If I Paid My Credit Card Bill ONE Day Late, Will It Reflect On My Credit Report? #CreditScope

Do you have questions about credit?

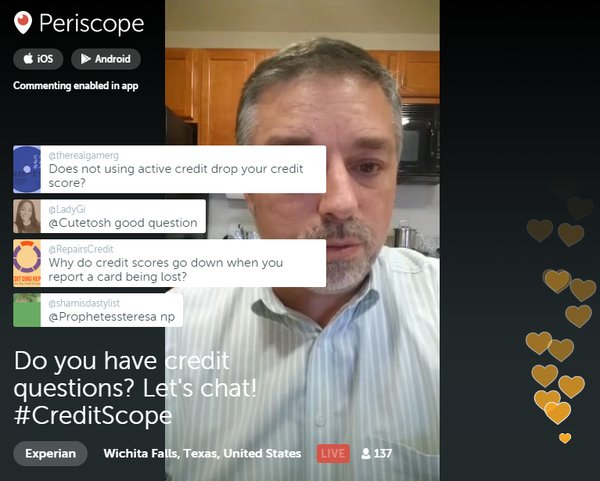

Join our live video chat every Tuesday and Thursday at 2:30 p.m. ET on Periscope. Rod Griffin, Director of Public Education at Experian, is available to answer your questions live.

Here are some of the key questions Rod addressed in today’s scope:

How long after you start paying off your debt will it take to see results? How much will your score go up?

When you start repaying debt you need to allow at least 30 days (one full billing cycle). When the payments start coming in, the balance will begin to drop, and that will help your utilization rate. When a score is calculated the next time, the reduced utilization rate will be reflected and that should help your score increase.

The amount it affects your score depends on where you are with your credit history and what your score was to begin with. If you have a really poor score, you might see a big jump relatively quickly. If you already have a good score, you may not see a significant jump.

If I paid my credit card bill ONE day late, will it reflect on my credit report?

If your payment is one day late it should not be reflected on your credit report. Thirty, 60 and 90 day late payments show up in your credit report. Late payments are not reported to the credit reporting companies until you have missed a full billing cycle (30 days).

If I paid a card that was maxed in full in one payment, is that good or bad?

The sooner you pay the balance in full the better. If you can pay it all at once, that is a good thing to do and it will help your credit scores and credit history. If it takes more than one payment, that is fine. You just need to reduce your balances.

How do you get your credit score?

A credit report and a credit score are two different things. When can get your free report through www.annualcreditreport.com, it does not include a credit score. A credit score is not part of your credit report and it is a separate process.

To get your credit score, you usually need to purchase it. You can purchase one from Experian and they are around $15. You can subscribe to credit monitoring services like Credit Tracker and get your score along with unlimited credit reports Other way to get a credit score are from your lender and some credit cards are now offering a FICO score on billing statements automatically.

Will your score increase if late payments are removed from your credit report?

Yes, payment history, and late payments in particular, have the most immediate and negative effect on credit scores. If you bring an account current, the late payments will come off your credit report. However, they won’t come off immediately because late payments stay on your report from seven years from the original delinquency date of the original debt.

Check out the scope to hear answers to all the questions asked today, and scroll down to see Rod’s responses to a few unanswered questions:

How can you get credit reports for your children to see if fraud has occurred?

If you are concerned that someone may have used your minor child’s identification information fraudulently, you can obtain a copy of your child’s credit report by sending a written request to Experian along with documentation showing that you are the child’s parent or legal guardian.

Experian will check our records to determine if there is credit record for your child. If we are unable to locate a record, we will send you a letter stating that we have no record in our files. If, in fact, your child does have a credit record, we can send you a copy, as well as place a security alert on his file that will alert creditors that someone may be trying to use their information fraudulently.

If you discover signs of fraud, you should also file a police report stating your child is a fraud victim. Having a copy of a police report available can be helpful in speeding the fraud recovery process.

Does getting married affect your credit?

Everyone has their own credit report, even after marriage so getting married does not cause your credit history to be combined with your new spouse. Each of you always will have separate credit histories. Each individual’s credit history contains only the information that is reported in their name.

When your lenders report your accounts in your new name, Experian will match it to your existing history and continue to update it, but only for the names associated with that account. But, when you apply for credit jointly, the lender will consider both of your credit histories when making its decision.

Scoped on: 02/11/2016