As we kick off a new calendar year, there’s already a lot of buzz in terms of expected advances in tech, especially for artificial intelligence. And what about fraud? Fraud isn’t just keeping pace with technology—it’s racing ahead. As the digital world expands, so too do the cunning schemes of fraudsters, who are more innovative and relentless than ever before. With businesses and consumers increasingly at risk, staying a step ahead requires insight into what’s next.

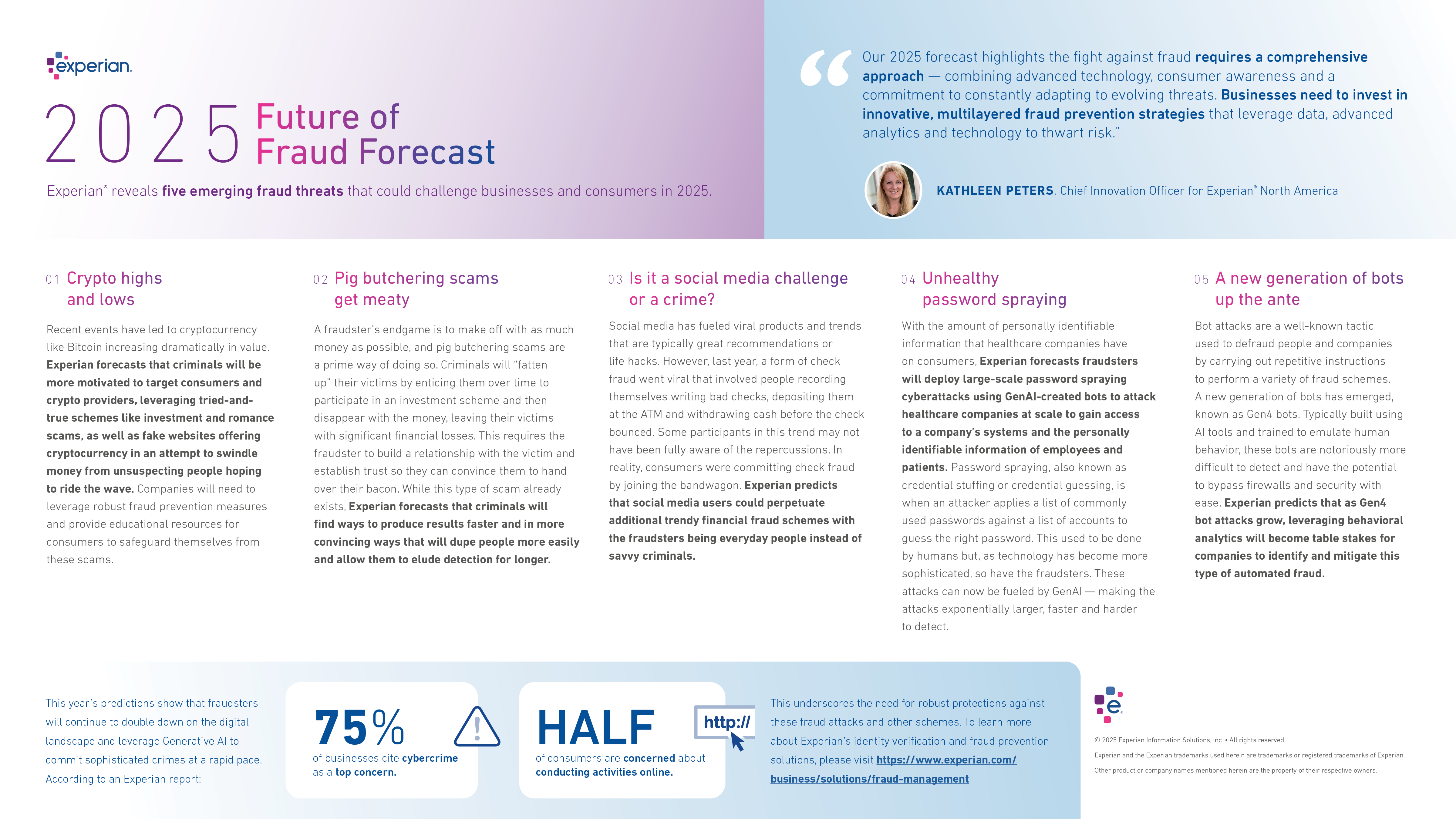

Today, we released our annual Future of Fraud Forecast to highlight five threats that could bring challenges this year for businesses and consumers. They include:

- Crypto highs and lows: Recent events have led to cryptocurrency like Bitcoin increasing dramatically in value. Experian forecasts that criminals will be more motivated to target consumers and crypto providers, leveraging tried-and-true schemes like investment and romance scams, as well as fake websites offering cryptocurrency in an attempt to swindle money from unsuspecting people hoping to ride the wave. Companies will need to leverage robust fraud prevention measures and provide educational resources for consumers to safeguard themselves from these scams.

- Pig butchering scams get meaty: A fraudster’s endgame is to make off with as much money as possible, and pig butchering scams are a prime way of doing so. Criminals will “fatten up” their victims by enticing them over time to participate in an investment scheme and then disappear with the money, leaving their victims with significant financial losses. This requires the fraudster to build a relationship with the victim and establish trust so they can convince them to hand over their bacon. While this type of scam already exists, Experian forecasts that criminals will find ways to produce results faster and in more convincing ways that will dupe people more easily and allow them to elude detection for longer.

- Is it a social media challenge or a crime? Social media has fueled viral products and trends that are typically great recommendations or life hacks. However, last year, a form of check fraud went viral that involved people recording themselves writing bad checks, depositing them at the ATM and withdrawing cash before the check bounced. Some participants in this trend may not have been fully aware of the repercussions. In reality, consumers were committing check fraud by joining the bandwagon. Experian predicts that social media users could perpetuate additional trendy financial fraud schemes with the fraudsters being everyday people instead of savvy criminals.

- Unhealthy password spraying: With the amount of personally identifiable information that healthcare companies have on consumers, Experian forecasts fraudsters will deploy large-scale password spraying cyberattacks using GenAI-created bots to attack healthcare companies at scale to gain access to a company’s systems and the personally identifiable information of employees and patients. Password spraying, also known as credential stuffing or credential guessing, is when an attacker applies a list of commonly used passwords against a list of accounts to guess the right password. This used to be done by humans but, as technology has become more sophisticated, so have the fraudsters. These attacks can now be fueled by GenAI — making the attacks exponentially larger, faster and harder to detect.

- A new generation of bots up the ante: Bot attacks are a well-known tactic used to defraud people and companies by carrying out repetitive instructions to perform a variety of fraud schemes. A new generation of bots has emerged, known as Gen4 bots. Typically built using AI tools and trained to emulate human behavior, these bots are notoriously more difficult to detect and have the potential to bypass firewalls and security with ease. Experian predicts that as Gen4 bot attacks grow, leveraging behavioral analytics will become table stakes for companies to identify and mitigate this type of automated fraud.

Being proactive is paramount in the fight against these and other future fraud threats. Businesses should work with a trusted partner to ensure that they leverage the right data, advanced analytics and technology to mitigate risk. Experian offers identity verification and fraud prevention solutions available on the Experian Ascend Platform™ to help companies anticipate, prepare for and fight fraud. Learn more about Experian’s fraud prevention offerings here.