Small Business News

Find out what’s happening right now.

Gary Stockton: In November of last year, the federal reserve banks conducted the Small Business Credit Survey. In all, they surveyed nearly 11,000 small businesses to ask them about their financial condition, whether they had sought financing in the prior 12 months, and what the effect the pandemic had on their business. The results of that survey have just been published in the 2022 Report on Employer Firms. Emily Wavering Corcoran is the Program Manager of the Small Business Credit Survey (SBCS) in the Community Development Department of the Federal Reserve Bank of Cleveland. The SBCS is a national collaboration among the 12 reserve banks of the Federal Reserve System, to gather timely information on small business, economic conditions, financing needs and credit availability. And we're recording this interview on Friday, March 4th, 2022 ahead of the Federal Open Market Committee meeting. Emily, welcome to the Small Business Matters podcast. Emily Wavering Corcoran: Thank you so much, Gary. Glad to be here. Gary Stockton: Well, one of the most heavily impacted small business segments is leisure and hospitality. Could you tell us what you found out about the financial condition of businesses in this sector? Emily Wavering Corcoran: Absolutely. So as you've mentioned in sort of the background you gave about the survey, the SBCS is fielded every fall. The 2021 SBCS, of course, was fielded from September through November, 2021. And it gathered information from over 17,000 small business owners across the country, including nearly 11,000 small businesses with employees. So that's the segment of small businesses that this report in particular focuses on. As you mentioned, the survey provides detailed information on performance and financing conditions from the perspective of small business owners. In addition to the standard questions about business conditions, debt and credit, the 2021 survey included questions about the ongoing effects of the pandemic, including its impact on revenues and employment, operating challenges, including workforce challenges and applications for pandemic related financial assistance. We also, for the second year in a row, included a question asking small business owners about the financial condition of their business, which is what you just referenced. They were given five options to select from. They could say their business was in excellent financial condition, the financial condition was very good, good, fair, or poor. Out of all employer small businesses, 59% were in poor or fair financial condition at the time of the survey, so, fall 2021. Now, when we drill down more deeply, we see that firms owned by people of color, firms with fewer employees, and firms in particular industries, including leisure and hospitality, were most likely to be in fair or poor financial condition. So relative to small businesses in other industries, leisure and hospitality firms were more likely to be in fair or poor financial condition. So three out of four firms in leisure and hospitality. In many ways, this is not surprising, right? Leisure and hospitality includes restaurants, hotels, entertainment venues. So many of those small businesses that were particularly hard hit, especially early in the pandemic. And that shows the persistent impact of that initial hit and trying to weather the pandemic as a firm that really relies on face-to-face contact, on having people come into the business--All of those things really hold for firms in the leisure and hospitality sector. Gary Stockton: More than half of the firms were in fair or poor financial condition at the time of the survey. And nearly all firms faced at least one operation or financial challenge in the prior 12 months. With so much government assistance made available, why do you think so many small businesses are still struggling? Emily Wavering Corcoran: Yeah, I think for this question, it's important to think about the counterfactual. What might SBCS data look like had pandemic related financial assistance not been made available? I don't know the answer to that question, no one does, but the fact that business performance numbers are tempered, and that many small businesses continue to face operational and financial challenges, even with pandemic related financial assistance, suggests that in the absence of that support, aggregate outcomes for small businesses, and of course the resulting SBCS data to measure those outcomes, could have been much worse. Gary Stockton: Can you talk a little about which businesses applied for additional financing vs. those who did not, and some of the reasons why they did not apply? Emily Wavering Corcoran: The Small Business Credit Survey identifies applicants or small businesses that did apply for credit, and non-applicants, or small businesses that did not apply for credit. So we get both sides of the experiences, right? Apply for credit, don't apply for credit. And then we can drill down to more deeply understand both of those sets of firms: firms that did apply, firms that chose not to apply. So 36% of firms did apply for financing. And 64% did not apply for financing. When you look at just that set of non-applicants, firms that did not apply for financing, 46% of those businesses did not apply because they had sufficient financing. So they did not need to apply for a loan or a line of credit because they had ample financing through other streams. Then 14% of that non applicant pool were discouraged, meaning that they did not apply because they believed that they would be turned down. When you look again, one step further, more deeply at those discouraged firms, a majority of those firms, or just over half of those firms, believed they would be turned down because of weak business financials. And then other reasons that those folks cited in the survey were lender requirements, the belief that lenders would not extend financing based on some characteristic of their business; previous denials and bad experiences in the past that made them discouraged about applying again, and missing documentation was also a relatively big factor for folks. Gary Stockton: You mentioned them being concerned about weak financials as a leading reason. Would that be a major concern when seeking government help through the PPP program? Or was it just maybe a confidence issue with that business owner? Emily Wavering Corcoran: I think both. Financials are certainly an important part of the credit application process. And so as we saw, business fundamentals being hard hit through the pandemic, that certainly played out in both folks deciding to apply for credit or not. And then also it played out in some of the outcomes that we saw for folks who did choose to apply for credit. Gary Stockton: Yeah. The other thing that we noticed in the report was that 2021 PPP outcomes were worse than 2019, particularly in that leisure and hospitality sector. And particularly with black and brown businesses, do you know what's going on there? Emily Wavering Corcoran: Yeah. So again, I would point to some of the information in the report about financial condition, about annual revenues and employment. Certain segments of firms being really hard hit, and then that playing out in different ways in terms of credit access. We did, as you point out, we saw both a decline in firms seeking PPP and a decline in firms receiving PPP. The why is an incredibly complex question to answer, right? Definitely not fully answered by SBCS data, but it is at least partially explained by the relatively smaller size of the third round of PPP funding compared to the two prior rounds, as well as additional eligibility requirements for PPP. But again, not fully answered by SBCS data, certainly something that I'm sure additional research will look at in the years to come. Gary Stockton: What was the most surprising thing to you about the 2022 survey? Was there one thing that really stood out to you as, as important? Emily Wavering Corcoran: Good question, but to be honest, “surprised” doesn't quite capture what I felt about any of the survey results as we were digesting the data and really examining things. In many ways, I feel like the survey data add greater nuance and more robust evidence to ongoing narratives about small business hardship and resilience that we've been hearing about and talking about over the last two years at this point. instead of surprise, I would say that the results for me strengthened my resolve to continue collecting and producing this data so that we can continue to have structural information on small business credit experiences. Small business does matter, and of course, small businesses are on the road to recovery, but it appears to be a long and uneven road, but SBCS data will continue to be there as small businesses move forward. Gary Stockton: Well, Emily, I'd like to thank you for sharing your thoughts with our listeners. Where can they learn more about the great work going on at the Federal Reserve Banks? Emily Wavering Corcoran: I love that question. You can learn more about the Small Business Credit Survey in particular at www.fedsmallbusiness.org. I would also encourage your listeners to check out www.fedcommunities.org, which is a website that shares information across the Federal Reserve System on the great work that the Federal Reserve Banks are doing at the community level. Gary Stockton: Emily, thank you very much for your time. 2022 Small Business Credit Survey Note: We recorded this interview on Friday, March 4, 2022.

Barry Moltz joins us on Small Business Matters to talk about why change is so difficult for small business owners.

Farmers & Merchants (F&M) Bank of Long Beach, CA has awarded $60,000 to 22 local micro and small businesses since 2020. In the first year of the program, F&M Bank had 84 applicants. In the second year, more than 600. Recipients say these grants have come at the perfect time to help with challenges sometimes made even greater by the ongoing pandemic. (Farmers & Merchants Segment appears at 28:37) “There were a lot of small businesses in our community struggling, that were having to rethink how they do business and how to adapt to circumstances well beyond their control,” said Andrea Carlson, Vice President at F&M Bank. “We were able to help more than 6,000 businesses through the SBA's Paycheck Protection Program (PPP), but we still saw a gap in assistance for businesses that didn't meet the criteria [for that program]," she said. Applicants did not have to be members or clients of F&M Bank to be eligible to receive the grants. To qualify, a business had to have existed for at least two years, have fewer than 20 employees, be in the bank’s geographical service area, and have less than $1 million in revenue. Microbusinesses Fall Through the Cracks "F&M Bank is really a jewel for small businesses. People tend to forget about these microbusinesses, that make less than $2 million a year, have less than 20 employees. But there are a lot of us like that, we are a growing part of the greater economy, but we are so often overlooked," said Omar Hernandez, a disabled veteran and owner of Global Urban Strategies, a PR firm for municipalities. “Because of the pandemic, everything really just stopped. So our cash flow just stopped. So we worked off our cash reserves, and then our savings. For me, our employees are the most important component of my business. We have to invest in our people. This grant was so important to us, because we were able to keep getting everyone paid on time.” Hernandez says he plans to become a customer of F&M Bank now. “The way I see it is, they invested in me, so why not go and do the same thing and do business with them?” Tatiana Pacheco owns Andrea's Healthy Kitchen, a juice bar in Rosemeade, CA. Just as sales began slowing down at the beginning of the pandemic, her business location suffered a colossal fire. "It took us one year to reopen. Even though December is our slowest month, we were able to keep our employees paid for that month. This grant came at just the right time," Pacheco said. Black-Owned Businesses Disproportionately Harmed by Pandemic A study1 from the early months of the pandemic showed 41% of Black-owned businesses closing their doors. Thirty-two percent of Latinx-owned businesses closed. Compared to about 17% of white-owned businesses. So F&M Bank gave priority to grant applicants whose businesses serve underprivileged neighborhoods, and/or are owned by people of color. Jala Eaton of On My Own Financial is an attorney and financial and estate planner on a mission to close the racial wealth gap. She started her business prior to the pandemic offering financial education and estate planning to business owners and families. “For me, these funds are going to build infrastructure and software to help me continue to serve my clients virtually. So online scheduling software, client management systems, even paying the annual fees to be an LLC,” Eaton said. “There is a big disparity—40% of Black businesses went out of business last year, because of COVID and lack of access to resources and money. That’s why I’m so passionate about talking to my community about money and being strategic with it.” Eaton said she's also planning on hiring her first employee this year. F&M Bank was founded in 1907 on the principles of honesty, integrity, the home, the church, and service above self. Each year F&M Bank gives away more than $1 million to charities, non-profit organizations, and religious entities within the communities they serve. Find them on social media, and learn more about the other extraordinary entrepreneurs who received grants as part of this program. And thanks to Farmers and Merchant’s Bank for investing in the community. Link to study: https://siepr.stanford.edu/sites/default/files/publications/20-022.pdf Got a story about Diversity, Equity, and Inclusion? Email us at smbmatters@experian.com. Listen to the full episode on any of these platforms:

In this episode of Small Business Matters we focus on generational entrepreneurship with our guest Keewa Nurullah. She is a fourth-generation small business owner.

Help is coming As America continues efforts to recover from the financial consequences related to the Covid-19 pandemic, some help is on the way for qualifying restaurants. Thanks to the Restaurant Revitalization Program, the U.S. Small Business Administration will be awarding funding to restaurants, bars, and similar food-and-drink-service businesses that meet eligibility requirements. This is a new initiative funded by the American Rescue Plan Act, which became law on March 11, 2021. Funds for business expenses The program will provide funds to cover revenue losses caused by the pandemic. The amounts awarded vary from $1,000 to $5,000,000 per location, to a maximum of $10,000,000 total per business. The funding is meant to provide “support the ongoing operations” of the business, according to the mandate from Congress. Funds may be used to cover many common business expenses, such as payroll (including wages and benefits costs), mortgage or rent, utility bills, construction, maintenance, supplier costs, and other operating expenses. Apply now Starting on Tuesday, May 3rd, eligible business owners can begin submitting applications. Applications will remain open only until allocated monies are expended to qualifying recipients. There is also a time limit on the use of funds granted to those businesses receiving money: March 11, 2023. So, interested businesses should begin their application process right away. Application requirements and information about necessary documentation can be found here: restaurants.sba.gov. More information on eligibility requirements and application documents are posted on the SBA website.

For many of us, 2020 has been the hardest year of our lives. As a society we are all going through this together, we know the pandemic will eventually end, and we all look forward to better days. Since the pandemic started the small business community has suffered greatly. We hear many stories about business owners struggling to survive. About business owners having to lay off staff and close permanently. But we draw inspiration from many of the innovation stories making headlines, stories about businesses who made a pivot to join the fight, and support healthcare professionals on the frontlines of the virus by converting factories to make PPE. We hear how small businesses navigated applying for the first round of PPP loans, and hope meaningful relief for small business comes soon. We draw inspiration from small business progress, and we stand strong with the people who went after their dreams. The pandemic will end, but dreams will not. It’s been said so many times that small businesses are the engine of our economy, and they truly are. Our commitment to helping small businesses with their financial health will continue to be unwavering. Supporting small businesses, helping them to create a better tomorrow Find out more about how Experian is supporting small businesses. https://www.experian.com/small-business/mybusinessfuture #smallbusiness #mybusinessfuture #businesscredit

Corporate Pledge Experian pledges to continue to help small businesses manage their risk, grow their business, and navigate their financial health during and after these turbulent times. We are offering small business owners 20% off their initial business credit report and 50 percent off a one-year subscription to monitor their business credit score. Going through this unprecedented time takes strength, and we pledge to support small businesses. https://www.smartbusinessreports.com/godaddy/ Experian is proud to have served and continue serving the small business community for over 70 years. We have learned a lot, as we have stood with small business through the best and worst of times. Most importantly, we understand that as the economy faces challenges, so do the ambitions and dreams of small business owners – and we have tailored our solutions with this in mind. Our credit data is an integral ingredient in the success of any business. An accurate view of financial health help businesses better evaluate trading partners, tap into new markets and make real-time decisions. It’s important that every small business owner knows where they stand and how others see them, especially during the times when they may need access to new capital. To ensure that small businesses have additional resources at their disposal to make informed decisions at this critical time, we are providing discounts on our 1-year monitoring service subscriptions. We also feel a deep obligation to our clients, the lenders, trade creditors, utilities, insurance underwriters, and more as they strive to support small businesses during this time. To further help small businesses gain access to capital they need, Experian also launched its free COVID-19 U.S. Business Risk Index to assist lenders and government organizations in understanding how to make lending options available to the business segments that need it the most. This new risk index can help business risk professionals better understand the impact that the pandemic may have on commercial operations based on several key factors. We hope that our data and advanced analytics enable our clients to offer fair and responsible lending to small businesses that need it most during this time. We encourage small business owners and partners to hold fast to your original visions and leverage our experience. No dream is too big, whether you are a company of one or one hundred, we’re here to support you. And together, we can create a better tomorrow. Hiq Lee, PresidentExperian Business Information Services #OPENWESTAND

Federal Small Business Stimulus Programs In response to the economic impact of the Coronavirus, President Donald Trump signed legislation that will allocate $2.2 trillion in federal small business stimulus funding to support the U.S. economy, small businesses are among those that will benefit.The Small Business Administration, under the stimulus package, will oversee the Paycheck Protection Program, and the Economic Injury Disaster Loans and Loan Advance program which combined will distribute $350 billion to small businesses that can be partially forgiven if the companies meet certain requirements.To help clarify the programs, we have invited small business author and expert Barry Moltz to share what small businesses need to know about these programs.

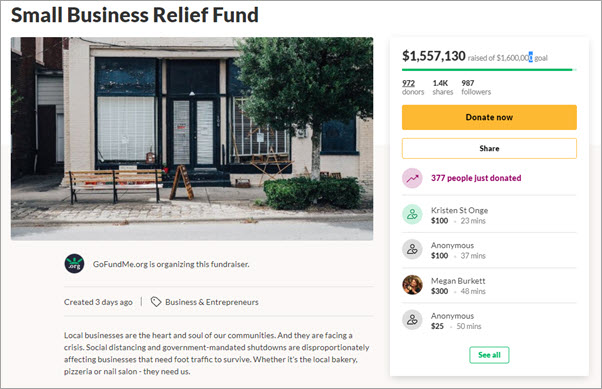

As the infections of Coronavirus continue to escalate unabated, millions of small businesses are closing and laying off workers. Others send the majority of their staff to work from home, as in our case here at Experian. If you are a business who can pivot to virtual selling Covid-19 may just be a temporary setback, but for other non-essential retail businesses laying off staff and closing their doors, workers have few options. I got a little burned out from watching all of the bad news as I flipped around cable the other night so I retreated to the den to read articles and saw that three days ago GoFundMe had set up a Small Business Relief Fund for businesses impacted but Covid-19. The goal of the fund is to raise $1.6 million, and as of this writing had raised $1.557,130 with major donations coming from Intuit Quickbooks, Yelp and GoFundMe. Hats off! Small Business Relief Fund The site is filled with over 80,000 businesses looking for donations. As I sat reading the stories about businesses here in Orange County, California, I was struck by the outpouring of support and the heartwarming comments left by customers. Many of the campaigns are launched by business owners who want to do right by their people while their businesses are struggling to remain open. Orange County businesses fight to survive A nurse from Children's Hospital Orange County picks up from Blue Bowl Teague, Ish, and Craig from Veteran-owned Blue Bowl Superfoods in Orange, California have a target of $50,000 from which a portion will go to feeding healthcare workers from nearby CHOC and St. Joseph hospitals. Their campaign description is a defiant open letter addressed to COVID-19 which reads "We are a veteran-owned small business fighting to keep our lights on because of you. You will not destroy our jobs and you will not destroy what we do." As of this posting his campaign had raised $11,548. Blue Bowl Superfoods GoFundMe Campaign I reached out to Blue Bowl and spoke with the company co-founder Teague Savitch. Teague got the idea for the company while deployed to Afghanistan in 2014, telling me “Towards the tail end of my deployment experience I was working in a team that was doing 24-7 operations and on-call all the time, always eating on the go. It was the first time in my life where for an extended period I was getting very little sleep and a lot of stress. When I came home, I started going to juice bars and really paid more attention to what I put in my body. That's when I kind of really got interested in the superfood movement. And from that Blue Bowl Superfoods was born.” When asked why he started a GoFundMe he responded “We're fighting to try and keep our doors open, and keep a paycheck going for our team, and it just so happens that our first location that we opened just over four years ago is right in the backyard of two major Orange County hospitals - Children's Hospital, Orange County and Saint Joseph Hospital. Both of those hospitals have been very key to our early success, spreading the word about our company and what we do. It's been a really popular item with hospital staff that need a meal that's healthy performance-enhancing nutrient-dense where they can come in quickly grab and go, get in and out of there and get back to doing their rounds in the hospital.” Solopreneurs turn to GoFundMe Cali Creechers GoFundMe Campaign Emily Creech of Cali Creechers, a pet sitting and dog walking business, is using GoFundMe to raise $3,500 to offset cancellations saying "most of my clients have had to cancel trips, work from home and isolate themselves from other humans in order to stay healthy." The impact of Covid-19 not only threatens her livelihood, but also her housing situation. I reached out to Emily to ask how she heard about the GoFundMe idea and she said: “I actually got an email from QuickBooks because I have QuickBooks for my business which is to keep everything organized, and they said they were sponsoring or helping promote the idea that you can start to go fund me for a local small business.” Emily says things started to change in her business around the 13th of March when she had one really big booking get canceled saying “I think people are canceling their trips because they have to, they're scared or they're elderly and they don't want anyone coming in their home to pick up their dog.” Cali Creechers got started after Emily started walking people’s dogs in her free time, picking up gigs using the Rover app. She said “You pass a background check and create a profile and people who need dog care can kind of narrow down their searches and get someone to care for their dog. So, I did that and I had a lot of really good response and I realized that it’s something I'm good at.” But Rover understandably charged a 20% fee on all of her business, so one day she decided to set-up an LLC so she could earn 100% of what she makes. Non-essential service-based businesses suffer sudden closures Team 12 GoFundMe Campaign Josh Boyd founded Costa Mesa-based Team 12 Group Training in 2013. He tells us that when the State ordered all non-essential businesses closed he had to lay off his 37 employees. He's hoping GoFundMe can help him raise $60,000 to help his employees, all out of work. Josh explained in his campaign profile, the revenue for his business is 100% Subscription-based and now that training sessions are on hold, they have no revenue to pay employees. I asked Josh if he thought Covid-19 would do any lasting damage to his business he said, "Once this is over the public will flock to gyms and have a deeper appreciation for the service based industry because they realize how hard it is to get motivated on their own.” Adding “You truly don’t value things as much until you actually lose it!”