Topics

Building and maintaining a strong business credit report takes time, and good fiscal discipline, but many business owners don’t know where to start on their road to establishing business credit. Business credit reports less regulated than consumer credit Business scoring is much less regulated than consumer credit scoring. The process of scoring your business is much more complicated and less clear than the consumer scoring process. For example, additional factors that can impact business risk models include the number of years a business has been operating and its industry type. Don't assume you have a business credit score Just because you have a business, don't assume you have a business credit score. Credit bureaus require a minimum amount of information before they can generate a report and score for your business. To establish your business credit history, encourage your vendors to report your payment history to the business credit bureaus. Many credit bureaus can provide you with information on suppliers who report to them. Keep business credit and personal credit separate Next – let’s talk for a moment about separating your personal and business credit. To build strong business credit, don't rely on your personal credit rating to finance your business. If your business becomes at risk, so will your personal credit score. Keep in mind that many creditors are now looking at scoring tools that consider both personal and business credit to predict small business risk. Business credit reports available to the public It is not widely known that access to business credit scores and reports is not as restricted as personal credit reports. Business credit reports are available to the public, and anyone - including potential lenders and suppliers - can view your business credit report. This makes it imperative to monitor your business credit score and report in an ongoing manner. Also - You can proactively manage your business credit score. Ensure your vendors are reporting your business payment history, and monitor your business' credit on a regular basis. For more information on business credit resources, plus articles and tips on this subject, go to BusinessCreditFacts.com. Learn more about establishing business credit by viewing our series of Business Credit Facts videos. Remember to subscribe to our channel for ongoing updates.

In the aftermath of Hurricanes Harvey and Irma, news outlets reported the FEMA statistic that 40% of small businesses never recover after a disaster. With 74% of small businesses closed after Hurricane Sandy, a 2015 Nationwide Insurance survey stated that 75% of small businesses still don't have a disaster plan in place. For overwhelmed small business owners, the possibility of a natural disaster may be a low priority compared to keeping customers happy and the bills paid. When an unfortunate and unplanned disaster strikes, they have to be creative when putting their lives and their businesses back in order. Savvy business owners who prepare in advance can usually mitigate potential damage to their business by being prepared and activating their business continuity plan. Small Business Disaster Planning With natural disasters, from hurricanes, flooding, tornadoes, earthquakes, or wildfires, there is a potential loss of: Office premises including equipment, supplies, furniture, and more. Records, paper or digital, that are necessary to keep the business running. Any goods or supplies needed to sell goods or services to customers. Employees' homes and the likelihood of their return to work. Suppliers or distributors who are unable to reach your place of business. Customers who may do business elsewhere if they are unable to reach your business. Office equipment and the like can be replaced eventually, but company and accounting records cannot. The U.S. Small Business Administration has created a Record Keeping for Small Business Guide to assist with the necessary records, such as contracts, licenses, leases, personnel information, and accounting records, for rebuilding your business. FEMA (Federal Emergency Management Agency) also has a Small Business Preparedness website for disaster planning. Helpful tips include storing records in the cloud, creating a threat analysis, purchasing business insurance, and the development of a continuity plan to include communication with employees, vendors and suppliers. The goal is to get back online as soon as possible so the loss of customers is minimal. Filling the gap Many business owners are finding out that their business insurance will only cover so much, and there is a significant gap between what is paid out in claims and what is needed. So many are forced to think up creative solutions to getting their businesses back online by borrowing from friends, family and investors. Entrepreneurs familiar with innovative financing options of startup capital are beginning to turn to relying on crowdfunding when disasters occur. Crowdfunding for Small Business Recovery Crowdfunding is a familiar source of capital to entrepreneurs with new or growing businesses. Many entrepreneurs relied on sites such as Kickstarter or Indiegogo to raise funds and a potential audience for their service or product. The 2017 University of Chicago Alternative Finance Benchmarking Report found that while equity-based crowdfunding decreased 7% last year, "Donation-based Crowdfunding grew by 60%, generating $224 million in 2016." The same report noted that over the past 3 years, donation-based crowdfunding has increased by 40%. This is good news to entrepreneurs who are also using crowdfunding to help raise funds after an unexpected natural disaster. Ashley Freeman, with Handy Ma'am home improvement services in Houston, TX, relied on Go Fund Me to help with her recovery in the aftermath of Hurricane Harvey. Ashley ran a campaign to replace tools and supplies that were damaged in the storm. Her goal was met but she's still recovering, "Go Fund Me was a great head start to getting back to where I need to be," says Ashley. "I'm so thankful for knowing so many people care as much as I do when other people are in need." Kiva, a non-profit organization dedicated to raising funds for entrepreneurs in 80 countries, is another crowdfunding platform being used by those affected by the September 2017 hurricanes. Jonny Price, a senior director with Kiva U.S., is proud of the work they're doing to support small businesses. "At Kiva, our aspiration is to leverage the generosity of our 1.6 million global lenders to expand financial access for entrepreneurs deemed too risky or expensive to serve by conventional lenders. Supporting small businesses hit by natural disasters like Hurricanes Harvey, Irma and Maria is one powerful and relevant example of how we hope to meet that aspiration. This loan to Matilsha in Puerto Rico was funded recently by 358 Kiva lenders. We hope that, through long-term reconstruction efforts, Kiva's sustainable lending model can complement the heroic work of more donation-based first responders like the Red Cross." Recovery Doesn't Have to be a Disaster 2017's hurricanes and wildfires have unfortunately put business owners on task to prepare for a worst-case scenario. FEMA and the U.S. Small Business Administration have created online guides for helping small businesses recover, and will also help financially through low interest loans. While businesses and residents await their turn in securing financing for rebuilding, more entrepreneurs and business owners are turning to alternative sources of financing to get back to the business of serving customers.

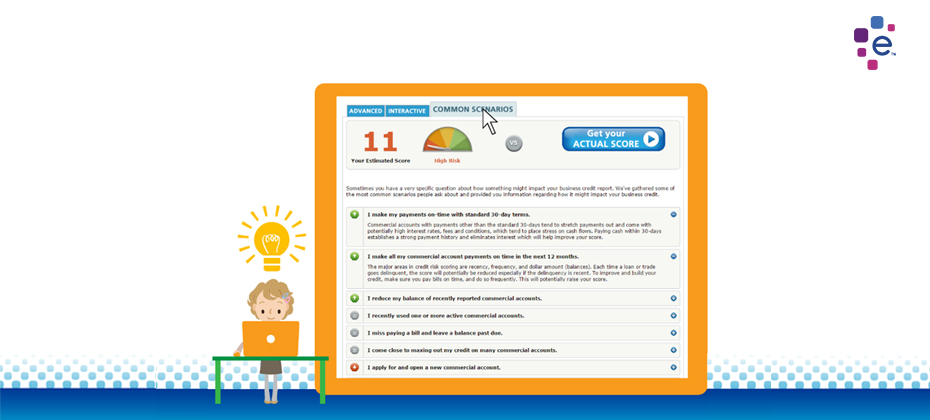

Experian has released a business credit score planner tool to help you run what-if scenarios. It helps you learn behaviors that build strong credit.

When a small business is damaged by a natural disaster — be it a hurricane, flood, earthquake or tornado — recovery presents its own set of hazards. There is, of course, the immediate cost of lost business. There are both short- and long-term physical dangers posed by weakened walls and ceilings, exposed power cables and mold. And then there are the threats posed by skilled disaster recovery scam artists who see small business owners as easy prey. Kenneth Citarella, CFE, knows all about these post-disaster scams. A former New York state prosecutor, Citarella now works for Guidepost Solutions LLC, which provides investigations, compliance, monitoring, and security and technology consulting solutions for clients in a wide range of industries. In the wake of Super Storm Sandy, which devastated large sections of coastal New Jersey, Brooklyn and Staten Island in 2012, Citarella served as a Guidepost Solutions “Integrity Monitor,” making sure contractors were in fact performing the work for which they were being paid. “The days and weeks following a natural disaster are times of great stress and confusion,” Citarella said. “This is the perfect breeding ground for scams of all kinds. Small business owners need to be aware of how they may be targeted and how to avoid being a victim.” How Fraudsters Find Their Marks While natural disasters are horrific events, they’re great for contractors and restoration companies for whom such events are their bread and butter. As soon as a disaster occurs, it’s not unusual for construction companies to descend on the affected site, blanketing the area with pamphlets and brochures, and stuffing mailboxes with business cards. While many contractors are legitimate, there can be a good number of storm chasers who are just out to make a fast buck. At a time when construction labor is at historic lows, small business owners may find themselves working with a firm with less than stellar credentials “The more enterprising scam artists will take the time to go door-to-door, offering low-ball prices or even offering to cut the business owner in on the fraud,” Citarella said. “For example, they’ll offer to do the $75,000 worth of restoration work that is actually required, bill the business owner’s insurance company for $100,000, and then split the difference. This is an obvious solicitation of fraud and should be reported immediately to the local police.” Common Types of Post-Recovery Fraud In addition to the insurance scam described above, Citarella discussed other forms of fraud a small business owner might encounter following a major disaster. “The most common type of recovery fraud involves a contractor who shows up to do the first two or three days’ worth of work, and then just disappears. Another type involves the use of lower-grade or otherwise substandard materials,” Citarella said. Citarella also noted that otherwise well-meaning contractors may buckle under the pressure a natural disaster creates, leaving the business owner out thousands of dollars and still unable to operate. “A small contractor can easily get in over his head,” Citarella stated. “He may not be able to get enough workers, have problems with his supply line, or be managing too many projects at once. There may be no criminal intent here, but the outcome is the same.” How to Avoid Contractor Fraud Find reliable, licensed contractors and validate their businesses before hiring them to help you rebuild. Experian’s ContractorCheck.com/Hurricane is being offered as a free resource to those affected during this time of recovery. This website enables you to find contractors and easily check the critical components of a contractor’s business background, including license, bond and insurance data (if an when available from state licensing boards). Click here to see a sample report. Also, the Better Business Bureau (BBB) offers a list of recommendations to business owners and anyone else looking to hire a construction contractor, among their recommendations: 1. Ask for Recommendations. Ask friends, relatives and fellow business owners to recommend contractors they have previously hired. 2. Check Their Track Record. Use bbb.org or other business review websites to get customer reviews, complaints and any notices of criminal violations. 3. Verify the Business License. Make sure the contractor under review has a valid license to do business in your state. 4. Get Multiple Quotes. Always get at least three quotes for any particular job. Any quote that is unusually low is probably one to avoid. Remember the old adage, “If something seems too good to be true, it probably is.” 5. Look for Signs of “Professionalism.” A reputable contractor will arrive in a vehicle that is clearly marked and branded, and may wear a uniform bearing his/her company name. 6. Request References. Ask the contractor for a list of previous customers you can contact and discuss their satisfaction with the contractor’s service. 7. Check Professional Affiliations. Ask if the contractor belongs to any trade organizations. Such companies are usually bound to operate according to a strict code of ethics. 8. Avoid Large Up-Front Payments. Pay by check or credit card for added protection. Avoid paying in cash. 9. Get Everything in Writing. Demand a written contract, and make sure to read it carefully, especially the fine print. Make sure the contract includes the contractor’s name, street address, telephone number, email address and state license number. Fill in any blank spaces. Don’t sign anything you don’t understand. “Document every step of the reconstruction progress,” Citarella added. “Take pictures every day to record the contractor’s progress. Smartphone pictures can be invaluable in the event of contractor misbehavior or if there is a challenge by your insurance carrier.” Citarella described four “gears” that run any reconstruction machine. “There’s the business owner, the adjuster, the carrier and the contractor. All four need to work together to get a job done right. However, the only one who has a stake in effective cooperation is the business owner. So if you have a business that needs post-disaster repair, take the time to make sure it’s done right.” If you are in the process of rebuilding following Hurricane Harvey or Irma and need to check the contractor you are working with, go to www.contractorcheck.com/hurricane to receive up to 15 free reports. Also, Sam Fenerstock of Credit Manager’s Association published an excellent article titled “How To Assist Your Customers To Stay In Business After Natural Disaster“, it contains lots of great information about disaster preparedness and working with your customers if they are impacted by a natural disaster.

The United States military is the one organization that has produced more business owners than any other institution. After World War II, a stunning 49 percent of veterans went on to start their own business. Veterans are a diverse, multi-talented, innovative group of leaders who deserve our respect and gratitude. The Small Business Administration (SBA) wanted to study the impact of veteran-owned businesses on the U.S. economy, and the results of this study have just been released in a new report titled Veteran-Owned Businesses and Their Owners: Data from the U.S. Census Bureau's Survey of Business Owners. Per the SBA's Office of Advocacy, there are 2.52 million businesses majority-owned by veterans. The report, compiled from 2012 Census data also states that veteran-owned firms represent a staggering $1.4 trillion in revenue, employing over 5 million people. Veterans represent a diverse cross-section of businesses in just about every industry. And it seems the training and skills these veterans learn while enlisted are a key to their success when they enter the private sector. John Lee Dumas Take John Lee Dumas, founder and host of the award-winning podcast Entrepreneur on Fire. Dumas credits his rapid success in the world of podcasting to his time in the U.S. Army as an armor platoon leader. After serving 13 months on active duty in Iraq and an additional four years in the reserves, Dumas worked in Real Estate briefly, and passed time while driving listening to podcasts. He noticed most podcasters released shows on a weekly basis, and saw an unfilled need for a daily show geared toward Entrepreneurs. Dumas now hosts one of the most successful business podcasts online. Veterans are also at the heart of our growing business economy. Recently Forbes profiled the top 25 veteran-founded startups in America, which included companies such as: Plated.com, founded by Nick Taranto, US Marine Corps, Infantry. Plated delivers everything needed to cook a chef-designed healthy, affordable, and delicious dinner at home in around 30 minutes. RallyPoint.com, founded by Yinon Weiss, U.S. Army, Special Forces; Aaron Kletzing, U.S. Army, Field Artillery Officer; and Dave Gowel, U.S. Army, Armor Officer. RallyPoint is an online network of more than one million current and former members of the U.S. military where they gather to discuss military life, share information, and exchange stories. Because having strong credit is an essential component of running a successful business, Experian would like to do our part in helping veterans continue to achieve success. In honor of Military Appreciation Month, veterans can receive: 50% off annual monitoring of business credit, or 20% off single reports It’s our way of saying thank you to our hometown heroes – not only for your service to this country, but also for your continued hard work towards keeping our economy thriving.

Business credit scores are vitally important to small businesses. In today’s competitive market, a faulty credit score can dramatically affect the bottom line of any business and can lead to higher interest rates, difficulty in securing loans, and potential problems with suppliers. Conversely, favorable credit history can serve as the linchpin to success. It not only can save a small-business owner a considerable amount of money, but it also can provide access to capital with which to grow the business. So, let’s do a quick review of some common business credit misconceptions. If I have a small business, I automatically have a small-business credit score. FALSE. If a business doesn’t have at least one tradeline and/or one demographic element (such as length of time the business has been credit active, how many employees, etc.), then a credit report and score are not generated. To establish a business credit score, you should ensure that your business vendors are reporting your payment history to the major credit reporting companies. This will help to build your commercial credit profile. There are no drawbacks to using my personal credit score, rather than a business credit score, when attempting to secure funding. FALSE. It’s true that many small-business owners fail to separate their business expenses from their personal expenses. However, the weakness of relying solely on personal credit is clear. If your business ever becomes at risk, your personal credit score becomes at risk as well. Anyone can request and view my business credit score. This is TRUE. Unlike personal credit reports, which are regulated and can be viewed only with the permission of the report holder, business credit reports are available to the public. This means that anyone — including potential lenders and suppliers — can openly view your business credit report. Given the public availability of business credit reports, it’s imperative to monitor your business credit score. There are things I can do to improve my business credit score. TRUE. It’s vitally important to be aware of possible inaccuracies or negative credit data on your credit file, should they exist. As the business owner, you may request that the credit reporting companies correct any mistakes to ensure that your credit file is accurate. By simply increasing your awareness of the factors that drive your current company credit score, you can begin to effectively manage your credit behavior. As always, the best thing that you can do is pay all financial obligations on time.

Debt Collection Scams Substantial debt can be a crippling burden to a small business, which is why they are often targeted by con artists who purport they can vastly reduce or even eliminate this debt — for a fee. This type of scam has a long and checkered history — and is showing no sign of abating. In late October of 2016, Ukrainian-born Sergiy Bezrukov — aka John Butler aka Thomas Paris aka Christopher Riley — was arrested by the FBI in upstate New York and charged with mail fraud for having allegedly duped more than 100 small business owners out of more than $500,000. His alleged scheme was simple: mass-mail an offer to reduce small business debt by up to 75 percent in just six to 12 hours. The fee for his services — required upfront — was $1,250, to be sent via wire transfer to his company, Corporate Restructure, Inc. Of course, no actual services were performed. Victims were not only out their initial $1,250, but many had their credit ratings seriously damaged — or further damaged — as a result. “Bogus credit relief schemes are not all that common, but when they do pop up, they give legitimate organizations a bad name,” said Robert Tharnish, senior vice president of ABC-Amega, Inc., a debt collection agency headquartered in Buffalo, N.Y. “There are many ways to deal with commercial debt. Owners just have to do their due diligence.” Robert Ingold, CEO of Commercial Collection Corp. in Tonawanda, N.Y., agrees. “For anyone who receives a solicitation to reduce their debt — be it commercial or consumer — be skeptical. Know who you’re dealing with.” Both Tharnish and Ingold serve on the board of the International Association of Commercial Collectors, the world’s largest international trade association for commercial debt collection professionals. Ingold noted that most companies have accountants and attorneys who should immediately raise a red flag when such sketchy offers come their way. Even so, enough small business owners either don’t have outside help or ignore their paid experts’ advice, allowing scammers like Berzukov to rake in hundreds of thousands of dollars in just a few months’ time. Dealing with a bogus agency can damage already fragile credit ratings, Ingold noted. “In most cases, a company targeted by a debt reduction scammer has debt and delinquencies that have already been noted by reporting agencies like Experian. Bezrukov’s victims weren’t just out their $1,250, but they probably fell further behind in their debt payments expecting relief, and this just decreased their business credit scores even further.” “This is an industry where all you need is a phone and list,” Ingold continued. “We see the same problem on the flip side with fraudulent collection agencies. Fly-by-night collection agencies approach lenders with wild claims of collection prowess, or buy existing paper for pennies on the dollar, then start harassing debtors in violation of all established laws and ethics.” “ Both Ingold and Tharnish noted that the legal system has numerous avenues available for businesses that find themselves over their head in debt. These include: Restructuring the debt with the existing creditors. This often includes devising a monthly payment plan that leaves the business with enough capital to keep growing. Getting an SBA or private business loan. Declaring Chapter 11 or Chapter 13 bankruptcy, which allow businesses to discharge many of their obligations and still keep their doors open. Both experts also emphasized the need for business owners to perform due diligence before hiring any debt reduction or collection agency to work on their behalf. “Ask to see their license. Their certification. Check with the Better Business Bureau,” Tharnish advised. “Also demand references. Ask, ‘Have you done business with anyone I know?’ If an agency can’t provide references, just walk away.” “When confronted with an amazing business solicitation, just remember the old saying,” Tharnish concluded. “If it sounds too good to be true, it probably is.”

Women business owners are feeling pretty positive about the future according to a recent survey by Bank of America titled, “2016 Women Business Owner Spotlight.” The study revealed women small business owners are more optimistic than male business owners about revenue and growth prospects of their businesses. This inaugural survey of 1,000 male and female small business owners, focused squarely on the aspirations and pain points of women. Among the key findings, female business owners are more excited about the future and focused on the success of their business compared to male business owners, with 54 percent of women surveyed expecting revenue to increase over the next 12 months compared to 48 percent of men. Bullish on business growth When considering the growth potential of their business over the next five years, the survey found women respondents felt more optimistic than men. Results showed that 60 percent of women business owners expected their businesses to grow versus 52 percent of men, an 18 point drop for men when compared to 2015. Credit cards The two main sources of funding used by women entrepreneurs include their business credit cards (28 percent) and bank loans (23 percent). Interestingly, 16 percent of women business owners indicated they use personal credit cards to fund their business. However, using personal credit to fund business activities presents some big challenges because if your business ever becomes at risk, it can also affect your personal credit. Experian recommends keeping business credit transactions completely separate from personal credit. Doing so protects personal assets and helps entrepreneurs build strong credit profiles. Also, many lenders are using blended credit scores that evaluate business and personal credit profiles when making lending decisions, so it is best for entrepreneurs to do all they can to build a strong business credit profile. Experian has more information about the dangers of using personal credit to fund your business on the Business Credit Facts web site. Access to capital and clients While access to capital has improved in recent years, many women don’t feel that way. In fact, the study showed that 28 percent of women said they do not have the same access to capital as their male counterparts. Access to clients, however, is one area where women feel they are on more equal footing, with 88 percent saying they have the same or greater access to clients than men. Increasing the minimum wage Women small business owners are more likely to support raising the minimum wage. In fact, the survey indicated that 55 percent of women entrepreneurs think raising the minimum wage would have a positive impact on the economy, compared to only 41 percent of men. Issues that concern small business owners While both women and men small business owners share similar views on top economic concerns over the next 12 months, more women small business owners are concerned about: Corporate tax rates (54 percent of women vs. 45 percent of men). Strength of the U.S. dollar (59 percent of women vs. 45 percent of men). Commodities prices (52 percent of women vs. 44 percent of men). To learn more about the study go to bankofamerica.com

On June 23, 2016, voters in the United Kingdom voted 52 to 48 percent to leave the European Union, the 28-member organization of which it had been a part since the early 1970s. Immediately, the value of the British pound plummeted. Stock markets tumbled worldwide. Financial experts began to warn of an impending European recession. Here, across the pond, owners of small-to-medium-sized enterprises (SMEs) looked at the "Brexit" results with a mixture of concern, confusion and mounting dread. Mostly because we’ve only recently found ourselves out of the massive hole caused by the Great Recession of 2007-09. Could this political shift trigger another, perhaps even more devastating downturn? Based on what we know so far, the answer is: probably not. While the British economy is likely to experience painful contractions over the next few years, U.S. companies will, with only a few exceptions, continue to operate as if the British referendum had never been held. I base my optimism on a number of factors, including the American small business community's economic relationship to the U.K., the increasingly robust state of the U.S. economy in general, and the growing resilience of the SME segment in particular. Brexit and the British Economy For the European Union, Brexit's "Leave" vote was a shock because of what leaving the E.U. may mean for the British economy and Europe as a whole. The United Kingdom represents the E.U.'s largest economy, ranking between the 5th and 10th largest in the world, depending on how one measures such things. For the past three years, it had the fastest-growing economy among all G7 nations, whose membership includes Canada, France, Germany, Italy, Japan and the United States. Its financial district, the City of London, is not only the largest in Europe, it's the largest in the world (yes, even larger than Wall Street.) London's financial industry employees some 750,000 people and is a major source of funding for companies across the Continent. Driven principally by nationalistic sentiment and concern over perceived unchecked immigration (according to exit polls), the "Leave" vote triggered heightened uncertainty throughout London, as well as markets from New York to Singapore. The global economy has become increasingly interconnected and interdependent over the past few decades, and the innumerable questions raised by the U.K.'s disconnection from its European partners sowed confusion and fear. This fear and confusion was manifested in many ways: The British pound fell to a new 30-year-low against the U.S. dollar. Many experts predict that the Pound Sterling could reach a historic one-to-one parity with the dollar by the end of this year. Market values plunged worldwide, causing hundreds of billions of dollars in assets to vanish literally overnight. (Fortunately, most markets have since recovered.) The U.K. relaxed many capital rules to support liquidity – an indication of the Bank of England’s serious concern about Brexit’s impact on U.K. banks. Trading in three sovereign property funds was suspended on July 5th with several more in the following days. Before Brexit, economic forecasters predicted that the British economy would grow some eight percent between now and 2020. Now, most are predicting a contraction of up to six percent. That's a 14 point swing. And because capital is both global and mobile, it would be unwise to ignore the situation. SMEs and the U.S. Economy Here on the west side of the Atlantic, the situation is quite different, especially for small-to-medium-sized enterprises. For one, Europe is not a major customer for most American small businesses. While it's true that 95 percent of the world's consumers live outside the U.S., only about 3.9 percent of U.S. small businesses actually export to the global market. And an even smaller percentage sell to Europe. The vast majority of SME business is done within the borders of the continental United States, hence any direct impact from Brexit is negligible. Then, there is the state of the American SMEs themselves. According to Experian's Main Street Report for Q1 2016, America's SME community is in better shape than it has been in for years: Small business credit conditions continue to improve. Small businesses credit scores are good and improving. Capital is readily available and is appropriately priced. Unemployment is low. (We are approaching statistically full employment.) Delinquencies and bankruptcies have declined in most industries and regions. Recent increases in credit limits suggest that lenders are optimistic about small businesses. So far, Brexit has not had a major impact on the availability or cost of capital here in the United States. Now that the initial panic sparked by the surprise "Leave" vote has subsided, the likelihood of a major worldwide recession grow smaller by the day. This leaves American SMEs well-positioned to continue serving their principally domestic markets, with the credit necessary to fuel further expansion and growth, regardless of what's happening in England, Scotland, Ulster and Wales. For the people of the E.U. and U.K., Brexit may very well represent a major turning point in the political and economic history of Europe. But for most American small businesses, the next few years are likely to mean business as usual — or in the words of the famous WWII-era British motivational poster, American businesses can "Keep Calm and Carry On."