The 2024 Report on Employer Firms is an analysis of the data presented in the Small Business Credit Survey, released in 2023 by the Federal Reserve Bank. The report examines the performance and challenges faced by small businesses in the United States. The data is based on a survey conducted in late 2023 of over 6,000 employer firms with 1-499 employees.

Key Findings from the 2024 Report on Employer Firms:

- Modest Improvement from Pandemic Lows:There are signs of a modest recovery from the COVID-19 pandemic’s impact. Measures of firm performance, such as revenue and employment growth, held steady and are well above the pandemic’s lows. However, they haven’t yet reached pre-pandemic levels.

- Supply Chain Issues Easing:A significant improvement is the decline in supply chain challenges. In 2023, only 41% of firms reported supply chain issues compared to 60% in 2022.

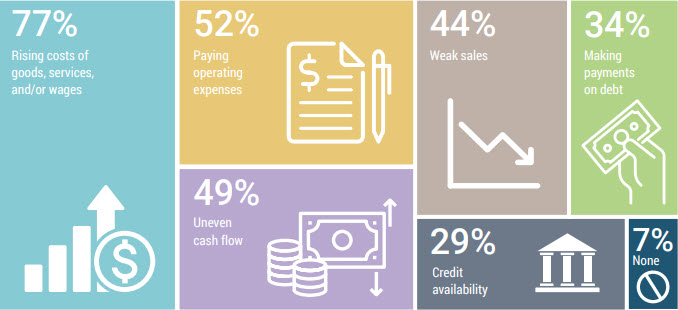

- Challenges Remain:Despite the positive signs, there are ongoing headwinds. The most common challenges identified by firms are rising costs and difficulty hiring or retaining qualified staff. Additionally, a majority of firms are feeling the impact of higher interest rates, particularly on debt payments.

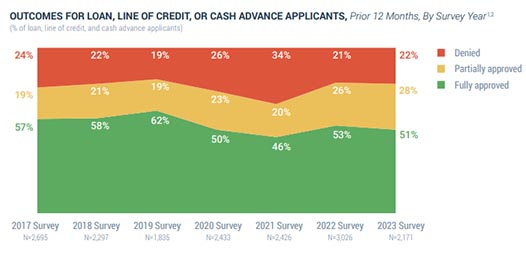

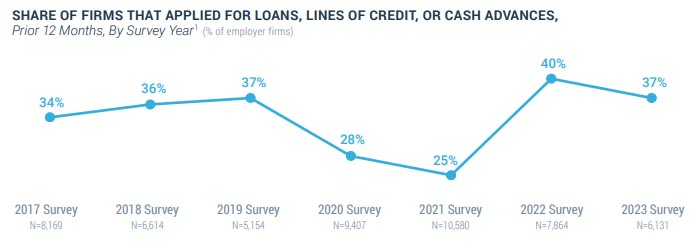

- Financing Demand Dips Slightly:The demand for loans, lines of credit, and merchant cash advances has decreased slightly compared to 2022. Approval rates remained steady. Among those applying, small banks, credit unions, and finance companies had the highest approval rates. However, applicant satisfaction with lenders has declined across the board.

Performance and Challenges:

- While performance metrics haven’t fully rebounded, they are stable and on an upward trajectory. There’s a more optimistic outlook for the future, with firms anticipating growth in revenue and employment in the coming year.

- Hiring and retaining qualified staff remains the most frequently reported operational challenge, although these numbers have dipped slightly from 2022.

were mostly steady between 2022 and 2023. The share of applicants fully

approved remains below prepandemic levels.

Debt and Financing:

- Firms are carrying more debt compared to pre-pandemic levels. In 2023, 39% of firms held over $100,000 in outstanding debt, up from 31% in 2019.

- Higher interest rates are a significant concern for businesses, impacting debt payments and causing some to delay expansion or capital spending.

- The use of financing products like credit cards and loans is on the rise, with 87% of firms regularly using or carrying a balance on at least one financing product in 2023, compared to 80% in 2019.

- Over half of the firms surveyed sought financing in the past year, primarily to cover operating expenses.

Financing Applications:

- The application rate for loans, lines of credit, and cash advances has dipped slightly, returning to pre-pandemic levels.

- Approval rates remained steady, but they haven’t yet reached pre-pandemic highs. Small banks, credit unions, and finance companies were the most likely lenders to approve applications.

- Firms owned by older individuals, larger firms, and white-owned businesses were more likely to receive full approval for financing.

- Applicant satisfaction with lenders has decreased overall. Applicants reported challenges with high-interest rates across all lender types.

Overall:

The report paints a picture of a small business sector that is gradually recovering from the pandemic. While there are signs of progress, challenges remain, particularly regarding rising costs, staffing, and the impact of higher interest rates. Businesses are still cautious when it comes to applying for financing, and those that do apply are facing an environment of tighter lending standards and higher borrowing costs.

“2024 Report on Employer Firms: Findings from the 2023 Small Business Credit Survey.” 2024. Small Business Credit Survey. Federal Reserve Banks. https://doi.org/10.55350/sbcs-20240307

This work is licensed under a Creative Commons Attribution-NonCommercial 4.0 International license.