All posts by Editor

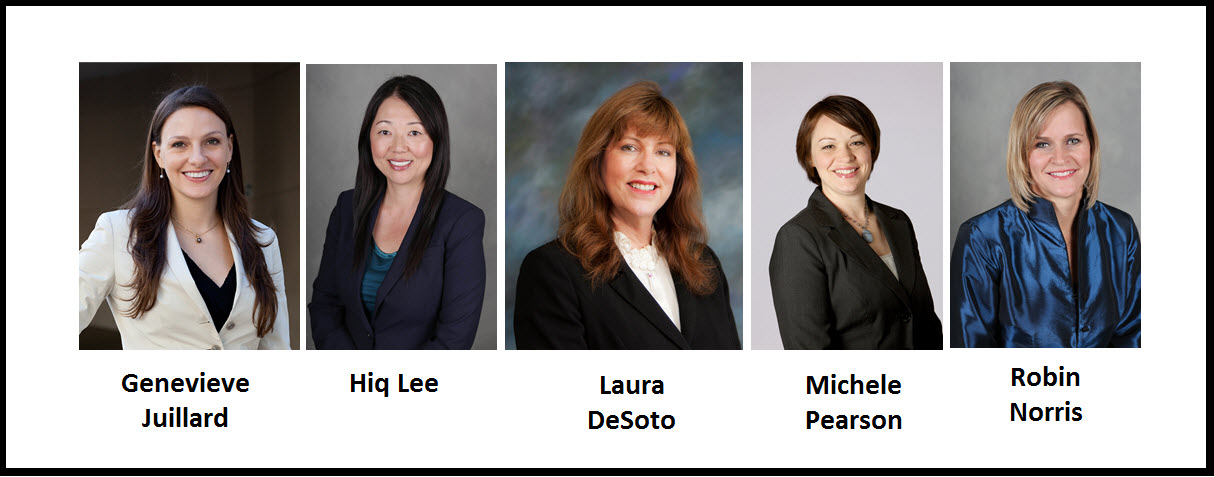

Today Experian announced five high-level appointments to its North American Credit Services group. Filling these crucial leadership roles are five seasoned women who have a proven track record of success with Experian. These women include:

Today Experian announced five high-level appointments to its North American Credit Services group. Filling these crucial leadership roles are five seasoned women who have a proven track record of success with Experian. These women include:

Most people will tell you that they’re extremely proud when their hometown or current city accomplishes something. Hometown pride is why people are diehard fans for the local professional or college sports teams. Knowing that their city shines bright in any light, gives people a good feeling inside. With that said, people in the New York Metro area should have a strong sense of pride in how their businesses are performing. According to Experian’s Q2 Metro Business Pulse analysis, which looks at the top metropolitan areas in four key business credit categories, businesses in the New York area had the lowest average bankruptcy rates in the quarter, at just 0.28 percent. Those in the Nassau, NY; Baton Rouge, La; Honolulu; and Miami areas also have reason to be excited, as their businesses rounded out the top five with the lowest rates in this category.

You’re sitting at home thinking about opening up a new business…maybe you’re just planning on relocating an existing office…or maybe you’re looking to do business with a new vendor. Whatever the situation may be, you have to ask the question, which cities are primed for new business opportunity? Where are businesses performing at a high level? Are businesses in City A paying their bills faster than City B?

You’re sitting at home thinking about opening up a new business…maybe you’re just planning on relocating an existing office…or maybe you’re looking to do business with a new vendor. Whatever the situation may be, you have to ask the question, which cities are primed for new business opportunity? Where are businesses performing at a high level? Are businesses in City A paying their bills faster than City B?

Experian Consumer Services (ECS) was recognized as the winner of the "Best in Class Call Center" category at the industry-leading Call Center Excellence Awards at the recent Call Center Week's Awards Luncheon.

The winners were announced by CustomerManagementIQ.com, a division of the International Quality & Productivity Center (IQPC), in front of 1,200 customer service executives at the 14th Annual Call Center Week, the largest, most comprehensive call center event in the world.

The Experian Consumer Services call center is comprised of hundreds of employees who deliver a personalized experience assisting customers with credit- and identity theft-related issues. The center is built on the philosophy of E3: Exceptional Experiences Every time, which allows the team to retain internal and external customers, attract large partners and drive continuous improvement at every touch-point.

Experian Consumer Services (ECS) was recognized as the winner of the "Best in Class Call Center" category at the industry-leading Call Center Excellence Awards at the recent Call Center Week's Awards Luncheon.

The winners were announced by CustomerManagementIQ.com, a division of the International Quality & Productivity Center (IQPC), in front of 1,200 customer service executives at the 14th Annual Call Center Week, the largest, most comprehensive call center event in the world.

The Experian Consumer Services call center is comprised of hundreds of employees who deliver a personalized experience assisting customers with credit- and identity theft-related issues. The center is built on the philosophy of E3: Exceptional Experiences Every time, which allows the team to retain internal and external customers, attract large partners and drive continuous improvement at every touch-point.

Most people shopping for a new car ask themselves that question all the time. In fact, there are many questions that surround whether to buy or lease a vehicle. What are the benefits of one over the other? Would my payment be lower if I leased? What if I decided to buy the car after, would there be a penalty?

Recently, these questions became very real to me when I found myself having to shop for a new car following the untimely death of my husband’s previous vehicle. The deceased was the typical “Dude” car - huge engine, power everything and it was bright yellow. For the new car, I wanted him to get something a bit more sensible; He wanted everything he had before and then some. So, as you can imagine, shopping was a lot of fun (insert sarcasm here).

Most people shopping for a new car ask themselves that question all the time. In fact, there are many questions that surround whether to buy or lease a vehicle. What are the benefits of one over the other? Would my payment be lower if I leased? What if I decided to buy the car after, would there be a penalty?

Recently, these questions became very real to me when I found myself having to shop for a new car following the untimely death of my husband’s previous vehicle. The deceased was the typical “Dude” car - huge engine, power everything and it was bright yellow. For the new car, I wanted him to get something a bit more sensible; He wanted everything he had before and then some. So, as you can imagine, shopping was a lot of fun (insert sarcasm here).

When it comes to credit, who is winning the battle between men and women? The latest credit trends study, released today from global information services company Experian, compares the financial differences between men and women, revealing that, overall, women are better at managing their money and debt. For the first time, Experian® analyzed credit scores, average debt, utilization ratios, mortgage amounts and mortgage delinquencies of men and women in the United States. While the national credit scores only vary slightly — with a one point difference — other differences between the population of men and women include the following:

- Men have 4.3 percent more debt than women

- Men have a 2 percent higher credit utilization amount

- Mortgage loan amounts for men are 4.9 percent higher

- Men have a higher incidence of late mortgage payments by 7 percent

When Kermit the frog said, “It’s not that easy being green,” he may not have been referring to the automotive market, but he may have been on to something.

Hybrid/alternative power vehicles are one of the smallest segments in the U.S., and have only just recently achieved a little more than one percent of the total vehicles in operation. However, according to Experian Automotive’s recently released Earth Day report, the segment has witnessed steady market share growth, increasing by 40.9 percent since 2011.

When Kermit the frog said, “It’s not that easy being green,” he may not have been referring to the automotive market, but he may have been on to something.

Hybrid/alternative power vehicles are one of the smallest segments in the U.S., and have only just recently achieved a little more than one percent of the total vehicles in operation. However, according to Experian Automotive’s recently released Earth Day report, the segment has witnessed steady market share growth, increasing by 40.9 percent since 2011.

When I think of large, successful companies, a couple of thoughts come to mind; excellent customer service, constant innovation and the unmistakable ability to attract new customers. While each of these is important in its own right, some would argue, the mark of a truly successful company is one that satisfies its existing customers, and keeps them coming back for more.

In our recently released Loyalty and Market Trends Report, we found that Ford did just that, as they passed GM and Toyota to take the top spot in corporate loyalty during Q4 2012. During the time period, 47.9 percent of the customers who owned a Ford vehicle returned to market to buy another Ford or Lincoln.

When I think of large, successful companies, a couple of thoughts come to mind; excellent customer service, constant innovation and the unmistakable ability to attract new customers. While each of these is important in its own right, some would argue, the mark of a truly successful company is one that satisfies its existing customers, and keeps them coming back for more.

In our recently released Loyalty and Market Trends Report, we found that Ford did just that, as they passed GM and Toyota to take the top spot in corporate loyalty during Q4 2012. During the time period, 47.9 percent of the customers who owned a Ford vehicle returned to market to buy another Ford or Lincoln.

The used car buying process can be as challenging for dealers as it is for consumers. Both parties want to make sure they are getting the best deal on a car that is safe and reliable. But how does anyone really know what they are getting?

The used car buying process can be as challenging for dealers as it is for consumers. Both parties want to make sure they are getting the best deal on a car that is safe and reliable. But how does anyone really know what they are getting?