All posts by Editor

Most consumers (89 percent) agree that credit plays an important role when buying a home or a car but only 73 percent recognize that identity fraud could affect their ability to get loans with favorable interest rates, according to a new survey from Experian Consumer Services. In addition, more than half of big-ticket purchasers fail to check their credit at any point in the buying process, which leads to surprises when it comes time to close the deal. “Identity fraud is real and affects consumers at very important times of life,” said Ken Chaplin, senior vice president of marketing for Experian Consumer Services. “In today’s environment, it’s especially important that consumers check their credit regularly to spot signs of fraud, understand better what affects their credit and make decisions that will help them be in the best position possible when it comes time to buy their dream home or car.”

Agreement extends Experian data and consulting services to ProAct clients Experian®, the leading global information services company, today announced an agreement with Ser Technology, developer of ProAct, a Web-based business intelligence consumer lending analysis and data warehousing solution. The agreement integrates Experian’s Global Consulting Practice expertise with ProAct providing SerTechnology’s credit union clients a 360 degree portfolio view, improving efficiency in the delivery of portfolio risk management decisioning. “We’re excited to collaborate and work more closely with Experian,” said Douglas White, executive vice president of business development at Ser Technology. “Credit unions are overwhelmed with increased risk management compliance burdens as well as executing strategic portfolio risk management strategies. With Experian, credit unions can now leverage ProAct and Experian data and business consulting for strategic portfolio risk management solutions.”

Experian’s State of Credit report recently highlighted the credit savviness of four generational groups, and showed how differently they manage their financial obligations. As you’d expect, there were several intriguing findings, so we extended the research to see how these same generational groups would differ when it comes to buying a vehicle. In a recent analysis of market trends in the automotive industry, Experian Automotive looked at vehicle registrations, and examined the car buying habits of Millennials (up to 32 years old), Generation X (33-48 years old), Baby Boomers (49-67 years old) and the Silent Generation (68-85 years old).

When a criminal steals your account number and security code, they often are planning to use that account to make purchases. Your credit report is not consulted for purchase transactions.

So, in such cases, you should consider contacting your card issuer and request a new account number. At minimum, you should check your account online to see if there has been any activity which you do not recognize.

If the criminal’s goal is to open new accounts in your name, then it is likely that one of your three credit reports would be accessed by the potential lender. In that case, you may want to consider adding an alert to your reports.

Fraud alerts are special statements consumers can have added to their credit report if they have reason to believe they may be a fraud victim or know that they have been victimized.

When a criminal steals your account number and security code, they often are planning to use that account to make purchases. Your credit report is not consulted for purchase transactions.

So, in such cases, you should consider contacting your card issuer and request a new account number. At minimum, you should check your account online to see if there has been any activity which you do not recognize.

If the criminal’s goal is to open new accounts in your name, then it is likely that one of your three credit reports would be accessed by the potential lender. In that case, you may want to consider adding an alert to your reports.

Fraud alerts are special statements consumers can have added to their credit report if they have reason to believe they may be a fraud victim or know that they have been victimized.

As Senior Vice President of Government Affairs and Public Policy at Experian, I had the opportunity to testify today before the Senate Committee on Commerce, Science and Transportation. As always, we continue to welcome the Committee’s interest in the marketing data industry.

In the spirit of cooperation, our goal is to help the Committee understand the role our data services play in the economy and in the lives of consumers.

Specifically, here are some key points we have shared to help inform the Committee’s work and interest in better understanding the marketplace:

Experian believes responsible information sharing enhances economic productivity in the United States and provides many benefits to consumers. Economists have stated the manner in which US companies collect and share consumer information among affiliated entities and third parties is the key ingredient to our nation’s productivity, innovation and ability to compete in the global marketplace.

As Senior Vice President of Government Affairs and Public Policy at Experian, I had the opportunity to testify today before the Senate Committee on Commerce, Science and Transportation. As always, we continue to welcome the Committee’s interest in the marketing data industry.

In the spirit of cooperation, our goal is to help the Committee understand the role our data services play in the economy and in the lives of consumers.

Specifically, here are some key points we have shared to help inform the Committee’s work and interest in better understanding the marketplace:

Experian believes responsible information sharing enhances economic productivity in the United States and provides many benefits to consumers. Economists have stated the manner in which US companies collect and share consumer information among affiliated entities and third parties is the key ingredient to our nation’s productivity, innovation and ability to compete in the global marketplace.

With less than a month left in the year, what does your to-do list look like? Finish holiday shopping? Jotting down your resolutions for the new year? Or perhaps you plan on heading down to the car dealership to take advantage of the great end of year sale offers. If it’s the latter of the three, you might just be in luck, because it’s a very good time to purchase a new vehicle.

According to Experian Automotive’s Q3 State of Automotive Finance Market report, the average interest rate for a new vehicle loan hit 4.27 percent, down from 4.53 percent a year ago. This marks the lowest rate we have seen, since Experian began publicly reporting the data in 2008.

With less than a month left in the year, what does your to-do list look like? Finish holiday shopping? Jotting down your resolutions for the new year? Or perhaps you plan on heading down to the car dealership to take advantage of the great end of year sale offers. If it’s the latter of the three, you might just be in luck, because it’s a very good time to purchase a new vehicle.

According to Experian Automotive’s Q3 State of Automotive Finance Market report, the average interest rate for a new vehicle loan hit 4.27 percent, down from 4.53 percent a year ago. This marks the lowest rate we have seen, since Experian began publicly reporting the data in 2008.

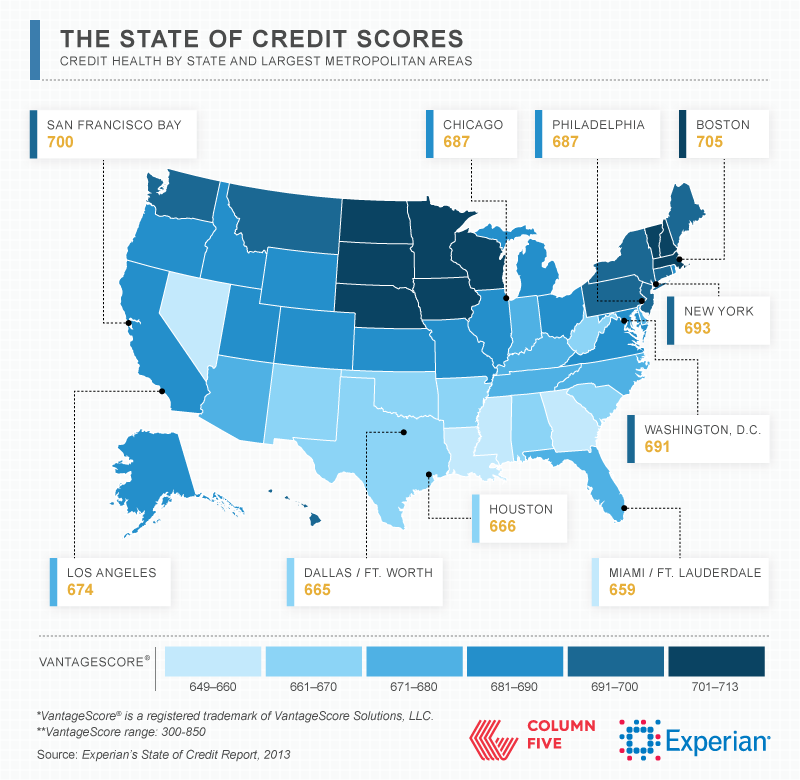

Experian’s fourth annual State of Credit features nationwide data on how four different generations are managing their debts. To provide a more detailed picture of how the nation is faring, we also analyzed over 100 Metropolitan Statistical Areas (MSAs).

Below are two snapshots of average credit scores and debt for the largest metropolitan areas. This study is an opportunity for consumers to better understand how credit works so they can make more informed financial decisions and live credit smart even in the face of national economic challenges. View our interactive map to learn more.

This guest post is by Gail Cunningham, Vice President of Membership and Public Relations.

Experian’s recent State of Credit Study revealed that The Greatest Generation has something else to brag about: responsibly managing credit. And that’s no small achievement considering that some of these folks have 50 or more years of credit history under their belt. That’s a lot of on-time payments. If you fall into the 65+ age bracket, congratulations! You’ve done a lot right. Now let’s keep a good thing going. Here are some tips to help you stay financially healthy moving forward:

This guest post is from Ted Jenkin, CFP®. Ted is co-CEO of oXYGen Financial and is a top ranked personal finance blogger (www.yoursmartmoneymoves.com). He is a regular contributor to Investment News, The Wall Street Journal, and The Atlanta Journal Constitution.

It’s official. For years and years everyone has labeled my generation (Generation X) the slacker generation. We were the ones that really started on the video game revolution with games like Pong and Atari and now we have relegated ourselves to worst in class when it comes to overall debt.

This guest post is from Ted Jenkin, CFP®. Ted is co-CEO of oXYGen Financial and is a top ranked personal finance blogger (www.yoursmartmoneymoves.com). He is a regular contributor to Investment News, The Wall Street Journal, and The Atlanta Journal Constitution.

It’s official. For years and years everyone has labeled my generation (Generation X) the slacker generation. We were the ones that really started on the video game revolution with games like Pong and Atari and now we have relegated ourselves to worst in class when it comes to overall debt.