NA – North America

News about Experian North America:

During Disability Pride Month, we are especially proud and hopeful by our most recent honor: Experian earned a score of 100 out of a possible 100 in the Disability Equality Index® (DEI). The DEI is the world’s most comprehensive benchmarking tool for the Fortune 1000 and Am Law 2001 to measure disability workplace inclusion against competitors. Several of our colleagues were on hand at the recent 2022 Disabilty:IN Conference to pick up our award. We improved from our score of 90 last year, and are considered a Best Workplace for Disability Inclusion. We’re honored to partner with two of the community’s leading organizations, Disability:IN and the National Disability Institute towards our commitment to financial empowerment for people with disabilities. We’re hosting conversations like this one to raise awareness of the barriers and explore solutions to financial inclusion. Experian is powering the credit resource page of the Financial Resilience Center so consumers have information at their fingertips. People with disabilities represent over one billion people across the globe. As one of our colleagues who represented Experian on a panel about innovation at the 2022 Disability:IN Conference explains, disability is a natural part of the human experience, and it crosses lines of age, ethnicity, gender, gender identity, race, sexual orientation, socioeconomic status and religion. It’s in that spirit that we held a Global Hackathon, challenging our colleagues to create future products and services that can further the mission of financial inclusion and equity for communities worldwide. As co-executive sponsors of Experian’s ASPIRE employee resource group, which advocates for teammates with disabilities, we’re proud to have our progress acknowledged. And we’re hopeful because while we know the work of inclusion will never be done, the Disability Equality Index indicates we’re evolving in the right direction. Learn more about Experian’s commitment to creating a better tomorrow for the communities in which we live and work in The Power of You: 2022 Diversity, Equity and Inclusion Report. Hear from Experian’s Roselyn M. about our culture of inclusion:

Last year, while still in the grip of the effects of the pandemic, Experian North America continued to reinforce our core purpose and People First approach through creating a workplace culture of belonging, employee wellness and personal and professional growth. It’s especially rewarding that this commitment, along with our financial planning and consumer education resources, were highlighted in this year’s Fortune 100 Best Companies to Work For award recognition. For the third year in a row, Experian North America was named to the prestigious national list that honors the “100 Best companies that adapted to massive changes in the workplace by prioritizing employee well-being, inclusion, purpose, listening and care wherever their employees are.” To determine this year’s 100 Best list, Great Place to Work®, America’s largest ongoing annual workforce study, surveyed more than 870,000 employees and gathered data from companies representing more than 6.1 million employees. The survey enables employees to share confidential feedback about their organization’s culture and the employee experience. Great Place to Work cited that “Experian has expanded benefits to include fertility, surrogacy, and adoption coverage and enhanced its higher education financial planning resources. It’s also tackling workplace equity from the very start of the hiring process with an in-house tool called Lingo that identifies gender-biased language in job descriptions.” In addition, “Experian began to hold conferences for employees to discuss their personal struggles during the pandemic. Since then, the company has continued to improve wellness initiatives, while staying committed to flexibility around employee schedules.” “At Experian we’re especially proud of our purpose-driven culture, where all our people play a role in making a positive impact in the day-to-day lives of the consumers, clients and communities we serve. This includes taking care of each other, celebrating our individual differences, and delivering on our purpose to create a better tomorrow for people everywhere,” said Jennifer Schulz, Chief Executive Officer of Experian North America. “This recognition from Fortune reflects the very best Experian offers to all those we help, and I couldn’t be prouder of our people and the work we’re doing.” At Experian, we believe bringing together unique experiences, diverse backgrounds and individual differences creates a dynamic, innovative and inspiring workplace — one reflective of the clients and communities we serve around the globe. This is why it’s such an honor to be recognized alongside other outstanding brands on the Best 100 list that prioritize their employees. This recognition continues the momentum we’ve built in recent months with other industry accolades and awards. In February, Experian North America was named a “Best Place to Work for LGBTQ Equality” for the fourth year in a row in the Human Rights Campaign Foundation’s Corporate Equality Index 2022, receiving a perfect score in the foundation’s evaluation. Last year, Experian North America was named to the Fortune Best Workplaces for Women™ 2021 among large organizations and 100 Best Large Workplaces for Millennials. In addition, we were ranked the #1 Top Workplace in 2021 by the Orange County Register for the second consecutive year.

Simplifying healthcare for all - that seems like a tall task to accomplish considering the last two years. What we once considered simple activities in our daily lives, such as going to the store to buy groceries or getting children to school, was upended by a global pandemic. Factor in the massive changes in healthcare operations, and it is clear the system needs to continue to evolve. It also cements my belief that Experian Health’s mission is even more relevant and achievable today than it was pre-COVID 19. In fact, this aspiration of simplifying healthcare for all is top of mind for me and Experian as we go into HIMSS22, the premier healthcare conference being held in Orlando this week. The healthcare industry has undergone massive changes since the fateful announcements in early 2020. While adapting to the pandemic was a huge undertaking for many organizations at the onset, those who opted to embrace change saw the payoff as they simplified administrative tasks and created efficiencies for both providers and patients. We saw organizations eagerly adopt technology and tools to take paperwork digital, streamlining the patient intake process and improving the accuracy of the data received. Instead of phone calls, patients and providers scheduled appointments and communicated online through secure portals saving time and manpower. The use of telehealth appointments allowed providers to see more patients and do so safely. Who would not want the simplicity of carving out just a few minutes from the comfort of one’s home for a non-urgent appointment? We are proud to have been a part of this evolution helping healthcare organizations pivot in the face of such a daunting predicament. For example, through our digital front door solutions, patients were able to schedule and pre-register for appointments online avoiding extra time spent in waiting rooms. We verified hundreds of thousands of identities quickly as Americans lined up for COVID-19 testing and vaccines. Our mobile payments system served to make the financial aspects of care easier to fulfill. Providers turned to us to help recoup costs from the government and insurers for COVID-19 care with our insurance discovery solution. Experian will not stop here, and we will continue to innovate high-tech, data-driven approaches to simplify healthcare for all; I hope the industry doesn’t stop either in tackling tough operational challenges using the power of technology and data. With this in mind, I look forward to hearing about the lessons learned by the industry as well as future innovations from the participants at HIMSS22. It’s the “can’t-miss healthcare conference of the year,” and we are pleased to be a sponsor and exhibitor once again. For those attending, visit us at Booth #3059. Taking the conference playbook of a hybrid approach with both digital and in-person participation, the healthcare industry should follow suit. Let’s certainly keep valuable in-person mechanisms in place, but not forget about the last two years and the incredible progress made that moved the industry forward. At Experian, we strive to help clients operate more quickly, smoothly and efficiently across the healthcare journey. With a new mindset in the industry and the tools available to act on change from providers like Experian, simplifying healthcare for all is not just a mission but an outcome we must achieve. Tom Cox is President of Experian Health.

Advocating for equality isn’t just my job, it’s a personal passion of mine. In my hometown, I’ve served as part of the organizing committee that planned Chicago’s Gay Black Pride. Working with a company that has values similar to my life’s work is an honor. That’s one of the reasons why I’m excited to share that for the fourth year in a row, Experian has been named a “Best Place to Work for LGBTQ Equality" from the Human Rights Campaign Foundation. Attaining a 100% rating from the Human Rights Campaign Foundation’s Corporate Equality Index is reflective of the work we’re doing to end discrimination against LGBTQ+ people and bring about fairness and equality for all. Our PRIDE employee resource group organizes programs year-round that raise awareness of issues including transgender rights, encouraging intersectionality with our other employee resource groups, and leading partnerships with organizations such as the Trevor Project and Out and Equal. It’s critical that these efforts within our organization extend to how we serve our communities externally. As an example, yesterday, we shared the process we now offer to help transgender and non-binary consumers update their name on their Experian credit report without impacting their credit history. Earning a perfect score by the nation’s largest LGBTQ+ civil rights organization is a tribute to our coworkers and company leadership, and continues to serve as an inspiration to follow our mission. This year, we will continue our efforts as we focus on credit education and awareness for those who are credit invisible within the LGBTQ+ community. Fostering and nurturing a culture of inclusion is part of our greater purpose. We are proud the HRC has recognized our work so far, and we look forward to what’s to come. For more information about Experian’s commitment to equity and diversity, visit experian.com/diversity

As a leading information services company, some of our chief priorities include protecting and ensuring the accuracy of consumer information. The integrity of our data is critical and aligns with our efforts to advocate for financial inclusion for everyone. Data accuracy is particularly relevant for the transgender and non-binary community with regard to name changes. It’s important to note that information about gender/sex, age, race, ethnicity, religion or sexual orientation is not included in credit reports or scores. However, when someone transitions, and changes their name, their credit and financial history may still be tied to their birth name, which is also referred to as their “deadname.” This can unintentionally “out” the consumer or force them to establish a new credit history. At Experian, we have a process through which those who identify as transgender and non-binary can provide legal documentation to prove their identity without the negative emotional and financial impact. You can learn more about this process here. When you affirm your identity and update your name, Experian will also suppress your deadname so it does not appear on your Experian credit report. Taking these steps only changes your name on your Experian credit reports, and you may need to inquire about the process with other credit bureaus. Fair access to credit tools is part of our mission, as is providing these services with dignity and respect. At Experian, this is our purpose, advocating for all communities and people. This is financial inclusion.

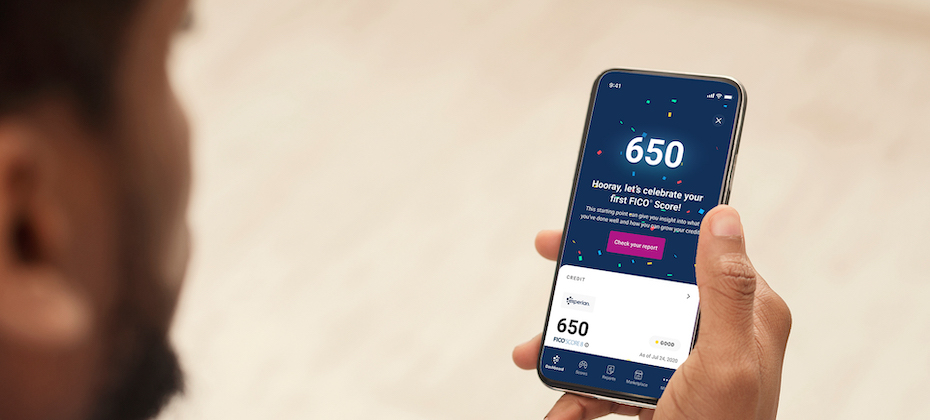

For the past several years, we’ve been on a journey to improve financial access for millions of people around the world. We’ve made it our job to help consumers get the best financial outcomes. This focus on consumers defines us and informs everything we do. In 2019, we reshaped how consumers access credit with Experian Boost™. Since then, nearly 9 million consumers have connected to the product. While we are proud of what we have and continue to accomplish with Experian Boost, we know there is more to be done to ensure more consumers can access fair and affordable credit. Improving outcomes for underserved consumers When credit is used responsibly, it can create new opportunities from getting a college degree, buying a car or home and starting or expanding a business. These are milestones that help people establish careers, build wealth and ultimately achieve greater financial freedom. Yet, there are millions of consumers who are unable to participate in the mainstream financial ecosystem today because they don’t have a financial identity. Without an established credit history, these consumers struggle to qualify for everything from an auto loan to a mortgage and even an apartment or employment. This problem more frequently impacts communities of color with 28 percent of all Black and 26 percent of all Hispanic consumers currently unscoreable or credit invisible. Increasing financial inclusion depends on creating opportunities for underrepresented consumers to succeed. And this starts with ensuring all consumers have a financial identity. Bringing financial power to all with Experian Go The challenge is many consumers who are not in the credit ecosystem today are unsure where to start. Today, we reached a pivotal and exciting milestone in our commitment to consumers with the launch of Experian Go™. This new program opens the front door to the financial ecosystem for millions of consumers by helping them establish their financial identity and move from credit invisible to scoreable. Within minutes, credit invisibles can have an authenticated Experian credit report, tradelines and a credit history by using Experian Boost™[1], and instant access to financial offers through Experian Go. In fact, early analysis shows 91 percent of consumers with no credit history who connect to Experian Boost, a free feature that allows users to contribute their on-time cell phone, video streaming service, internet, and utility payments directly to their Experian credit report, can become scoreable in minutes with an average starting near-prime FICO® Score of 665[2]. Throughout the experience, we’ll provide ongoing credit education and access to tools like Experian Boost™ to make it easy for consumers to learn how to use and responsibly grow their credit histories. Until now, our industry has struggled to verify the identity of credit invisibles. Over the last several years, we’ve introduced new identity verification technologies to our toolbox. With Experian Go, we’re leveraging these technologies to verify a credit invisible’s identity and get them in the front door to start building credit. No other credit bureau or organization is doing this today. During our pilot, we helped more than 15,000 consumers establish their credit history. This is a great start. Now that Experian Go has launched, I look forward to helping millions more consumers get the credit they deserve. To learn more about Experian Go, visit www.experian.com/go. [1] Results may vary. Some may not see improved scores or approval odds. Not all lenders use Experian credit files, and not all lenders use scores impacted by Experian Boost. [2] Experian analysis based on an anonymized and statistically relevant sample of consumer credit reports with only Experian Boost tradelines included and FICO® Scores. December 2021.

The past few years have sparked a swift digital transformation that subsequently drove a rapid increase in fraud. In fact, fraudsters have gotten more creative, putting businesses and consumers at risk now more than ever. At Experian, we predict that more intricate challenges lie ahead and are dedicated to helping businesses combat fraud threats. Here’s what we expect in 2022: 1. Buy Now, Pay Never – The Buy Now, Pay Later (BNPL) space has grown massively recently. In fact, the number of BNPL users in the US has grown by more than 300 percent per year since 2018, reaching 45 million active users in 2021 who are spending more than $20.8 billion . Without the right identity verification and fraud mitigation tools in place, fraudsters will take advantage of some BNPL companies and consumers in 2022. Experian predicts BNPL lenders will see an uptick in two types of fraud: identity theft and synthetic identity fraud, when a fraudster uses a combination of real and fake information to create an entirely new identity. This could result in significant losses for BNPL lenders. 2. Beware of Cryptocurrency Scams – Digital currencies, such as cryptocurrency, have become more conventional and scammers have caught on quickly. According to the FTC, investment cryptocurrency scam reports have skyrocketed, with nearly 7,000 people reporting losses totaling more than $80 million from October 2020 to March 2021 . In 2022, Experian predicts that fraudsters will set up cryptocurrency accounts to extract, store and funnel stolen funds, such as the billions of stimulus dollars that were swindled by fraudsters. 3. Double the Trouble for Ransomware Attacks – In the first six months of 2021, there was $590 million in ransomware-related activity, which exceeds the value of $416 million reported for the entirety of 2020 according to the U.S. Treasury's Financial Crimes Enforcement Network . Experian predicts that ransomware will be a significant fraud threat for companies in 2022 as fraudsters will look to not only ask for a hefty ransom to gain back control, but criminals will also steal data from the hacked company. This will not only result in companies losing sales because of the halt caused by the ransom attack, but it will also enable fraudsters to gain access and monetize stolen data such as employees’ personal information, HR records and more – leaving the company’s employees vulnerable to personal fraudulent attacks. 4. Love, Actually? – Because more consumers went on dating apps and social media to look for love during the pandemic, fraudsters saw an opportunity to create intimate, trusted relationships without the immediate need to meet in-person. The FBI found that from January 1, 2021 — July 31, 2021, the FBI Internet Crime Complaint Center received over 1,800 complaints, related to online romance scams, resulting in losses of approximately $133 million. Experian predicts that romance scams will continue to see an uptick as fraudsters take advantage of these relationships to ask for money or a “loan” to cover anything from travel costs to medical expenses. 5. Digital Elder Abuse Will Rise – According to Experian’s latest Global Insights Report, there has been a 25 percent increase in online activity since the start of Covid-19 as many, including the elderly, went online for everything from groceries to scheduling health care visits. This onslaught of digital newbies presents a new audience for fraudsters to attack. Experian predicts that consumers will get hit hard by fraudsters through social engineering (when a fraudster manipulates a person to divulge confidential or private information) and account takeover fraud (when a fraudster steals a username and password from one site to takeover other accounts). This could result in billions of dollars of losses in 2022. As a leader in fraud prevention and identity verification, Experian offers a full suite of automated tools that harness data and analytics to prevent fraud and mitigate losses. Learn more about Experian's fraud management tools.

For the ninth year, the Orange County Register has named Experian North America as a Top Workplace, securing the #1 ranking for the second consecutive year. The award, which is based on employee feedback in a survey of hundreds of leading companies in Orange County, recognizes our company’s culture of inclusion, and our commitment to employees and communities. Orange County is the home of our North America operations, and we are especially honored to be recognized again for our inclusive work environment and achieving higher performance while giving back. This honor demonstrates the talent and compassion of all the people who work at Experian. Thank You All our decisions are driven by our desire to ensure our employees feel valued and protected. As part of this, we issued a ‘Thank You’ Share Award to all employees at the beginning of this year to recognize perseverance through the pandemic, giving thousands of employees an equity stake in the company. Coming Together Our Employee Resource Groups (ERGs) continue to grow and support employees in different ways, which include activities that bring employees together internally to serve their communities externally. For example, our Asian American ERG worked closely with Pan-Asian leadership organization Ascend to support the Asian American community and employees, considering increasing discrimination and xenophobia during the pandemic. Together they kicked off Feed Your Hospital, which facilitated the delivery of meals to frontline COVID-19 healthcare workers by supporting local Asian restaurants. Meals were purchased at the restaurants and delivered to participating hospitals. The campaign raised funds for hospitals in Orange County. Social Good This year, we also awarded two OC-based organizations with major grants – the OC Hispanic Chamber of Commerce and TGR Foundation (a Tiger Woods Charity). For the OC Hispanic Chamber of Commerce, we funded and facilitated credit education initiatives for the Youth Chamber Program – funds went towards scholarship awards and event costs. We also added credit education to the ‘Pre-Venture Business Program’ curriculum – with funds going into marketing, training, one-on-one consulting, and event costs offered in both Spanish and English. For the TGR Foundation grant, we are working on ongoing projects with the foundation to support credit education, small business entrepreneurship, homeownership, and financial inclusion efforts. In total, employees volunteered more than 900 hours to Orange County-based nonprofits and Experian matched funds to those organizations that employees volunteered with and donated to. Our employees continue to help people who are facing unprecedented and unforeseen challenges. Different groups and employees of all levels are working together to help our clients, customers and communities persevere. We are honored that the Orange County Register continues to recognize our tireless efforts to make a difference in the communities in which we live and work.

We believe every individual deserves the opportunity to reach their fullest financial potential through fair and affordable access to credit. While leveraging data, analytics and technology are key components of this, we must also ensure consumers understand how credit works and the ways it can be used as a financial tool throughout their lifetimes. This notion is the impetus behind our annual State of Credit report. Now in its twelfth year, this report takes a close look at how consumers are managing their credit histories to educate them about the factors influencing their financial health. This year’s report shows the average credit score has climbed to 695 – the highest point in more than 13 years. Many consumers were managing credit well before the pandemic’s arrival and the accommodations afforded by the Coronavirus Aid, Relief and Economic Security (CARES) Act may have helped consumers protect their financial health. At the same time, stay-at-home orders and record savings levels may have contributed to fewer missed payments, lower credit utilization rates and lower debt. While these findings are positive, we recognize they do not tell the full story. There are tens of millions of consumers who lack fair access to credit because of a limited credit history. Low-income consumers and communities of color are disproportionately credit invisible, preventing them from obtaining low-cost, traditional financial services. There is significantly more work to do to ensure all consumers have fair access to credit. We are committed to working with lenders, regulators, businesses, consumers and partners to eliminate credit invisibility and improve financial equity and access. Our meaningful partnership with Operation HOPE, the largest financial literacy nonprofit in the U.S., is one example of this commitment brought to life. Operation HOPE has goals that align with ours: to uplift disenfranchised youth and adults from poverty to thriving in a credit ecosystem. Together with Operation Hope, we are making a tangible difference in financial inclusion by helping consumers raise their credit scores through financial coaching, education and tools like Experian Boost. As part of this year’s State of Credit report, we also helped introduce Operation HOPE’s new HOPE Financial Wellness Index. This new tool will be a valuable resource for the Hope Research Institute who plans to leverage it to identify the communities most in need of financial literacy programs. “While consumers on average are managing their credit histories well, we know there are many communities in critical need of more financial education and resources,” said John Hope Bryant, Operation HOPE founder and CEO. “By helping people raise their credit scores, we are empowering them to take advantage of one of our nation’s most democratic tools. From housing and employment to healthcare and education, credit worthiness can be leveraged to improve our overall quality of life. We’re committed to using the HOPE Financial Wellness Index as a force for good in the communities we serve.” Through our investments in expanded data, technology, advanced analytics and new innovations, we will continue to help lenders identify consumers who are excluded from the credit ecosystem, but who can fulfill their financial obligations and pay responsibly. At the same time, we will continue to take strides that empower consumers to take control of their financial lives. For additional free educational resources and more information about this year’s State of Credit report, I encourage you to visit the links below. State of Credit report findings: https://www.experian.com/blogs/insights/2021/09/state-of-credit-2021 Join Experian’s weekly #CreditChat hosted by @Experian on Twitter with financial experts every Wednesday. Bilingual and Spanish speakers are also invited to join Experian’s monthly #ChatDeCrédito hosted on Twitter at 3 p.m. Eastern time beginning September 16. The Ask Experian blog includes answers to common questions, advice and education about credit Positive telecom, utility and streaming service payments can be added to your Experian credit report by visiting experian.com/boost Additional resources available at https://www.experian.com/consumereducation