News

What’s happening in our industry and what we’re doing

It was extremely gratifying to see Experian named a Top Workplace by the Orange County Register this week.

No surprise to me. (Though I may be partial.)

To be sure, this is an important milestone. Although we have been part of the Orange County community for 40+ years, this is the first time we have participated in the Top Workplaces Survey. Additionally – and importantly – this was a recognition that was earned by the feedback of our employees who genuinely appreciate their work environment and the Experian culture. That means we, as a company, are putting the right focus on our our employees – or as we prefer to call them, our team members.

It was further gratifying when Steve Churm, vice president of the OC Register and Freedom Communications, said: “The Orange County Register's top workplace initiative identifies 100 companies that truly understand the essential link between a positive corporate culture and bottom line performance and growth. Experian is one of those great companies in the heart of Orange County that recognize their key assets are their employees, and that their well-being and growth drives Experian's success.”

It was extremely gratifying to see Experian named a Top Workplace by the Orange County Register this week.

No surprise to me. (Though I may be partial.)

To be sure, this is an important milestone. Although we have been part of the Orange County community for 40+ years, this is the first time we have participated in the Top Workplaces Survey. Additionally – and importantly – this was a recognition that was earned by the feedback of our employees who genuinely appreciate their work environment and the Experian culture. That means we, as a company, are putting the right focus on our our employees – or as we prefer to call them, our team members.

It was further gratifying when Steve Churm, vice president of the OC Register and Freedom Communications, said: “The Orange County Register's top workplace initiative identifies 100 companies that truly understand the essential link between a positive corporate culture and bottom line performance and growth. Experian is one of those great companies in the heart of Orange County that recognize their key assets are their employees, and that their well-being and growth drives Experian's success.”

Owning your own business is what many perceive to be as the American dream. And if you’ve been fortunate enough to make that dream a reality, then you’ve certainly heard how indispensable your business is to the country’s economy. But as invaluable as your small business is, many small business owners face daily challenges when it comes to sustainability, profitability and growth. For the last year, Experian and the Small Business Administration (SBA) have lent a helping hand to small businesses that are facing those types of challenges. As a part of their efforts, all Historically Underutilized Business Zone (HUBZone) firms and small businesses that are considered to be socially and economically disadvantaged under the SBA’s 8(a) business development program have full access to BusinessIQ Express.

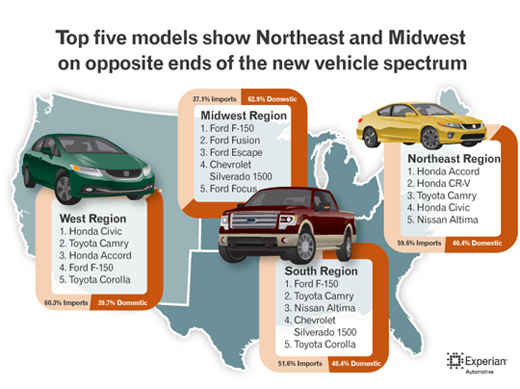

Grab a pen and paper. Jot down some differences between the Northeast and Midwest. What came to mind? Maybe it was the bright city lights of the Northeast versus the Midwest’s starlit farms? Or maybe it’s the city’s busy streets compared to quiet open fields? What you may or may not have written down is that Northeasterners prefer to drive more import vehicles than the folks in the Midwest.

According to Experian Automotive’s mid-year review of automotive market trends, in the first half of 2013, the top five new vehicle models in the Northeast region were all import brands. Conversely, as one might have guessed, American-made vehicles dominated the Midwestern roads. In the Northeast, the list was made up of the Honda Accord, Honda CR-V, Toyota Camry, Honda Civic and Nissan Altima. Out in the Midwest, Ford vehicles made up four of the top five and the Chevrolet Silverado 1500 filled out the list. The top five in order included the F-150, Fusion, Escape, Silverado 1500 and the Focus.

Grab a pen and paper. Jot down some differences between the Northeast and Midwest. What came to mind? Maybe it was the bright city lights of the Northeast versus the Midwest’s starlit farms? Or maybe it’s the city’s busy streets compared to quiet open fields? What you may or may not have written down is that Northeasterners prefer to drive more import vehicles than the folks in the Midwest.

According to Experian Automotive’s mid-year review of automotive market trends, in the first half of 2013, the top five new vehicle models in the Northeast region were all import brands. Conversely, as one might have guessed, American-made vehicles dominated the Midwestern roads. In the Northeast, the list was made up of the Honda Accord, Honda CR-V, Toyota Camry, Honda Civic and Nissan Altima. Out in the Midwest, Ford vehicles made up four of the top five and the Chevrolet Silverado 1500 filled out the list. The top five in order included the F-150, Fusion, Escape, Silverado 1500 and the Focus.

Today I’ve been reading sensational and very misleading headlines saying things like “Experian Sold Consumer Data to ID Theft Service” and “Experian Duped into Selling Social Security Nos.”

Let me share with you the actual – and factual – events that led to the investigation and subsequent arrest of the suspect in the case surrounding Court Ventures and US Info Search.

The suspect in this case obtained access to US Info Search data through Court Ventures prior to the time Experian acquired the company.

To be clear, no Experian database was accessed.

Today I’ve been reading sensational and very misleading headlines saying things like “Experian Sold Consumer Data to ID Theft Service” and “Experian Duped into Selling Social Security Nos.”

Let me share with you the actual – and factual – events that led to the investigation and subsequent arrest of the suspect in the case surrounding Court Ventures and US Info Search.

The suspect in this case obtained access to US Info Search data through Court Ventures prior to the time Experian acquired the company.

To be clear, no Experian database was accessed.

![]()

This guest post is from Rod Ebrahimi, CEO of ReadyForZero

At ReadyForZero, our focus has always been on helping people pay off debt and take control of their finances so they can begin building wealth. It’s a mission that has inspired us since our very first user. We started out very small, when I helped my girlfriend make a spreadsheet to organize her student loans. After that, my co-founder Ignacio Thayer and I realized that many of our friends and loved ones had debt. We decided it was our challenge to create a tool that would help them. Focusing on this mission has helped us create the best debt management tool in the industry. Our users are regular people all across the U.S. who are tired of being burdened by their debt and ready to become debt free.

Underscoring Experian’s goal to help consumers and be an advocate for credit education, the National Foundation for Credit Counseling (NFCC) last week awarded Victor Nichols, CEO of Experian North America its “Making the Difference” award from at their Annual Leaders Conference in Denver.

This prestigious award is presented to organizations that have made significant contributions to assisting consumers with financial literacy, awareness and education, furthering the NFCC’s mission, visions and programs through a national presence.

Mr. Nichols attended the conference to accept the award and to speak to the attendees about Experian’s vision and commitment to financial literacy and consumer empowerment.

Underscoring Experian’s goal to help consumers and be an advocate for credit education, the National Foundation for Credit Counseling (NFCC) last week awarded Victor Nichols, CEO of Experian North America its “Making the Difference” award from at their Annual Leaders Conference in Denver.

This prestigious award is presented to organizations that have made significant contributions to assisting consumers with financial literacy, awareness and education, furthering the NFCC’s mission, visions and programs through a national presence.

Mr. Nichols attended the conference to accept the award and to speak to the attendees about Experian’s vision and commitment to financial literacy and consumer empowerment.

Consumers around the world are increasingly reliant on a variety of Internet-connected devices for everything from banking to shopping to entertainment and media. Creating relevant on-line customer experiences and preventing fraud are large and growing business challenges.

41st Parameter’s patented device identification technology will enable Experian clients and their consumers to interact on the web effectively and securely, recognizing consumers to reduce fraud losses.

Consumers around the world are increasingly reliant on a variety of Internet-connected devices for everything from banking to shopping to entertainment and media. Creating relevant on-line customer experiences and preventing fraud are large and growing business challenges.

41st Parameter’s patented device identification technology will enable Experian clients and their consumers to interact on the web effectively and securely, recognizing consumers to reduce fraud losses.

If you’re anything like the millions of people who counted down the hours until the Breaking Bad series finale, then you too were sitting on the edge of your seat waiting to see how it would all end. But now that it’s all over, what do we have to keep the memories of a show that’s captivated us for the last five years?

Fans of the show don’t have to look too far to answer that question, as vehicles used during filming are now up for auction through ScreenBid, the world’s best source for certified authentic, screen-used Hollywood memorabilia and collectibles. Experian Automotive has also joined in the effort to preserve the show’s history, as it’s providing complimentary AutoCheck vehicle history reports on most of the Breaking Bad vehicles up for auction through the ScreenBid website.

If you’re anything like the millions of people who counted down the hours until the Breaking Bad series finale, then you too were sitting on the edge of your seat waiting to see how it would all end. But now that it’s all over, what do we have to keep the memories of a show that’s captivated us for the last five years?

Fans of the show don’t have to look too far to answer that question, as vehicles used during filming are now up for auction through ScreenBid, the world’s best source for certified authentic, screen-used Hollywood memorabilia and collectibles. Experian Automotive has also joined in the effort to preserve the show’s history, as it’s providing complimentary AutoCheck vehicle history reports on most of the Breaking Bad vehicles up for auction through the ScreenBid website.

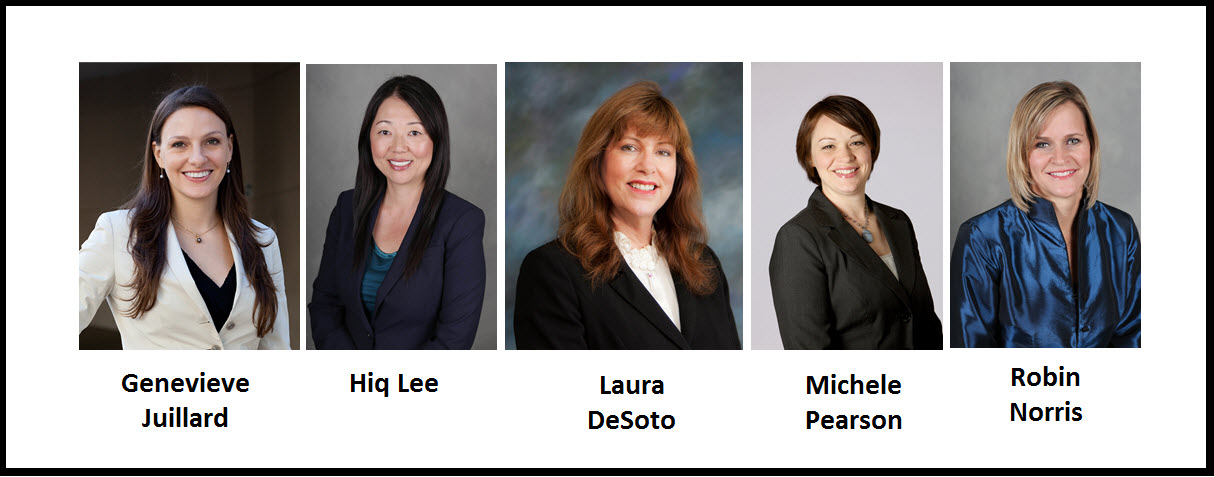

Today Experian announced five high-level appointments to its North American Credit Services group. Filling these crucial leadership roles are five seasoned women who have a proven track record of success with Experian. These women include:

Today Experian announced five high-level appointments to its North American Credit Services group. Filling these crucial leadership roles are five seasoned women who have a proven track record of success with Experian. These women include: