Featured

Featured

As part of the company’s commitment to diversity and inclusion, Experian is celebrating Asian Pacific American Heritage Month through May. This article is by Dacy Yee, VP of Marketing and Customer Relationship Management for Experian Consumer Services and executive co-sponsor for Experian’s Asian American Employee Resource Group (ERG). My parents’ story is not unlike any other immigrant story. At 20 years old, they came to the United States from Hong Kong with nothing but a dream for more opportunity and a better life for their family. Their drive and resilience empowered me from a young age. I got my hustle from my dad; he is the hardest-working person I know. Throughout my childhood, he juggled multiple jobs, from working in Chinese restaurants and bagging groceries to becoming a mechanic. He worked his way from mechanic to owner of a gas and service station, often spending early mornings and late evenings opening and closing the shop. I got my toughness from my mom; she always pushed me to be better by making me believe that I was capable, strong and resilient, and by telling me that I could achieve anything I wanted to in life. My parents showed me what courage and determination meant by leaving the familiar in their home country to move here and maneuver a new, unfamiliar culture. They empowered me to work hard and take risks—to always think bigger. Asian Americans have a unique place in history; from the Chinese immigrants working on the railroad in the 1880s to the Japanese WWII internment camps of the 1940s, there’s something to be said about the Asian American story in this country that has only recently been explored in pop culture and entertainment. There’s the quiet, hard work ethic and driven mentality from my parents’ generation that worked so well in certain countries, but a steady drumbeat of wanting to stand out in future generations after that. This has profound implications for professional environments. The generalizations of the silent model minority have been disputed in recent years. Even more so, there’s much to be discussed as to how we carry our past generational habits into the future and how that shapes who we become. The lessons my parents taught me sometimes translate differently and result in the culmination of stereotypes I’ve tried to avoid throughout my career. Putting my head down and working hard might suddenly mean I’m passive. Thinking twice about challenging authority might translate to being soft-spoken or submissive. As an Asian American professional woman, I’m faced with minute-to-minute decisions of when to speak up, when to fight my battles and when to simmer down. There have been studies showing that there is a real “bamboo” ceiling for Asian Americans trying to reach the C-suite level. In fact, Asian Americans are currently the racial group least likely to be promoted to management positions in the U.S., according to a study in the Harvard Business Review. The question is: how do we break through that ceiling? As a company rooted and driven by data, we are constantly looking at numbers in everything we do. This is why we’re hosting a speaker to walk through his findings about what builds and creates this “bamboo” ceiling and how it affects Asian Americans in the workplace. We need to speak up and share our struggles with each other; as part of Asian Pacific American Heritage Month, we’re hosting a panel featuring our own Asian American leaders and professionals to talk about this very issue. To each other, to their colleagues, to their managers and to the larger Experian community. Finally, we’re going to chart the path forward and lead by example. As members of the Asian American ERG at Experian, we’re going to host more skill-building workshops, have open and candid conversations, and keep each other accountable to our stretch goals and ultimately our professional aspirations. As we celebrate Asian Pacific American Heritage Month, there will be an ongoing dialogue of what empowerment means to us in the workplace. Ultimately, regardless of where you come from and how you identify yourself, the resounding lesson is of empowerment; standing up for what you’re passionate about and leading the way for others who will be following in your path.

Technology revolutionizes the way businesses operate, but implementing change within a company is often challenging. Company-wide support is vital to successfully undergo a transformation. At Experian, in 2015, we underwent the task of moving from a traditional computing architecture to the cloud. This is a monumental transformation with our massive digital infrastructure and significant global reach, but it enables us to provide customers with real-time access to data. This journey is featured in the new book, Cascades: How to Create a Movement that Drives Transformational Change, by Greg Satell. Last year Satell’s first book shone a light on Experian’s innovation story. In his latest book he talks about the power of cascades - small groups, united with a common purpose - to drive transformational change within businesses. He gives examples of how some companies succeed, while others fail. Satell uses Experian as a case study and highlights how changes to our culture, organizational structure and skills is allowing us to adopt new technologies quicker, in better collaboration with our customers, to get cutting-edge, innovative products to market faster. At Experian, we believe in the culture of inclusion, which brings a culture of innovation with the added diversity perspective that empowers our people to continue to evolve and create valuable additions to the company during this transformation. Our philosophy is about advancing a culture that not only respects differences, but also actively celebrates them. In Cascades, Satell writes about the idea of small groups, loosely connected, but united by a common purpose. We asked the author for his thoughts about Experian’s technology journey, which he refers to as our digital transformation, and why he’s used Experian as a success story in his book. Q. What are your thoughts about Experian’s digital transformation so far? Satell: What attracted me to the Experian story was how closely it tracked with so many of the social and political movements I researched for my book. Senior leadership at Experian didn’t just try to push its digital transformation through. Rather, they identified those who were already enthusiastic and empowered them to bring others into the fold and they, in turn, could bring others in. That's how you create a cascade that leads to transformational change. Q. What has impressed you the most about Experian’s digital transformation, from both technology and human perspectives? Satell: What I found most impressive is that Experian is able to break free from decades of legacy and build a new future for itself. That's a very hard thing to do. You have all this infrastructure that served the business so well for so long. I mean you're talking about decades of investment. Still, the company leadership was able to step back and say, ‘That's our past and we're proud of it, but it's not our future’, and move forward from there. Q. Have you seen any examples of how our digital transformation is driving innovation within Experian? Satell: Well I think it has driven a lot. Things like Experian’s Analytical Sandbox, the Ascend platform and much of the current work around Artificial Intelligence (AI) wouldn't be possible without moving to more of a cloud infrastructure.

Inclusion is at the heart of everything we do, and we’ve made it a priority to embrace the diversity that makes up the Experian family. This is why we’re especially proud to release our 2018 The Power of You Inclusion & Diversity Annual Report, highlighting the strides we’ve made to celebrate our diverse work force and create an inclusive company culture. "We believe that embracing a truly inclusive culture, where everyone has a real sense of belonging, is critical to building a diverse workforce and fostering innovation," says Craig Boundy, former chief executive officer of Experian North America. "We don't just encourage inclusion at Experian, we celebrate it." The Power You initiative was created to recognize ways we can create a more supportive work environment and provide greater transparency into our commitment towards diversity and inclusion. We’ve instated progressive policies and programs, such as flexible working, paid parental leave and Experian clubs, to help foster support, empowerment and employee pride about working for Experian. Here are some of the highlights from the report: 89 percent of employees across North America agree that creating a diverse and inclusive work environment is at the forefront of Experian's values More than 900 employees joined our 8 Employee Resource Groups (ERGs) From 2017 to 2018, the percentage of women hired into executive positions increased from 31% to 38% Nearly half of our job applicants were non-white, a 10% increase from 2017 Volunteer Time Off (VTO) was increased from one day to two days Experian North America was honored with a North America Great Place to Work certification and regional Top Workplaces awards From the events organized by our Employee Resource Groups (ERGs) to the support provided by our Experian Hardship Fund, The Power of You initiative is exemplified by the work and dedication our employees have invested to help in our mission to create an inclusive workplace. "Creating a better tomorrow starts within the company, and that's why we're committed to diversity and inclusion," adds Justin Hastings, former chief human resources officer of Experian North America. "We search the globe for the very best people so we can innovate and meet the needs of our increasingly diverse clients. Drawing on this collective strength is what truly makes us a top workplace." Our dedication to creating a more inclusive and supportive workplace has not gone unrecognized. We’ve been honored with a number of high-profile employer awards, including being named the #1 Top Workplace in Orange County by the Orange County Register and one of the World’s Most Innovative Companies for the fifth consecutive year by Forbes Magazine. Innovation starts with creating an inclusive culture and growing a diverse workforce. We are proud of the supportive work culture we’ve created and will continue finding ways we can further build upon the progress we’ve made. A copy of this year's report can be found here. Photos taken by Nhan T. Nguyen.

Fraud attacks continue to increase, and businesses and consumers alike are recognizing the need for more effective preventative measures. In June 2016, we launched the industry’s first open platform designed to catch fraud faster, improve compliance, and enhance the customer experience. Experian CrossCoreTM has put more control in the hands of fraud teams and it continues to receive global recognition for its impact in the industry. We are proud to announce that CrossCoreTM has been named a market leader for fraud prevention by Cyber Defense Magazine’s 7th Annual InfoSec Awards. Judged by an independent panel of certified security professionals, the InfoSec Awards recognize the best ideas, products and services in the information technology industry. In the past year, the platform was also named best fraud prevention innovation by Cybersecurity Breakthrough and as best cybersecurity initiative of the year by CIR Magazine. Since 2016, Experian has been proud to serve organizations looking for better ways to get more out of their existing fraud and identity systems and to more effectively deploy new products and offers, while improving the customer experience and minimizing risk. According to Experian’s 2019 Global Identity & Fraud Report, 55% of businesses reported an increase in online fraud-related losses over the past 12 months, predominantly around account origination and account takeover attacks. Our study shows that consumers value security and convenience. They also expect to be recognized and met with a personalized experience. Businesses can deliver both security and convenience, but to do so, they need to apply the right tools and relevant information. CrossCoreTM is helping fraud teams around the world accomplish this by adapting and deploying strategies that keep up with the pace of fraud while reducing burdens on IT and data science teams. Learn more about CrossCore.

The Human Rights Campaign (HRC) Foundation has recognized Experian with a 100 percent score on their 2019 Corporate Equality Index (CEI), earning the distinction as one of the “Best Places to Work for LGBTQ Equality”. The CEI is the nation’s premier benchmarking tool in evaluating corporate policies and practices related to LGBTQ workplace equality. We are honored to have received such top marks alongside some of America’s most respectable companies. “Our mission as a company is to create greater financial inclusion for consumers, but inclusion also means creating an open and accepting workplaces where everyone can thrive,” said Craig Boundy, former chief executive officer of Experian North America. “We work hard to make diversity and inclusion a priority in our company culture, and our efforts are showing real results.” We strive to celebrate our company’s diversity by creating an inclusive workplace environment where employees feel supported and appreciated. We’ve launched initiatives and implemented policies that have solidified our commitment to being a strong ally to the LGBTQ community. Our dedication to foster a supportive work culture for our LGBTQ employees is exemplified by such practices as: Our progressive benefit programs, which include transgender services and offer equal coverage to same and different-sex domestic partners and spouses. Our non-discrimination and equal employment policies go beyond federal requirements, ensuring equal treatment regardless of “gender identity” or “sexual orientation.” Our dedication to be inclusive through executive sponsorship and the Power of YOU initiative which facilitates Employee Resource Groups and Clubs. "The top-scoring companies on this year's CEI are not only establishing policies that affirm and include employees here in the United States, they are applying these policies to their global operations and impacting millions of people beyond our shores," said HRC president Chad Griffin. Practicing an inclusive work culture has always been one of our top priorities and being honored by the HRC demonstrates our dedication to that goal. We are proud to support our LQBTQ employees, along with the diverse work force that make up the Experian family. For more information on the 2019 Corporate Equality Index, download the HRC report.

More areas of the business are leveraging data and insight around customers than ever before. Today’s digital consumer puts more pressure on organizations to provide personal interactions across all industries, even when that individual is not interacting face-to-face. In order to accomplish that monumental feat, businesses are turning to their data assets to give them the insights they so desperately need. But that is no easy task. We find that most organizations lack trust in their data, typically due to outdated and ineffective data management practices. Businesses can no longer wait for others within the organization to improve the quality of their data. Many are looking to take more control themselves. In fact, according to a recent Experian study, 75 percent of respondents believe data quality responsibility should ultimately lie with the business with occasional help from IT. The rise of the business user is putting more pressure on the tools they leverage. While data quality is a continuous practice that requires constant care, it is certainly enabled by technology. That technology needs to be easy-to-use, intuitive, and provide value back to the business quickly. This week, the 2019 Gartner Magic Quadrant for Data Quality Tools was issued. The report provides an overview of the players in the space and the "key capabilities that organizations need in their tool portfolio, if they are to address the increasing importance and urgency of data quality." The business user is reshaping the data quality market. Now, rather than looking at just features and functions, new Experian research shows that the ease of use by business users and the ability to work with existing technology are more important. These tools need to be designed differently than they have in the past. 56% of businesses say their IT department doesn’t fully understand the data management needs of the business. That means that organizations need to put their data more in the hands of the people who leverage it every day. At Experian Data Quality, we believe in empowering business users to better understand their data assets in order to transform their businesses. We offer easy-to-implement, easy-to-use tools that are designed to help businesses maximize their data insight and build trust in their information. We want our clients to tackle their projects with speed and agility, giving them the confidence and clarity to put their data to good use. We are proud to be named a ‘Challenger’ once again in Gartner’s 2019 Magic Quadrant for Data Quality Tools. We believe in the changing nature of the business and are working to challenge the status-quo in our industry and for our clients. Access the Gartner 2019 Magic Quadrant for Data Quality Tools report.

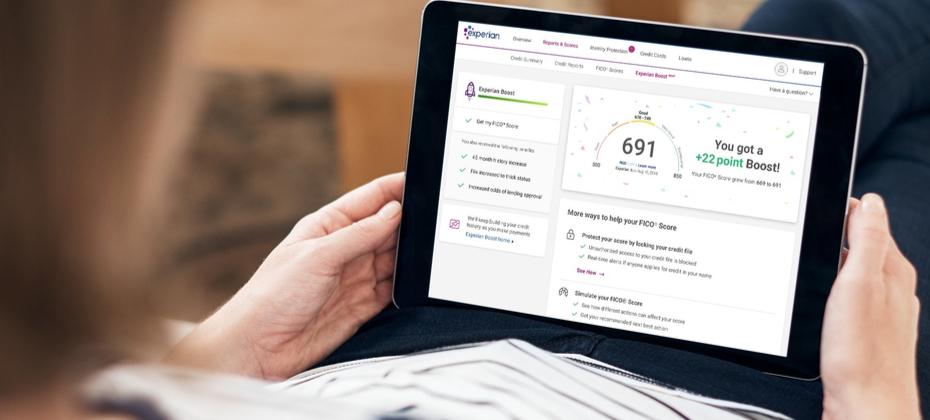

Today marks a notable milestone in our company’s history and for consumers. Today we officially launched Experian Boost, a free tool that, for the first time, will allow millions of consumers to add positive payment history directly into their credit file for an opportunity to instantly increase their credit score. For the past several years, we have been working to develop new products and innovations that will disrupt the credit industry and help improve the financial lives of consumers. This commitment to financial inclusion has defined us and created a real sense of purpose for everyone who works here – and that purpose is realized with the launch of Experian Boost today. There are more than 100 million Americans who don't have access to credit today. A low credit score, due to a thin file or incomplete information, may force these consumers to rely on high interest credit cards and loans. The fact that many of these consumers consistently and responsibly pay cell phone and utility bills on time every month hasn’t seemed to matter. At Experian, we know that’s not right. A good credit score is a gatekeeper to better financial opportunities. We need to develop products and services that make achieving and maintaining a good score easier, not harder. As the consumer’s bureau, we want to ensure that as many people as possible can access and participate in the financial system, and we believe everyone deserves a fair shot at achieving their financial dreams. We have a fundamental mission that is shared by our colleagues around the world: to strive to be a champion for the consumer. With Experian Boost, we're bringing that mission to life and I couldn’t be prouder. Many of our colleagues at Experian worked tirelessly over the last few years to make this day a reality. To everyone who’s played a part, I offer my very heartfelt thanks. It’s truly a great day to be a part of Experian, and we know there will be a lot of great days ahead for all the consumers who will benefit from having their credit score truly reflect who they are. To find out more about the Experian Boost, please visit experian.com/boost.

Financial exclusion is a global issue with an estimated 1.7 billion adults currently ‘unbanked’ . Experian’s core mission is to help bring financial inclusion to every adult in the world. There are currently millions of ‘thin file’ consumers and SMEs in sub-Saharan Africa. These are consumers with limited information on a traditional credit bureau or have no information at all, so-called ‘invisibles’, who find themselves excluded from mainstream finance. They often face more difficulty – or higher costs - when applying for financial products or services. That’s why we are proud to announce today the launch of a ground-breaking new smartphone app, GeleZAR, in South Africa, which aims to bring more micro-entrepreneurs into the mainstream economy and ensure they get the credit score they deserve.. Using the expertise of our global innovation hubs, we have developed a unique financial education and credit scoring mobile app. GeleZAR is designed to educate entrepreneurs and individuals on how to manage their finances, budget and credit score in a fun, entertaining and digestible way. It can also advise individuals on how to maintain a good credit health and recommends remedial actions where needed. In partnership with a local South African consumer and fintech developer, Experian designed the app specifically for entry-level smartphones. We are also working with one of the largest low-cost mobile phone retailers in Africa to trial the app which has been pre-installed on a range of its entry-level smartphones.. The intention is to extend the rollout and make the app accessible for free on more than six million devices annually. Working with alternative data that an individual user consents to share on the app, GeleZAR will be able to assess an individual’s stability, build a credit profile and potentially improve their credit score. This in turn could enable them to access a broader range of financial products at more affordable interest rates. This is a great example of how Experian is innovating to find new ways to empower our customers while uplifting societies. It also fulfils our passion for financial inclusion and the accurate assessment of affordability. Experian’s cutting edge technological capabilities enable us to use the power of data to transform lives, businesses and economies for the better. Through our pioneering work in this space we hope to help consumers around the world on their credit journey. GeleZAR is just one of the ways we are delivering on our mission to build and improve the credit files of millions of people in South Africa and beyond.

Today I testified before the U.S. House Committee on Financial Services. Many important questions were asked: Are we doing enough to ensure the accuracy and security of consumer data? What are we doing to help promote financial inclusion so that millions of American consumers can finally gain access to the credit they deserve and need? On behalf of everyone at Experian, I was proud to share with the committee that financial inclusion is part of our sense of purpose. This sense of purpose is what drove us to create game-changing initiatives like Experian Boost, which will help millions of Americans instantly increase their credit scores and gain access to better financial opportunities. I also commented to the committee that nothing was more important to us than ensuring the security and accuracy of consumer data, and our mobile-optimized online dispute resolution service is evidence of that ongoing commitment. You can read the full text of my written testimony here. However, the issues discussed today need to be part of a larger and ongoing dialogue. Credit is vital to buying a place to live, a car to drive and paying for everyday expenses. We know we have a special responsibility to play in what is arguably one of the most effective credit ecosystems in the world. We take that responsibility very seriously. But we also know that winning the trust of consumers is something we need to consistently earn. We hold ourselves accountable for doing that every day and agree with committee members that everyone involved in consumer credit should do the same. We are proud of what we have accomplished so far, but we know we can and must go further. We need to constantly strive to reinvent what is possible by leveraging new technologies and innovative solutions. Today’s consumers and even our lending customers should expect nothing less from us. And Congress has an important role to play, too. We strongly support legislative initiatives like the Credit Access and Inclusion Act, which would amend the Fair Credit Reporting Act and allow positive consumer credit information, such as on-time payment histories, to be shared with consumer reporting agencies. This proposed legislation would also remove barriers to financial inclusion, such as state and local laws that prevent public utilities from sharing positive customer payment data. While many voices need to contribute to a robust dialogue on the future of the credit economy, it seems clear that the most effective solutions will stem from consumer demand and not legislation or regulation. There are over 100 million American consumers who don't have access to credit today, either because their credit scores are too low, or because they don't have enough credit history. Most of these individuals have never heard of Experian and have little if any idea of what we do. That’s ok. We know the struggles they face and we have some ideas on how we can help make a difference. In many ways we already are and we’re ready to roll up our sleeves to do even more in the future. Millions are counting on us.