As more and more finance apps fill the marketplace, consumers have the opportunity to be increasingly selective with their download choices.

App availability is widely accessible to smartphone users, and many users are progressively feeling the need to keep a close tab on their finances when on-the-go, whether away from their home base, or simply in their daily routines between bank visits. When they make the decision to bring a financial app into their device, how do security concerns versus the convenience factor play out?

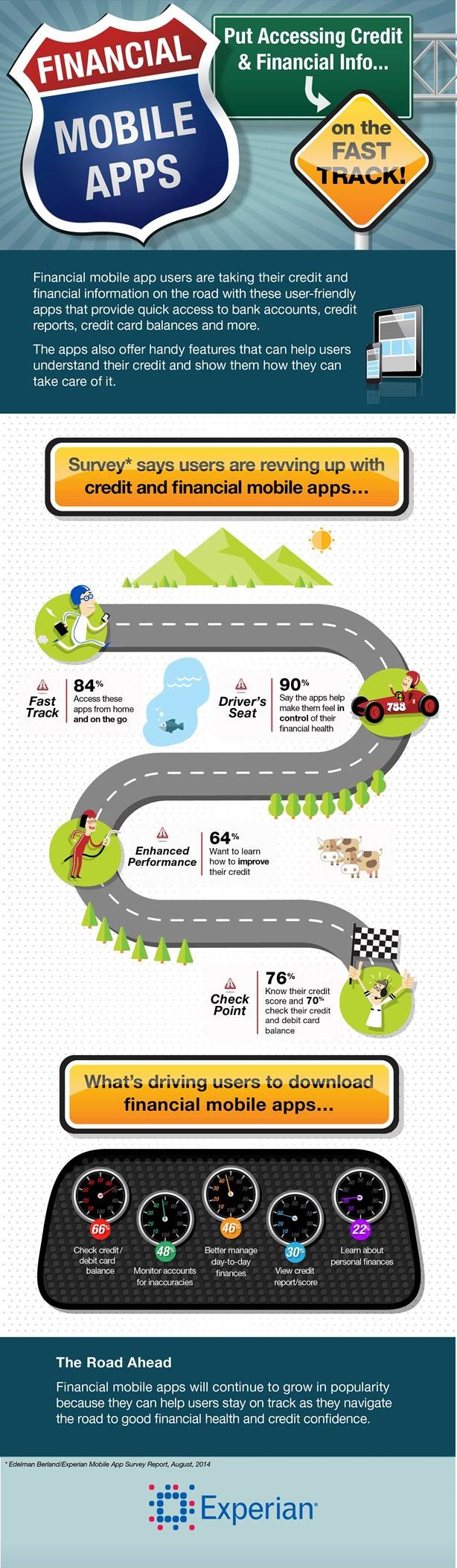

A recent study by Experian explored these decision-making evaluations and the motivations behind them, finding that nearly half of consumers currently use financial apps to gain confidence and control over their financial welfare (46 percent).

Four in five of those using apps felt more knowledgeable about their current financial situation since downloading. Respondents also cited secure login protocols and alerts as important features to help them maintain control of their information in the mobile space, whether accessing via smartphone or tablet.

Among those with mobile devices (either a smartphone or a tablet), 60 percent currently use them to access their personal financial information in some way, with nearly half – 45 percent – also using the device to learn more about their personal finances or credit. Further, the interest for credit education is real: nearly two in three are interested in learning how to improve their credit.

And 90 percent of respondents said that immediate access to apps made them feel more in control of their financial health.

“When people know more about credit, that’s power – power to better understand credit and reach their financial goals,” said Guy Abramo, president of Experian Consumer Services.

“Since April is National Financial Literacy Month, it’s the perfect reminder to learn more about something that affects our financial lives on a daily basis, namely credit,” continued Abramo. “The survey shows that when people engage with financial apps, including ours, they feel more confident about their financial situation.”

The demand for information continues to be strong, especially among those beginning their credit journey: of respondents ages 18-34, at least three in four wanted to know how to improve their financial outlook and how to improve their credit.

Check out the full survey:

This article is provided for general guidance and information. It is not intended as, nor should it be construed to be, legal, financial or other professional advice. Please consult with your attorney or financial advisor to discuss any legal or financial issues involved with credit decisions.