Did you know children are increasingly vulnerable to being a victim of identity theft? Their clean credit history is an easy target for perpetrators. Thieves often can profit for years before the crime is detected.

In general, minors should not have credit activity or a credit report until they apply for loans or a credit card. That said, it is possible that they may have a credit history if you have added them as an authorized user to your credit accounts during their teen years.

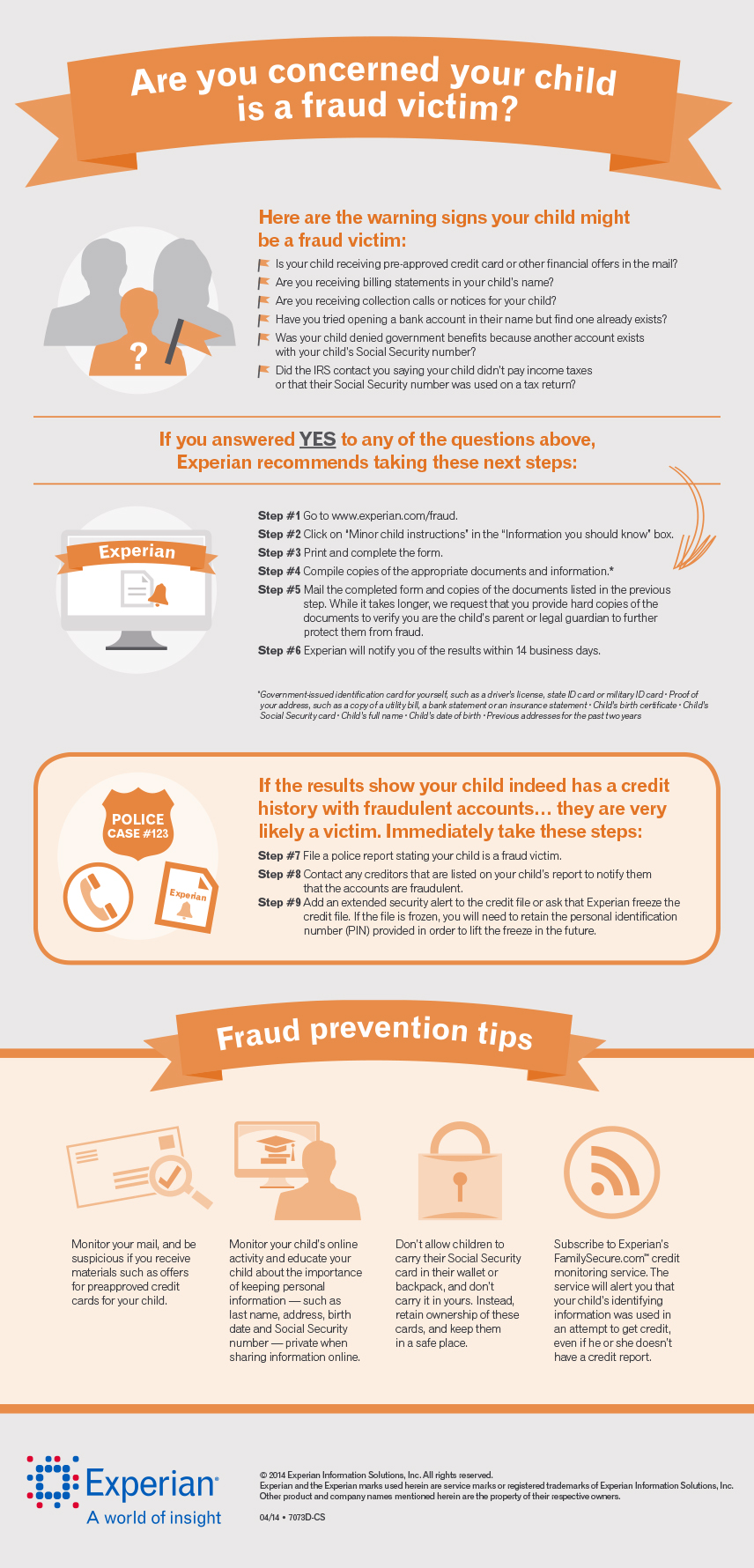

If you are concerned, checking your credit report is always a good first step in determining whether or not you are a fraud victim, and the same rule applies to children as well. Check out the infographic below for warning signs, steps you can take to see if your child has a credit report and tips to prevent your child from becoming a fraud victim.

Here are the measures Experian uses to protect minors’ credit histories:

- Experian will not knowingly disclose a credit report that belongs to a minor except to a parent or legal guardian.

- At www.annualcreditreport.com if you enter a birth date that is associated as being under the age of 13, it will automatically reject the request to pull the credit report.

- Experian will not provide a credit report to a lender if our records indicate the report belongs to a minor. We will return a notice to the lender that states the report they requested is associated with a minor. The lender then can take appropriate action to protect the child from credit fraud.

- You cannot request your child’s credit report without providing appropriate documentation that proves you are the parent or legal guardian.

For more information on minor’s credit visit the Ask Experian blog.