We are diving into the small business matter of business sentiment in this special episode of Small Business Matters with a discussion with Emily Wavering Corcoran. Emily is the Program Manager in charge of the Small Business Credit Survey at the Federal Reserve Banks.

Watch our interview

If you are unfamiliar with the SBCS, the Small Business Credit Survey, is a collaboration of all 12 Federal Reserve Banks, which provides timely information about small business conditions to policymakers and service providers. In 2022, the survey reached nearly 8,000 employer small businesses, collecting information about the performance, challenges, and credit-seeking experiences of firms across the United States. The results of that survey have just been published in the 2023 report on employer firms.

2023 Report on Employer Firms:

Findings from the 2022 Small Business Credit Survey

Small business revenue, employment, and profitability each improved from 2021, but expectations worsened year-over-year. With the end of pandemic-related funding programs, the application rate for traditional financing rebounded to pre-pandemic levels.

What follows is a lightly edited transcription of our interview.

Gary Stockton: So, can you talk a little bit about the gradual return to profitability seen in the survey across mostly all industries and your thoughts on what’s driving this, also if you could comment on the nominal improvement seen in businesses who said they were in very good or excellent financial condition since your last survey.

Emily Wavering Corcoran: Absolutely, Gary; there’s a lot to unpack in that question. So, happy to dive on in. We are seeing a continuation of the economic recovery from the early days of the pandemic, but economic growth did slow overall last year, and this is reflected in our survey findings. Even though small business profitability, revenue, and employment improved last year, these measures have not returned to the levels that we saw pre-pandemic.

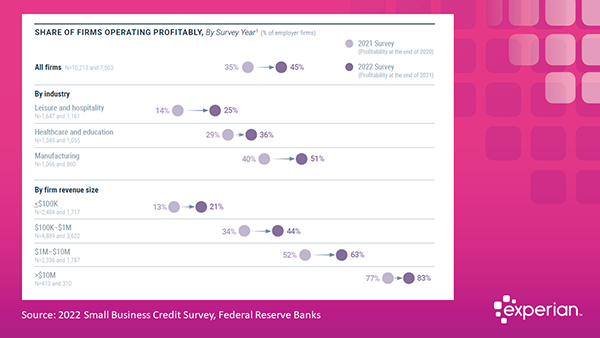

Like you pointed out in your question, there is an interesting contrast that we see in the data between performance measures, which improved and self-reported financial condition, which largely stayed the same. When it comes to performance. So, profitability specifically, 45% of small businesses were profitable at the end of 2021.

Emily Wavering Corcoran: That’s lower than, say, the end of 2018, when 57% of firms were profitable. But it is an improvement from the depths of the Pandemic. From the survey data, we see that revenue increases are largely driving those profitability gains. When we flip over then to look at the self-reported financial condition, we see little movement.

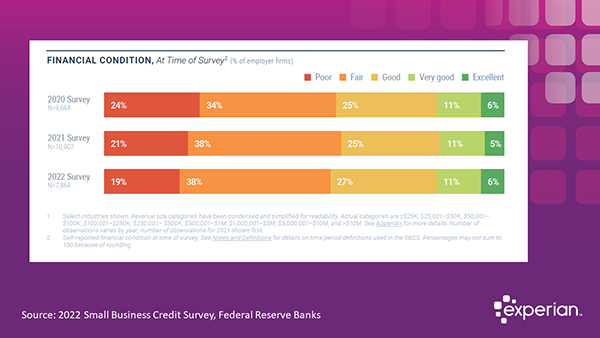

Emily Wavering Corcoran: Unlike profitability and revenue, our survey question on financial condition captures how the business owner is feeling about their business’s financial health. So we think about this information as small business sentiment, right? Small business owners don’t necessarily feel that their overall financial condition is substantially different, substantially improved than it was over the past several years.

Gary Stockton: Employers feel less confident about employment growth. Are you surprised about the sentiment reflected by small business owners running contrarian to what’s actually happening?

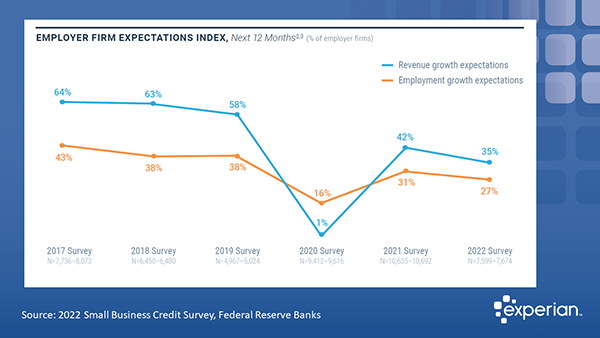

Emily Wavering Corcoran: It’s an uncertain economic environment to be sure. I do wanna be careful here because I don’t want to overstate the extent to which employers feel less confident about employment growth. Right, year-over-year small business expectations on this question we’re little changed. The percentage of small business owners that expected to decrease their workforce in the coming 12 months ticked up two percentage points from 10% in 2021 to 12% in 2022. But this trend that we see here on the chart, it was somewhat surprising to our team just because small business owners tend to be an optimistic and resilient group of people, right?

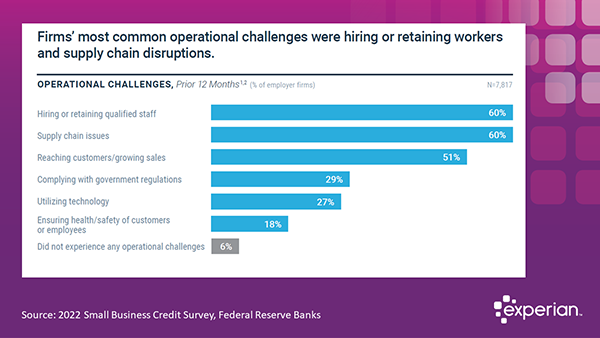

Emily Wavering Corcoran: But at the end of 2022, they were experiencing some uncertainty about the year to come. And no doubt, we think some of that uncertainty stems from the challenges that they experienced through 2022, including their most frequently cited operational challenges, which were hiring and retaining staff and supply chain issues, really persistent challenges.

Gary Stockton: Yeah, you, you just touched on it, firm’s most common operational challenges were hiring or retaining workers and supply chain disruptions, both at 60%. Are we seeing the great resignation play out in the survey results, or are small businesses not keeping up with wage expectations for these positions?

Emily Wavering Corcoran: It’s a great question, and honestly, it’s one of the reasons that last year we did a special report on hiring and worker retention, and it’s also one of the reasons that we continued in 2022 to ask a series of special questions on hiring and retention to really understand these dynamics and understand how small business owners were responding to such a tight labor market.

Emily Wavering Corcoran: To speak to your question a little bit, I think it’s some of both playing out in different ways in different sectors. Overall, small businesses turned a corner from 2021 through 2022, from operations tightening to wage and benefits boosting. So back in 2021, when faced with a very tight labor market, firms reduced their hours. They took on fewer projects, things like that. But in 2022, firms were more likely to increase employee compensation and they were less likely to reduce their operations. We saw that about two in three small businesses that had trouble hiring or retaining workers in 2022 responded by raising their wages.

Emily Wavering Corcoran: Now whether or not these increases are fully meeting the expectations of workers is, a separate question that’ll vary a lot by circumstance, but we do see small business owners making those wage increases.

Gary Stockton: Excellent. One follow-up on the supply chain, the transportation industry is challenged to find enough truck drivers as the boomers retire with the port slowdowns mostly behind us, do you see worker training and attraction to logistics careers as the thing driving this concern among small businesses? Or are we still dealing with the difficulty obtaining materials?

Emily Wavering Corcoran: Our results suggest a little of both. Labor market conditions remain strong, right? So labor demand continues to outpace labor supply, and supply chain disruptions have improved, but again, not uniformly across sectors and across products. That 60% of total firms that experienced supply chain challenges was really driven by a few key industries. So for example, 86% of manufacturing firms and 84% of retailers experienced supply chain issues in 2022. Within these industries, of course, there’s a confluence of factors. The labor market, goods supply, warehousing, and international complexity can elevate the likelihood of experiencing those supply chain challenges.

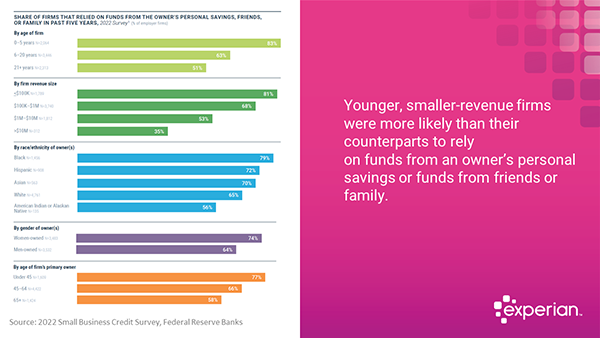

Gary Stockton: Excellent. We’ve seen record numbers of new businesses starting in the last couple of years, over 10 million according to census, so there are lots of younger businesses seeking access to capital. The survey indicates there are still very high numbers of young businesses tapping personal savings and funds from friends and family. More so in women-led firms. What are your thoughts on that?

Emily Wavering Corcoran: Yeah, so first I think it’s really important to remember that personal savings have always played a really important role for new businesses, right? It’s, it’s not uncommon to save up and then use that personal money as seed funding to invest in your new business, to start your new business.

Emily Wavering Corcoran: But I think what’s notable this year is that the pandemic altered, in some ways, the sources of funding that small businesses accessed. So pre pandemic respondents were most likely to rely on funds from a financial institution or a lender, followed closely by funds from the owners’ savings or friends and family. But in the 2022 survey that flipped, we found that respondents were more likely to use funds from an owner’s savings or friends or family. Or from a government funding source over the past five years, than they were to rely on funds from a financial institution. This isn’t surprising necessarily, right? But it is notable. Small businesses were facing enormous challenges during the pandemic. They were leaning on funds from a wide range of sources, and that included the owner’s personal funds. Those, those increases in the use of personal funds since 2019 are fairly uniform across firm categories.

So, for example, you asked about woman-owned firms. When we look at differences by the gender of the owner, those differences are similar to the differences that we observed prior to the pandemic. These are likely correlated, at least to some extent with firm age and firm size. Smaller, newer firms rely more on personal funds and woman-owned firms are more likely to be smaller and newer. Of course, as we transition back to a more normal funding environment, it’ll remain to be seen if the broader trend of increased reliance on personal funds will last or not.

Gary Stockton: Yeah. Very good. So what was the most surprising trend in the 2022 survey?

Emily Wavering Corcoran: I think the expectations index that we talked about at the top of our conversation did stand out to our team, right? Because small business optimism is relatively high. We expected upward or, maybe a flat trend rather than a slight downtick. But I think that really goes to, to show, to emphasize, the truly complicated environment that small business owners are operating in.

Gary Stockton: Excellent. Well, Emily, I’d like to thank you for sharing your thoughts with our listeners. Where can they learn more about the great work going on at the Federal Reserve Banks?

Emily Wavering Corcoran: Yeah. Thank you for asking that, Gary. I mean, I do have to say that I barely scratched the surface here, right? So the report and associated data are super rich. I would really encourage folks to head to our website, which is fedsmallbusiness.org, to dig into the data themselves, and Gary, I did wanna mention that just because solutions, policy solutions are as important as data. I wanted to plug an upcoming event from the Federal Reserve – Policy Summit. Yeah, Policy Summit is hosted by the Cleveland Fed, as well as several partner reserve Banks as well. and it’s this summer; it’s June 21st through 23rd.

Emily Wavering Corcoran: It’s being hosted in person in Cleveland, Ohio, as well as virtually. So if folks who are listening are interested in policy conversations happening outside the Beltway, I would encourage them to take a look at Policy Summit, check it out, come join us, and it’ll include lots of conversations like this about how our data inform innovations that support small business credit access, as well as, supporting workforce and affordable housing.

And I’ll just say that at the end of the day, we’re super passionate about supporting small businesses and helping them thrive. So again, fedsmallbusiness.org Policy Summit, and thank you so much, Gary, for having me.

Gary Stockton: Awesome. Emily. Thanks so much for coming back on the show.

Emily Wavering Corcoran: Glad to be here.