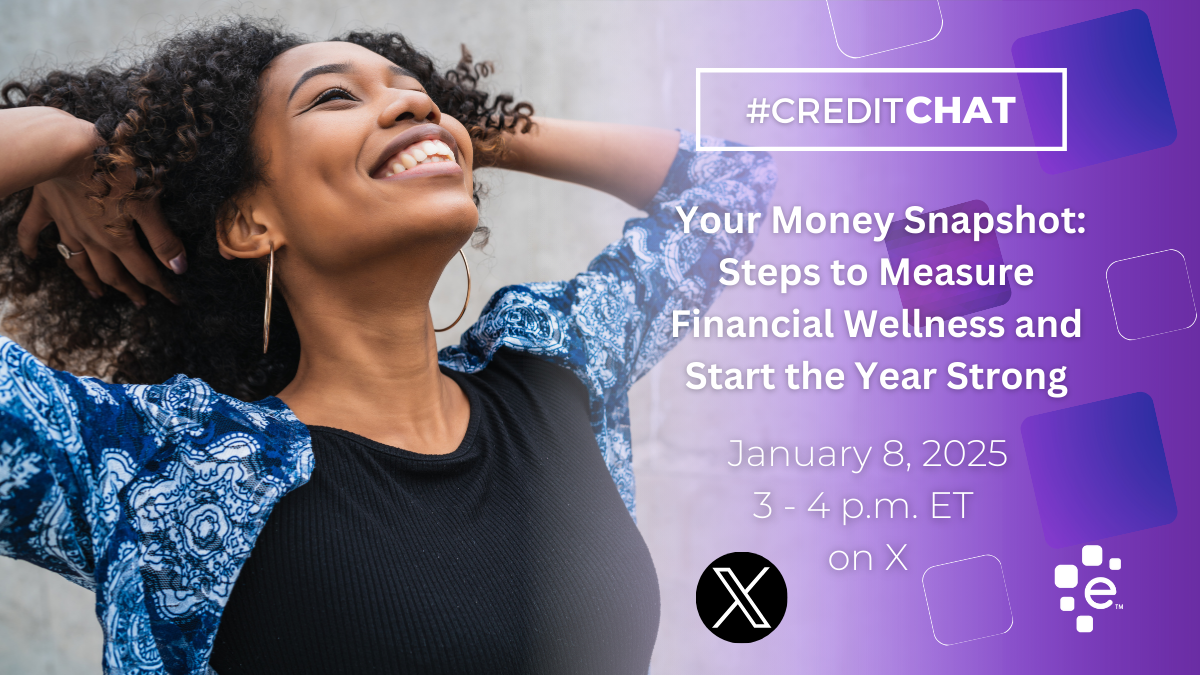

Your Money Snapshot: Steps to Measure Financial Wellness and Start the Year Strong

Our weekly #CreditChat started in 2012 to help our community learn about credit and important personal finance topics (e.g. saving money, paying down debt, improving credit scores). Each chat is hosted by @Experian on X (formerly Twitter) and all are welcome to participate. DM us any questions.

Don’t miss this week’s #CreditChat! We’ll discuss practical tips for overcoming financial anxiety, setting empowering goals, and cultivating positive money habits for lasting confidence. Let’s make 2025 the year you take control of your finances and thrive!

Topic: Your Money Snapshot: Steps to Measure Financial Wellness and Start the Year Strong

When: Wednesday, January 8, 2025 at 3 p.m. ET.

Where: Join the live hashtag discussion

The panel will include: Navicore Solutions; Cameron Huddleston: Director of Education at Carefull; Matt Sapaula: U.S. Marine Veteran, Best-Selling Author of Faith-Made Millionaire, Host of the 7 Figure Squad, and founder of MoneySmartGuy.com; Ilyce Glink: Real Estate and Financial Wellness expert, author, speaker, entrepreneur and founder of ThinkGlink.com; Gabrielle Olya: Lead Writer and Editor at GoBankingRates.com; Beverly Harzog: Credit Card Expert, Bestselling Author, columnist and podcast host of Your Personal Economy; Rod Griffin: Senior Director, Consumer Education and Advocacy, Experian; Jennifer White: Consumer Education and Advocacy Team, and Christina Roman: Consumer Education and Advocacy Manager at Experian.

Gift Card Giveaway

Enter here for a chance to win a $50 Amazon gift card! We will be announcing a winner at the end of the chat. Entry Period: Raffle open now and closes at the end of this chat at 4 p.m. ET. Complete rules here.

Questions we will discuss:

- What does financial wellness mean to you, and how do you define success in this area?

- How can you assess your financial performance last year and use your successes and lessons to shape your approach for financial wellness this year?

- How often do you evaluate your financial situation, and what metrics or indicators might you use to measure financial wellness?

- What are your top financial goals for the year, and how do you plan to achieve them?

- How do you evaluate and adjust your spending habits to align with your financial priorities?

- What are some common obstacles to achieving financial wellness, and what steps can be taken to overcome them?

- What role does debt management play in financial wellness, and what steps can you take to reduce or eliminate debt?

- How do you prepare for unexpected expenses, and what role does an emergency fund play in your financial strategy?

- How do you plan for long-term financial needs, such as retirement or large purchases, while balancing current expenses?

- How do you hold yourself accountable for financial decisions, and who or what helps you stay motivated to maintain financial discipline?

Check out our complete list of upcoming personal finance Twitter chats here.