The National Bureau of Economic Research conducted a study of nearly 6 million PPP loans made between April 2020 and February 2021 and determined that black-owned businesses were least likely to receive Paycheck Protection Program loans from small and mid-sized banks, where subjectivity was most likely to influence lending decisions.

In this episode of the Small Business Matters podcast, we focus on work being done to improve racial equity in small business underwriting with our special guest Shannan Herbert. Shannan is the Executive Vice President and Chief Credit Officer for City First Bank, one of the largest black-led community development, financial institutions, and minority depository institutions in the country. With more than 20 years of experience, Shannan has served in key leadership roles for most of her career, leveraging her expertise to direct enterprises in the strategic development and delivery of value-driven, user-friendly solutions in the commercial credit and financial services arena.

For the last three years, Shannan has focused on providing capital to under-resourced groups that have historically been denied access to funding. Her commitment to community development and small business lending has helped hundreds of small businesses that are minority-owned thrive.

What follows is a lightly edited transcription of our interview.

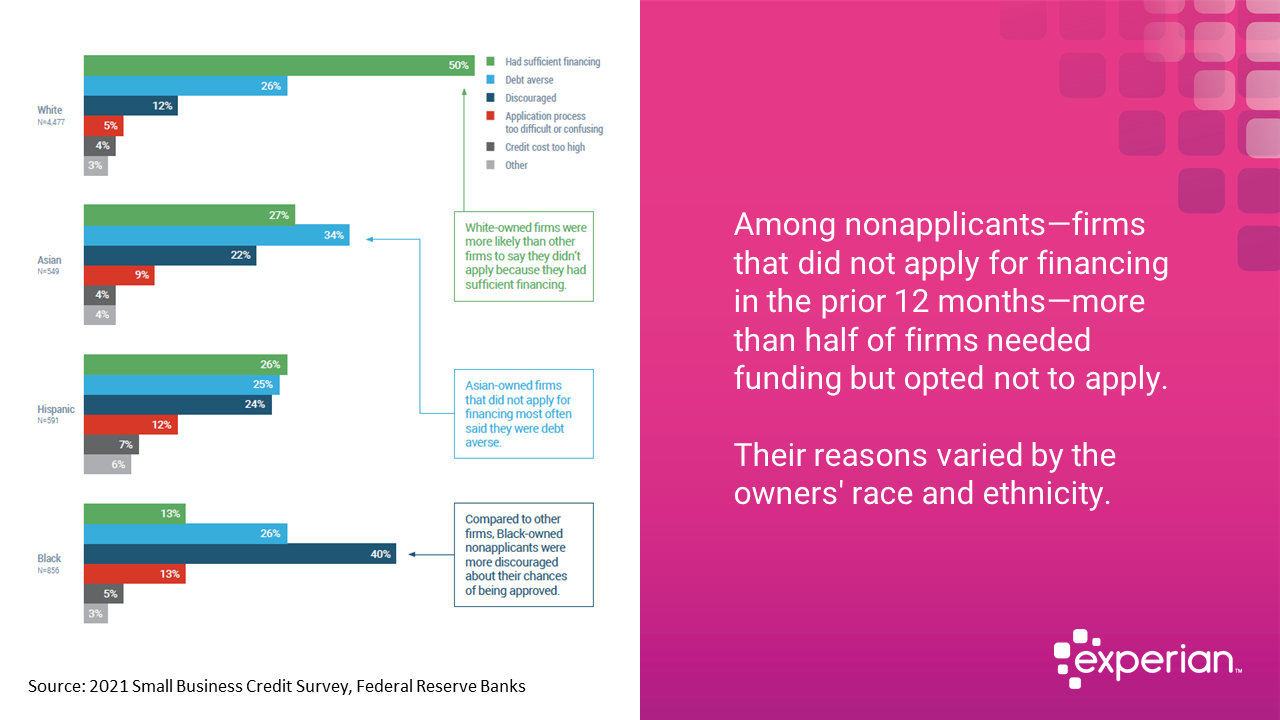

Gary Stockton: The Federal Reserve Bank recently published the 2022 Report On Firms Owned by People of Color, and there was some very fascinating research. One of the most interesting findings in the survey was the number of discouraged borrowers who did not apply for financial assistance because they didn’t think they would qualify.

Shannan, when you see data like this and when you think about your mission there, how does that make you feel?

Shannan Herbert: Well, it’s, it’s not surprising. Because as we see these data points here, we know that there are real stories behind each one of those data points. I can’t tell you how many small business owners I know, black-owned businesses who have completely checked out of the process. Either through word of mouth or previous bad experiences have decided that traditional bank financing isn’t for them. You know, we saw this, especially during PPP. I can’t tell you the number of small businesses I had to convince to apply for PPP funding. “Hey, this money is here available for you. Why don’t you apply?” And the response was, well, they’ll never approve me for that. Or, I don’t understand that, it’s too complicated. And so, you know, I think that we have a responsibility to help borrowers, especially, navigate the process, but encourage them to apply.

If it means working capital funds for the business, helping the business scale, we can see these things. There have been some other studies done during the PPP era, Reveal News also did a study that showed that in metropolitan areas where populations were greater than 1 million, PPP loans were given out at higher rates in white majority areas when compared to black and LatinX majority areas.

National Community Reinvestment Coalition did similar research during PPP and found that, with their mystery shoppers, Black and Latinx mystery shoppers were given significantly less information about PPP loans when compared to white mystery shoppers.

So, you know, you have that disparity there too, where borrowers, borrowers of color are coming to banks, looking for information and not being able to obtain that information. We also know that 89% of new businesses are started by women of color, but, minority entrepreneurs and black entrepreneurs are twice as likely to be denied financing from a traditional bank or from a large bank.

Part of that is small business owners; black small business owners are less likely to have relationships with their banks; less than one in four have a banking relationship. And so, this is a story behind those data points that you have there that shows why so many black small business owners have been discouraged from even participating in the process.

Gary Stockton: So can you tell us a little bit about Underwriting for Racial Justice and how the group got started?

Shannan Herbert: Certainly. So I have to give a shout-out to the folks at Beneficial State Foundation; our fearless leader, Erin Kilmer Neel, who’s their Chief Impact Officer, convened this group right before the pandemic started. We started our work in 2021. And so what this is, it’s a group of really smart bankers, CDFIs, CDFI leaders, non-profit loan funds, and non-profit organizers that want to be involved and want to help, coming together to figure out what those barriers are to lending in BIPOC communities to BIPOC small business owners, and figuring out how to eliminate those barriers. And so what we did was kind of level set in the beginning and go through some of the historical relevance. Why are we all here? How did this start? How did we get to this place where we’re talking about these things? Because we all have this goal of closing the racial wealth gap. We’re eliminating the racial wealth gap. But you know, are we doing it on a large scale? Are we doing it in very bite size pieces? Or how are, how are we getting there? And then from there, what we did was look at what each of our banks were doing individually to address some of these disparities that we saw in lending.

With City First Bank we have a program called unitranche where we’re able to lend up to 90% loan to value to supplement those borrowers that don’t have the required equity investment. So we can lend up to 90%. And borrowers can come to the table with less. So that covers debt service coverage requirements, and equity requirements but solves for that limited equity issue.

There is another financial institution, included that, instead of having a traditional loan committee approval system, use community members as their loan committee. So the community could weigh in on whether or not a business deserves financing based on their experience with that business in their community. Which makes a ton of sense. If you’re talking about community lending, if we’re all sitting around the table and we’re not from that community, it’s kind of hard to make a decision about a business that is important or vital to a particular community. So that was another model that we explored, but it’s been a great learning experience working with such smart people, such mission-oriented people, looking to make a deep impact in their communities.

Gary Stockton: It’s important work it’s and it’s making a huge difference in so many peoples’ lives and business owners’ lives as well.

Shannan Herbert: Absolutely.

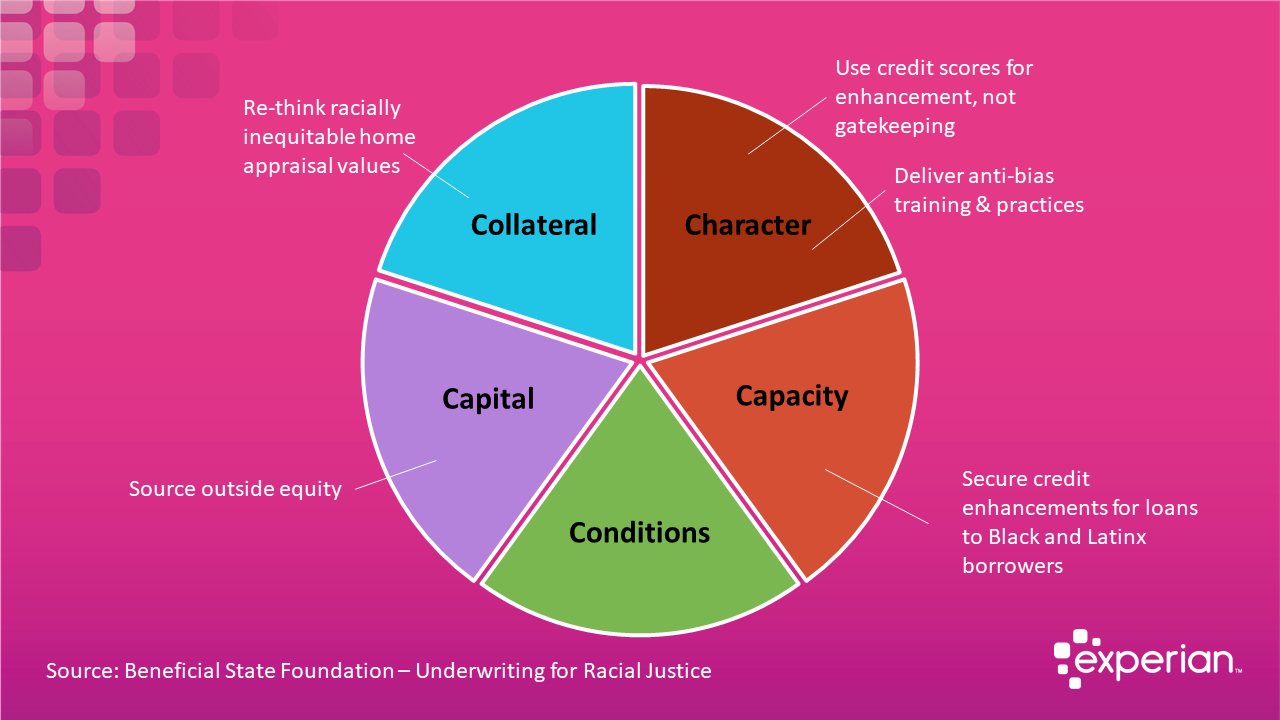

Gary Stockton: I found this chart on your website where you broke this out into the areas where you could respond in the five C’s of credit. Can you talk a little bit about that?

Shannan Herbert: Really it’s the framework for inclusive underwriting. So when we think about inclusive underwriting, we think about access for all. Equitable access for all. Recognizing where we have fallen short in the past, where bias may show up in some of our decision-making, and try to solve for that. So that more people have access. We’re not having the same issues that we highlighted in that first chart you shared, but really focusing on those things that are part of the underwriting process, the prospecting, the relationship manage management, the approval process, all of it. And, you know, everyone understands the five CS.

So, you know, there’s not, if you’re a lender, you’re not a lender, you’re a borrower– everyone knows what the five Cs are. So this is the easiest framework to break these down. For instance, when you think about character, how do you determine character? What data points are you using to determine character and how much bias is creeping into that character assessment?

Capital is another, another area. As I mentioned with the unitranche product that we have at City First. We have readily available data on the racial wealth gap and the gender wage gap, but equity requirements are still the same across the board, irrespective of race and gender. So, you know, how do we adjust for that?

What do we do in our lending practices, policies, and products to adjust for those disparities? Because we’re not all starting at the same point on the field.

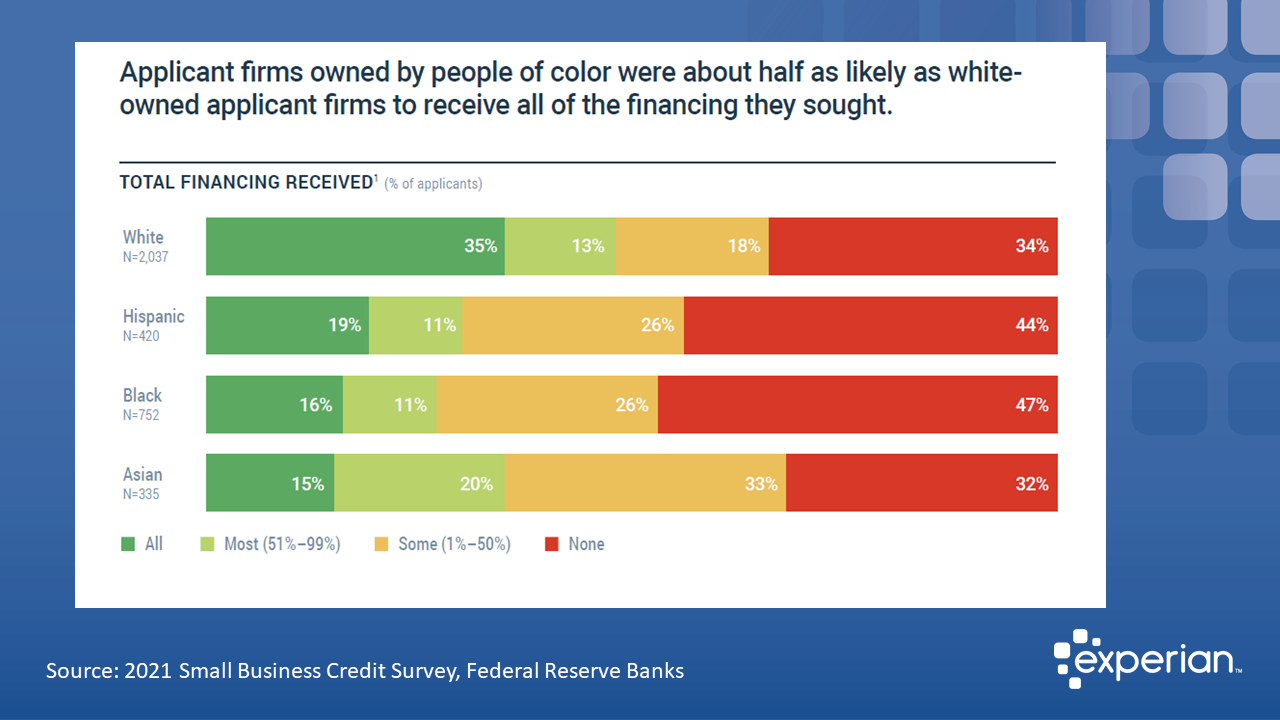

Gary Stockton: It’s clear from reading the most recent SBCS report on the Firms Owned by People of Color that there’s inequity in access to capital. The report said firms owned by people of color were about half as likely as white applicants to receive all the funding they sought. What do you think is going on here, Shannan?

Shannan Herbert: I think it goes back to that inclusive underwriting discussion and understanding risk. We have this perception of what risk is, but when you ask people where the data is to support some of those risk assessments, that data isn’t readily available. So a lot of it is perception. Some of it could be based on bias. But I think for us, it’s about reenvisioning or reimagining risk, and what that really looks like. Is a loan to a black-owned business in a black community riskier than a loan made to a white-owned business and a white community? So gathering that data to really say yes or no, that that’s the case. And then, you know, making those policy changes or product changes, whatever they may be according to that data.

When we think about risk, changing the way that we think about it, and then the way that we are applying some of our standards and some of our policies to our underwriting practices could help in that area. I think that could be what we see there with those disparities.

Gary Stockton: Yes. So Diversity, Equity, and Inclusion has been in the public lexicon for a few years now. I am glad there’s more discussion about that. We want action happening. What’s the difference between your work and a typical DEI initiative?

Shannan Herbert: I think with DEI initiatives, and I applaud many organizations for even taking up that challenge and saying, “yes, we recognize that we have a problem.” And, we’re going to do everything that we can to solve that problem. And solving that problem meant hiring more diverse staff, and diversifying boards and executive management levels. And all of that is wonderful. I think what we are doing here is, what do we do now? So you’ve put all these great people in place, but what’s next? What’s the next step? And so that’s where this work gets to. What’s the next step? How do we put these diversity equity and inclusion initiatives into action? And this is the action. These are the actionable items that you can measure.

So now I can see, I’m lending. I can follow that money to see what happens with that money. I can see if there’s wealth generation on the back end. I can see how communities are improving. I can see how many jobs are created. I can see all of these things and follow that money along the way. And that’s, that’s measurable. That’s measurable DEI all day long.

Gary Stockton: So, what have been some of the most significant learnings from the group thus far?

Shannan Herbert: I think it made me feel like I wasn’t on an island, hearing some of the stories from some of the other bankers and the challenges they had. It created a community, a community, grounded in this fight for racial equity and lending. I’ve been a banker for more than 20 years, and there was a lot that I didn’t know. And I, and that was something that I had to reconcile with, but the more I learned, you know, I couldn’t sit there and not do anything. You know, you see something that’s like, oh wait, I need to dig a little deeper. And what does this mean? And how do we fix this? And I think that’s what it’s been for all of us.

Once we hear this, hear the stories, we see some of the creative things that are getting done; it means that we can do it, too.

Gary Stockton: Yes. What is the special purpose credit program that is currently under development, and how can that help firms owned by people of color?

Shannan Herbert: So what we decided after we went through all of the history and the case studies and learning from one another, we decided that we would put together our own special purpose credit program. And what we wanted to do was create a comprehensive program for lenders that not only included the program itself but training on the front end. So inclusive underwriting training, as I just mentioned, and kind of walk through a little bit, but inclusive underwriting training looks for the bias as it shows up in all those areas from start to finish. From prospecting to approval to relationship management, we have to make sure that those involved in this program have the same understanding we had when we first walked into the program that, that Erin and the folks at Beneficial created. So having that training on the front end, the product itself, and that’s what’s in development right now. So you have the product itself, then the policy.

So we must ensure that loan policies are still tracking to this program being created. And we would provide that help to bankers looking to enhance their policies with this special purpose credit program language—regulator support is very important for regulated banks.

The regulators are in support of the use of special credit-purpose programs. So this isn’t something new, but the regulators have been supportive of. And we want to ensure that as we’re designing this, we’re not running afoul of any regs, and that when it’s exam time, regulators come in, and they’re comfortable with what has been implemented.

So we’ve had great success talking with the regulatory agencies around this concept, and we’ll keep them in the loop as we build. And then the last part of it is the community advisory. So going back to one of the examples that we had during our case study, having a community voice as part of this process, having an advisory group in your particular community that can provide that letter of reference for your borrower; that can say, oh, these are the places where you should be looking for business for diverse business.

Having that, having that sounding board. Someone on the ground connected to the community can inform some of the decisions being made with the larger group. So that’s the last piece of it.

Gary Stockton: That’s awesome. Well, Shannan, it’s been a real pleasure speaking with you today and hearing about the work that you’re doing. It’s so exciting. It’s it’s transformative, and we need to do all we can to spread that message. Where can our listeners find more information about Underwriting for Racial Justice?

Shannan Herbert: Absolutely. They can go to the Beneficial State Foundation webpage, and there is a link for Underwriting for Racial Justice you can click through; and I’m certain that Erin’s contact information is listed there.

If you can’t find her there, you can always contact me via LinkedIn.

Gary Stockton: Awesome. Awesome. Thanks so much for sharing your knowledge and your passion for change, Shannan.

Shannan Herbert: Thank you so much, Gary.