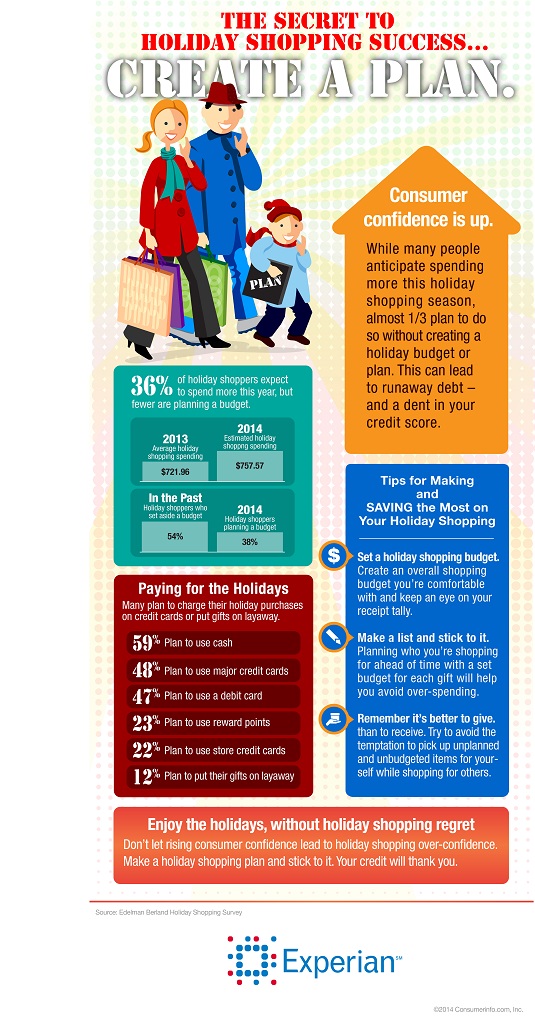

Do you already have a plan for your holiday shopping game this year? A recent study commissioned by Experian Consumer Services shows that spending confidence continues to recover, with 11 percent of those surveyed saying they anticipate spending more than they did last year on holiday gifts. Respondents plan to spend an average of $757.57 this year, up from $721.96 in 2013.

People may be planning to spend more this season, but their means of payment won’t come as a surprise. A dramatic majority (82 percent) planned to purchase either with their credit cards or via a layaway plan this year. Still others (59 percent) plan to pay for their holiday gifts in cash this year, while only 17 percent plan to open a store credit card as a part of their holiday payment plan.

While there will certainly be lots of sweaters, games, toys and ties under the tree, just under half of respondents plan to give either an experiential or DIY gift this year (45 percent). A quarter of those surveyed are planning to align a major purchase with their holiday gifting strategy, to truly make this a holiday to remember, while more than a third plan to make merry and gift themselves with a treat (37 percent).

Is your spending plan ready for winter? “Oftentimes, people happily overspend in December, only to feel overwhelmed in January when their credit card statements arrive,” said Becky Frost, senior manager of consumer education at Experian Consumer Services. Don’t throw away the good spending behaviors you may have challenged yourself with simply because it’s the end of the year. Be realistic and specific with your budgeting to help avoid overspending, and to keep your priorities in check.

For tips on holiday spending this year, see our helpful infographic below.

You can also view the complete survey results and methodology here: