Building a strong business credit profile can often be a determining factor in the success or failure of a business. Especially important when you consider roughly fifty percent of new businesses will fail in the first two years, according to the Small Business Administration. By establishing and building business credit early on, business owners are reducing their chances of becoming a statistic. So in this blog post we outline the top five factors that impact your business credit score.

There are a number of things that could have an adverse impact on your company’s business credit score.

1: The number of years your business has been operating.

Establishing a strong credit profile requires time, and the longevity of your business plays a pivotal role. Lenders and credit agencies often view well-established businesses more favorably, as they demonstrate stability and reliability. A company with a longer operating history showcases its ability to navigate challenges and sustain operations.

This longevity factor contributes positively to the business credit score. For newer businesses, the challenge lies in building credit over time. Implementing responsible financial practices, maintaining positive cash flow, and fulfilling financial obligations can gradually enhance your credit standing. Experian has a Blueprint for building and establishing business credit–it’s a PDF step-by-step guide to establishing and improving your business credit, and it can help you whether your businessr is 5 days or 5 years old.

2: Lines of business credit applied for in the last 9 months.

Credit inquiries, or the number of times your business seeks new lines of credit, can impact your credit score. Multiple credit applications within a short period may signal financial instability or desperation for funds, which can be viewed unfavorably.

It’s crucial to carefully assess and strategically apply for business credit. A thoughtful approach to securing credit ensures that each application is a well-considered step toward supporting business growth. Understanding the specific credit needs of your business and aligning them with suitable lenders minimizes unnecessary inquiries, positively influencing your credit score.

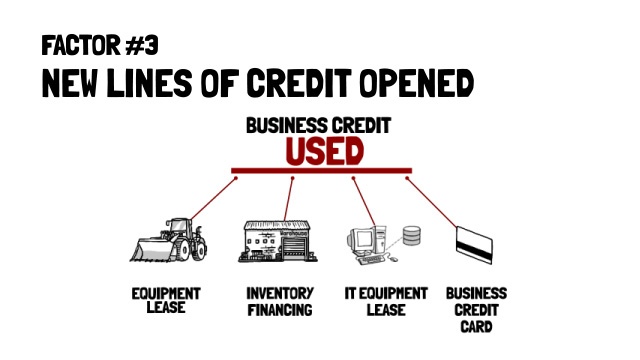

3: New lines of business credit opened and the number of business credit lines used in the last 6 months.

The utilization of business credit lines within a specified timeframe is a key metric in determining your creditworthiness, for business and personal credit. Opening too many credit lines or utilizing them excessively may indicate financial stress or overreliance on borrowed capital.

Striking a balance between accessing credit for business needs and managing credit responsibly is crucial. Keeping track of the number of credit lines opened and effectively managing their usage demonstrates fiscal prudence, fostering a positive perception among creditors and credit agencies.

4: Any collection amounts or tax liens in the last 7 years.

A business’s creditworthiness is also influenced by its ability to meet financial obligations and handle outstanding debts. Instances of collections or tax liens within the last seven years are red flags for creditors. These events suggest a failure to fulfill financial responsibilities, potentially leading to a lower credit score.

Proactively addressing and resolving outstanding collections or tax issues is essential for maintaining a healthy credit profile. Engaging in timely communication with creditors and tax authorities to settle any outstanding amounts can mitigate the negative impact on your business credit score.

5: Payment history reflecting how often payment is made on time.

Consistent and timely payment of financial obligations is a cornerstone of a positive credit history. Payment history is a significant factor influencing your business credit score. Delinquent payments, late fees, or defaults can significantly harm your credit standing.

On the flip side, consistently making payments on time demonstrates financial responsibility and reliability. Business owners should prioritize meeting payment deadlines for loans, credit cards, and other financial commitments to maintain and improve their credit score over time. Regularly reviewing your payment history and addressing any discrepancies promptly is essential for sustaining a favorable credit profile.