News

What’s happening in our industry and what we’re doing

In the chronicles of business evolution, one often recalls Amazon's humble beginnings as an online book seller before transforming into the e-commerce giant we know today. Reminiscent of that journey, Experian has undergone its own transformation. It has long since ceased to be simply a “credit bureau” and has instead embraced a story that is far more dynamic and which defies this caricature. The Real Experian: When people associate Experian with being a credit bureau, our response is a resounding, “Yes, but that is only a part of our story." It is the beginning chapter—as data evolved to ‘Big Data’, we layered in technology to understand that data, catapulting our company into a different realm. Today, Experian is a global force with a presence in over 30 countries, boasting a team of 22,000 professionals dedicated to harnessing the power of data and analytics for the betterment of businesses, societies, and consumers worldwide. Embracing Data and Analytics: At the core of our story lies a commitment to embrace data and analytics in a way that only Experian can. We collaborate across our operations to deploy advanced technologies, artificial intelligence, and to tap into rich data. The result? A powerful impact on businesses, societies, and consumers alike. Only Experian can: We are proud to share our story of how we power opportunities in a way that only Experian can. Experian leaders worldwide provide a glimpse into what sets Experian apart in the modern landscape of advanced technologies and powerful analytics. You can read the 5-minute story here. Continual Evolution: Experian's evolution from the world's leading credit bureau to a global data and analytics powerhouse is an ongoing journey. Our vision propels us forward, driving us to continually redefine our role in an ever-changing landscape. As Experian continues to evolve, our commitment to making a powerful difference remains unwavering. Our story is one of transformation, innovation, and a relentless pursuit of excellence. Join us on this journey, as we redefine what it means to be a global leader in data and analytics.

Experian celebrates its fifth consecutive year of achieving the highest score in the Human Rights Campaign's Corporate Equality Index (CEI), solidifying our position as a leader in LGBTQ+ workplace inclusion. Our enduring commitment to LGBTQ+ equality and inclusion has not only earned us this prestigious recognition, but also underscores our dedication to fostering a diverse and inclusive workplace where everyone can thrive. Michele Bodda, Executive Sponsor of Experian’s PRIDE ERG said, “I am incredibly proud to see our company achieve this milestone recognition again. It's a testament to the dedication of our entire Experian family in fostering an inclusive and accepting workplace where everyone can be their authentic selves.” LGBTQ+ Workplace Inclusion in ActionOur score of 100 in the 2023 CEI is a testament to our continued efforts in promoting LGBTQ+ workplace inclusion. Here are some of the initiatives that exemplify our commitment: Progressive Benefit Programs: Experian offers comprehensive benefit programs that encompass transgender services and provide equal coverage to same and different-sex domestic partners and spouses. These benefits support the diverse needs of all our employees. Non-Discrimination and Equal Employment Policies: Our non-discrimination and equal employment policies are committed to fairness and respect for all employees, transcending federal requirements and embracing inclusivity without regard to gender identity or sexual orientation. Transgender and Nonbinary Identity Support: We've created a process for transgender and non-binary individuals to update their identity documentation without emotional and financial strain. We also suppress their former names (deadnames) from Experian credit reports. The Power of YOU Initiative: To foster an inclusive work culture, Experian actively supports LGBTQ+ employees through initiatives like the Power of YOU campaign and the PRIDE Employee Resource Group. Check out the 2023 Power of You DEI Report to learn more. Celebrating five consecutive years of earning the highest possible score on the CEI is a milestone that underscores our continued dedication to creating an inclusive work environment where every employee, feels supported, valued, and empowered. For more information on our HRC Award and the 2023 Corporate Equality Index, check out the full report here. You can also learn more about Experian’s awards for our work supporting consumers, businesses, and our employees here.

Experian North America has once again been recognized for its inclusive work environment and corporate culture by The Orange County Register. This marks the 11th straight year that Experian has been named to the list of Top Workplaces. The publication annually surveys employees at hundreds of local businesses to evaluate their respective companies on a variety of criteria. According to the OC Register, we earned the accolade based on a positive company culture and listening to our team. This was highlighted by employees’ response to our collaborative and engaging work environment — one that enables every team member to clearly understand their own personal contribution to the company's mission. By welcoming a wide range of ideas and opinions, we’ve been able to create a favorable environment for employee achievement while continuing to develop new and better ways to serve our clients and benefit consumers. This latest award builds on other recognitions the company has received, including being recognized on Fortune’s list of the “100 Best Companies to Work For.” Great Places to Work, a global authority on workplace culture, has listed Experian as one of the “Best Workplaces for Parents™” and one of the “Best Workplaces for Millennials™” “While business strategy is core to our growth and success, the only way that strategy gets executed is to build a culture that makes workers want to stick around and give their best each day,” said Jennifer Schulz, Experian North America CEO. “I am proud that we are recognized for driving an award-winning culture, while staying true to our growth strategy.”

Healthcare insurance coverage is a necessity in the U.S. but it’s a complex system to navigate for both providers and patients. At Experian Health, we aim to simplify the administrative and operational sides of healthcare so improving the registration and insurance identification process for providers within the patient access workflow is an important problem we want to help solve. With a myriad of insurers, plans and benefits coverage, along with complexities like multiple levels of coverage some individuals may have, providers have a tough task trying to coalesce all the right information when a patient registers for care in real time – so the searching and querying is often pushed out beyond the registration desk, creating manual rework, denied claims and delays in reimbursements. This downstream impact has been a huge pain point with claims denials contributing to hospitals and medical practices losing more than $200 billion dollars in lost revenue per year. A rejection not only impacts the provider but the patient too. If inaccurate information is submitted to a payer and the claim gets denied, providers don’t get reimbursed and patients could receive bills that they may not be able to pay. We believe technology is the answer to solve many administrative challenges, which led us to acquire Wave HDC, a healthcare company that can deliver a real-time response. Identifying insurance coverage and benefits is a piece to the overall claims puzzle and this workflow has been ripe for improvement with better software. We believe we can now deliver the best solution in the market with this integration. What is Wave HDC’s expertise? Their AI-powered healthcare data curation solutions utilize an “if-then” logic, returning multiple data points required for accurate patient billing from a single inquiry, in real-time (30-45 second processing time), during the registration process. This innovation is a major step forward. No longer is a single response efficient as it pertains to uncovering a patient’s eligibility, coordination of benefits, insurance coverage and beyond. Our acquisition of Wave HHDC transforms the outdated clearinghouse model and will deliver immense benefits to our healthcare providers in the form of more accurate claim submissions and higher reimbursement rates, while also reducing manual work on their administrative teams. In fact, Wave HDC has prevented denials for its clients of over $1 billion dollars since 2020. Reducing claims denials will have a major impact on providers as the industry faces many headwinds including inflation, complex regulations, and constantly changing payer rules that may hurt their financial stability. The issue is only getting worse; a 2022 Experian Health survey revealed that 42 percent of respondents see claims denials increasing and that uptick is between 10-15 percent according to a third of respondents. Additionally, 3 out of 4 survey respondents say reducing denials is the highest priority. We are very excited to tackle this pain point with an advanced solution and welcome the Wave HDC team and these additional capabilities to Experian Health. For more information about Experian Health, visit experian.com/health.

Early in my career, I gained a lot of knowledge about credit. But when I moved to the United States from Brazil, establishing credit was a challenge. I worked part-time in a credit card company call center during college. I come from a humble family, and through helping customers, I learned the ins and outs about credit and money management. But all the solid credit history I built up in my home country didn’t transfer to the U.S. When I immigrated, I had to pay upfront for everything from utilities to a cellphone and it made me feel at a disadvantage. Thanks to Experian Boost®i, our feature that allows you to build credit without debt, and responsible management of debt, my FICO® Scoreii quickly rose to reflect my true creditworthiness. But I’ll never forget how it felt to be invisible when it came to the credit system. Being seen is the first step to equitable access to financial tools. Now that Experian conveniently offers Experian credit reports in Spanish onlineiii, consumers who prefer to access information in Spanish will be able to directly comprehend their credit profile so they can feel empowered. Understanding your credit report is a critical component for your ability to make informed decisions about your finances. As the executive sponsor of our Juntos Employee Resource Group (ERG) and someone who was new to credit in the U.S., I know first-hand that being seen is the first step in a journey towards financial wellness. To help you be informed, Experian also has a Spanish-language credit e-book and articles at the Ask Experian blog. Learn more about my financial health journey and my colleague's through #ExperianStories. i Results will vary. Not all payments are boost-eligible. Some users may not receive an improved score or approval odds. Not all lenders use Experian credit files, and not all lenders use scores impacted by Experian Boost®. Learn more. ii Credit score calculated based on FICO® Score 8 model. Your lender or insurer may use a different FICO® Score than FICO® Score 8, or another type of credit score altogether. Learn more. iii Only Experian credit reports are available in Spanish. All other services associated with an Experian membership are available in English only. English fluency is required for full access to Experian’s products.

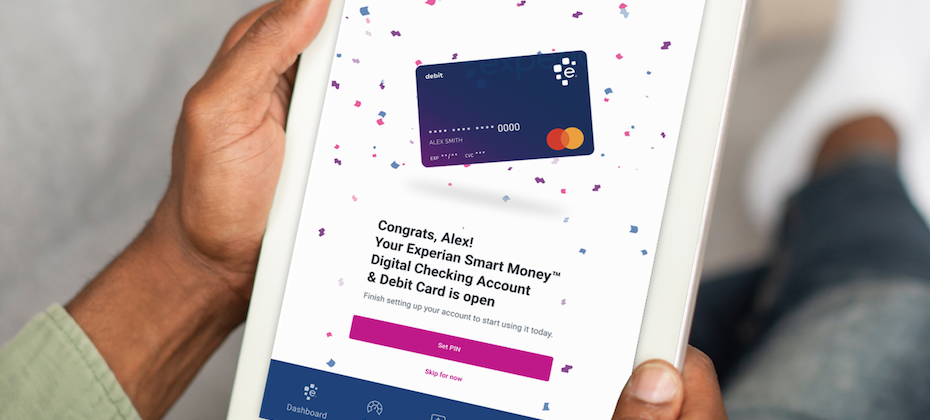

Our mission at Experian Consumer Services to achieve Financial Power for All™ drives our purpose and innovation. Continuing in our commitment to financially empower consumers, we are excited to announce today the launch of the Experian Smart Money™ Digital Checking Account & Debit Card2. What makes the Experian Smart Money Account unique is that it takes one of our most successful features ever in Experian Boost®3 to a new level of ease by embedding the feature in our new digital checking account. Experian Boost is a free game-changing feature launched in 2019 that allows consumers to contribute positive payments for eligible bills such as utilities and residential rent to their Experian® credit reports to potentially increase their credit scores. More than 14 million consumers have already connected to Experian Boost - via their existing checking account or credit card - with an average FICO® Score 84 increase of 13 points, among those who saw an increase. Now, the Experian Smart Money Account will drive efficiencies for consumers by allowing them to build credit more easily without debt and manage their day-to-day finances in one place. Helping consumers along their financial journeyWe understand that every consumer has different needs when it comes to their finances. When consumers engage with Experian, they can tap into many resources such as Experian Go™, which allows consumers to directly establish an Experian credit file for the first time and take off on their credit journey. For consumers who already have a credit profile and are looking to build their credit history and potentially increase their credit scores, they can leverage Experian Boost to contribute eligible payment history to their Experian credit file. Now with the Experian Smart Money Account, Experian is building upon these innovations and creating an even more robust credit and financial hub beneficial for various life stages. In fact, being credit visible and establishing a good credit score is essential for achieving many goals like moving into a new home, buying a car or securing employment. The positive impact we can have on consumers’ financial lives is what motivates us every day to create products and tools like the Experian Smart Money Account. Making ‘smart’ money movesWhile Experian is entering a different category of services, offering a digital checking account is a natural next step for us to help consumers reach their financial goals. The Experian Smart Money Account could most benefit consumers who are looking to build their credit profile. So, we believe our credit-building power makes this offering a positive complement to other financial products and services in the market. The Experian Smart Money™ Account accelerates, supports, and enriches consumer choice to build credit responsibly, which has a direct impact on the growth of credit-eligible populations. It benefits both consumers and broader financial institutions, and we are dedicated to playing a special role in the financial ecosystem helping consumers leverage debit and credit to their advantage. For more information about Experian Smart Money™ Account, visit www.experian.com/smartmoney. 1 Financial Inclusion and Access to Credit by Experian and Oliver Wyman, October 2021 2 The Experian Smart Money Debit Card™ is issued by Community Federal Savings Bank (CFSB), pursuant to a license from Mastercard International. Banking services provided by CFSB, Member FDIC. Experian is a Program Manager, not a bank. 3 Results will vary. Not all payments are boost-eligible. Some users may not receive an improved score or approval odds. Not all lenders use Experian credit files, and not all lenders use scores impacted by Experian Boost®. Learn more. 4 Credit score calculated based on FICO® Score 8 model. Your lender or insurer may use a different FICO® Score than FICO® Score 8, or another type of credit score altogether. Learn more.

You may have recently read that Experian®, alongside the other two credit bureaus, permanently extended free weekly access to consumer credit reports through AnnualCreditReport.com. While I believe the move helps consumers more regularly review their credit reports, it only begins to scratch the surface of how we empower consumers to take control of their financial lives. People come to Experian looking for ways to improve their financial health. We have direct relationships with millions of consumers and listen to their wants and needs. That’s why we’ve transformed ourselves into the one stop shop for our members to address many facets of their financial journey. Whether it’s accessing credit education materials, monitoring their credit files, finding ways to save money or improving their credit history, consumers can come to Experian to find the tools and resources they need. Building creditFor instance, in 2019, we launched Experian Boost® --a first-of-its-kind feature that allows consumers to contribute positive payment information for eligible bills including utilities, telecom and even video streaming services, directly into their Experian credit file. Consumers can now also add positive residential rent payments through Experian Boost®1. More recently, we debuted Experian Go™—another first-of-its-kind feature designed to help “credit invisibles,” or people with no credit history, begin building credit. Credit invisibles who utilize the feature together with Experian Boost can establish an authenticated Experian credit report, tradelines and a credit history and, as a result, get access to financial offers. Staying on top of your informationBeyond our credit building offerings, we’ve long provided consumers the opportunity to access their Experian credit report and FICO® Score2, free-of-charge. By providing consumers access to their credit report and FICO® Score, we’re enabling them to better understand how they may look to lenders, identify potential fraud, determine the specific factors that are affecting their credit and how to improve it. In addition, our credit and dark web monitoring services help consumers detect whether their personal information is potentially available to fraudsters and protect against identity theft. Putting money back into your walletWe also recognize the value of saving money. As part of an Experian membership, we offer resources that can potentially help consumers save on the cost of their auto insurance and find the best credit card for their financial needs. We empower consumers to: Compare auto insurance policies. Consumers can comparison shop to potentially find a better rate on their current policy and save. The free Experian service delivers multiple, tailored rates from up to 40 leading and well-established auto insurance carriers, allowing consumers to quickly find and purchase an auto insurance coverage plan that meets their needs. Find the right credit card. Our free Marketplace makes it easy for consumers to compare different credit card options. We match consumers’ financial information against lender’s requirements to match them with the tailored offers. Every consumer deserves the opportunity to live their best financial life. Providing free resources to help consumers effectively navigate their financial journey is the best way to help them realize financial independence. While I’m proud of how we’ve helped consumers thus far, we will continue to innovate and offer consumers the tools to improve their financial wellbeing. [1] Results will vary. Not all payments are boost-eligible. Some users may not receive an improved score or approval odds. Not all lenders use Experian credit files, and not all lenders use scores impacted by Experian Boost®. Learn more. [2] Credit score calculated based on FICO® Score 8 model. Your lender or insurer may use a different FICO® Score than FICO® Score 8, or another type of credit score altogether. Learn more. [3] Results may vary and some may not see savings.

At Experian we recognize our teammates are central to our business success. By including people with disabilities in our workplace, we gain their unique perspectives and different approaches to problem solving. Experian is committed to supporting this community and we are delighted to be named a 2023 Best Place to Work for Disability Inclusion by the American Association of People with Disabilities and Disability:IN. For the second year in a row, we earned a score of 100 out of 100 in the Disability Equality Index (DEI), the world’s most comprehensive benchmarking tool that measures disability workplace inclusion. We continue to explore and prioritize ways to enhance our flexible work environment and engage with those who can help lead the charge most effectively. Creating a better tomorrow extends to third parties we work with and serve. We launched a pilot program called the Support Hub, which gives disabled people and those with additional support needs an easy, one-stop portal to tell organizations what they need to access essential services; it also helps organizations meet their obligations to better identify and support vulnerable customers. We’re proud to partner with National Disability Institute to support its Financial Resilience Center that provides information and resources to help people with disabilities and chronic health conditions build their financial resilience, and with National Disability Institute and Disability:IN to explore how financial service providers can better support equal access to financial opportunities. Our inclusion in the DEI for the third consecutive year honors the determination, creativity, and empathy of our colleagues with disabilities as we strive to be a great place to work. Learn more about Experian in its Power of YOU: 2023 Diversity, Equity and Inclusion Report.

Many times during the course of our last fiscal year, Experian was asked to describe its Diversity, Equity and Inclusion (DEI) “program.” We found this difficult to do. Because DEI isn’t just a “program” at Experian. It drives our mission, our partnerships, and our company culture. We’re happy to share our progress in the Power of YOU: 2023 Diversity, Equity and Inclusion Report. In this edition of our global report, you’ll see how our mission of financial inclusion is at the center of our products and services; how we support our consumers, clients and communities; and how we seek and attract the best talent across the world. Our teammates are key to progress and impact. Together, we drive innovations to meet consumers’ needs, such as Experian Go and our new auto insurance comparison shopping service in North America. The Support Hub pilot in the United Kingdom helps disabled people get easier access to essential services like banking and utilities. We’re proud of programs like Transforme-se in Brazil for people in vulnerable circumstances, which provide scholarships and training in STEM. In the first month, more than half of the participants improved their social and financial standing. Across the globe, partnerships with nonprofits and non-governmental organizations (NGOs) have impacted more than 18 million people so far. I hope you’ll enjoy reading the report to understand why our efforts around inclusion and belonging make Experian such a great place to work. You’ll also gain an appreciation for our ongoing focus on supporting the communities in which we live, work, and serve, and helping consumers achieve their life goals.