Financial Education

One of the largest barriers to financial inclusion is a lack of financial education. Experian is changing that. Our partnerships and initiatives are dedicated to getting the proper tools, resources and information to underserved communities so that consumers can best understand and improve their financial health. Read about our financial education news below:

Agreement extends Experian data and consulting services to ProAct clients Experian®, the leading global information services company, today announced an agreement with Ser Technology, developer of ProAct, a Web-based business intelligence consumer lending analysis and data warehousing solution. The agreement integrates Experian’s Global Consulting Practice expertise with ProAct providing SerTechnology’s credit union clients a 360 degree portfolio view, improving efficiency in the delivery of portfolio risk management decisioning. “We’re excited to collaborate and work more closely with Experian,” said Douglas White, executive vice president of business development at Ser Technology. “Credit unions are overwhelmed with increased risk management compliance burdens as well as executing strategic portfolio risk management strategies. With Experian, credit unions can now leverage ProAct and Experian data and business consulting for strategic portfolio risk management solutions.”

Experian North America CEO Victor Nichols recently was recognized by the Consumer Credit Counseling Services of Orange County, California, as its 2014 Community Hero of the Year for his commitment to consumer financial literacy.

Mr. Nichols and Experian are proud to have been honored with this award. Experian has long been committed to consumer financial literacy and removing the mystery surrounding credit reports and scores, and that commitment has not wavered.

Experian North America CEO Victor Nichols recently was recognized by the Consumer Credit Counseling Services of Orange County, California, as its 2014 Community Hero of the Year for his commitment to consumer financial literacy.

Mr. Nichols and Experian are proud to have been honored with this award. Experian has long been committed to consumer financial literacy and removing the mystery surrounding credit reports and scores, and that commitment has not wavered.

When a criminal steals your account number and security code, they often are planning to use that account to make purchases. Your credit report is not consulted for purchase transactions.

So, in such cases, you should consider contacting your card issuer and request a new account number. At minimum, you should check your account online to see if there has been any activity which you do not recognize.

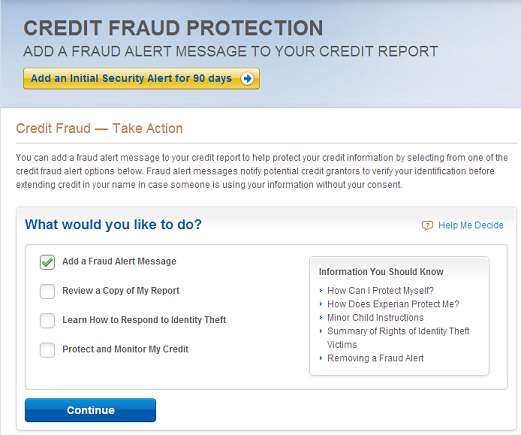

If the criminal’s goal is to open new accounts in your name, then it is likely that one of your three credit reports would be accessed by the potential lender. In that case, you may want to consider adding an alert to your reports.

Fraud alerts are special statements consumers can have added to their credit report if they have reason to believe they may be a fraud victim or know that they have been victimized.

When a criminal steals your account number and security code, they often are planning to use that account to make purchases. Your credit report is not consulted for purchase transactions.

So, in such cases, you should consider contacting your card issuer and request a new account number. At minimum, you should check your account online to see if there has been any activity which you do not recognize.

If the criminal’s goal is to open new accounts in your name, then it is likely that one of your three credit reports would be accessed by the potential lender. In that case, you may want to consider adding an alert to your reports.

Fraud alerts are special statements consumers can have added to their credit report if they have reason to believe they may be a fraud victim or know that they have been victimized.

News of the Target stores security breach has caused many people to ask what they can do to protect themselves from misuse of their stolen identification information.

The system of fraud alerts that has been in place for decades in the credit reporting systems was designed specifically to help people who are identity theft victims, or have reason to believe they may be, to stop credit fraud resulting from that identity theft.

In the Target incident and similar data breaches, neither a temporary security alert nor a fraud victim statement on your credit report will stop the thief from using your credit card account.

But the alerts may help protect affected consumers from new credit fraud if the identity thief attempts to open new credit accounts using their stolen information.

These services are available at no charge to anyone who is a victim of identity theft, or who has reason to believe they may be a victim:

News of the Target stores security breach has caused many people to ask what they can do to protect themselves from misuse of their stolen identification information.

The system of fraud alerts that has been in place for decades in the credit reporting systems was designed specifically to help people who are identity theft victims, or have reason to believe they may be, to stop credit fraud resulting from that identity theft.

In the Target incident and similar data breaches, neither a temporary security alert nor a fraud victim statement on your credit report will stop the thief from using your credit card account.

But the alerts may help protect affected consumers from new credit fraud if the identity thief attempts to open new credit accounts using their stolen information.

These services are available at no charge to anyone who is a victim of identity theft, or who has reason to believe they may be a victim:

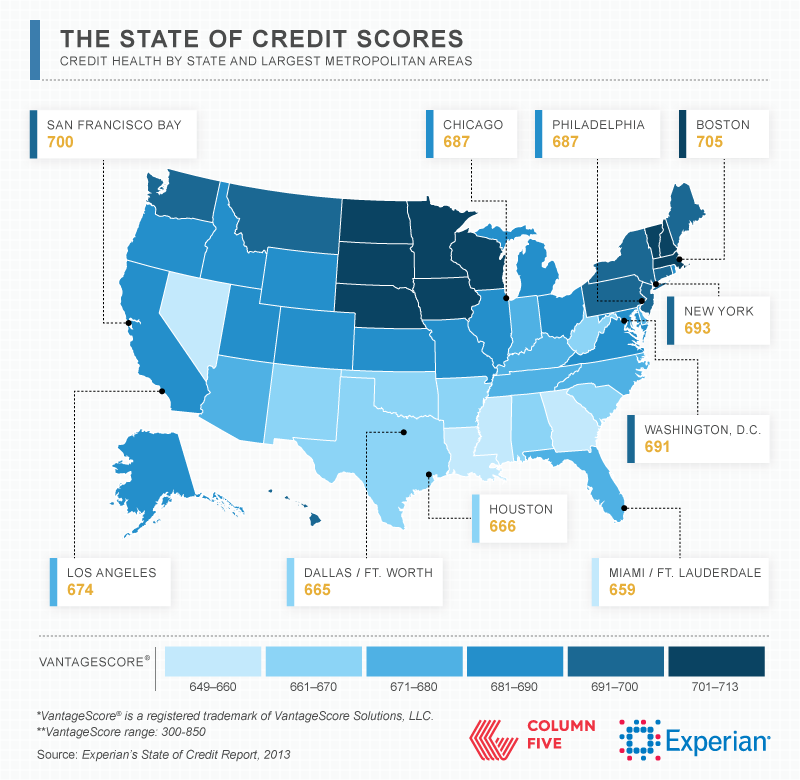

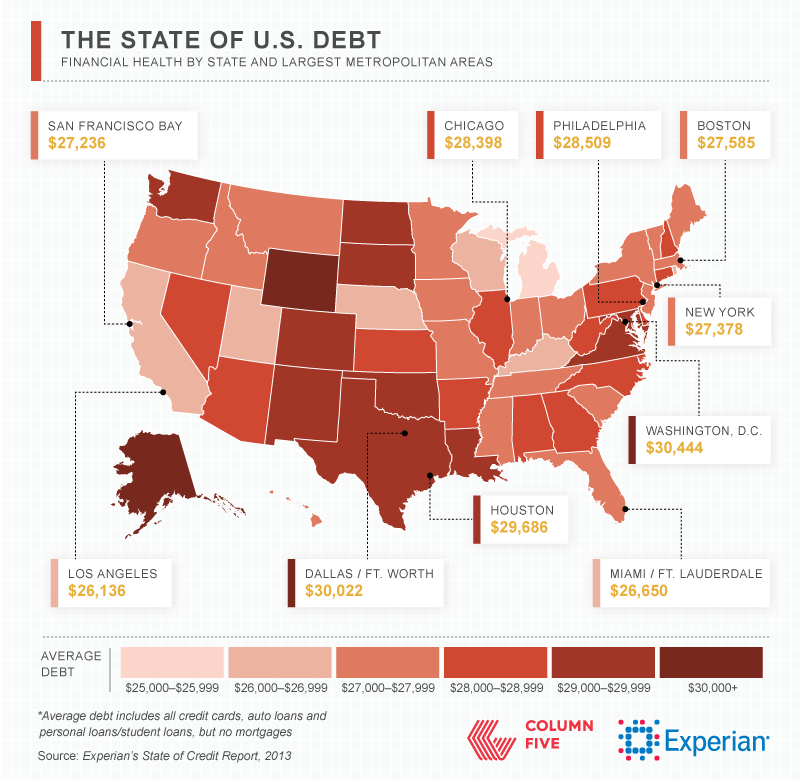

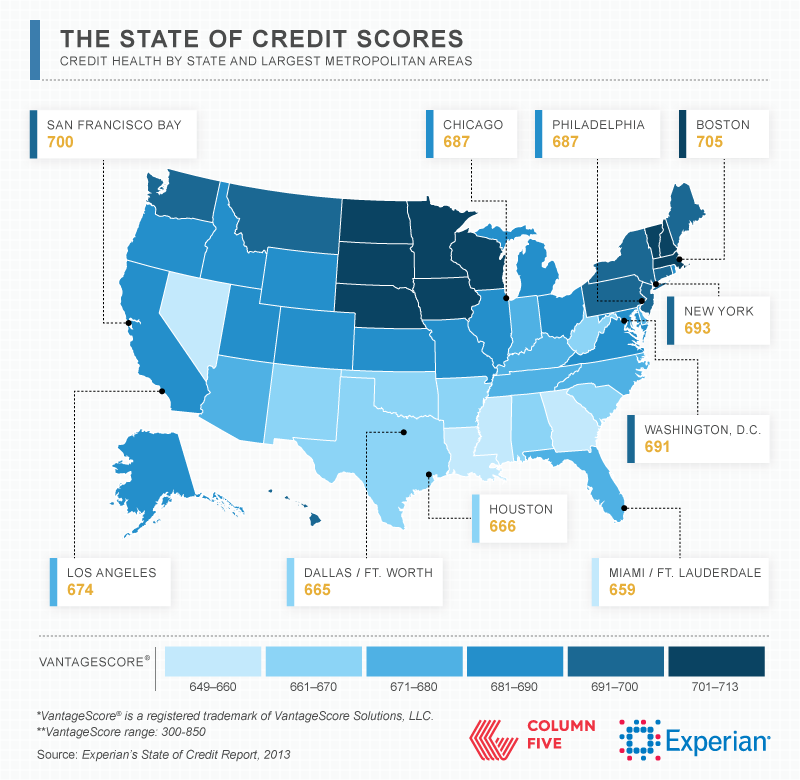

Experian’s fourth annual State of Credit features nationwide data on how four different generations are managing their debts. To provide a more detailed picture of how the nation is faring, we also analyzed over 100 Metropolitan Statistical Areas (MSAs).

Below are two snapshots of average credit scores and debt for the largest metropolitan areas. This study is an opportunity for consumers to better understand how credit works so they can make more informed financial decisions and live credit smart even in the face of national economic challenges. View our interactive map to learn more.

A glimpse at average debt in the largest metropolitan areas …

View interactive map: Experian's Fourth Annual State of Credit Report

View interactive map: Experian's Fourth Annual State of Credit Report

A glimpse at credit scores in the largest metropolitan areas ...

View our interactive map: Experian’s Fourth Annual State of Credit Reportf Credit, 2013

View our interactive map: Experian’s Fourth Annual State of Credit Reportf Credit, 2013

Do you want to buy gifts for friends and family this holiday season?

Check out these great holiday shopping tips from some of our favorite personal finance writers:

Do you want to buy gifts for friends and family this holiday season?

Check out these great holiday shopping tips from some of our favorite personal finance writers:

1. Think experience over tangible items

Stay sane. I’m not kidding. It’s so easy to lose control and get wrapped up in the feeling of needing everything. Back up and question each purchase. Especially gifts. By March, very few people even remember what they got in December - so is it worth overspending for? Think experience over tangible items. If you’re going to drop some cash, do a party or a trip. That’s what people recall and often value.

Right now I’m big into Groupon. I love the goods and getaways Amazing deals!

Erica Sandberg is one of the nation’s foremost personal finance authorities. She is editor at large for the Bankrate Inc.‘s subsidiary Credit Card Guide and a columnist and reporter for CreditCards.com

Stay sane. I’m not kidding. It’s so easy to lose control and get wrapped up in the feeling of needing everything. Back up and question each purchase. Especially gifts. By March, very few people even remember what they got in December - so is it worth overspending for? Think experience over tangible items. If you’re going to drop some cash, do a party or a trip. That’s what people recall and often value.

Right now I’m big into Groupon. I love the goods and getaways Amazing deals!

Erica Sandberg is one of the nation’s foremost personal finance authorities. She is editor at large for the Bankrate Inc.‘s subsidiary Credit Card Guide and a columnist and reporter for CreditCards.com

This guest post is by Gail Cunningham, Vice President of Membership and Public Relations.

Experian’s recent State of Credit Study revealed that The Greatest Generation has something else to brag about: responsibly managing credit. And that’s no small achievement considering that some of these folks have 50 or more years of credit history under their belt. That’s a lot of on-time payments. If you fall into the 65+ age bracket, congratulations! You’ve done a lot right. Now let’s keep a good thing going. Here are some tips to help you stay financially healthy moving forward: