News

What’s happening in our industry and what we’re doing

Earlier this spring, the Federal Deposit Insurance Corporation (FDIC) announced a proposed amendment to the Assessments, Dividends, Assessment Base and Large Bank Pricing (LBP) rule that it put forward in February 2011.

Earlier this spring, the Federal Deposit Insurance Corporation (FDIC) announced a proposed amendment to the Assessments, Dividends, Assessment Base and Large Bank Pricing (LBP) rule that it put forward in February 2011.

Experian Healthcare, the leading provider of financial information services and market intelligence for health systems, hospitals, medical groups and specialty organizations, today announced that it is ranked No. 77 on the 2012 Healthcare Informatics (HCI) 100 list.

Experian Healthcare, the leading provider of financial information services and market intelligence for health systems, hospitals, medical groups and specialty organizations, today announced that it is ranked No. 77 on the 2012 Healthcare Informatics (HCI) 100 list.

Although 46 states, the District of Columbia and Puerto Rico have passed laws requiring consumer notification in the event of a security breach of personal information, recent large-scale and publicized breaches continue to make data security a top legislative agenda item in statehouses across the country. Of the 15 data breach proposals introduced by State legislators this year, two have been signed into law.

Although 46 states, the District of Columbia and Puerto Rico have passed laws requiring consumer notification in the event of a security breach of personal information, recent large-scale and publicized breaches continue to make data security a top legislative agenda item in statehouses across the country. Of the 15 data breach proposals introduced by State legislators this year, two have been signed into law.

Experian Automotive today announced that average credit scores for consumers buying a vehicle have dropped to near prerecession levels.

According to its quarterly automotive credit analysis, the average credit score for financing a new vehicle dropped six points to 760 and dropped four points to 659 for used vehicles. Comparatively, credit scores in Q1 of 2008 were at an average of 753 for new vehicles and 653 for used.

Experian Automotive today announced that average credit scores for consumers buying a vehicle have dropped to near prerecession levels.

According to its quarterly automotive credit analysis, the average credit score for financing a new vehicle dropped six points to 760 and dropped four points to 659 for used vehicles. Comparatively, credit scores in Q1 of 2008 were at an average of 753 for new vehicles and 653 for used.

Experian Marketing Services today announced the acquisition of Conversen. Conversen is a pioneer in developing interaction management technologies that enable marketers to create fully integrated, cross-channel conversations through mobile, Web, social, email and traditional channels.

Experian Marketing Services today announced the acquisition of Conversen. Conversen is a pioneer in developing interaction management technologies that enable marketers to create fully integrated, cross-channel conversations through mobile, Web, social, email and traditional channels.

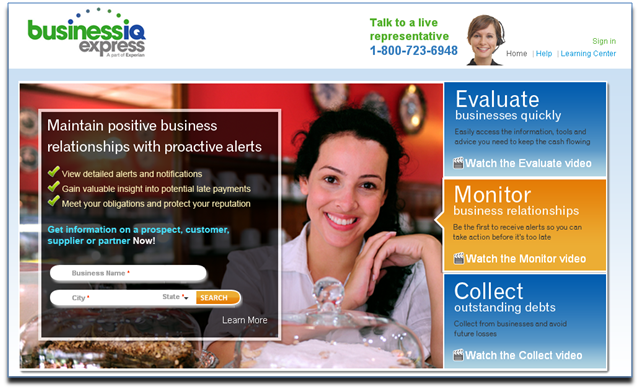

Experian®, the leading global information services company, today announced that during National Small Business Week, May 20–26, it will offer BusinessIQ Express at half off its annual subscription price for the first year of service.

Experian®, the leading global information services company, today announced that during National Small Business Week, May 20–26, it will offer BusinessIQ Express at half off its annual subscription price for the first year of service.

Experian®, the leading global information services company, today announced that it has joined forces with Moody’s Analytics to create a business index and detailed report that provides insight into the health of U.S. businesses.

Experian®, the leading global information services company, today announced that it has joined forces with Moody’s Analytics to create a business index and detailed report that provides insight into the health of U.S. businesses.

Secure and convenient online access to your Social Security earnings and benefit information is available due in part to fraud prevention services that help the U.S. Social Security Administration (SSA).

The SSA uses Experian fraud prevention services to securely authenticate and safeguard the identities of consumers who now have online access to their Social Security earnings and benefit information through the SSA’s new online Social Security Statement.

Secure and convenient online access to your Social Security earnings and benefit information is available due in part to fraud prevention services that help the U.S. Social Security Administration (SSA).

The SSA uses Experian fraud prevention services to securely authenticate and safeguard the identities of consumers who now have online access to their Social Security earnings and benefit information through the SSA’s new online Social Security Statement.

Recently there has been one area of Consumer Financial Protection Bureau (CFPB) reform that has gained support from Republicans and Democrats in Congress, as well as the CFPB Director himself: ensuring the confidentiality of privileged information that financial institutions provide to the bureau.

Recently there has been one area of Consumer Financial Protection Bureau (CFPB) reform that has gained support from Republicans and Democrats in Congress, as well as the CFPB Director himself: ensuring the confidentiality of privileged information that financial institutions provide to the bureau.