Lender Benefits of Reporting Credit

Credit Builders Alliance (CBA) has been connecting non-profit lenders to Experian for over a decade. The advantages of credit reporting for the borrower have been well documented.

If the loan is paid on time, most borrowers report a positive increase in their credit score and the subsequent ability to qualify for affordable mainstream credit. However, no such analysis has been conducted to ascertain the benefits to the lender from reporting their loan portfolios to the credit bureaus.

In an effort to determine whether there are any resultant benefits, CBA administered a survey in winter 2016 to all of its lender members (CBA Reporters).

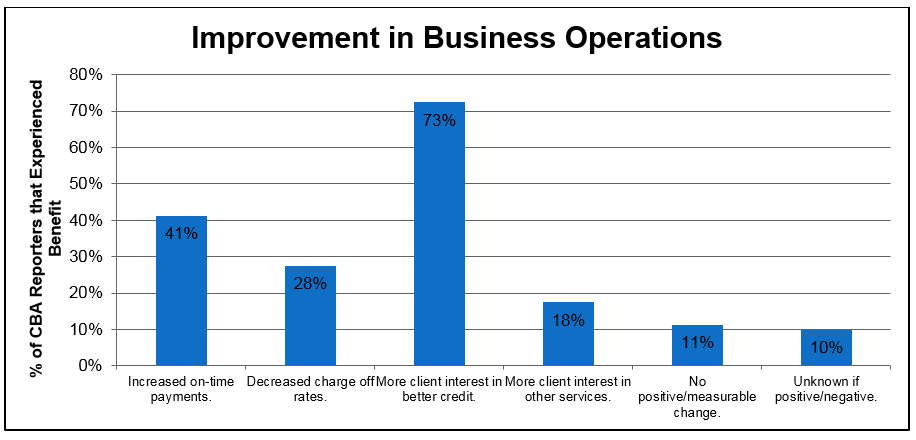

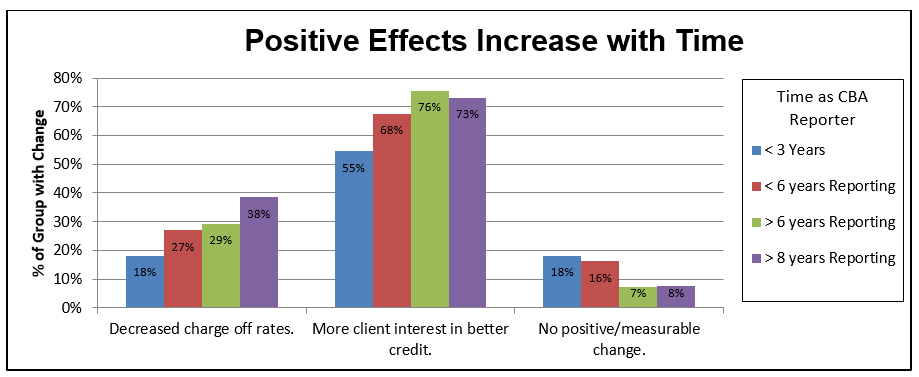

The following charts highlight the most significant findings:

The data reveals three major benefits:

- Organizations reported positive, measurable improvements to their business operations

- Organizations see more benefits from credit reporting as they increase their time reporting through CBA

- Organizations saw more interest from clients in their engagement towards credit building

Additionally, we asked respondents their opinions on how much of an impact credit reporting has been to their organization.

Here are some of their responses:

“[CBA Reporter] adds validity to our microloan program as a credit-building tool.” – Kentucky Coalition Against Domestic Violence

“By reporting our loans, we have helped to build a credit file for our borrowers. Over time, we have seen them become ‘bankable’ due in part to their loan being reported.” – Rising Tide Community Loan Fund

“We have also been able to demonstrate to customers that their credit scores have increased as a result of our reporting through CBA. That makes for a positive customer relations experience and an increase in word of mouth recognition of our CDFI as well.” – Mainstream Finance

In conclusion, this survey data supports the general intuition CBA has held over the years. Credit reporting has positive impacts on the financial and operational business goals of those willing to invest the time and resources into the credit reporting process.

Once lenders can commit to this decision, they are sure to receive a great return on their investment. At the same time, their borrowers are building a credit history. A win-win for all.

To learn more about how nonprofit organizations can benefit from reporting loans through CBA Reporter, please visit our Credit Builders Alliance website.