Featured

Featured

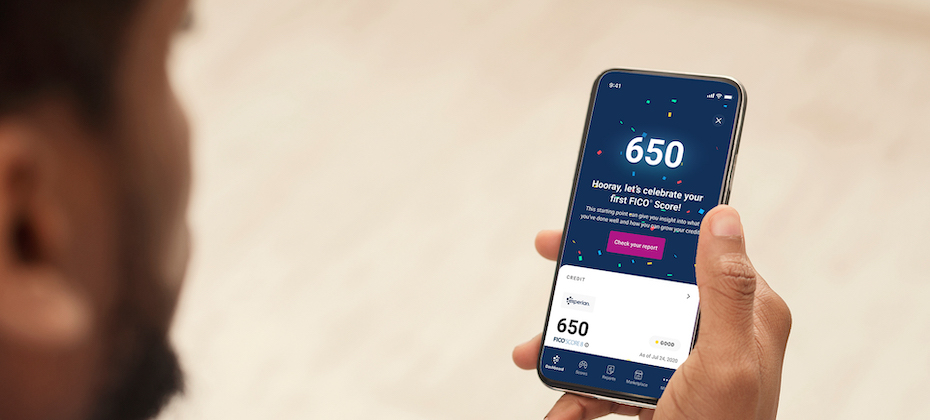

For the past several years, we’ve been on a journey to improve financial access for millions of people around the world. We’ve made it our job to help consumers get the best financial outcomes. This focus on consumers defines us and informs everything we do. In 2019, we reshaped how consumers access credit with Experian Boost™. Since then, nearly 9 million consumers have connected to the product. While we are proud of what we have and continue to accomplish with Experian Boost, we know there is more to be done to ensure more consumers can access fair and affordable credit. Improving outcomes for underserved consumers When credit is used responsibly, it can create new opportunities from getting a college degree, buying a car or home and starting or expanding a business. These are milestones that help people establish careers, build wealth and ultimately achieve greater financial freedom. Yet, there are millions of consumers who are unable to participate in the mainstream financial ecosystem today because they don’t have a financial identity. Without an established credit history, these consumers struggle to qualify for everything from an auto loan to a mortgage and even an apartment or employment. This problem more frequently impacts communities of color with 28 percent of all Black and 26 percent of all Hispanic consumers currently unscoreable or credit invisible. Increasing financial inclusion depends on creating opportunities for underrepresented consumers to succeed. And this starts with ensuring all consumers have a financial identity. Bringing financial power to all with Experian Go The challenge is many consumers who are not in the credit ecosystem today are unsure where to start. Today, we reached a pivotal and exciting milestone in our commitment to consumers with the launch of Experian Go™. This new program opens the front door to the financial ecosystem for millions of consumers by helping them establish their financial identity and move from credit invisible to scoreable. Within minutes, credit invisibles can have an authenticated Experian credit report, tradelines and a credit history by using Experian Boost™[1], and instant access to financial offers through Experian Go. In fact, early analysis shows 91 percent of consumers with no credit history who connect to Experian Boost, a free feature that allows users to contribute their on-time cell phone, video streaming service, internet, and utility payments directly to their Experian credit report, can become scoreable in minutes with an average starting near-prime FICO® Score of 665[2]. Throughout the experience, we’ll provide ongoing credit education and access to tools like Experian Boost™ to make it easy for consumers to learn how to use and responsibly grow their credit histories. Until now, our industry has struggled to verify the identity of credit invisibles. Over the last several years, we’ve introduced new identity verification technologies to our toolbox. With Experian Go, we’re leveraging these technologies to verify a credit invisible’s identity and get them in the front door to start building credit. No other credit bureau or organization is doing this today. During our pilot, we helped more than 15,000 consumers establish their credit history. This is a great start. Now that Experian Go has launched, I look forward to helping millions more consumers get the credit they deserve. To learn more about Experian Go, visit www.experian.com/go. [1] Results may vary. Some may not see improved scores or approval odds. Not all lenders use Experian credit files, and not all lenders use scores impacted by Experian Boost. [2] Experian analysis based on an anonymized and statistically relevant sample of consumer credit reports with only Experian Boost tradelines included and FICO® Scores. December 2021.

The past few years have sparked a swift digital transformation that subsequently drove a rapid increase in fraud. In fact, fraudsters have gotten more creative, putting businesses and consumers at risk now more than ever. At Experian, we predict that more intricate challenges lie ahead and are dedicated to helping businesses combat fraud threats. Here’s what we expect in 2022: 1. Buy Now, Pay Never – The Buy Now, Pay Later (BNPL) space has grown massively recently. In fact, the number of BNPL users in the US has grown by more than 300 percent per year since 2018, reaching 45 million active users in 2021 who are spending more than $20.8 billion . Without the right identity verification and fraud mitigation tools in place, fraudsters will take advantage of some BNPL companies and consumers in 2022. Experian predicts BNPL lenders will see an uptick in two types of fraud: identity theft and synthetic identity fraud, when a fraudster uses a combination of real and fake information to create an entirely new identity. This could result in significant losses for BNPL lenders. 2. Beware of Cryptocurrency Scams – Digital currencies, such as cryptocurrency, have become more conventional and scammers have caught on quickly. According to the FTC, investment cryptocurrency scam reports have skyrocketed, with nearly 7,000 people reporting losses totaling more than $80 million from October 2020 to March 2021 . In 2022, Experian predicts that fraudsters will set up cryptocurrency accounts to extract, store and funnel stolen funds, such as the billions of stimulus dollars that were swindled by fraudsters. 3. Double the Trouble for Ransomware Attacks – In the first six months of 2021, there was $590 million in ransomware-related activity, which exceeds the value of $416 million reported for the entirety of 2020 according to the U.S. Treasury's Financial Crimes Enforcement Network . Experian predicts that ransomware will be a significant fraud threat for companies in 2022 as fraudsters will look to not only ask for a hefty ransom to gain back control, but criminals will also steal data from the hacked company. This will not only result in companies losing sales because of the halt caused by the ransom attack, but it will also enable fraudsters to gain access and monetize stolen data such as employees’ personal information, HR records and more – leaving the company’s employees vulnerable to personal fraudulent attacks. 4. Love, Actually? – Because more consumers went on dating apps and social media to look for love during the pandemic, fraudsters saw an opportunity to create intimate, trusted relationships without the immediate need to meet in-person. The FBI found that from January 1, 2021 — July 31, 2021, the FBI Internet Crime Complaint Center received over 1,800 complaints, related to online romance scams, resulting in losses of approximately $133 million. Experian predicts that romance scams will continue to see an uptick as fraudsters take advantage of these relationships to ask for money or a “loan” to cover anything from travel costs to medical expenses. 5. Digital Elder Abuse Will Rise – According to Experian’s latest Global Insights Report, there has been a 25 percent increase in online activity since the start of Covid-19 as many, including the elderly, went online for everything from groceries to scheduling health care visits. This onslaught of digital newbies presents a new audience for fraudsters to attack. Experian predicts that consumers will get hit hard by fraudsters through social engineering (when a fraudster manipulates a person to divulge confidential or private information) and account takeover fraud (when a fraudster steals a username and password from one site to takeover other accounts). This could result in billions of dollars of losses in 2022. As a leader in fraud prevention and identity verification, Experian offers a full suite of automated tools that harness data and analytics to prevent fraud and mitigate losses. Learn more about Experian's fraud management tools.

For the ninth year, the Orange County Register has named Experian North America as a Top Workplace, securing the #1 ranking for the second consecutive year. The award, which is based on employee feedback in a survey of hundreds of leading companies in Orange County, recognizes our company’s culture of inclusion, and our commitment to employees and communities. Orange County is the home of our North America operations, and we are especially honored to be recognized again for our inclusive work environment and achieving higher performance while giving back. This honor demonstrates the talent and compassion of all the people who work at Experian. Thank You All our decisions are driven by our desire to ensure our employees feel valued and protected. As part of this, we issued a ‘Thank You’ Share Award to all employees at the beginning of this year to recognize perseverance through the pandemic, giving thousands of employees an equity stake in the company. Coming Together Our Employee Resource Groups (ERGs) continue to grow and support employees in different ways, which include activities that bring employees together internally to serve their communities externally. For example, our Asian American ERG worked closely with Pan-Asian leadership organization Ascend to support the Asian American community and employees, considering increasing discrimination and xenophobia during the pandemic. Together they kicked off Feed Your Hospital, which facilitated the delivery of meals to frontline COVID-19 healthcare workers by supporting local Asian restaurants. Meals were purchased at the restaurants and delivered to participating hospitals. The campaign raised funds for hospitals in Orange County. Social Good This year, we also awarded two OC-based organizations with major grants – the OC Hispanic Chamber of Commerce and TGR Foundation (a Tiger Woods Charity). For the OC Hispanic Chamber of Commerce, we funded and facilitated credit education initiatives for the Youth Chamber Program – funds went towards scholarship awards and event costs. We also added credit education to the ‘Pre-Venture Business Program’ curriculum – with funds going into marketing, training, one-on-one consulting, and event costs offered in both Spanish and English. For the TGR Foundation grant, we are working on ongoing projects with the foundation to support credit education, small business entrepreneurship, homeownership, and financial inclusion efforts. In total, employees volunteered more than 900 hours to Orange County-based nonprofits and Experian matched funds to those organizations that employees volunteered with and donated to. Our employees continue to help people who are facing unprecedented and unforeseen challenges. Different groups and employees of all levels are working together to help our clients, customers and communities persevere. We are honored that the Orange County Register continues to recognize our tireless efforts to make a difference in the communities in which we live and work.

The United Nations identifies removing poverty as one of its 17 Sustainable Development Goals. There’s a reason it’s number one on their list: Access to affordable financial services opens the door to opportunities for people to transform their lives – from homes and healthcare to education and entrepreneurship.. At Experian, our focus is on increasing access to financial services, improving financial literacy and building consumer confidence; we help people take control of their financial health. We are using the power of data innovation to transform lives and help businesses grow, improving financial health for people around the world. We created a dedicated Social Innovation Programme to fund, build and recognize products that will have a positive impact on the financial health of consumers. Between 2013 and April 2021 we have invested over US$8m across 29 product ideas. Eighteen of those products have launched, reaching 61 million people, many of whom are from financially vulnerable backgrounds. In June, we opened applications for our latest round of annual Social Innovation funding and asked teams to come up with new innovative products that positively impact the financial health of our consumers and use data for good. Of these, seven projects were shortlisted and presented to our Social Innovation Committee, which I am privileged enough to chair. It was a tough decision, but we chose three truly diverse projects to receive this year’s Social Innovation funding and we are really excited about what they could achieve. These projects will give millions of people in India access to a more positive loan decision, allow citizens in the UK to manage their vulnerability data across multiple organisations, and help farmers in Brazil to access the credit they need to keep their businesses going. Between them, these three projects alone have the potential to reach over 85 million people in the next five years, which is a truly exciting prospect. We are proud to celebrate our culture of purpose-led innovation. Our social innovation products have reached 61 million people since 2013 and we aim to reach 100 million by 2025. Read more about how we are helping to create a better tomorrow.

This year is the first time we are observing International Day of Persons with Disabilities (IDPD), but Experian has been working to support those who identify as part of this community long before now. I share the story of my colleague, software engineer Andy Willard. While Andy has been with Experian for 25 years, he didn’t share his deteriorating eyesight condition with managers at first. “Truthfully, I didn’t ask for a lot. I had the position and I don’t want to rock the boat or put a spotlight on myself. But in 2000, I stopped driving and rode the bus to work a lot. That would take an hour and a half each way. I finally went to my manger and requested telecommuting days, and at the time no one was getting those,” Andy said. His managers immediately agreed and he works 100 percent remotely, long before the pandemic. Experian provided tools like larger monitors and accessibility software to assist with on-screen reading. He appreciates the technology and the time the company allows him for classes to learn about new ways to adjust to working with his visual impairment. But, there can still be some challenges, like when a company-wide software update doesn’t automatically reconnect his system with the screen reader or screen magnifying tools. We know we still have work to do. Being named a Best Place to Work for Disability Inclusion earlier this year let us know we’re on the right track; and we’re excited to continue developing our partnerships with Disability:IN and the National Disability Institute, for which our Chief Diversity, Equity and Inclusion Officer Wil Lewis is a board member of both. As the co-executive sponsor of the ASPIRE employee resource group, which focuses on mental health, caregiving and disabilities, we want our coworkers to know they are supported and we will do all we can to ensure they continue to grow and develop their careers, as Andy did. His first job at Experian was as an analyst, then moved on to software development and then into a software engineering role. I’m proud of the work we are doing at Experian. We’ve made great strides forward to support an inclusive work environment for everyone, and there’s more to be done. I encourage my coworkers to share their stories as Andy did so we know where we should focus our efforts and support our colleagues in making Experian an employer of choice for people who live with disabilities.

It’s hard to believe that Christmas is just around the corner. Many of us will be starting to think about (or if you’re very organised, have already finished) their Christmas shopping. Black Friday sales will kick-off this week’s online bonanza, as bargain hunters pursue the best deals online. However, while we are all busy getting into the spirit of things, it has never been more vital that we do what we can to protect ourselves from identity fraud. As the popularity of the Black Friday sales season has grown, we’ve also seen a marked increase in the volume of fraudulent activity, as criminals use stolen or illegally obtained personal details to apply for credit in someone else’s name. According to our latest analysis of National Hunter Fraud Prevention Service data, the fraud rate for credit card applications has increased by 43% in the last three months to 69 confirmed fraudulent applications per 10,000 applications. It’s expected the rate will rise even more in December, as criminals look to take advantage. It’s naturally worrying if you are a victim of ID fraud. The fraudster will likely have tried to obtain credit in your name – perhaps on multiple occasions – and you’ll be concerned about how and from where they got hold of your information in the first place. Fortunately, there’s a host of things you can do to protect yourself. Checking your credit report on a regular basis is one of the best ways to spot if fraudsters have used your personal information to attempt to access credit, and our dedicated teams can help guide you through the steps if the worst happens and your identity has been stolen. New services and solutions are also helping companies identify and prevent more fraud. In part, the rise in rates can be attributed to better detection, helping fraud teams focus their energy on fraudulent applications, rather than genuine ones. So, while you’re browsing for gifts this festive season, make sure you are mindful of those looking to spoil your Christmas spirit. Help is available and you can read more on how to guard yourself against identity fraud on our website.

Growing up, my family rarely talked about money. So, in college, when I had the opportunity to get my first credit card, I also found myself in a little trouble when the first bill came. Most of us simply don’t learn about money matters until we find ourselves in these difficult situations. That’s one of the reasons why we’re excited to launch a creative and new program to teach young adults about the basics to building a financial legacy. “Protect The Bag” debuts today. It’s a six-part web series produced in partnership with Grammy-award winning artist, entrepreneur, author and community advocate, Lecrae. We first met Lecrae when he supported a United for Financial Health initiative in his hometown last year. “Protect The Bag” is a hip master class with finance and credit basics presented in an authentic way. Lecrae describes it as “edutainment” that includes scripted skits and interviews with everyday people. His friends Tyler Lockett, Coco Jones and WHATUPRG, among others, join him and share their financial health journeys as part of the shows as well. “Protect The Bag” is not just about credit. It’s about all aspects of personal finance. We’re proud of this innovative way to help consumers understand topics like saving, investing, budgeting and identity protection through someone they admire and trust. We hope you tune in every Tuesday, starting today, for the next six weeks. Episodes will appear on Lecrae’s YouTube channel starting at 7:00 p.m.EST/4 p.m.PST.

Every day at Experian, we are investing in new technologies, talented employees and innovation to help all of our clients maximize every opportunity we have to offer. We are honored the work performed under Eric Haller in our DataLabs received the San Diego Top Tech Awards of 2021. The awards honor technology executives who truly stand out by innovating. In 2010, Experian DataLabs was established to develop and drive creation of innovative products generated from breakthrough experimentation leveraging artificial intelligence, machine learning, advanced analytics and data assets from a variety of sources across Experian’s businesses in 37 countries. Eric originally pitched the idea of DataLabs and received funding for 8 people to begin the first lab in San Diego. Since then, Experian DataLabs has expanded its labs to London, Sao Paulo and Singapore. New products developed in the labs cover mobile, payments, consumer & commercial credit, fraud, targeted marketing & healthcare. During the last year and a half, Eric and his team continue to develop offerings and create new technologies to support the community. In May 2020, in conjunction with the company’s healthcare business, Experian DataLabs developed a free interactive heat map of geographic populations at-risk of being most susceptible to developing severe cases of COVID-19. The Experian COVID-19 Outlook and Response Evaluator (CORE) tool is guiding healthcare organizations and government agencies with planning for the “new normal” and COVID-19 recovery. In addition, Experian DataLabs develop other important initiatives such as the Covid Radar in Brazil to help people, small businesses and governments. Produced in collaboration with 50 organizations, including the United Nations, Amazon, SAP and the University of Sao Paulo, COVID Radar helps the coalition track where supplies are needed most. The coalition delivered tools, equipment, PPE and other supplies to Brazil’s most vulnerable zones. The second part of the initiative focused on aggregating and analyzing the data to create forecasting models that allowed researchers to track various key indicators that has helped dictate what officials should do with lockdowns and provide data around ICU beds and assess what the demand is. As part of Experian’s culture of innovation, Eric inspires his team to innovate due to his inclusive nature, openness, and willingness to listen to new ideas. The AI and revolutionary technology that Experian DataLabs is utilizing is enabling the company to continuously fuel new projects in its pipeline and turn ideas like the COVID Radar and the CORE heat map into a reality faster than ever before.

We believe every individual deserves the opportunity to reach their fullest financial potential through fair and affordable access to credit. While leveraging data, analytics and technology are key components of this, we must also ensure consumers understand how credit works and the ways it can be used as a financial tool throughout their lifetimes. This notion is the impetus behind our annual State of Credit report. Now in its twelfth year, this report takes a close look at how consumers are managing their credit histories to educate them about the factors influencing their financial health. This year’s report shows the average credit score has climbed to 695 – the highest point in more than 13 years. Many consumers were managing credit well before the pandemic’s arrival and the accommodations afforded by the Coronavirus Aid, Relief and Economic Security (CARES) Act may have helped consumers protect their financial health. At the same time, stay-at-home orders and record savings levels may have contributed to fewer missed payments, lower credit utilization rates and lower debt. While these findings are positive, we recognize they do not tell the full story. There are tens of millions of consumers who lack fair access to credit because of a limited credit history. Low-income consumers and communities of color are disproportionately credit invisible, preventing them from obtaining low-cost, traditional financial services. There is significantly more work to do to ensure all consumers have fair access to credit. We are committed to working with lenders, regulators, businesses, consumers and partners to eliminate credit invisibility and improve financial equity and access. Our meaningful partnership with Operation HOPE, the largest financial literacy nonprofit in the U.S., is one example of this commitment brought to life. Operation HOPE has goals that align with ours: to uplift disenfranchised youth and adults from poverty to thriving in a credit ecosystem. Together with Operation Hope, we are making a tangible difference in financial inclusion by helping consumers raise their credit scores through financial coaching, education and tools like Experian Boost. As part of this year’s State of Credit report, we also helped introduce Operation HOPE’s new HOPE Financial Wellness Index. This new tool will be a valuable resource for the Hope Research Institute who plans to leverage it to identify the communities most in need of financial literacy programs. “While consumers on average are managing their credit histories well, we know there are many communities in critical need of more financial education and resources,” said John Hope Bryant, Operation HOPE founder and CEO. “By helping people raise their credit scores, we are empowering them to take advantage of one of our nation’s most democratic tools. From housing and employment to healthcare and education, credit worthiness can be leveraged to improve our overall quality of life. We’re committed to using the HOPE Financial Wellness Index as a force for good in the communities we serve.” Through our investments in expanded data, technology, advanced analytics and new innovations, we will continue to help lenders identify consumers who are excluded from the credit ecosystem, but who can fulfill their financial obligations and pay responsibly. At the same time, we will continue to take strides that empower consumers to take control of their financial lives. For additional free educational resources and more information about this year’s State of Credit report, I encourage you to visit the links below. State of Credit report findings: https://www.experian.com/blogs/insights/2021/09/state-of-credit-2021 Join Experian’s weekly #CreditChat hosted by @Experian on Twitter with financial experts every Wednesday. Bilingual and Spanish speakers are also invited to join Experian’s monthly #ChatDeCrédito hosted on Twitter at 3 p.m. Eastern time beginning September 16. The Ask Experian blog includes answers to common questions, advice and education about credit Positive telecom, utility and streaming service payments can be added to your Experian credit report by visiting experian.com/boost Additional resources available at https://www.experian.com/consumereducation