At Experian, we know a credit score is the gatekeeper to better financial opportunities, which is why we are committed to developing products and services that support consumers in their financial journey.

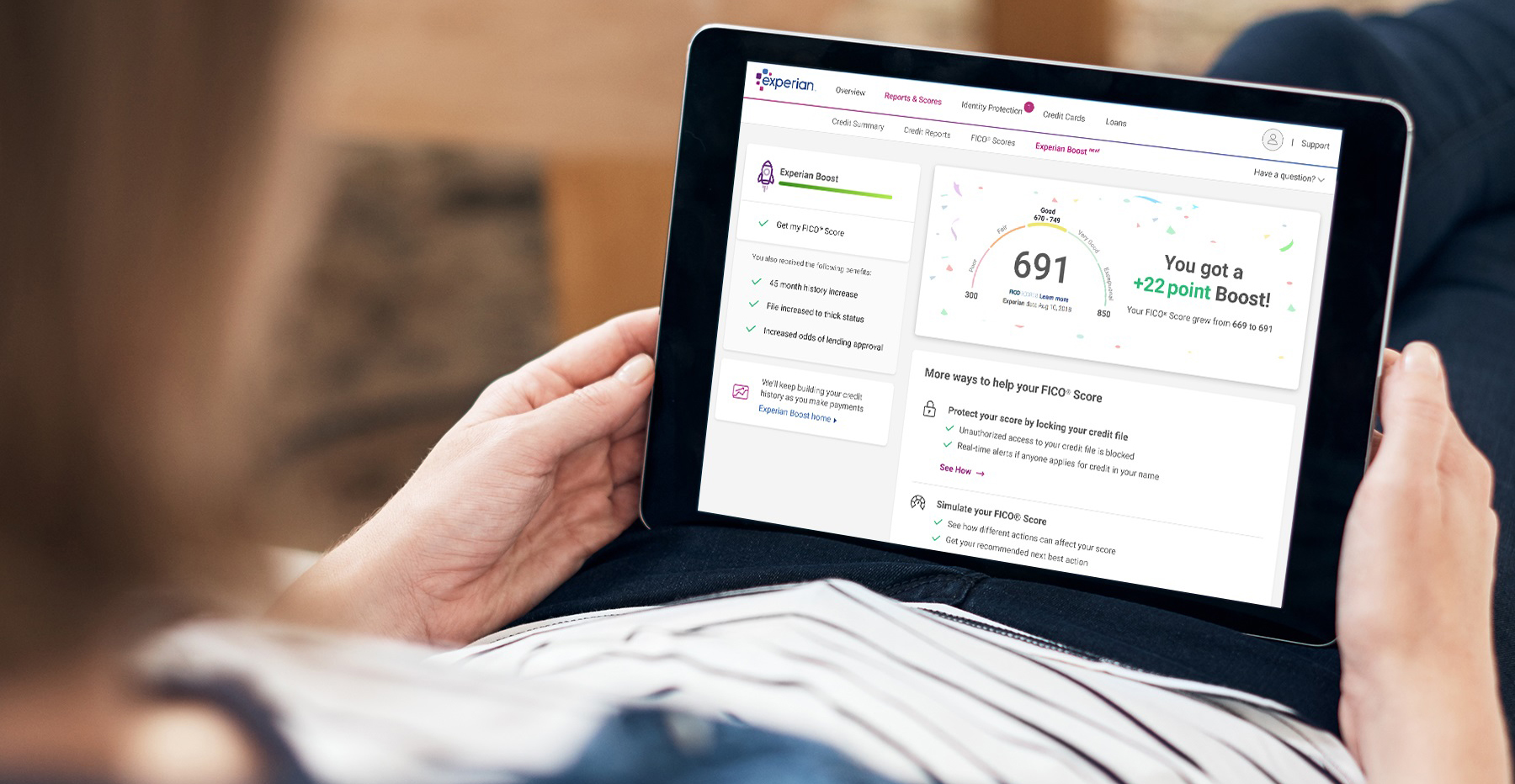

Six months ago, we hit a major milestone in bringing this commitment to life with the launch of Experian Boost. This innovative tool gave consumers the ability to add positive telecom and utility payment history directly to their credit file for an opportunity to instantly increase their credit scores for the first time.

When we launched Experian Boost, we knew there were more than 100 million Americans who didn’t have fair access to credit because of a limited credit history or a subprime score. We also knew these consumers were often forced to pay higher interest rates and fees for financial services. Today, as we look at our Experian Boost results, we know we’re helping to change that.

To date, for consumers who’ve used Experian Boost, we’ve seen:

- More than 11 million cumulative FICO Score points boosted

- FICO Scores increased for 2 out of 3 users with an average increase of more than 10 points

- Of those who boosted their credit scores, an average of 13% moved up a credit tier and of those in the “poor” credit tier, 24% moved to a “fair” tier

- Approximately 90% of “thin” file consumers who improve their credit scores saw an average increase of 19 points

- California, Texas and Florida rank 1-2-3 in number of consumers who have boosted their scores and total points boosted

To say we’re pleased with the positive feedback we’ve received about Experian Boost to date would be an understatement, but we’re not surprised. For years, lenders have been seeking new means to identify creditworthy consumers. At the same time, consumers have been asking for more control of their data and credit where credit is due. This is exactly what we’re providing with Experian Boost.

We’re helping to level the playing field and reward positive behavior and it’s not going unnoticed. Members of the credit counseling and advocacy community have reached out with excitement about Experian Boost. This solution is giving many of their clients a tangible way to impact their credit scores and improve their financial lives.

Improving consumer financial health is a core part of our sense of purpose and we’re just getting started. We’ll continue to enhance Experian Boost and develop new products and solutions to improve financial access to for more consumers.

To find out more about the Experian Boost, please visit www.experian.com/boost.