A recent study conducted by the Governing Institute and commissioned by Experian confirms that government benefit agencies can greatly improve their eligibility verification processes through automated data analytics.

Historically, assorted health and human service programs have been compartmentalized, with each benefit agency having its own data collection system, eligibility requirements and program rules. The technology to streamline processing by allowing one agency to match its data against other content repositories, though available, has not been in place. The result has been frequent re-entry of information causing processing delays, slowing response time and increasing manual labor costs. These shortcomings have limited agencies’ ability to detect and combat fraud.

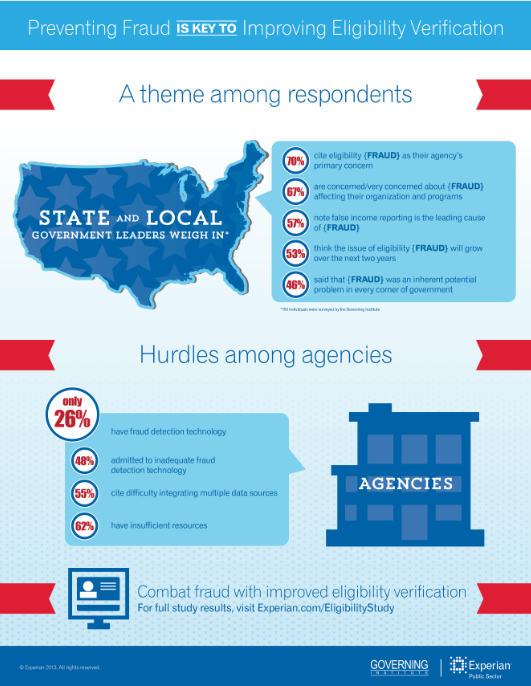

The Governing Institute survey of 150 state and local government leaders shows several areas of concern for benefit agencies. Notably, those surveyed cited a need to validate applicant information and the desire for reliable fraud detection and prevention tools. Nearly 70 percent of respondents cited the need for improved accuracy of their eligibility decision-making, and almost 60 percent of respondents believed that false income reporting was seen as the greatest cause of fraud.

The study also found that while only 70 percent of benefit agencies report currently verifying information, even fewer re-verify an applicant once they are in the system. Yet, 88 percent of respondents described eligibility verification as either “very important” or “one of the most important” issues they face. And more than half the government officials responding (53 percent) believe that the issue of eligibility fraud will increase in importance to their agency over the next two years.

The Governing Institute survey highlights the fact that benefit-eligibility verification is still in its early adoption stage. “A number of technology controls can help improve the fraud situation,” the analysts found. “These include fraud detection and monitoring.” However, a mere 26 percent of respondents are currently taking advantage of these types of systems.

The research points out the many obstacles agencies face when attempting to combat abuse. In addition to insufficient resources (budget and personnel), respondents cited difficulty integrating data from multiple sources and inadequate fraud-detection tools as the greatest hurdles to preventing eligibility fraud. According to the survey, 67 percent of respondents said they were either concerned or very concerned about fraud affecting their organizations and the programs they steward.

Check out the results of the eligibility verification study and learn more about Experian’s Eligibility Assurance Framework solution.