Tag: Small Business

Starting a solo business is financially empowering, whether you do freelancing to earn extra income or build a full-time enterprise. But along with greater financial independence comes the risk of not being paid. Clients may pay late; some may not pay at all. When your client doesn't pay, what can you do? Late payments from clients happen for a variety of reasons. How you respond can determine whether you get your money—or keep the client. Reacting to a brief delay with the threat of a lawsuit, for example, could damage your client relationship needlessly. On the other hand, failing to follow up could result in hundreds of lost work hours and financial problems for you if your client never pays their bill. The following steps begin with simple reminders and escalate to more significant action. Keep reading for tips on how to prevent missed payments in the future. 1. Resend Your Invoice If there’s been a simple problem—the invoice got lost, the client’s bookkeeper is on vacation—resending the invoice acts as a reminder. Send one as early as the day after a payment was due if necessary. 2. Contact the Client If resending an invoice doesn’t trigger a response, respectfully reach out to your client with an email or a phone call and inquire about payment. They may tell you a payment has already been sent or that one will be issued soon. Make a note of when you should expect payment, along with a calendar alert to follow up again if payment doesn’t arrive as promised. 3. Stop Working for the Client If you sent the client a new invoice and spoke with them about the late payment by phone, it may be time to step up your actions if payment still hasn’t arrived as they said it would. If you’re continuing to do work for them, consider pausing until you receive payment. Continuing to work may just result in a bigger bill—one that you aren’t sure is ever going to be paid. It also takes time away from paying clients. Letting your client know that you can’t continue working without payment may prompt them to act quickly. Are you working on a product, such as a book manuscript or custom cabinetry? Don’t deliver it until you have payment in hand. 4. Send a Debt Collection Letter You can have an attorney prepare a debt collection letter for you or find a templated letter to modify online. A debt collection letter acts as formal notice and documentation that your client owes you money, including how much they owe and when it was due. In your debt collection letter, you might specify whether you’d be willing to set up a payment plan to help your client get back on track or let them know you plan to initiate formal debt collection action. Depending on your client’s reaction or lack thereof, you can send more than one of these letters, escalating the matter’s urgency. 5. Consider Your Next Steps It’s possible your client will come through with payment at any of the previous steps. But if you’ve made every effort to collect payment from your client and they still refuse to pay, you can try taking them to small claims court to recover your money. Be sure to hold on to any documentation, such as debt collection letters, asking the client to pay. You’ll need to prove you are owed the amount you claim by providing contracts, letters, receipts or other information noting the agreed upon amount for the job. You’ll also need to find out what the small claims dollar limit is in your state. You can also look into turning over the debt to a collection agency to collect payment. However, you’ll only see only a fraction of your payment if collections are successful because the agency will take a percentage of the amount collected (which may or may not be equal to what was owed. You may also decide simply to move on. The time and stress required to recoup your loss may not be worth it. If you’ve lost tangible goods, you may be able to write off your loss on your taxes. However, you won’t be able to deduct an unpaid balance for services—the IRS doesn’t allow it. How to Avoid Not Getting Paid in the Future It’s impossible to completely avoid the risk of being stiffed. Even a good client can suffer an unexpected financial downturn or a sudden life crisis, and it can be hard to know whether a prospective client is creditworthy. You can’t eliminate risk entirely but you can reduce it by following a few basic tips: Sign a contract with a payment schedule. Whether it’s prepared by the client or by you, a contract spells out the scope and cost of the work you’re proposing. It can also include a payment schedule with clear deadlines and late payment fees (or discounts for early payment). Especially with a new client, get paid as much as possible up front, or consider breaking the payments up to coincide with specific work milestones. Vet new clients before you take them on. Has a new client been referred to you by someone you know? Have they been in business for a long time or are they just starting? Do they have references you can call? If you’re unsure about a new client, think about the work you agree to as having a credit limit attached to it: Start with a $500 project then increase the size of the projects if things go well. Speaking of credit, you can also check a prospective client’s business credit report. The information in Experian's business credit reports is continually updated, always accessible and includes the Experian business credit score, credit trade payment information, corporate registration, business public records, key personnel, and a lot more. Make it easy for clients to pay. Accepting electronic payments or credit cards may give your clients helpful options to pay on time. You may also consider accepting a payment plan or partial payment from a client who’s having trouble paying an invoice. If you do, though, think twice before accepting future work from them. Building a Stronger Business The more you depend on money from your freelance work, the more critical it is to get paid—in full and on time. When clients pay late or don’t pay, your business and personal finances suffer. You may not be able to meet your business expenses or pay your personal bills. You risk falling behind in monthly credit card and loan payments. You may also have to use business or personal credit to make ends meet while you’re waiting on payments and may be stuck with debt if you’re never paid. Fortunately, most business transactions don’t go this way. By limiting your risk with upfront payments, smaller projects and frequent billing; using contracts that spell out work and payment terms clearly; and following basic steps to collect when payments run late, you can reduce your chances of running into trouble. The risk of lost payments can also motivate you to build a cash cushion for your business—or your personal finances—so a late payment here and there is easier to manage. In these ways, the threat of late payments can make your business and your finances stronger, by making you a smarter business owner. About the author Gayle Sato writes about financial services and personal financial wellness, with a special focus on how digital transformation is changing our relationship with money. As a business and health writer for more than two decades, she has covered the shift from traditional money management to a world of instant, invisible payments and on-the-fly mobile security apps. Gayle began her career as a staff writer for Entrepreneur magazine. As an independent publisher, she edited and produced a series of personal finance magazines for credit union members and THINK, an executive magazine for the credit union industry.

Brandelyn Green, the entrepreneur behind Voice of Hair, knows a thing or two about building a community. Her thriving hair care business is exploding.

Small business owners may have a small business credit card or even use their personal credit card when they’re just getting started. However, as a business grows, new types of financing that don’t depend on the owner’s personal finances—such as corporate credit cards—may become available. The Difference Between Corporate and Small Business Cards Corporate and small business credit cards can offer a variety of benefits. One of the main reasons companies sign up for a credit card is to empower employees to make purchases on the company’s behalf by using the company card. Using these cards, employees won’t have to pay out of pocket and wait to be reimbursed later. And employers may be able to limit where employees can use the card and how much they can spend, giving them greater control over their business finances. There are some similarities between corporate and small business cards, but they’re not created for the same types of companies. While small business credit cards may be available to any business, corporate cards are primarily intended for large and established businesses. What Is a Corporate Credit Card? Corporate credit cards—also known as commercial credit cards—are credit cards for medium- and large-sized businesses, although there are also some corporate card programs for startups. To qualify, a company must be either registered or incorporated—for example, as a limited liability company (LLC) or an S or C corporation. Card issuers may look at different factors when reviewing a card application, such as the business’s revenue, number of employees, history with the issuer and investors. In some cases, a business may need several hundred thousand (or several million) dollars in revenue to qualify. You may be subject to a credit check before getting a company card, but it won’t be reported to the credit bureaus under your name or impact your personal credit. Instead, the card’s usage and payment history is added to the company’s business credit report. Corporate cards also often don’t require a personal guarantee, meaning cardholders aren’t personally responsible for the debt. Unlike many small business cards, corporate cards are often charge cards rather than credit cards—meaning the company must pay the full balance at the end of each billing period. But similarly to personal and small business cards, some corporate cards offer rewards and have annual fees. Rewards aren’t the only—or even the most important—benefit, however. Companies can request employee cards to easily authorize and track employees’ expenses, eliminating the need for reimbursement requests. Corporate cards may also offer in-depth analytics and integrate with accounting platforms, which can help businesses save time, money and paperwork. What Is a Small Business Credit Card? Small business credit cards are typically more similar to consumer credit cards than corporate credit cards. Some consumer and small business cards even have similar names, fees and rewards programs. And, as with consumer cards, small business credit cards may let you revolve a balance and charge you interest on the unpaid amount. Unlike a corporate credit card, getting approved for a small business credit card can partially depend on the owner’s creditworthiness. If you apply for a small business card, the application might lead to a hard inquiry on your personal credit report. A card issuer may even report the card to the credit bureaus under your name, meaning it can impact your credit—although some only do this if the business misses payments. Small business cards also generally require a personal guarantee. As a result, if the business can’t afford the payments, you could be personally liable for the card’s unpaid balance. However, a small business card can help you keep your personal and business finances separate. The cards may also offer business-specific perks, such as free employee cards and bonus rewards on common business purchases. And, as the primary cardholder, you may be able to set limits on employee cards and determine how you want to use the rewards. Which Credit Card Is Best for Your Business? Most small business owners, entrepreneurs, solopreneurs and contractors will only be eligible for small business credit cards. However, if you work for or run a medium- to large-sized business or a venture-backed startup, a corporate credit card may be a better option. While you could open a small business credit card, a corporate card might give you a higher spending limit, more control over employees’ cards and better analytics and reporting. The ability to finance your business’s operations without being personally liable for the debt can also be a major benefit. Be Sure to Monitor Your Company’s Credit If you run a business and want to open a business or corporate credit card, your business credit score could be an important factor. Additionally, some small business lenders require a personal credit check before they’ll offer you a business loan, line of credit, invoice factoring or other types of financing. You can check and monitor your Experian business credit report, and get insights into how you can improve your company’s credit scores. About the author Louis DeNicola is freelance personal finance and credit writer who works with Fortune 500 financial services firms, FinTech startups, and non-profits to teach people about money and credit. His clients include BlueVine, Discover, LendingTree, Money Management International, U.S News and Wirecutter. Louis lives in beautiful Oakland, California, where he enjoys indoor rock climbing, yoga, and volunteers as a tax preparer.

Some people might consider starting a business easy; the hard part is keeping the company open and profitable beyond the first two years. The odds of success are tough; a third of new businesses will close by the end of their second year. And 70% of these companies fade by year 10. According to the U.S. Census, 2020 business starts soared 27 percent to 4.4 million. COVID-19 closures and related layoffs were a likely catalyst. How many of these new businesses will succeed beyond their second year? It takes hard work, guts, and determination to grow a successful business, especially one that remains open for decades.The Small Business Administration studied business failure. In this post, we summarize ten leading reasons. Use them to keep your business on track. #10: Over-investment in fixed assets Up-front expenses are common for any business. However, over-investing early on can spell disaster. Evaluate the necessity of owning these assets. Perhaps you can lease or buy used equipment rather than buy new when you are just getting started. Avoid this problem by limiting start-up expenses, and maximize cash flow. #9: Personal use of business funds Some business owners will use their business to cover personal expenses, a big risk, and a potential accounting hazard. Many small business owners will use personal credit to bootstrap their operations. To bypass this mistake, keep your funding sources separate. To avoid legal liability, set up your business as an LLC, corporation, or partnership. #8: Poor inventory management For a young business, good inventory management is crucial. Tying up working capital in inventory can be risky. So, putting in place good inventory controls early on is just smart. Make conservative, experience-based projections of supply needs. Rather than draining capital and eroding profits, a business can set up a line of credit but must exercise proper control and accountability. #7: Unexpected growth As a business starts to flourish, it's tempting to invest everything back into it in order to grow. For the long-term, it's better to limit spending, especially on more significant expenses. Spending too much, too quickly exposes the business to increased risk, which can endanger working capital. #6: Unable to keep pace with competitors The free-market economy encourages competition. Competition can be good for consumers, but a new business must work hard to distinguish itself against larger, established competitors. Study them and look for areas of opportunity – the path to longevity is taking care of your customers. Find ways to deliver good value and good service. This will build good word of mouth and help set you apart. Business reviews are a great place to start building. #5: Location and visibility Visibility is a key component of success, so try to find a physical location close to where targeted customers work or live. Consider accessibility, parking, and the condition of the building. A business’s online presence is just as important – for both digital and brick and mortar businesses. Customers can’t buy from someone they can’t find, so a professional-looking website with pages designed to get found by search engines is a must. A strong presence on social media is equally important. #4: Lack of experience Good business leadership means having the experience to make the right decisions and anticipate the challenges in the initial stages of growth and beyond. Aside from the expected steps to build a business, leaders must adapt to handle the pressure and avoid costly mistakes. Before opening your business, know your products and services and research customer needs and the general market. #3: Poor credit arrangements A business must make customer payment and credit terms accessible, but it can hurt cash flow if your financing options are too flexible. Mobile payments such as Square, PayPal, Venmo, and Zelle may help provide easy payment solutions. Establishing clear credit terms for large accounts is best. Just as you assess the creditworthiness of your customers, your business is also being assessed by potential vendors. To be seen as good credit risk, keep tabs on your own business credit score. #2: Low sales Maintaining consistent sales levels is a significant success factor for any growing business. Low sales can result from keeping an underperforming sales force, having inferior products and services – or overpricing them, lacking a solid understanding of buying trends, or misreading the competition. Business owners need to be ready to make course corrections to increase sales and revenue. #1: Insufficient capital Having money on hand is an obvious necessity to run a business. Investors, government grants, and business loans are common ways to raise capital. Online lenders have stepped in to fill the gap left by major banks following the Great Recession. Getting a loan may not be difficult, but a new business lacking credit history may face less favorable terms. Even if showing a profit, small businesses must focus on maintaining positive cash flow and paying bills on time to build strong credit. Don’t allow poor credit to limit your potential When it comes to managing your business credit, think of Experian. Whether you need to monitor your own business credit report or evaluate others, Experian® SmartBusinessReportsSM has the ideal small-business reporting service for you. Experian’s business credit reports and subscriptions are the best value for the money, giving you the choice to monitor your business credit reputation or instantly evaluate business backgrounds and credit scores on your suppliers and customers.

For many of us, 2020 has been the hardest year of our lives. As a society we are all going through this together, we know the pandemic will eventually end, and we all look forward to better days. Since the pandemic started the small business community has suffered greatly. We hear many stories about business owners struggling to survive. About business owners having to lay off staff and close permanently. But we draw inspiration from many of the innovation stories making headlines, stories about businesses who made a pivot to join the fight, and support healthcare professionals on the frontlines of the virus by converting factories to make PPE. We hear how small businesses navigated applying for the first round of PPP loans, and hope meaningful relief for small business comes soon. We draw inspiration from small business progress, and we stand strong with the people who went after their dreams. The pandemic will end, but dreams will not. It’s been said so many times that small businesses are the engine of our economy, and they truly are. Our commitment to helping small businesses with their financial health will continue to be unwavering. Supporting small businesses, helping them to create a better tomorrow Find out more about how Experian is supporting small businesses. https://www.experian.com/small-business/mybusinessfuture #smallbusiness #mybusinessfuture #businesscredit

Corporate Pledge Experian pledges to continue to help small businesses manage their risk, grow their business, and navigate their financial health during and after these turbulent times. We are offering small business owners 20% off their initial business credit report and 50 percent off a one-year subscription to monitor their business credit score. Going through this unprecedented time takes strength, and we pledge to support small businesses. https://www.smartbusinessreports.com/godaddy/ Experian is proud to have served and continue serving the small business community for over 70 years. We have learned a lot, as we have stood with small business through the best and worst of times. Most importantly, we understand that as the economy faces challenges, so do the ambitions and dreams of small business owners – and we have tailored our solutions with this in mind. Our credit data is an integral ingredient in the success of any business. An accurate view of financial health help businesses better evaluate trading partners, tap into new markets and make real-time decisions. It’s important that every small business owner knows where they stand and how others see them, especially during the times when they may need access to new capital. To ensure that small businesses have additional resources at their disposal to make informed decisions at this critical time, we are providing discounts on our 1-year monitoring service subscriptions. We also feel a deep obligation to our clients, the lenders, trade creditors, utilities, insurance underwriters, and more as they strive to support small businesses during this time. To further help small businesses gain access to capital they need, Experian also launched its free COVID-19 U.S. Business Risk Index to assist lenders and government organizations in understanding how to make lending options available to the business segments that need it the most. This new risk index can help business risk professionals better understand the impact that the pandemic may have on commercial operations based on several key factors. We hope that our data and advanced analytics enable our clients to offer fair and responsible lending to small businesses that need it most during this time. We encourage small business owners and partners to hold fast to your original visions and leverage our experience. No dream is too big, whether you are a company of one or one hundred, we’re here to support you. And together, we can create a better tomorrow. Hiq Lee, PresidentExperian Business Information Services #OPENWESTAND

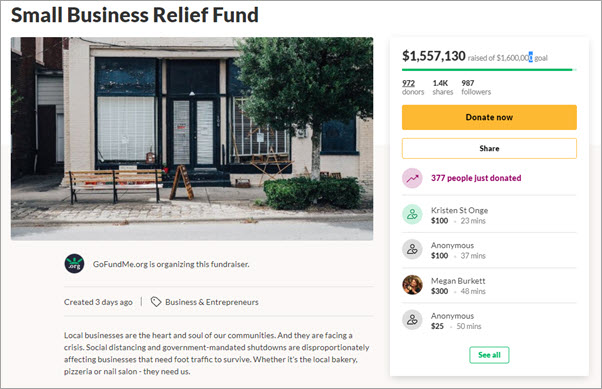

As the infections of Coronavirus continue to escalate unabated, millions of small businesses are closing and laying off workers. Others send the majority of their staff to work from home, as in our case here at Experian. If you are a business who can pivot to virtual selling Covid-19 may just be a temporary setback, but for other non-essential retail businesses laying off staff and closing their doors, workers have few options. I got a little burned out from watching all of the bad news as I flipped around cable the other night so I retreated to the den to read articles and saw that three days ago GoFundMe had set up a Small Business Relief Fund for businesses impacted but Covid-19. The goal of the fund is to raise $1.6 million, and as of this writing had raised $1.557,130 with major donations coming from Intuit Quickbooks, Yelp and GoFundMe. Hats off! Small Business Relief Fund The site is filled with over 80,000 businesses looking for donations. As I sat reading the stories about businesses here in Orange County, California, I was struck by the outpouring of support and the heartwarming comments left by customers. Many of the campaigns are launched by business owners who want to do right by their people while their businesses are struggling to remain open. Orange County businesses fight to survive A nurse from Children's Hospital Orange County picks up from Blue Bowl Teague, Ish, and Craig from Veteran-owned Blue Bowl Superfoods in Orange, California have a target of $50,000 from which a portion will go to feeding healthcare workers from nearby CHOC and St. Joseph hospitals. Their campaign description is a defiant open letter addressed to COVID-19 which reads "We are a veteran-owned small business fighting to keep our lights on because of you. You will not destroy our jobs and you will not destroy what we do." As of this posting his campaign had raised $11,548. Blue Bowl Superfoods GoFundMe Campaign I reached out to Blue Bowl and spoke with the company co-founder Teague Savitch. Teague got the idea for the company while deployed to Afghanistan in 2014, telling me “Towards the tail end of my deployment experience I was working in a team that was doing 24-7 operations and on-call all the time, always eating on the go. It was the first time in my life where for an extended period I was getting very little sleep and a lot of stress. When I came home, I started going to juice bars and really paid more attention to what I put in my body. That's when I kind of really got interested in the superfood movement. And from that Blue Bowl Superfoods was born.” When asked why he started a GoFundMe he responded “We're fighting to try and keep our doors open, and keep a paycheck going for our team, and it just so happens that our first location that we opened just over four years ago is right in the backyard of two major Orange County hospitals - Children's Hospital, Orange County and Saint Joseph Hospital. Both of those hospitals have been very key to our early success, spreading the word about our company and what we do. It's been a really popular item with hospital staff that need a meal that's healthy performance-enhancing nutrient-dense where they can come in quickly grab and go, get in and out of there and get back to doing their rounds in the hospital.” Solopreneurs turn to GoFundMe Cali Creechers GoFundMe Campaign Emily Creech of Cali Creechers, a pet sitting and dog walking business, is using GoFundMe to raise $3,500 to offset cancellations saying "most of my clients have had to cancel trips, work from home and isolate themselves from other humans in order to stay healthy." The impact of Covid-19 not only threatens her livelihood, but also her housing situation. I reached out to Emily to ask how she heard about the GoFundMe idea and she said: “I actually got an email from QuickBooks because I have QuickBooks for my business which is to keep everything organized, and they said they were sponsoring or helping promote the idea that you can start to go fund me for a local small business.” Emily says things started to change in her business around the 13th of March when she had one really big booking get canceled saying “I think people are canceling their trips because they have to, they're scared or they're elderly and they don't want anyone coming in their home to pick up their dog.” Cali Creechers got started after Emily started walking people’s dogs in her free time, picking up gigs using the Rover app. She said “You pass a background check and create a profile and people who need dog care can kind of narrow down their searches and get someone to care for their dog. So, I did that and I had a lot of really good response and I realized that it’s something I'm good at.” But Rover understandably charged a 20% fee on all of her business, so one day she decided to set-up an LLC so she could earn 100% of what she makes. Non-essential service-based businesses suffer sudden closures Team 12 GoFundMe Campaign Josh Boyd founded Costa Mesa-based Team 12 Group Training in 2013. He tells us that when the State ordered all non-essential businesses closed he had to lay off his 37 employees. He's hoping GoFundMe can help him raise $60,000 to help his employees, all out of work. Josh explained in his campaign profile, the revenue for his business is 100% Subscription-based and now that training sessions are on hold, they have no revenue to pay employees. I asked Josh if he thought Covid-19 would do any lasting damage to his business he said, "Once this is over the public will flock to gyms and have a deeper appreciation for the service based industry because they realize how hard it is to get motivated on their own.” Adding “You truly don’t value things as much until you actually lose it!”

Experian is partnering with the Federal Reserve to conduct its annual Small Business Credit Survey for both pre-start and existing businesses, and we’d like you to participate. This short survey will take approximately 10 minutes and will ask about business conditions, financing needs, and credit experiences. Summary results will be shared with you in the Spring, and all responses are confidential. The survey highlights the experiences of small businesses nationwide and provides critical information that service providers, policymakers, and lenders use to improve programs for small business owners. Please click the button below to complete the survey. Thank you for participating.

This week's guest post is by small business tax expert and best selling author, Barbara Weltman of Big Ideas for Small Business. Barbara shares ideas on how small businesses can remain competitive with health care benefits to attract employees in a tight labor market. With the cost of healthcare premiums rising, and a tight labor market, small businesses are looking at all options to attract employees, and benefits are one way to remain competitive. So, in this post I thought it would be timely to share some ways employers can deal with offering health coverage without breaking the bank. As P.T Barnham famously said “The foundation of success in life is good health,” so let’s start with a quick dose of reality then get down to the business of assessing your options for 2020 . It’s estimated that premiums for large employers in 2020 will be on average 5% higher than 2019 (statistics on premiums for small employers are not available). Small business owners are tasked with the challenge of offering health coverage to their staff that is within their budget. Fortunately, there are several ways for employers to deal with health coverage, and the tax law provides breaks to help defray the cost. Here is a summary of health coverage options and a brief discussion of the tax breaks that result. Employer mandate Despite repeal of the individual mandate, the employer mandate requiring certain employers to “play or pay” continues to apply. If you have at least 50 full-time and full-time equivalent employees, you are an applicable large employer (ALE) and must offer minimum essential health coverage that’s affordable (meaning the employee share of premiums doesn’t exceed a set percentage of their household income) or pay a penalty. In deciding whether to play or pay, keep in mind that the penalty amounts (there are different penalties) are increasing for 2020. And if you play, there are cost management initiatives—shopping around, increasing deductibles, using virtual care—to help keep premium costs down. Small employer options Even if you aren’t an ALE, small companies want to offer their employees health coverage. They want their workers to be healthy. And in today’s tight job market, health coverage is an important benefit, with the majority of employees saying that their coverage is a key factor in deciding whether to stay with the company. Here are some affordable options to consider: Health savings accounts (HSAs). If you offer employees a high-deductible health plan (HDHP), which is a low premium policy that requires employees to pay out of pocket up to their policy’s deductible before coverage kicks in. The HDHP is then combined with an IRA-like savings plan called a Health Savings Account (HSA). You can decide whether to contribute to an employee’s HSA or let the employee do so. If you make the contributions, they are tax deductible and as a tax-free fringe benefit are not subject to payroll taxes. Qualified Small Employer Health Reimbursement Arrangements (QSEHRAs). Instead of having the company obtain a group plan, a small employer (one that is not an ALE) can reimburse employees up to a set dollar amount for their individually obtained health coverage. Reimbursement limits for 2020 have not yet been announced. For 2019, they were $5,150 for self-only coverage and $10,300 for family coverage. Individual Coverage Health Reimbursement Arrangements (ICHRAs). Starting in 2020, employers of any size can reimburse employees for their personal health coverage premiums. The employer—not the government—sets the reimbursement limit. The ICHRA must be offered on a nondiscriminatory basis. And the arrangement must meet other requirements, including notice of the plan and verification of coverage by employees in order to receive reimbursement. Sounds similar to the QSEHRA, but there are some important differences. Excepted Benefit Health Reimbursement Arrangements (EBHRAs). Also starting in 2020, employers that want to offer certain extra coverage up to $1,800 to help employees pay for non-covered expenses (e.g., vision or dental care) can do so with an EBHRA. This is a supplement to and not a substitute for group health coverage. Association Health Plans (AHPs) In 2018, the U.S. Department of Labor issued a final rule permitting chambers of commerce, trade associations, and other groups to band together to offer their members affordable group health coverage. The groups, referred to as Association Health Plans (AHPs), would be treated as a single large employer and, due to economies of scale, would be able to command favorable premiums. Tax incentives Premiums paid by employers are fully tax deductible. What’s more, employer-provided health coverage is a tax-free fringe benefit exempt from payroll taxes, but employers must report it on employee W2’s. Instead of a deduction, small employers that purchase coverage through a government Small Business Health Options Program (SHOP) (or through an insurer where there is no SHOP) may be eligible for a 50% tax credit for the premiums they pay for their staff. Details of this tax credit are in the instructions to Form 8941. Final thought Because of the wide array of options for obtaining health coverage, small business owners have a lot to think about. But they must do so soon so they can select their option and shop around now to have coverage in place by January 1, 2020. About Barbara Weltman Called the “guru of small business taxes” by the Wall Street Journal, Barbara Weltman is a prolific author with such titles as J.K. Lasser’s Small Business Taxes and J.K. Lasser’s Guide to Self-Employment and a trusted advocate for small businesses and entrepreneurs. She has appeared on numerous radio shows and television programs, including Fox News, CNN, and The Today Show. She has been named one of the 100 Small Business Influencers in the U.S. five years in a row. Learn more by visiting Big Ideas for Small Business.