If I Cancel My Credit Cards, Will My Score Go Up?

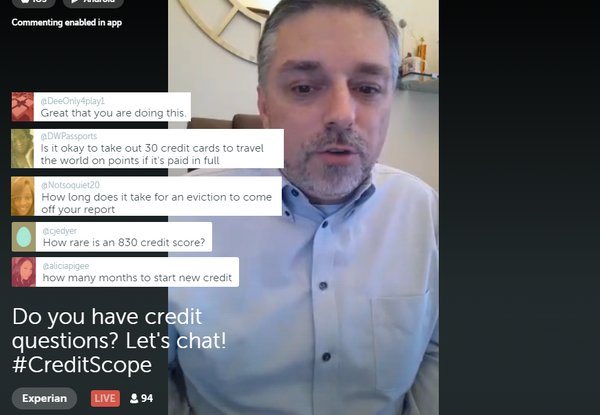

Do you have questions about credit?

Join our live video chat every Tuesday and Thursday at 2:30 p.m. ET on Periscope. Rod Griffin, Director of Public Education at Experian, is available to answer your questions live.

Here are some of the key questions Rod addressed in today’s scope:

How do you remove an old address?

You may be able to remove an address through the dispute system. Go to https://www.experian.com/disputes/main.html and follow the instructions provided on the site. If you have your current personal report, enter the report number and you will be able to enter a dispute there. If you don’t have your report, enter the information requested and you can enter a dispute online.

However, previous addresses are shown as a part of your history and past or current lenders have reported the information. Your previous addresses reported by your lenders will be included in the credit report. Addresses of joint account holders may also appear in the report. Addresses are not part of credit score calculations. They serve as an additional identifier, and Experian includes all variations reported by lenders as belonging to you. Addresses you don’t recognize could be an indicator of fraud or identity theft.

If it’s an address you don’t recognize and there is other information that does not belong to you, consider requesting an initial security alert and dispute the information as potentially fraudulent.

Which score is more credible? FICO or Vantage?

They are equally credible. Lenders use many different credit scores, all of which are legitimate as credible as any other. Unfortunately, there is a misconception that there is only one real score, which has never been the case. Both FICO and VantageScore are well known and respected credit scoring companies whose scores are used by many lenders.

What do mortgage lenders look for credit-wise?

Mortgage lenders are looking at the same thing other lenders are looking for. Essentially they want to see that you manage debt well and pay your bills on time. They are going to have scoring systems that look at the information on your credit report a little differently because they are trying to determine if you are going to pay your mortgage bill on time.

If I cancel my credit cards, will my score go up? If so, how much?

If you close credit cards, you actually will likely see an initial dip in your scores because of the effect doing so has on your utilization ratio. When you close an account, you lose the available credit limit on that card, and the existing balances on your other accounts become a greater percentage of your available balance. It’s simply a matter of math.

The increase will look as though you are carrying more debt and as a result it can cause your score to drop for a period of time. When it becomes clear that you did not take on more debt, the score will usually bounce back up. As a general rule, it is not a good idea to close credit cards in advance of applying for a major purchase, like a mortgage or a car loan because doing so will change your utilization rate.

If you are not planning to make a major credit purchase in the next 3-6 months, consider your overall financial situation. It might make sense to close one or more of the accounts even though there will be a temporary drop in your credit scores.

How long do late payments stay on your report?

Late payments stay on your report seven years from the original delinquency date of the missed payment. The original delinquency date is simply the date the payment was reported late. If you never bring the account current, it is charged off as a loss and sent to collection, both the original account and the subsequent collection will be deleted at the same time. The original delinquency date of the original account must be reported by the collection agency and cannot be changed.

I’ve only been late one time. Can I ask the creditor to remove it?

Yes you can ask the creditor to remove it. If you’ve never had any other delinquencies or credit issues, they may be willing to remove it. On the other hand, if there is a history of late payments, they likely won’t. Lenders understand that sometimes life happens and will often work with their customers. It’s a habit of late payment or misuse of credit that indicates risk. Late payments are not reported until a full billing cycle has passed, so if you contact the lender soon enough, it may never appear in your credit report at all.

I pay my bills on time, but I’ve used 80% of my available credit. Is this bad?

You never want your balances on one credit card or all of them as a whole to be more than 30 percent of the credit limit. That’s a maximum, not a target or goal. The people with the best credit scores generally have a utilization rate of less than 10 percent. Generally, the lower your balance-to-limit ratio, the better it will be for your credit scores. Ideally you should pay your balances in full each month.

Check out the scope to hear answers to all the questions asked today, and scroll down to see Rod’s responses to a few unanswered questions:

How long does it take for an eviction to come off of your report?

An eviction does not show up on your credit report. However, your credit report may include a collection account for unpaid rent or lease payments, or possibly a civil judgment if you were sued for breaking the lease.

Is there a difference between an online dispute and a snail mail dispute?

There is no difference between online disputes and mailed in disputes except for the way in the dispute was settled. Once received, the disputes will be processed in exactly the same way. Online disputes are much faster because you don’t have to wait for the mail to be sent or to be entered into the system manually. Disputes are usually completed between 10-15 business days and often within 2-4 business days.

Scoped on: 02/04/2016