News

What’s happening in our industry and what we’re doing

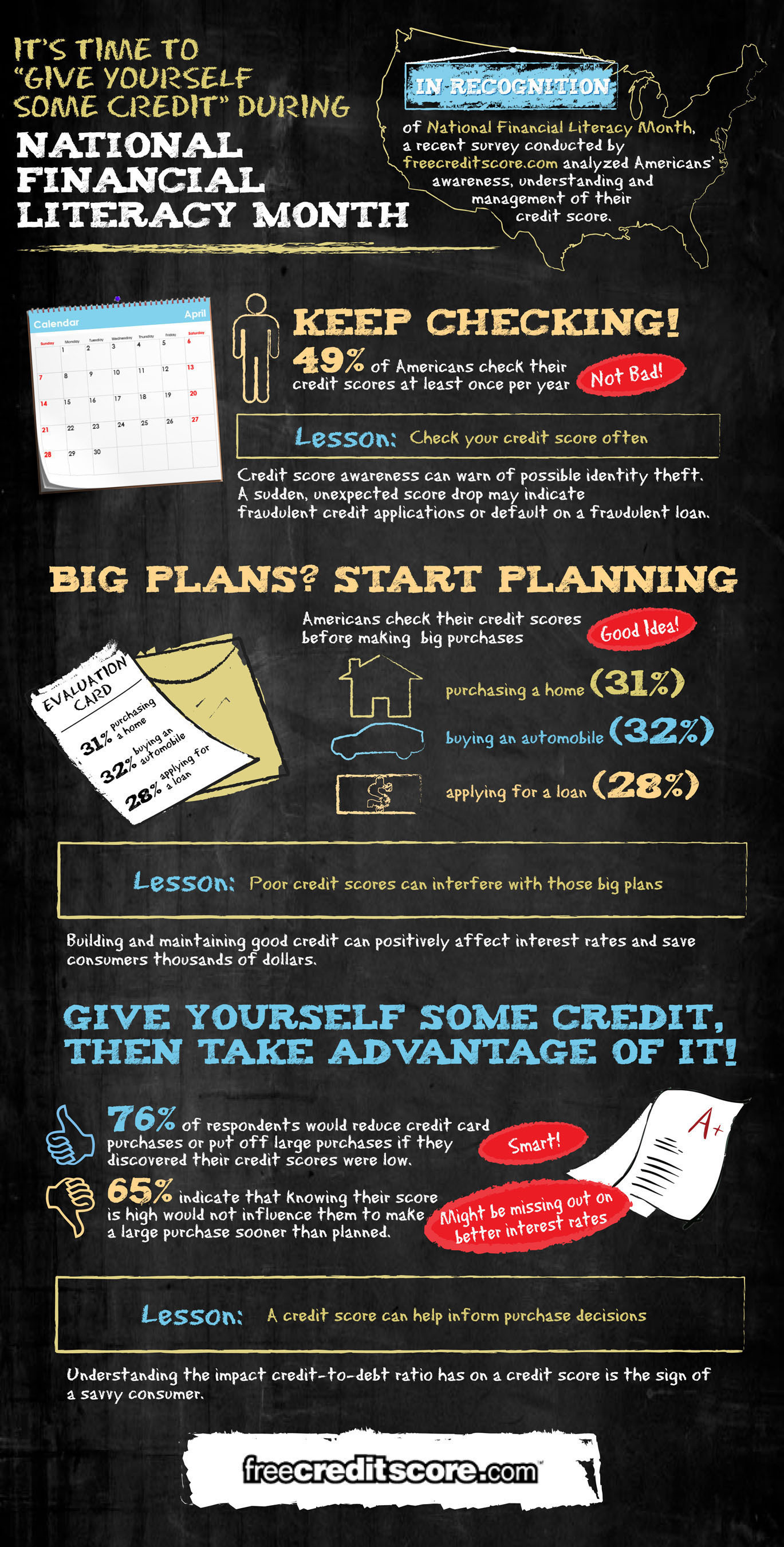

In the spirit of National Financial Literacy Month, freecreditscore.com created this infographic to share some simple credit tips:

When I think of large, successful companies, a couple of thoughts come to mind; excellent customer service, constant innovation and the unmistakable ability to attract new customers. While each of these is important in its own right, some would argue, the mark of a truly successful company is one that satisfies its existing customers, and keeps them coming back for more.

In our recently released Loyalty and Market Trends Report, we found that Ford did just that, as they passed GM and Toyota to take the top spot in corporate loyalty during Q4 2012. During the time period, 47.9 percent of the customers who owned a Ford vehicle returned to market to buy another Ford or Lincoln.

When I think of large, successful companies, a couple of thoughts come to mind; excellent customer service, constant innovation and the unmistakable ability to attract new customers. While each of these is important in its own right, some would argue, the mark of a truly successful company is one that satisfies its existing customers, and keeps them coming back for more.

In our recently released Loyalty and Market Trends Report, we found that Ford did just that, as they passed GM and Toyota to take the top spot in corporate loyalty during Q4 2012. During the time period, 47.9 percent of the customers who owned a Ford vehicle returned to market to buy another Ford or Lincoln.

Linda Haran has been selected for her leadership and contributions to the field of mortgage technology by Mortgage Banking Magazine for the development and introduction of Experian’s IntelliViewSM product.

The company’s new interactive, Web-based query, analysis and reporting tool enables financial professionals to optimize strategic planning, uncover new opportunities and improve decision making by having 24-7 online access to Experian’s aggregated quarterly consumer credit data. Data is available for seven lending categories, including bankcard, retail card, automotive, first mortgage, second mortgage, home-equity lines of credit and personal loans.

IntelliView data is sourced from the information that supports the Experian–Oliver Wyman Market Intelligence Reports and is easily accessed through an intuitive, online graphical user interface, which enables financial professionals to extract key findings from the data and integrate them into their business strategies. This unique data asset does this by delivering market intelligence on consumer credit behavior within specific lending categories and geographic regions.

Linda Haran has been selected for her leadership and contributions to the field of mortgage technology by Mortgage Banking Magazine for the development and introduction of Experian’s IntelliViewSM product.

The company’s new interactive, Web-based query, analysis and reporting tool enables financial professionals to optimize strategic planning, uncover new opportunities and improve decision making by having 24-7 online access to Experian’s aggregated quarterly consumer credit data. Data is available for seven lending categories, including bankcard, retail card, automotive, first mortgage, second mortgage, home-equity lines of credit and personal loans.

IntelliView data is sourced from the information that supports the Experian–Oliver Wyman Market Intelligence Reports and is easily accessed through an intuitive, online graphical user interface, which enables financial professionals to extract key findings from the data and integrate them into their business strategies. This unique data asset does this by delivering market intelligence on consumer credit behavior within specific lending categories and geographic regions.

Organizations across a range of industries and geographies are facing an increasingly complex, new business environment. As a result, they have a desire to implement originations and customer acquisition strategies quickly and at low risk.

The acquisition enables Experian to package Decisioning Solutions’ powerful and proven multitenant, multilingual software with its consumer and commercial data, analytical expertise, and identity proofing and authentication technologies, all from a robust and flexible SaaS model. This will allow small, medium and large organizations to make secure, on-demand, analytics-based customer decisions so they can achieve and sustain significant growth.

Organizations across a range of industries and geographies are facing an increasingly complex, new business environment. As a result, they have a desire to implement originations and customer acquisition strategies quickly and at low risk.

The acquisition enables Experian to package Decisioning Solutions’ powerful and proven multitenant, multilingual software with its consumer and commercial data, analytical expertise, and identity proofing and authentication technologies, all from a robust and flexible SaaS model. This will allow small, medium and large organizations to make secure, on-demand, analytics-based customer decisions so they can achieve and sustain significant growth.

The used car buying process can be as challenging for dealers as it is for consumers. Both parties want to make sure they are getting the best deal on a car that is safe and reliable. But how does anyone really know what they are getting?

The used car buying process can be as challenging for dealers as it is for consumers. Both parties want to make sure they are getting the best deal on a car that is safe and reliable. But how does anyone really know what they are getting?

Who doesn’t like low monthly payments? Unless you are lucky enough to buy a car outright, most consumers would agree that when making any large purchase, one of the goals is to keep the monthly payments as low and affordable as possible. Whether it is providing a large down payment, extending loan terms or securing the lowest interest rates, keeping costs down is a number one priority (at least in my household).

Who doesn’t like low monthly payments? Unless you are lucky enough to buy a car outright, most consumers would agree that when making any large purchase, one of the goals is to keep the monthly payments as low and affordable as possible. Whether it is providing a large down payment, extending loan terms or securing the lowest interest rates, keeping costs down is a number one priority (at least in my household).

There’s a lot of commentary in the press today as a result of a report the Federal Trade Commission issued this morning about the accuracy of credit reports.

This gives me the opportunity to share some insight into Experian’s business and how we actively manage the integrity of our data.

After thoroughly reviewing the FTC report issued today, we believe it confirms that consumer credit reports are predominately accurate and serving lenders and consumers well.

There’s a lot of commentary in the press today as a result of a report the Federal Trade Commission issued this morning about the accuracy of credit reports.

This gives me the opportunity to share some insight into Experian’s business and how we actively manage the integrity of our data.

After thoroughly reviewing the FTC report issued today, we believe it confirms that consumer credit reports are predominately accurate and serving lenders and consumers well.

As you may have seen, 60 Minutes ran a story on the credit reporting industry tonight, and unfortunately, much of the story was inaccurate and misleading. The focus of the segment was on data accuracy and the results of the yet-to-be released FTC accuracy study.

Many parts of the story did not accurately reflect the facts that have been validated by independent third party studies, the industry’s position or Experian’s position. As such, we would like to clarify our industry position and specific allegations about Experian’s practices.

As you may have seen, 60 Minutes ran a story on the credit reporting industry tonight, and unfortunately, much of the story was inaccurate and misleading. The focus of the segment was on data accuracy and the results of the yet-to-be released FTC accuracy study.

Many parts of the story did not accurately reflect the facts that have been validated by independent third party studies, the industry’s position or Experian’s position. As such, we would like to clarify our industry position and specific allegations about Experian’s practices.

As the global leader in the credit business, it’s our responsibility to assist lenders in managing consumer credit risk, and importantly, to empower consumers to understand and responsibly use credit in their financial lives.

These responsibilities require a commitment – a commitment from us to play a leading role in helping consumers understand the fundamentals of credit management and how they can benefit from this growing marketplace reliant upon credit. To do this, we continually invest in processes and products that help consumers throughout their credit journey.

Experian has created a long-standing culture of commitment to evolve with the changing marketplace and demands of consumers (and the credit industry). We have a proven track record of continual improvements to our systems over the years, including:

As the global leader in the credit business, it’s our responsibility to assist lenders in managing consumer credit risk, and importantly, to empower consumers to understand and responsibly use credit in their financial lives.

These responsibilities require a commitment – a commitment from us to play a leading role in helping consumers understand the fundamentals of credit management and how they can benefit from this growing marketplace reliant upon credit. To do this, we continually invest in processes and products that help consumers throughout their credit journey.

Experian has created a long-standing culture of commitment to evolve with the changing marketplace and demands of consumers (and the credit industry). We have a proven track record of continual improvements to our systems over the years, including: