Financial Education

One of the largest barriers to financial inclusion is a lack of financial education. Experian is changing that. Our partnerships and initiatives are dedicated to getting the proper tools, resources and information to underserved communities so that consumers can best understand and improve their financial health. Read about our financial education news below:

This guest post is from Ted Jenkin, CFP®. Ted is co-CEO of oXYGen Financial and is a top ranked personal finance blogger (www.yoursmartmoneymoves.com). He is a regular contributor to Investment News, The Wall Street Journal, and The Atlanta Journal Constitution.

It’s official. For years and years everyone has labeled my generation (Generation X) the slacker generation. We were the ones that really started on the video game revolution with games like Pong and Atari and now we have relegated ourselves to worst in class when it comes to overall debt.

This guest post is from Ted Jenkin, CFP®. Ted is co-CEO of oXYGen Financial and is a top ranked personal finance blogger (www.yoursmartmoneymoves.com). He is a regular contributor to Investment News, The Wall Street Journal, and The Atlanta Journal Constitution.

It’s official. For years and years everyone has labeled my generation (Generation X) the slacker generation. We were the ones that really started on the video game revolution with games like Pong and Atari and now we have relegated ourselves to worst in class when it comes to overall debt.

Underscoring Experian’s goal to help consumers and be an advocate for credit education, the National Foundation for Credit Counseling (NFCC) awarded Victor Nichols, CEO of Experian North America, its “Making the Difference” award from their Annual Leaders Conference in Denver. This prestigious award is presented to organizations that have made significant contributions to assisting consumers with financial literacy, awareness and education, furthering the NFCC’s mission, visions and programs through a national presence.

This prestigious award is presented to organizations that have made significant contributions to assisting consumers with financial literacy, awareness and education, furthering the NFCC’s mission, visions and programs through a national presence.

This guest post from Erin Lowry. Erin is the founder of Broke Millennial, where her sarcastic sense of humor entertains and educates her peers about finances. Erin lives and works in New York City, so she's developed quite the knack for finding deals and free events.

At the tender age of 18 I opened a letter from my bank to find my first credit card. I peeled the card off the letter and took a moment to stare in awe at this powerful little piece of plastic that suddenly offered me access to money.

This was 2007, pre-Credit CARD Act of 2009, when all a college student had to do to get a credit card was head down to the local back -- or in some ghastly cases walk through vendor tables set up during orientation days. Students scribbled down their information in exchange for a free t-shirt or water bottle and gleefully received plastic cards that seemingly offered “free money.”

This guest post from Erin Lowry. Erin is the founder of Broke Millennial, where her sarcastic sense of humor entertains and educates her peers about finances. Erin lives and works in New York City, so she's developed quite the knack for finding deals and free events.

At the tender age of 18 I opened a letter from my bank to find my first credit card. I peeled the card off the letter and took a moment to stare in awe at this powerful little piece of plastic that suddenly offered me access to money.

This was 2007, pre-Credit CARD Act of 2009, when all a college student had to do to get a credit card was head down to the local back -- or in some ghastly cases walk through vendor tables set up during orientation days. Students scribbled down their information in exchange for a free t-shirt or water bottle and gleefully received plastic cards that seemingly offered “free money.”

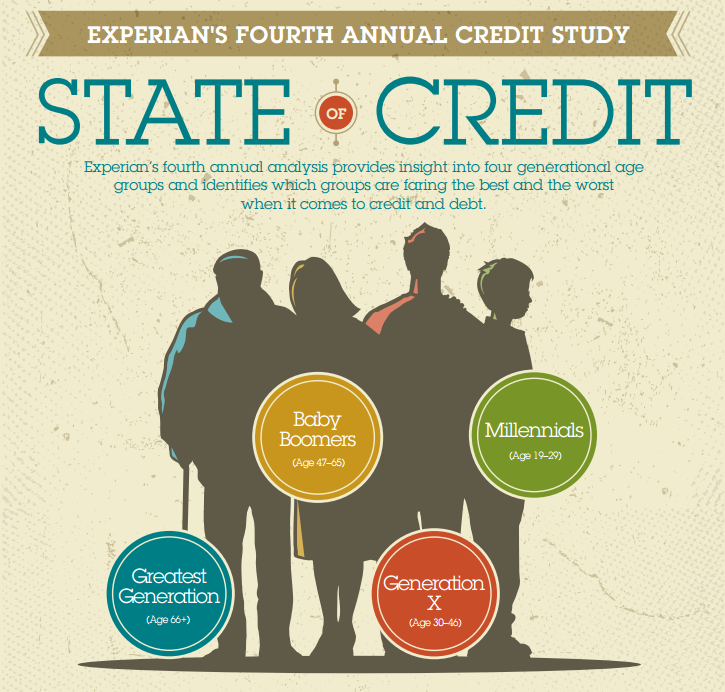

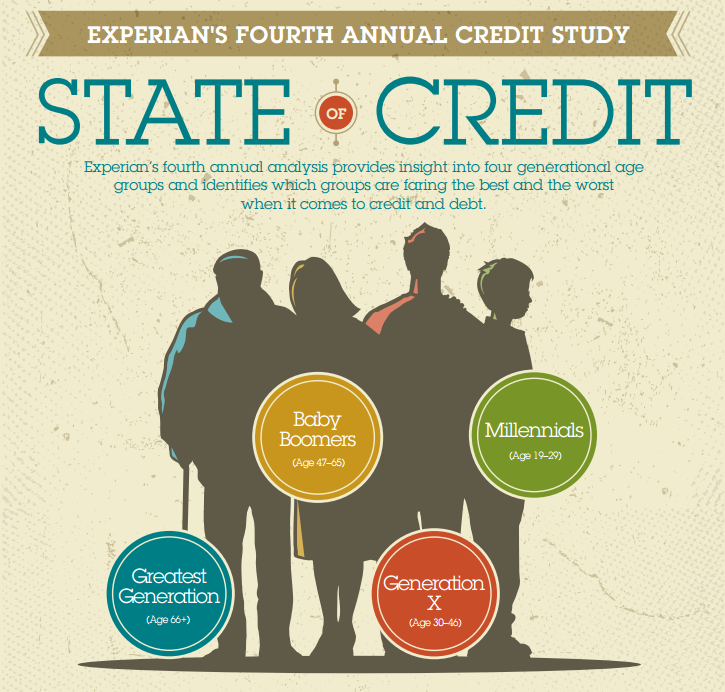

The Fourth Annual State of Credit report is Experian’s comprehensive look at nationwide data to determine how four different generations are managing their debts by analyzing their credit scores, the number of credit cards they have, how much they are spending on those cards and the occurrence of late payments.

Additionally, credit scores were examined in Metropolitan Statistical Areas (MSAs) to provide the 10 highest and 10 lowest credit scores in each generation across the nation. The study creates an opportunity for consumers to better understand how credit works so they can make informed financial decisions and live credit smart even in the face of national economic challenges.

Check out the full infographic.

This guest post is from Donna Freedman (@DLFreedman). Donna is a former newspaper journalist and staff writer for MSN Money and Get Rich Slowly. Currently she writes for Money Talks News and for her own website, donnafreedman.com.

What do Baby Boomers and millennials have in common? Stereotyping, retirement issues and, sometimes, a residence. About that last: According to a Pew Research Center study called “The Boomerang Generation,” 29% of adults aged 20 to 34 live with their folks. Which leads us to a two-pronged stereotype: Boomers were overly indulgent parents who never let their kids suffer even a moment of The Sadz, which is why millennials are such an entitled, failure-to-launch cadre.

The Fourth Annual State of Credit report is Experian’s comprehensive look at nationwide data to determine how four different generations are managing their debts by analyzing their credit scores, the number of credit cards they have, how much they are spending on those cards and the occurrence of late payments. Additionally, credit scores were examined in Metropolitan Statistical Areas (MSAs) to provide the 10 highest and 10 lowest credit scores in each generation across the nation. The study creates an opportunity for consumers to better understand how credit works so they can make informed financial decisions and live credit smart even in the face of national economic challenges.

Check out the full infographic.

The National Foundation for Credit Counseling® (NFCC) and Experian® jointly announced today that Experian committed 80,000 free, 12-month memberships to its freecreditscore.comTM product, in support of the NFCC’s Sharpen Your Financial Focus™ program. The NFCC program, launched in September of this year, includes a broad cross-section of supporters – Experian and others – who are committed to increasing the financial well-being of Americans.

Millions of Americans face economic hardships today due to the financial crisis. The Great Recession made a big impact on the financial lives of consumers. Unemployment was high and many struggled to make ends meet, forcing them to tap into their savings and live off credit to survive. Now that our economy is recovering, we believe that education is the key for consumers to unlock the door that leads to financial success and opportunity.

In the personal finance world, credit is one of the hottest topics to talk about and there are many resources available to consumers.

To further empower consumers to take a more active role in managing their credit, Experian provides a number of solid consumer education programs.

As a positive extension to those, in 2011 we developed Experian Credit Educator, a consumer-education service that offers personalized, live, one-on-one, telephone-based credit education sessions to consumers and customers of Experian’s clients.

Experian recently announced that we’ve added new features to this service in order to give consumers insights into specific actions which may produce an improvement to their credit score.

In the personal finance world, credit is one of the hottest topics to talk about and there are many resources available to consumers.

To further empower consumers to take a more active role in managing their credit, Experian provides a number of solid consumer education programs.

As a positive extension to those, in 2011 we developed Experian Credit Educator, a consumer-education service that offers personalized, live, one-on-one, telephone-based credit education sessions to consumers and customers of Experian’s clients.

Experian recently announced that we’ve added new features to this service in order to give consumers insights into specific actions which may produce an improvement to their credit score.