Credit 101: Strategies to Improve Your Credit Scores

Join our weekly #CreditChat on Periscope, YouTube Live, Twitter, and Snapchat every Wednesday at 3 p.m. ET. This week, we talked about credit scores and what everyone needs to know about credit reports.

The panel included: Corey Carlisle: Director of the ABA Foundation; Jeanne Kelly: Credit Expert, Author, and Founder of ReadyForGoodCredit.com; Shannon McNay: Director of Content at MyBankTracker; Rod Griffin: Director of Public Education at Experian and Mike Delgado: Director of Social Media at Experian.

What is a good credit score?

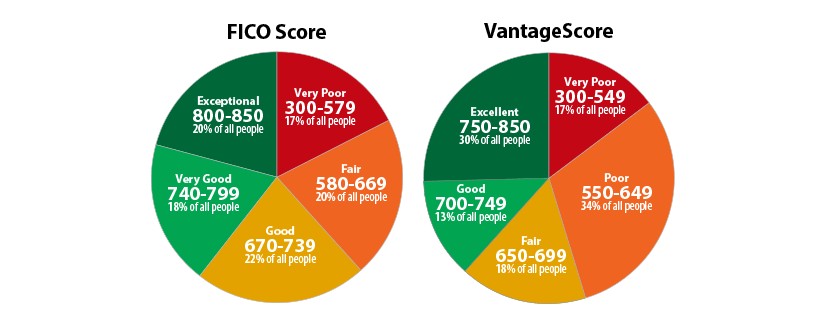

For a score with a range between 300-850, a credit score of 700 or above is generally considered good. A score of 800 or above on the same range is considered to be excellent. Most credit scores fall between 600 and 750. Higher scores represent better credit decisions and can make creditors more confident that you will repay your future debts as agreed.

Credit scores are used by lenders, including banks providing mortgage loans, credit card companies, and even car dealerships financing auto purchases, to make decisions about whether or not to offer your credit (such as a credit card or loan) and what the terms of the offer (such as the interest rate or down payment) will be. There are many different types of credit scores. FICO® Scores and scores by VantageScore are two of the most common types of credit scores, but industry-specific scores also exist.

Learn more about credit scores here on the Ask Experian blog.

Questions We Discussed:

- Q1: What is credit?

- Q2: Why is it important for young people to know about credit?

- Q3: How is a credit card different from a debit card?

- Q4: What are important things to look for when applying for a card?

- Q5: How can someone who has no credit history get a credit card?

- Q6: What are common mistakes people make with credit cards?

- Q7: What is a credit score?

- Q8: How is a credit score different from a credit report?

- Q9: What information is on a credit report?

- Q10: Any final tips or best practices for someone trying to get smart about credit?

View the Entire Discussion via Storify:

We also featured financial tips all week on Snapchat.