Vehicle Finance Option

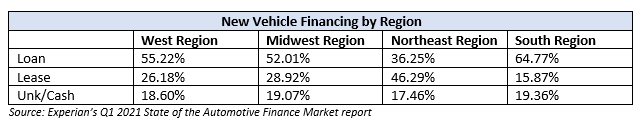

With overall financing on new vehicles increasing across the country, it’s important to dig into what that looks like on a regional level. Across most regions, loans were the preferred method of financing for new vehicles, however, the Northeast saw heavy leasing activity with 46.29% of new vehicles being leased in Q1 2021. Both lenders and dealers can leverage this data to inform expectations and build strategies that address their business on a location-by-location basis.

Regional Differences in Types of Vehicles Financed

Similar to the financing options, there were also regional differences when it came to the types of new and used vehicles financed. For instance, the Ford F150 was the top financed new vehicle in the Midwest (3.54%) and South (3.10%), while the Toyota RAV4 took the top spot in the West (3.48%) and the Honda CR-V led in the Northeast (3.55%).

Looking at used vehicles, we saw similar trends in vehicle popularity, with the Ford F150 landing as the top financed vehicle in the West (3.00%), Midwest (4.08%) and South (3.78%) regions, while the Toyota RAV4 lead the Northeast region (2.52%).

Average Credit Scores Increase Year-Over-Year

On a national level, both new and used vehicle credit scores increased compared to last year. The average new credit score across the country increased six points from 728 in 2020 to 734 this year. Looking regionally, the Midwest generally had a higher credit score, while the South had the lowest.

Meanwhile, the average national used credit score saw an increase of eight points, from 655 to 663 in the same time frame. The Midwest region again led with the highest credit scores, and the South with the lowest.

There is an abundance of valuable data lenders and dealers can leverage when strategizing for their businesses. Looking at data on a national level provides an overall view of the auto finance market, but it doesn’t necessarily tell the whole story. Digging into the data on a regional level, however, can help lenders and dealers identify what is working in some areas, what might not be working in others, and how they can adjust their strategies to maximize their goals, wherever they may be located.

Learn more by watching Experian’s full Q1 2021 State of the Automotive Finance Market report.