News

What’s happening in our industry and what we’re doing

Experian had the honor of celebrating innovative achievements in marketing with a few of our superstar clients at the 2016 Marketing&Tech Innovation Awards presented by Direct Marketing News and The Hub. The second annual awards program honors achievements in marketing leveraging data and technology. Three Experian Marketing Services’ client programs were recognized for their innovation in analytics, email marketing and omnichannel marketing.

Experian had the honor of celebrating innovative achievements in marketing with a few of our superstar clients at the 2016 Marketing&Tech Innovation Awards presented by Direct Marketing News and The Hub. The second annual awards program honors achievements in marketing leveraging data and technology. Three Experian Marketing Services’ client programs were recognized for their innovation in analytics, email marketing and omnichannel marketing.

Does knowing where fraud takes place matter? That is the question we asked ahead of compiling data from 2015 to show where billing and shipping fraud attacks occur in the United States. The answer is Yes, it does matter. With more than 13 million fraud victims in 2015,[1] assessing where fraud occurs is an important layer of verification when performing real-time risk assessments for e-commerce. Experian analyzed millions of e-commerce transactions to identify fraud attack rates across the United States for both shipping and billing locations. You can view the map to see the attack rates for all states and download the top 100 ZIP Code rankings as well. Click here for the highlights and the findings.

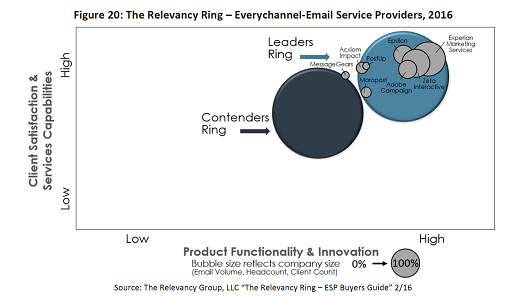

The Experian Marketing Suite is recognized by The Relevancy Group for its innovative technology and functionality, offline and addressable TV solutions for marketers.

The Experian Marketing Suite is recognized by The Relevancy Group for its innovative technology and functionality, offline and addressable TV solutions for marketers.

This Forbes business story about how the Experian DataLabs was established illustrates the innovation and entrepreneurial spirit that is alive and well at Experian today.

This Forbes business story about how the Experian DataLabs was established illustrates the innovation and entrepreneurial spirit that is alive and well at Experian today.

TMCnet’s premium technology blog, TechZone360 featured a byline article by Eric Haller, Executive Vice President of Experian DataLabs about the growing demand for data scientists. According to Haller, because data science is in its infancy, there’s tremendous room for innovation.

TMCnet’s premium technology blog, TechZone360 featured a byline article by Eric Haller, Executive Vice President of Experian DataLabs about the growing demand for data scientists. According to Haller, because data science is in its infancy, there’s tremendous room for innovation.

The American economy rises and falls on the successes of the small business community. As a major contributor to job growth, as well as innovation, small businesses have laid the foundation toward our country’s economic success. But as important as small businesses are to financial progress of our economy, some business owners have experienced their own growth challenges along the way.

The American economy rises and falls on the successes of the small business community. As a major contributor to job growth, as well as innovation, small businesses have laid the foundation toward our country’s economic success. But as important as small businesses are to financial progress of our economy, some business owners have experienced their own growth challenges along the way.

This Q&A interview that appeared on Monster.com with Dr. Shanji Xiong, Experian DataLab’s global chief scientist, discusses his career and provides advice for data scientist hopefuls.

Good data is a critical part of building a robust business strategy. Organizations use actionable data insight to improve the customer experience, drive operational efficiencies, leverage cost savings, and enhance the bottom line. In fact, the majority of sales decisions are expected to be driven by customer data by 2020.

Good data is a critical part of building a robust business strategy. Organizations use actionable data insight to improve the customer experience, drive operational efficiencies, leverage cost savings, and enhance the bottom line. In fact, the majority of sales decisions are expected to be driven by customer data by 2020.

The Relevancy Group’s The Marketer Quarterly recognized Experian’s contributions to outstanding email marketing campaigns