Small Business News

Find out what’s happening right now.

Experian is partnering with the Federal Reserve to conduct its annual Small Business Credit Survey for both pre-start and existing businesses, and we’d like you to participate. This short survey will take approximately 10 minutes and will ask about business conditions, financing needs, and credit experiences. Summary results will be shared with you in the Spring, and all responses are confidential. The survey highlights the experiences of small businesses nationwide and provides critical information that service providers, policymakers, and lenders use to improve programs for small business owners. Please click the button below to complete the survey. Thank you for participating.

In celebration of Women’s History Month, Yelp has made it easier for customers to tell if a business is Woman-owned by enabling a special “Women-owned Business” attribute on their Yelp page. “We’re excited to help raise the profile of millions of women-owned businesses who drive the local economies of our cities and towns,” says Miriam Warren, Yelp’s vice president of engagement, diversity, and belonging. “We’re hopeful that this new attribute not only makes it easier to identify and connect with great women-owned businesses on Yelp, but that it also drives more dollars directly to the bottom line for these female-owned businesses.” To help build awareness among Women Business Owners, Yelp has partnered with Rebecca Minkoff’s Female Founder Collective to automatically list existing members as “Women-Owned” on their respective Yelp pages. If you are a Woman Business Owner and would like to self-identify as Woman-Owned-Business, you can do so by updating your Yelp page. Women are feeling empowered Much has changed for Women in the past five years. Women are feeling empowered — according to Visa’s State of Female Entrepreneurship report, 79 percent of American female entrepreneurs feel more empowered than they did five years ago. But 73 percent found funding to be a significant challenge in getting their business off the ground. By shining a light on Women-owned businesses, Yelp is taking an important step in highlighting female entrepreneurs, making them easy to identify and support.

Veteran entrepreneurs have always been at the core of American business owners. In May of this year, Experian conducted a series of interviews with veteran business owners and found that the skills and values learned while serving their country naturally prepared them for entrepreneurship. Of those skills and values were leadership, adaptation, discipline, and perseverance. Recently, the New York Federal Reserve Bank, in conjunction with the U.S. Small Business Association (SBA), released a detailed report about veteran business ownership and found that the number of veteran entrepreneurs is declining. With historical numbers revealing strength in veteran entrepreneurship, what are the reasons for the sudden decline? The U.S. Small Business Association (SBA) reports in a series of surveys, 36% of veteran entrepreneurs had no prior interest in business ownership before their military service. Because of the training and experience of serving in the military, veterans seem to be well-fitted for entrepreneurship. According to the Institute for Veterans and Military families, of those who returned home from prior wars, 49.7% of WWII vets and 40% of Korean War veterans started their own businesses. The U.S. Bureau of Labor Statistics also reports that the highest rates of self-employment were those who served in World War II, Korea, and Vietnam. Veteran business formation declining In a 2011 report, however, the U.S. Small Business Association noted a decline in veteran entrepreneurs and began to look deeper into determining factors. Part of the reason was that the older generation was aging out of the workforce. Since 9/11, only 4.5% of veterans have opened businesses, clearly emphasizing that the rate of new veteran entrepreneurs is in steady decline. Also of note, compared to non-veteran-owned small businesses in any industry, veteran-owned companies with 1 - 4 employees seem to be underperforming in sales. Larger veteran-owned businesses, with 5 or more employees, actually outperform non-veteran owned businesses. Does this reveal that newer, veteran-owned small businesses seem to have more challenges than veteran entrepreneurs of decades past? Factors in the decline of veteran entrepreneur success Recent years have seen many corporate initiatives that encourage veteran hiring and could be contributing to the decline of veteran entrepreneurs. The New York Fed’s report on veteran entrepreneurship notes, however, that veterans are underemployed compared to non-veterans and nearly of quarter of returning vets would like to start businesses. Further details of the report reveal that veterans long to “forge their own path” and “showcase skills”. The challenge for many veterans is the lack of a strong business or personal network with which to begin their new ventures. Because they’ve been away and typically relocate fairly often, the lack of social resources could be a factor in the decline of new veteran-owned businesses. The Federal Reserve Bank analyzed data and Small Business Credit statistics of veteran and non-veteran business owners and found that the biggest factor affecting veteran entrepreneurs is access to capital. Small business access to capital According to the New York Fed Small Business Credit Survey, the firms surveyed had less than 500 employees and were asked about their business performance and financing needs. If more than 50% of the business was owned by a veteran, they were referred to as veteran-owned businesses. The report found that the need for small business financing was similar between veteran and non-veteran owned businesses.The difference was that veteran-owned businesses submitted more applications and reached out to banks large, small and online. Even with the greater number of applications and the variety of lenders, veteran-owned businesses typically obtained less financing and saw lower approval rates than non-veteran owned businesses. During a time of economic recovery (2010 - 2017), the SBA loans to non-veteran owned businesses increased to 82% as compared to 48% for veterans, even with relief programs set aside for veterans. Veterans also seem to be asking for smaller loans, something that also affects women business owners’ access to capital. Larger banks are less likely to approve loans under $100K. Because of the frequent traveling and working overseas, some veterans are also struggling with building solid credit or having collateral. As they’re seen as higher risk, some lenders aren’t willing to take the chance. Veterans are still asking for help Even with these challenges and barriers to capital, veterans are seeking out assistance from the SBA and other resources to grow their small businesses after they have been denied capital. With common traits of strength and self-reliance, veteran entrepreneurs may be starting businesses before they’ve met with financial and business advisors. More preparation and knowledge about which lenders would better meet their financial needs and how to prepare for credit and collateral requirements could be helpful for veteran business owners. The New York Fed report suggests for several recommendations for policymakers to help veteran business owners including: Easier debt financing Mentorship Awareness and marketing To learn more about the challenges faced by veteran entrepreneurs and how to help, access the New York Federal Reserve Bank report here.

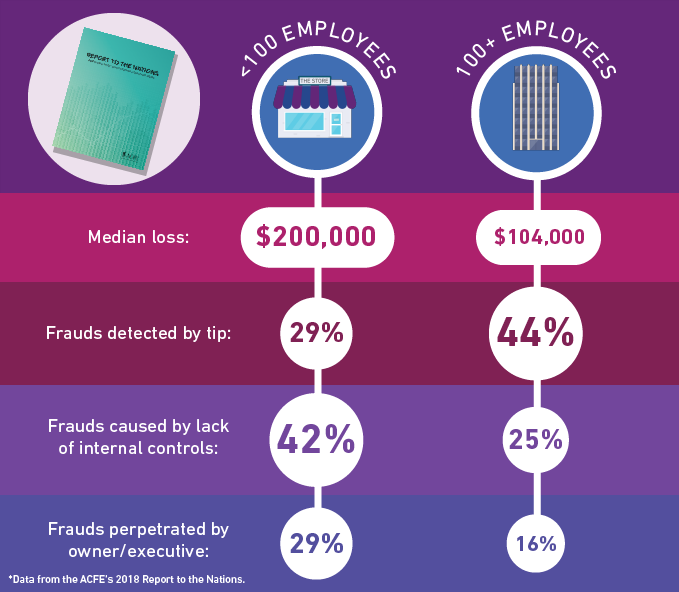

The Association of Certified Fraud Examiners has released their 2018 Report to the Nations: Global Study on Occupational Fraud and Abuse and small businesses should take heed. The annual report, which began in 1996, was implemented to identify cases of fraud in order to best address the problem. The Report to the Nations identifies: how fraud is committed, how it is detected, who commits it and how organizations can protect themselves. One of the key findings is that small businesses lose almost twice as much per fraud incident as larger businesses. Other key findings will be addressed in this article. Experian spoke with Andi McNeal, co-author of the report and ACFE’s Director of Research, to dive deeper into the reports’ findings. How is Occupational Fraud Harmful to Small Businesses? Occupational fraud is when someone steals from their own company. For small businesses, fraud can be more impactful than in large businesses. In the Report to the Nations, small businesses are identified as those with less than 100 employees as compared to larger businesses with 100 or more. According to the report, the median loss for small businesses is $200,000 versus $104,000 for large businesses. With the average amount of each incident nearly double, and with revenues likely much less than in larger businesses, this loss can be quite devastating to the business. ACFE’s Director of Research, Andi McNeal, points out that the report doesn’t necessarily cover all industries, only 23 industry categories are included, so the average amount per industry can vary. However, considering the average size of small businesses, one single employee stealing $200,000 could wipe out the whole company. How is Fraud Committed and Detected? According to McNeal, the report was built on a survey of ACFE fraud examiners sharing case information from the prior 2 years. The current report looked at 2,690 cases of occupational fraud from all over the world, including 28% that were perpetrated in small businesses. The report revealed that fraud is typically found because there are few if any, internal controls to prevent and detect it. In a small business, fraud can be perpetuated by: a co-owner one owner running personal purchases through the company or to family members the person controlling the bank account With the average median duration of a fraud scheme lasting 16 months, corruption is the most common with 70% of cases perpetrated by a business leader. McNeal stated that the lack of internal controls contributed to almost half of all frauds. Most organizations, including those without reporting hotlines, are more than twice as likely to detect fraud only by accident. The unfortunate truth for small businesses is the “risk of fraud can be easily overlooked and quite devastating”. In small businesses, owners are less likely to detect and report fraud. Owners and leaders operate on trust, even when formal policies are in place. Small business leaders are focused on operations and not necessarily concerned that someone is stealing from them. The Report to the Nations states that only 2% of owners will detect and report occupational fraud compared to 53% of employees. So having these conscientious whistleblowers among your ranks is your best line of defense. How Can Small Businesses Protect Themselves from Fraud? McNeal recommended internal controls to prevent and detect fraud. Small businesses have half the implementation rate of internal controls than larger businesses if they have any at all. Some of the internal controls that can help include: A Code of conduct Anti-fraud training Data analytics to control fraud 3rd party audits of financial statements The best way to prevent fraud is to emphasize that fraud will be reported right away. McNeal recommended sitting down with staff to look over the company’s anti-fraud policy. This management procedure sends a strong message to staff to let them know that fraud will be taken seriously. In other cases, employees did have suspicions of fraud but didn’t know what to do about it. Setting up a formal procedure of transparency, including a hotline program, allows employees to know there’s someone they can talk to. Empowered staff will speak up if given a directive of reporting concerning behaviors, including pressure or frustration. Some employees need an outlet instead of resorting to fraud. Build a layer of management review. McNeal stated that if the small business owner opened the monthly bank statements, it could stop most small business fraud. Surprise accounting audits can also ensure the accounting procedures are truthful and accurate. Final Thoughts on Detecting Small Business Fraud Andi McNeal shared that there are many third-party businesses available to help detect fraud. ACFE Membership is made up of anti-fraud professionals, including many boutique firms. Some consultancies specialize in helping small business implement scaled anti-fraud programs. Business owners can decide which firms fit their need or make sense for the number of resources they have available. There are also resources online to help detect fraud and build internal controls. Business owners need a clearer understanding of where their risk is, and which parts of their company are most vulnerable to fraud. Small business needs to pay special attention to their accounting department, including implementing processes and procedures. For instance, McNeal recommends that staff is cross-trained when someone is going on vacation or that more than one person is reviewing the accounting. Surprise audits are most effective. “Also,” said McNeal, “Management behaving in an ethical manner. If employees are watching management making ethical decisions in a grey area, then they may do the same. The tone is set from the top.” Running background checks is also helpful, so small business owners do not hire those who have stolen before. According to McNeal, only 4% of fraudsters have been convicted of fraud prior to the cases in the report. 89% had no criminal background. Unfortunately, after the fraud is detected, fewer organizations are actually prosecuting the fraudsters. So businesses could be hiring first-time offenders or those who simply weren’t prosecuted because of cost if the previous victim was afraid of bad publicity or they believed the internal justice was sufficient. There should be appropriate consequences to help stop the propagation of fraud. You can download this fascinating report from the Association of Certified Fraud Examiners website.

As Millennials and Generation Z enter the workplace, traditional work expectations have been questioned. Not only are companies being challenged for their dress code, the younger generation also has higher expectations of the benefits they’ll receive. With the global economy growing at a rapid pace, boomers retiring and others leaving the American workforce to pursue entrepreneur opportunities, qualified job seekers can be a scarce commodity. At least 72% of organizations are increasing their benefits offerings to attract and retain employees. To build a more attractive compensation package and entice more applicants, should companies embrace the “work-life balance” concept with reduced work weeks? A Shorter Work Week Defined While the origins of a reduced work week idea are unclear, ad agencies of the 1960’s may have started the trend when they noticed a reduction in productivity during the summer months. They began a program called “Summer Fridays” and offered half-days or full Fridays off. State employees in Utah began working ten-hour days, Monday through Thursday, in 2008. The decision was based on the expectation of reducing operating costs. Although Utah reverted back to five-day work weeks in 2011, many state and local governments still operate on alternative schedules. Many organizations already offer reduced work week programs and have found that employees are more productive in a shorter amount of time. The focus is more consistent, sick days reduced and, considering the amount of work an employee would likely accomplish before going on vacation, the motivation to complete tasks increases. Companies Offering Flexibility Amazon made headlines across the business world with its announcement of a 30-hour work week pilot program in 2016. In an effort to restore work-life balance, especially after a New York Times article claimed that Amazon pushed their employees to work day and night, the policy sought to offer flexibility and encourage more creativity. Even before Amazon made its move, audit firm KPMG was already offering 4-day work weeks to increase morale and productivity among its employees. The program wasn’t available to all employees and managers had final discretion for whom it would be offered. Project management company Basecamp offers a 4-day work week for employees who’ve been on staff for at least a year. May through September is the only time of year employees can take this option and they only have to work four 8-hour days. The CEO of the advertising agency, SteelHouse, implemented a program that gives employees a 3-day weekend every month of the year. Many months already have a 3-day weekend due to certain holidays. For those months that don’t, the company offers “SteelHouse Days” on either a Monday or Friday. In Germany, IG Metall, the country’s largest metalworker’s union, recently struck a deal to reduce their work week to 28 hours. In an effort to allow more time at home for those with younger children, the move will also allow companies to offer more 40-hour week contracts to others as needed. The deal is expected to reverberate throughout the EU with more businesses considering the same. According to The Guardian’s report in 2011, employees in EU countries work considerably less than in the U.S. Luxembourg, for example, reveals the highest productivity at only working 29 hours on average per week. Lessons Learned from Executives Since a shorter, or compressed, work week has already been piloted in many organizations, executives can share best practices for implementing the program. Concerns were mainly around state labor laws, wage laws, vacation days and holidays. For instance, in California, overtime begins after an employee works 8 hours in a single day. Management must also lead the charge and allow the individual to take a 3-day weekend without work expectations such as being scheduled for a meeting on their day off. If possible, start small and monitor productivity before rolling out the program company-wide. There are several flexible options for making a reduced work week possible including: Four 10-hour work days Summer Fridays One 3-day weekend every month Staggering or rotating schedules so the business can operate 5 days a week if required Allowing employees to come in earlier rather than staying later In a tight labor market where applicants have more than one job offer on the table, employers are offering even more impressive perks like reimbursement for vacations. It’s no surprise that job seekers are doing their research and being choosy about where they land. Considering reduced work weeks and 3-day weekends, even if it’s only part of the time, is one benefit that is very attractive.

News of the General Data Protection Regulation (GDPR) has been floating in our peripherals since it was passed by the European Parliament back in 2016, but as of May 25, 2018, the privacy-focused piece of legislation will finally go into effect. And, though it’s specifically designed for those in the EU, American business owners are not exempt from impact. As an American business owner with your own set of privacy rules and regulations to contend with, the GDPR may not seem like much of a concern. However, since the regulations impact all organizations that process or hold EU customer data, any American business that falls into that category (i.e., businesses that have a web presence and/or sells their products to citizens within the EU) will need to comply. You’ll note that “web presence” was included, not just the notion of selling products or services. That’s specifically because of stipulations that focus on the collection of personal data, not just monetary transactions So, any organization that collects identifiable information (PII), which includes social security numbers, phone number, salary, race, marital status, military rank or civilian grade, age, medical records etc., from EU citizens will need to be in compliance. Top GDPR Takeaways for Small Businesses You know what the GDPR is, generally, but what specific things will be required of businesses? Here are a few of the most significant regulations and considerations that you’ll need to take into account if you want to be in compliance. Seventy-two-hour breach notification: Just like it sounds, any organization or company that detects a customer data breach must notify the national authorities within seventy-two hours of that breach, and in some cases, customer notification must also take place. Consent for data is a must: Companies and organization must obtain explicit and informed consent when collecting and/or processing data from individuals, even if it’s something as simple as an email list. Explicit consent should be used if an organization wants to validate the sensitive data for use. Additionally, the consent must be achieved with a clear affirmative action, which means that those companies can no longer use “opt-out” or pre-checked boxes to achieve that consent. Further, consent requests must be separate from terms and conditions; cannot, in most cases, be a contingency for signing up; must be granular or designed in such a way that consent is specific to each type of processing; and named, meaning the individual must be made aware of what organizations or third-parties rely on that consent. Finally, organizations must document the aforementioned consent, including the specific consent requested/provided and when that consent took place, individuals must have the right to withdraw their consent at any time, and organizations must provide information about how an individual can withdraw their consent as well as an easy path to do so. The right to be forgotten: organizations and businesses must comply with a request by an individual to “be forgotten” or to have a copy of their data. Though simplistic in theory, the right to be forgotten will require that all organizations be able to delete not only primary data but also any data duplications, be they due to operational processes (i.e., cloud storage backup) or unspecified employee lead duplication. This will require universal conversations and policies among all departments and employees who can access, copy or otherwise maintain customer data. Any data processed for a child under sixteen is considered unlawful if there is no prior parental consent; however, states within the EU can opt to reduce that age, with 13 years of age representing the cutoff. The aforementioned are just a few of the more specific requirements that business owners must meet if they want to become compliant with the GDPR. Some of these requirements may take a few weeks (or months) to plan and execute, and so, as mentioned above, it’s best to start as soon as possible if you haven’t already. To get started, or make sure your efforts are aligned with expectations, considering the following steps. Analyze your current data processes; this includes how you obtain data as well as how you process and maintain that data. If you don’t have one already, you should have a Personal Information Assessment (PIA), and in some cases, you may need a Data Protection Impact Assessment. Work with your legal department to fully understand and address the GDPR requirements (like the DPIA; however, efforts should extend past legal departments or consultants and include contact with multiple departments, including IT, Marketing, and Finance, as many are directly involved or involved. Create a plan, not only for immediate compliance, but for long-term data procurement, management, and processing. The end result should be a data privacy and security plan that can act as guidance for the future operations as well as documentation for compliance. Companies that don’t comply (or document that compliance) with the GDPR face substantial fines of up to four percent of global revenues. And while that amount can be damaging to any organization, small businesses that depend on every cent may suffer the most from non-compliance. During the next little while, your time will be especially precious as you work to ensure your business is compliant. The average business owner spends 33 hours applying for credit, you can save that time by checking with Nav. If you’re not currently compliant and the May 25th date is giving you anxiety, take a deep breath. Garnter, Inc. suggests that by the end of 2018, more than fifty percent of American businesses will be non-compliant. Of course, that doesn’t mean that herd mentality will protect you from non-compliance in the event of a data breach – we all know how frequent they are these days. For that reason, it’s important to address the issue immediately and take the steps required to meet GDPA requirements More from Nav The Best Small Business Checking Accounts Your Ultimate Guide to Small Business Loans What Is Cash Flow This article originally appeared on Nav.com. Jennifer is a alum of the University of Denver. While in the graduate program there, she enjoyed spending time identifying ways in which non-profits and small businesses could develop into strong and profitable organizations that while promoting strong community growth. She also enjoys finding unique ways for freelancers and start-up businesses to reach and expand their goals. More by Jennifer Lobb

Experian Business Information Services has been honoring Veteran Entrepreneurs in the month of May on the Small Business Matters blog featuring a series of posts highlighting military veterans who went into business for themselves. We asked them about making the transition from military to small business, what challenges they faced, and how their career in the service prepared them to run their own small businesses. A common thread among the veteran entrepreneurs we’ve interviewed for this series is family. They came from a military family, they built a family with those who work in their business, or they left active duty to spend more time with their family. To these veterans, it is an honor and duty to serve their country. They show the same commitment and respect to those closest to them. With a family legacy of military service, entrepreneurship and a “passion to serve”, this veteran honors his heritage by sharing his story, starting with his father’s choice to join the Army. In his late teens, Blake Vaughn’s father was involved in a deadly bar fight. When he was given the choice to go to prison or join the Army, he chose to serve. He left the military early to take care of his ailing parents, and, after his parents died, he took in his siblings as well. He soon started his own family and worked for the post office before going into business for himself. In 26 years, he grew his business from nothing into a multi-million-dollar company. Between the 2001 recession and a divorce, the family suffered multiple setbacks, including foreclosure on their home. After the divorce, Blake, still, a teenager, decided he needed to do something to help lift his family out of poverty and help his mother put food on the table. He decided to follow in the footsteps of his father, grandfather, uncles, and brother and join the military. What did you like most about serving in the U.S. Military? “Serving my country and building strong relationships with people. On a personal level, it’s fulfilling to know you’re participating in something greater than yourself. I feel weird and undeserving when someone says, “thank you for serving.” I think of my brother… his vehicle was destroyed by an IED. Thankfully, nobody got hurt. I don’t like to compare the two of us but at the same time, I at least participated in the security of the country. I’ve always had a huge love for our history, values, the Constitution and our country. My wife homeschools our son and part of that is history… so from the perspective of serving in the military, sharing that with my son is cool. The most enjoyable part is the people and the camaraderie. I was a junior officer, so I learned the leadership that comes with that. I’m a big fan of leadership and personal development. As a leader, people don’t care how much you know until they know how much you care. I am more interested in getting to know people first and building relationships and letting them shine. By doing that, I had some excellent relationships with those guys I led. I still have great relationships with them.” What inspired you to make the transition to entrepreneurship? “My father was a veteran and entrepreneur. He was given the choice to go to prison or go to the army after a bar fight. He chose to serve and straightened up his life. He got out and worked for a little while until he decided to start his own business. He built a $12 million business and then lost it after 20+ years. I wanted to serve just as my father, grandfather, several uncles, and brother did as well, but I also wanted to pursue entrepreneurship because I saw the satisfaction that comes from creating something for your family.” Blake worked through college earning his MBA in marketing while waiting to go into the military. Due to delays in his selection process and a government sequester, it took many years before Blake was finally able to attend officer candidate school in the Navy. He served as a gunnery/ordnance officer on the USS CHAFEE in Hawaii before exiting with an honorable discharge into the reserves. In that time, he also married his college sweetheart, whose first husband had passed away and left her with a 1-year-old son. Between his time working through college and after leaving the military, he “bounced around to all areas of business”, working various customer service, finance and hospitality jobs before finally taking the entrepreneurship leap. Tell us about your business. “We started our first business, a restoration franchise in August 2016, handling water and fire damage. Our second business, Patriot Services Construction, started in May of 2017. In our first calendar year, we generated $1.1 million in gross revenue. For our 2nd full year, we hope to close over $2M. We’re also adding roofing to our services.” Blake’s business can be found online here: Restore NTX LLC & Patriot Services LLC What skills from your military career do you apply most often to your business? “Administrative, risk assessment and management, program management, leadership, motivation, inspection, and accountability. It (the military) was extremely grueling work. Only about 2% is cool. The other 98% is mundane repetitive tasks. It can tear you down, so you have to keep focused and motivated to do what’s necessary because if the country calls on you, you have to be ready. I find fulfillment from motivating people and that allowed me to press harder and stay focused. It was a great learning experience for me.” Did you access Government programs to launch your business such as SBA loans? “Yes, we did get an SBA 7A loan for $110K when we first started. We combined that with personal funds and I took on a partner when we started - a guy I know from church named Jeff Lott. We both wanted financial freedom and control of our time. We partnered together to buy vehicles and equipment to launch our business. There’s a book called Rocket Fuel that talks about the combination of visionaries and integrators when building a business. The book is good. I’m a visionary. I look for new revenue sources and he’s the integrator. We compliment each other in business. We’ve found a really good spot. It’s been an excellent partnership.” What is the biggest challenge about being an entrepreneur? “Facing the unknown and taking risks that could cost us greatly. I took away from the military, and my time during training especially, that you’re used to having pleasures in life, being comfortable, and they strip that away… 6 months living out of a backpack. You learn perseverance. You don’t need a lot to live. It allows you to lay it all on the line when you do have challenges. Entrepreneurs, when failure looks like it could happen, they begin to backtrack. Several people I know went back to their corporate jobs. You have to define what is essential and get rid of everything else that doesn’t take you closer to what’s important to you. It’s a challenge… “what if we fail”. Jeff and I didn’t have experience. In our industry, people typically use a direct sales force to get off the ground, build relationships with trade partners to refer work. We tried that and it didn’t get off the ground. Instead of getting scared, we looked into internet marketing instead. We shifted heavily into internet marketing. We have no salespeople whatsoever and 90% of our business now comes from internet marketing. Creating the right mindset is most important, and being willing to take a risk is part of that. As Grant Cordone says, “Commit first and figure it out later.” We also try to automate our business as best we can, taking advice from Tim Ferris’ 4 Hour Work Week. What is the greatest reward in being an entrepreneur? “Our technicians do hard work and their mindset is serving people, not just making money. It was nice to volunteer a short time in Houston after Hurricane Harvey and tracking through the disaster to help with recovery. We didn’t need to be directed. We knew what to do so we just got to work helping those folks. There’s also satisfaction in creating something important and it’s nice to have more freedom to enjoy life.”

For the month of May, as we head into Memorial Day, the Small Business Matters blog will feature a series of posts highlighting military veterans who went into business for themselves. We’ll ask them about making the transition from military to small business, what challenges they faced, and how their career in the service prepared them to run their own small businesses. Many veterans are attracted to military service because of world travel and learning opportunities. With permanent changes of station (PCS) and the responsibility of mobilization at a moment’s notice, active duty veterans will likely have visited several other countries before retiring or transitioning from the military. On these assignments, troops will find themselves in unfamiliar territory, unable to speak the language and often surrounded by people and cultures they do not understand. One such veteran immersed himself in the culture of his station in a foreign country and came back to the States inspired to build a business. Raised near Niagara Falls in an Italian/Polish community, Michael Signorelli grew up around good food and already considered himself a “foodie”. When he joined the Navy, he was offered an assignment working with NATO in Naples, Italy for 3 years. He imagined he would be enjoying a glorified version of the food he grew up eating. He realized immediately that “true Italian food from the motherland is wildly different from Italian American food”. For 14 years, Signorelli worked in administration, finance and personnel in the Navy. For his last 10 years, he was commissioned as a Limited Duty Officer. These assignments instilled business organizational skills and taught him how to train and lead people, skills that would be necessary for his future business. He’s currently running a successful Neapolitan pizza restaurant in Virginia. What did you like the most about being in the military? “I cherished every single tour of duty because I was able to learn something in every place I went and every job I had. Most of it was good. My approach was to learn something from everyone. Naples was my best tour. Who knew that tour would develop what I would do post-retirement? It would have been something along the lines of Italian food but if it wasn’t for Naples, I wouldn’t have even tried it. My second best tour was Djibouti, Africa. Our goal was to win the hearts and minds of the people to keep Somali warlords from setting up terrorist camps. I saw people struggle and build houses out of rocks - stacked them like you’ve never seen them stacked before…. Because of that time, I don’t like to waste things. It was rewarding and when I think I’m having a bad day or my kids or employees think something is challenging, I bring those moments up as teaching moments. If you don’t have the opportunity to see that, you’d never know. I worked with remarkable people that influenced me and made me a better leader and groomed me to be an entrepreneur. It gave me the tools, the exposure and diversity of the jobs. The Navy prepared me in a way that Harvard Business school couldn’t have. I loved every minute of it. I still interact with people in the Navy. We work hard but the payback is in experience. You can’t always be compensated in money.” What inspired you to make the transition to entrepreneurship? “Pizza making is a respected craft in Italy. It’s ingrained in their life, runs in their veins. When you show interest, they want to share their story. In Naples, even through the language barrier, I learned ‘survival Italian’ so I could learn everything I could about Neapolitan food and pizza. My lifelong dream was always to open a restaurant. I went through the rest of my Navy career always looking for that pizza. We ended up getting stationed near Buffalo, NY. We missed it so much we tried to get back to Italy, but we couldn’t, so we took a tour in Sardinia. I learned more about that unadulterated island where farmers and winemakers work into their 60s and 70s…. it’s just amazing. Back in states, we couldn’t find Neapolitan pizza unless we were going to New York City. I decided I’d one day open a Neapolitan pizzeria.” Tell us more about your business. “We decided, after I ended up in VA (after 14 years in the navy), we’d build a wood-fired oven in our backyard. We started cooking pizzas for ourselves, entertaining neighbors and friends. It was great practice. When we started thinking about retirement from the Navy, about 3 years before, I discovered a company in Colorado who was building wood-fired ovens on trailers – like a food truck - built to last for 10 years. For our $19,000 investment, we could test the market in Virginia to see if Neapolitan pizza would take off. We started doing small catering gigs and the popularity soared. We were requested to do corporate events, big weddings, local city events in the park… The craziness started but we still had full time jobs. My wife was permanent substitute teacher and I was still in the Navy. Evenings and weekends were spent doing these mobile events. It was a great platform and great training. We tested the market and got out of it what we wanted. Then it was time to hang it up in the Navy and enter this restaurant idea. It wasn’t easy to graduate this idea, but we weren’t exposed to Mother Nature anymore. Wind messes up tents or temperatures can ruin a party, but when you’re committed to a private event, you do it. Working in a restaurant was easier but it was a big learning curve. We worked our butts off and plowed to that goal. Now it’s 3 years later. We got rid of the mobile oven - we wanted to keep it but we sold it because the restaurant was keeping us so busy.” Michael and his wife opened Bella Vista Pizzeria in September 2015. What is the greatest thing about being a small business owner? “That dream I had to start a restaurant? I get to walk in that door every day and see it and touch it and live it and there’s nothing more special than that for me. And to be able to give back. I support special programs here locally. It’s great to be in a position to be able to live off of something you created and be able to help people in a small way, like delivering pizzas, one of the most favorite foods in America, on National Pizza Day to a food bank. So rewarding. “ What is the hardest thing about being a small business owner? “In the military, we’re constantly faced with ‘you gotta do more with less’ and ‘get the job done’ mentality. And you usually do get the job done. Then you start your own business and suddenly… remember what I did in the Navy? My job was to be somewhat organized and now I’m having to order food and track inventory. The mobile business was easy for me to track everything and now I’m doing pest control, dishwashing, ordering food from different sources, wine, beer, payroll, and suddenly I was completely disorganized. I woke up one day, 3 months behind in reconciling, leading up to doing my taxes, and I’m in there doing business and making pizzas. I had to learn that I couldn’t do everything. I had to leave some things to the professionals. I freed my time up by paying a fee for an accounting service and payroll service and that lifted an incredible burden on me and allowed me to focus on training of staff and execution of day-to-day operations. I suddenly couldn’t do everything. I was, for the first time in my life, overwhelmed. Of course, my wife helped but we were both overwhelmed. We really loved it, and we were good at it. We had to learn to get good at other stuff or get help with it.” Did you tap any Government programs to help launch your business? “No but I tried to. I banked forever with Navy Federal. I didn’t pursue any venture capitalist or loan programs. I went to the bank I’d went to for years. I first asked for $80,000 to help. They looked at my business plan and they told me no, they’re not a business-centric financial institution. They rejected the $80,000 but favorably endorsed me for a government small business loan with the SBA. SBA came back a month later and said they were unable to back a ‘mom and pop’ restaurant because the rate of failure is too high. So, my loan officer at Navy Federal went back to the folks in D.C and got me a $35,000 loan, which was helpful. I funded a majority of the business out of savings.” Could more be done to help Veterans go into business for themselves? “There are a lot of programs out there – I’ve looked at some – but there’s a lot of bureaucracy. Sometimes it could be made so hard. For me, when I got rejected by the largest government-backed organization, I felt like the smaller programs wouldn’t help.” For fun, can you tell us what makes Neapolitan pizza different? “Did you know that Neapolitan pizza just won Unesco’s Cultural Gift to Humanity? The Vera Pizza Napoletana Association governs that Neapolitan pizza is always done the right way with only fresh ingredients, a certain type of flour, a specific type of tomatoes and cooked in a 900-degree oven for 90 seconds. The crust is charred and the toppings soupy. It’s like no other pizza you’ve ever tasted and it’s not a pizza you can take to go. If you’re ever in Virginia, stop by and give us a try!” Watch Bella Vista's Small Business Story, courtesy of Navy Federal Credit Union

For the month of May, as we head into Memorial Day, the Small Business Matters blog will feature a series of posts highlighting military veterans who went into business for themselves. We’ll ask them about making the transition from military to small business, what challenges they faced, and how their career in the service prepared them to run their own small businesses. A 2017 Small Business Association report on Veteran-Owned Businesses states that over 2.5 million businesses in the United States are majority-owned by veterans. Nearly all were small businesses, and over half were based out of their homes. While on active duty, many veterans faced situations where they had to be hardworking and resourceful. They’re driven and often fearless leaders who have traveled the world and learned how to work in uncomfortable environments. Many discovered their passion during their time in the service while others found that starting their own business fit their mobile lifestyle. Today we’ll hear from one veteran entrepreneur who drew from her military training to overcome a professional setback, and how the military prepared her to be an entrepreneur. Sarah Stahl is a mother of 3 children who served in the Army as a Finance Specialist for 3 years. While enlisted she met her husband of 16 years, Daniel, and for the next 12 years, she has been a military spouse. They are still transitioning to civilian life after leaving the military 2 years ago. Stahl discovered her entrepreneurial spirit in high school. She didn’t have a desire to go to college because she didn’t feel like it was a good fit for her. The military was appealing for training and the ability to travel the world. After leaving the military to raise her children, she tapped into her restless entrepreneurial spirit and began creating and selling wedding invitations on the e-commerce site for handmade items, Etsy. Selling on Etsy allowed her to work from anywhere and remain home with her young children. It was a chance encounter through the website that led her to meet the person who would become her business partner. “I had an unusual request for a World of Warcraft wedding invitation, with the bride and groom’s faces built into the invitations. I asked on an Etsy forum for anyone who could help and Merrilee answered.” Together they started taking on personalized requests for wedding invitations and built their first business together, Paper Perfections. As Stahl and her business partner worked closely, and over the internet, they became like sisters. Their friendship led to the creation of their current company, Avant Creative. What did you like best about the military? “World travel & the tight-knit comradery that I have yet to find outside military life. I’m only 36 but my time on active duty (3 years) and as an active military spouse (12 years) I already feel like I’ve lived a whole life. The business venture I’m working on now is a chance to live a second life.” Sarah is also finishing up a masters degree, thanks to her time in the military. How did the military prepare you for entrepreneurship? “I learned about leadership, integrity, and having a DON’T QUIT mentality.” Sarah and Merrilee finally met in person last fall and a month later, Merrilee passed away suddenly. Stahl is still recovering from the loss. Transitioning out of the military, moving to a different place every few years, and running an online business means that Stahl often felt very isolated. “Merrilee was my crutch,” Stahl says, “But I’m independent. I can’t go back to work.” Stahl made the very difficult decision of continuing the business without her friend, “There were 4 of us in total but she knew the other two partners better. Out of necessity, we’ve had to band together to get a hold of things. We’ve had to go through this crisis together so we’re moving towards a partnership.” Business is growing and they’re considering a legal partnership. Although there are still decisions to be made, Stahl is looking forward to growing Avant Creative. What is the hardest thing about being a small business owner? “Probably the fact that there isn't anyone to fall back on. I constantly feel like I'm out on a limb, recreating the wheel. It causes stress in all areas of life and makes me question if what I'm doing is the best path for life.” What is the best thing about being a small business owner? “My schedule. My husband and I have 3 kids and it's invaluable to be able to adjust my work schedule, however, I need to in order to both support and be available for our children.” Did you look into government programs or funding for your small business? “I looked into getting a startup business loan but I’m nervous about funding and interest rates. I’ve been bootstrapping the business, using whatever cash I have on hand. I was looking for funding for a solid brick and mortar, but the debt scares me. I do want to invest in the business and keep growing but I’m not sure if I should go to an investor or get funding. There are still a lot of decisions to be made.” To drive awareness for Avant Creative, Sarah uses social media extensively. She hosts a weekly “Reinventing Marketing” session on Facebook live, where she shares marketing tips and best practices. She also writes articles and posts videos on LinkedIn where she talks openly about the challenges being an entrepreneur. Her approach to LinkedIn is to establish a professional brand which leads other entrepreneurs to her marketing services. With young children, a growing business, and finishing up an advanced degree, there’s no question that Sarah Stahl’s time in the military has helped her to step outside of her comfort zone. Hardworking, resourceful entrepreneurs benefit from the military training and experience and Stahl is no exception.