Tag: Small Business

Experian has just released the Women in Business credit study, a three year study of around 2.8 million credit files for small business owners. One of the key findings in this study was women business owners, in particular, are reliant upon personal forms of credit, and they may be at a disadvantage through this practice. In the below video, Experian talked with Sarah Evans, owner of Sevans Strategy, a digital PR agency and Linda Waterhouse, owner of WSI Web Systems, to get their perspectives on managing credit, and some of the insights revealed in the Experian study. Click below to learn more about the Women in Business credit study.

What is good business credit? See how a good business credit score can help strengthen and protect your business.

In this guest post, tax expert and author Barbara Weltman offers some tax saving tips for business owners as we head into tax season. You can find more posts by Barbara on her blog Big Ideas for Small Business. Tax season is upon us and business owners want to minimize their tax bill for 2018 to the extent allowed by law. Fortunately, there is considerable flexibility on tax returns to cut taxes and be positioned for 2019. Here are some business-related strategies to consider. Take advantage of new tax laws Your 2018 return will reflect changes made by the Tax Cuts and Jobs Act of 2017. The new rules applicable to you depend on your type of business entity: C corporations. The most dramatic change here is the cut in the corporate tax rate to 21%. Pass-through entities. For owners in partnerships, limited liability companies, S corporations, and sole proprietors, the most dramatic change here is the introduction of a new tax deduction called the qualified business income (QBI) deduction. This personal write-off effectively reduces taxable profits by 20% for those eligible to fully utilize it; many limitations apply. All businesses. Regardless of how the business is organized, write-offs for buying certain property have been enhanced, enabling all of the cost to be deducted up front. This is so even if the purchases are financed in whole or in part. And if you’ve continued paying wages to employees on family or medical leave and meet certain requirements, you may be eligible for a new tax credit. Make smart tax elections Size up where you stand in terms of profitability for 2018. As a generalization, if 2018 was a good year, you want to maximize your deductions; if it was not a good year, you probably want to save deductions where possible to use them as offsets when profitability returns. For example, if you’re in the black in 2018 and have placed newly acquired equipment in service in 2018, then use tax breaks—Section 179 deduction and bonus depreciation—to write off all of the cost on your 2018 return. Conversely, if you’re in the red, don’t elect the Section 179 deduction and opt out of bonus depreciation so you use regular depreciation to spread deductions over the recovery period of the property; hopefully, you’ll be profitable then and benefit more from these deductions. Discuss with your CPA or another tax advisor any accounting method changes to be made for 2018 in light of new rules under the Tax Cuts and Jobs Act. Making such changes can impact when deductions are taken and income is reported. Make last-minute retirement plan contributions If you have a qualified retirement plan in place (i.e., it’s been operating for years or you at least signed the paperwork for a 2018 plan by December 31, 2018), you can complete contributions to the plan up to the extended due date of your return. For example, if you are a sole proprietor with a solo 401(k) plan (you don’t have employees), your contribution for 2018 can be made up to the extended due date of your 2018 return (October 15, 2019) if you have a filing extension. If you don’t have a qualified retirement plan in place, it’s not too late to set up and fund a SEP. This type of plan, which can be used by any type of entity, requires you to include eligible employees and make contributions on their behalf up to the extended due date of your return. Figure your estimated taxes for 2019 The due date of your personal income tax return—April 15, 2019 (April 17th if you live Maine or Massachusetts)—is also the date for paying the first installment of estimated tax for 2019. If you file your 2018 return by this date, you can use the 2018 tax liability to gauge your 2019 estimated tax payments. As long as your 2019 estimated taxes are at least 100% of your 2018 liability (110% if your adjusted gross income in 2018 exceeds $150,000, or $75,000 if married filing separately), then you won’t owe any estimated tax penalties even if this estimate falls short of what you’ll actually owe on your 2019 return. In making your 2019 estimated, factor in: A higher Social Security wage base ($132,900 in 2019), which is part of self-employment tax. Cost of living adjustments to various tax breaks (e.g., retirement plan contribution limits, Section 179 deduction limitation). Conclusion Now that the dust has settled on the Tax Cuts and Jobs Act, some businesses may want to consider changing their form of entity (e.g., revoking an S election to become a C corporation). Keep in mind that such action has more than mere tax effect and shouldn’t be undertaken without considering not only all the federal and state taxes but also non-tax considerations.

Veteran entrepreneurs have always been at the core of American business owners. In May of this year, Experian conducted a series of interviews with veteran business owners and found that the skills and values learned while serving their country naturally prepared them for entrepreneurship. Of those skills and values were leadership, adaptation, discipline, and perseverance. Recently, the New York Federal Reserve Bank, in conjunction with the U.S. Small Business Association (SBA), released a detailed report about veteran business ownership and found that the number of veteran entrepreneurs is declining. With historical numbers revealing strength in veteran entrepreneurship, what are the reasons for the sudden decline? The U.S. Small Business Association (SBA) reports in a series of surveys, 36% of veteran entrepreneurs had no prior interest in business ownership before their military service. Because of the training and experience of serving in the military, veterans seem to be well-fitted for entrepreneurship. According to the Institute for Veterans and Military families, of those who returned home from prior wars, 49.7% of WWII vets and 40% of Korean War veterans started their own businesses. The U.S. Bureau of Labor Statistics also reports that the highest rates of self-employment were those who served in World War II, Korea, and Vietnam. Veteran business formation declining In a 2011 report, however, the U.S. Small Business Association noted a decline in veteran entrepreneurs and began to look deeper into determining factors. Part of the reason was that the older generation was aging out of the workforce. Since 9/11, only 4.5% of veterans have opened businesses, clearly emphasizing that the rate of new veteran entrepreneurs is in steady decline. Also of note, compared to non-veteran-owned small businesses in any industry, veteran-owned companies with 1 - 4 employees seem to be underperforming in sales. Larger veteran-owned businesses, with 5 or more employees, actually outperform non-veteran owned businesses. Does this reveal that newer, veteran-owned small businesses seem to have more challenges than veteran entrepreneurs of decades past? Factors in the decline of veteran entrepreneur success Recent years have seen many corporate initiatives that encourage veteran hiring and could be contributing to the decline of veteran entrepreneurs. The New York Fed’s report on veteran entrepreneurship notes, however, that veterans are underemployed compared to non-veterans and nearly of quarter of returning vets would like to start businesses. Further details of the report reveal that veterans long to “forge their own path” and “showcase skills”. The challenge for many veterans is the lack of a strong business or personal network with which to begin their new ventures. Because they’ve been away and typically relocate fairly often, the lack of social resources could be a factor in the decline of new veteran-owned businesses. The Federal Reserve Bank analyzed data and Small Business Credit statistics of veteran and non-veteran business owners and found that the biggest factor affecting veteran entrepreneurs is access to capital. Small business access to capital According to the New York Fed Small Business Credit Survey, the firms surveyed had less than 500 employees and were asked about their business performance and financing needs. If more than 50% of the business was owned by a veteran, they were referred to as veteran-owned businesses. The report found that the need for small business financing was similar between veteran and non-veteran owned businesses.The difference was that veteran-owned businesses submitted more applications and reached out to banks large, small and online. Even with the greater number of applications and the variety of lenders, veteran-owned businesses typically obtained less financing and saw lower approval rates than non-veteran owned businesses. During a time of economic recovery (2010 - 2017), the SBA loans to non-veteran owned businesses increased to 82% as compared to 48% for veterans, even with relief programs set aside for veterans. Veterans also seem to be asking for smaller loans, something that also affects women business owners’ access to capital. Larger banks are less likely to approve loans under $100K. Because of the frequent traveling and working overseas, some veterans are also struggling with building solid credit or having collateral. As they’re seen as higher risk, some lenders aren’t willing to take the chance. Veterans are still asking for help Even with these challenges and barriers to capital, veterans are seeking out assistance from the SBA and other resources to grow their small businesses after they have been denied capital. With common traits of strength and self-reliance, veteran entrepreneurs may be starting businesses before they’ve met with financial and business advisors. More preparation and knowledge about which lenders would better meet their financial needs and how to prepare for credit and collateral requirements could be helpful for veteran business owners. The New York Fed report suggests for several recommendations for policymakers to help veteran business owners including: Easier debt financing Mentorship Awareness and marketing To learn more about the challenges faced by veteran entrepreneurs and how to help, access the New York Federal Reserve Bank report here.

In this guest post, Experian invited Alan W. Silberberg, Founder and CEO of Digijaks, a boutique Cybersecurity company, to share his views on how small businesses are vulnerable to cyber attacks, and some best practices every small business should adopt to protect their businesses. In 2017 61% of small businesses in the United States suffered some kind of cyber attack according to a report by Ponemon Institute. This number reflects an over 50% increase year to year in cybersecurity assaults on U.S. small businesses. There are many reasons why small businesses need cybersecurity — privacy, client trust, financial integrity, employee integrity, data integrity and the longevity of the business. For a small business owner, the topic of cybersecurity can seem overwhelmingly complex, but a basic understanding of cybersecurity is considered table stakes for running a business in 2018, particularly a business with any kind of online presence. But even those companies without an online presence can be quite vulnerable to cybersecurity threats. Threats include attacks launched through email, SMS and voice phishing, even insider threat attacks, or in person cybersecurity attacks. Small businesses are also very likely to suffer a reputational attack, where someone starts posting negative information in social media, websites, blog posts to harm your brand and or reputation. There are many kinds of cybersecurity tools and protocols available to the small businesses, and it would be impossible to boil the topic down in a single blog post. Rather, I’d like to outline some common sense protections to have in place for your business and illuminate some tactics hackers are employing when going after an unsuspecting business. Two-Factor Authentication Two Factor Authentication and or multi-factor authentication are needed for every sign in, every banking account, every insurance account, and if possible should be defacto, Two-factor authentication can be commonly known as using a secondary password or 4 digit code to authenticate login after your username and password are entered. While many consumers know two-factor authentication as something like SMS messaging post-login, many banks, and government players are moving into multi-factor authentication or relying on non-sms delivery. Firewalls There are multiple types of firewalls, including solutions specifically for mobile devices. Generally speaking, a firewall serves as the first or sometimes the second point of response for all incoming traffic including normal and business-related data/voice data. A firewall will defend a network, a device, or both against multiple kinds of cyber attacks. This could include things like malicious code insertion, denial of service, data stuffing, viruses and potentially malicious payloads in documents. Usually, a firewall will work best when configured onto a specific network or device to the needs of that specific instance. Not using a firewall is a novice mistake since they do capture and stop a large number of certain kinds of attacks. This being said, however, a smart attacker, using social engineering and or network monitoring, even network penetration can create malicious code designed to bypass firewalls. This is why layered cybersecurity approaches to even the smallest business can reap long-term rewards. The kinds of threats facing a small manufacturer versus a small FinTech company; are simultaneously different and the same. Each industry has specific devices, use cases, and technology that need securing in different ways. However, all small businesses need to use common sense and some basics; like strong password rules, firewalls, https websites, two-factor authentication, encryption for both data storage and transmissions like email or website. Common cyber hacks used on Small Business Social engineering attacks, for example, account for over 50% of all cybersecurity intrusions in one form or another. This includes social media, search results, email phishing, voice phishing, SMS phishing, and link bait. Then there is reverse social engineering, where someone learns enough about your business to be able to convince you they are the ones to solve your problems when they are really behind the hack in the first place. Social engineering attacks can occur in multiple instances. One kind might be directed at the CEO or CFO like in the “CFO Scam” otherwise known as the Business Email Compromise scam. Others can be directed at corporate websites, using fake comments, fake vendors and fake customers to deluge a small business with negative comments and create a bad vibe. Other social engineering attacks can occur through social media; with LinkedIn and Facebook especially often used to mine information about who is who, and what they do inside organizations. This can be used in good ways obviously, but also to inform attackers about potential vectors in. Social engineering can take the form of someone contacting your customer service representatives, with just enough information about a certain account, to request password changes. Or address changes. While this may be directed at a specific user or client, it affects your company directly and can result in litigation or loss of business or both. Reputation security of your brand, your key employees, and even the owner of a small business is just as important as cyber security and all business need to pay attention to external attacks that may start as, or be through search or social media. A small business might have up to date cyber security controls and protocols, but may still be open to reputation attacks. Set up Google alerts in your brand name, key employees names and your own. Monitor for any changes in search results which are often tied directly to reputation attacks. Create a social media plan that encourages employees to not share any work-related information, and trains people how to ascertain fake accounts versus real ones. It should not take a cyber horror story to get your company investing the time, money and training to protect your business., Protecting the security of the business is viewed as a positive thing to share with investors, due diligence teams from prospective partners, and or even with your clients. All of us want to do business with safe companies, or those perceived to be that way. In fact, there is a huge incentive. Recent studies show that on average 20-25% of US companies that suffer a data breach permanently lose clients. This number can increase dramatically if the breach is with a financial company, health care company or insurance company. So do not wait. Educate yourself, your colleagues and your employees. Learn what kind of cybersecurity you need and how it would be implemented across your business. Do not assume you won’t be attacked. Do not assume your own business is too small or not worth a hacker’s time. Take the necessary steps beginning with education. Then begin to form an action plan and next steps. Want to learn more? Resources for Cybersecurity information Here are some additional resources to consider when researching cybersecurity options for your business: U.S. Small Business Administration “Cybersecurity for Small Business” training program List of large and growing Cybersecurity companies U.S. CERT Cybersecurity Resources for Small Business U.S. Homeland Security Cybersecurity Resources for Small Business Top Small Business

Failing to seek IP protection may put your small business at a competitive disadvantage, so in this guest post we include some basic IP tips.

The Qualified Business Income Deduction is part of the recently revised business tax code. In this guest post, leading author and tax expert, Barbara Weltman how business owners with multiple businesses can approach the QBI deduction. You can find more blogs by Barbara on her blog Big Ideas for Small Business. The qualified business income (QBI) deduction provides a significant opportunity for business owners to slash their federal income tax bill. Designed to lower the effective tax rate on owners of pass-through entities, the write-off can be as much as 20% of QBI. But various limitations come into play that can reduce or bar the deduction. For a basic primer on QBI, read my earlier post "Understanding The New Qualified Business Income Deduction." If you are a business owner with an interest in multiple businesses, you should read on. The good news is, you may be able to aggregate them to optimize their deduction. The bad news: certain businesses may not be able to break up in order to use the deduction, more on that part later. So here are some of the points to note in putting businesses together or taking them apart in order to get the biggest QBI deduction possible. Aggregating businesses Usually, if you own businesses directly (a sole proprietorship or single-member limited liability company, or LLC) or have interests in S corporations, partnerships, or limited liability companies (LLCs), you figure the deduction for each business and then combine them for a single entry on your tax return. But you may be able to lump your business numbers together in figuring your QBI deduction. This may allow you to take a larger deduction than if you didn’t aggregate your business interests. If eligible, you can aggregate your interests, regardless of what your co-owners do with their interests. To qualify for aggregation, you must meet all 5 conditions: The same person or group of persons own (directly or indirectly) 50% or more of each business being aggregated. The 50% or more ownership exists for more than half the year. All tax items attributable to each business are reported on tax returns with the same tax year end (e.g., all businesses use a calendar year). None of the businesses are a specified service trade or business, or SSTB (any trade or business involving the performance of services in the fields of health, law, engineering, architecture, accounting, actuarial science, performing arts, consulting, athletics, financial services, brokerage services, or any trade or business where the principal asset of such trade or business is the reputation or skill of one or more of its employees or owners). The businesses being aggregated satisfy at least 2 of these 3 requirements: (a) the businesses provide products and services that are the same (e.g., a restaurant and a food truck) or customarily provided together (e.g. a gas station and a car wash), (b) the businesses share facilities or significant centralized elements (e.g., personnel, accounting, legal, manufacturing, purchasing, human resources, or information technology services), and (c) the businesses operate in coordination with or reliance on each other (e.g., they have supply chain interdependencies). Other key points: Assuming eligibility, you can choose to aggregate some of your businesses and not others. The aggregation of businesses for purposes of the passive activity loss rules has no impact on aggregation for the QBI deduction. If one of the businesses being aggregated produces a negative QBI, each business with a positive QBI must be offset by a portion of the negative QBI. But W-2 wages and the unadjusted basis immediately after acquisition (UBIA) of qualified property from a business that has a negative QBI aren’t taken into account in figuring the QBI limitation. If there’s an overall negative QBI for the year, it is treated as a loss from a qualified business in the following year (the loss continues to haunt you). An election to aggregate businesses means they must continue to be aggregated in the future. New businesses can be added to the aggregated group. But if things change for businesses within the group (e.g., ownership drops below 50%), they may no longer qualify for aggregation. Each year you must attach to your return a statement identifying each business being aggregated. If you don’t, the IRS can “disaggregate” the businesses. Chopping up businesses Specified Service Trade Businesses's (SSTB's) with owners having high taxable income that would otherwise bar them from taking a QBI deduction may have thought they could separate out some functions in an attempt to qualify those separate parts as non-SSTBs. For example, it had been suggested to remove administrative functions or building ownership into a separate business to at least get the QBI deduction for this business. While having separate businesses is certainly allowed, the IRS has effectively killed the idea of chopping up businesses in certain situations in order to get the QBI deduction. An SSTB includes any trade or business with 50% or more common ownership that provides 80% or more of its property or services to an SSTB. If a trade or business has a 50% or more common ownership with an SSTB, to the extent it provides property or services to the commonly-owned SSTB, the portion of the property or services is treated as income from an SSTB. Even if a business would not otherwise be an SSTB but has 50% or more common ownership with an SSTB and shared expenses (e.g., wages, overhead expenses), it is treated as incidental to an SSTB if its gross receipts are modest. More specifically, the trade or business will be treated as an SSTB if its gross receipts represent no more than 5% of the gross receipts of the combined businesses. Bottom line The QBI deduction is a wonderful way to reduce your tax bill because it doesn’t cost you anything to get it (you don’t need to expend any money); it’s yours if you qualify. For the vast majority of business owners, the deduction is rather straightforward. But qualifying for the deduction becomes a complicated matter for anyone with taxable income over $315,000 on a joint return or $157,500 on any other return. Check with your tax advisor to learn more about how you can qualify for this write-off. Learn more about the QBI Deduction at our upcoming webinar with Barbara Weltman October 2nd.

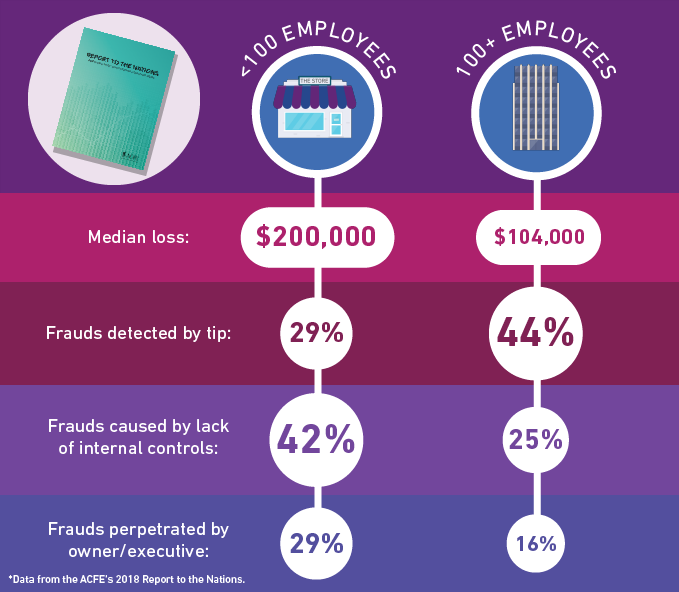

The Association of Certified Fraud Examiners has released their 2018 Report to the Nations: Global Study on Occupational Fraud and Abuse and small businesses should take heed. The annual report, which began in 1996, was implemented to identify cases of fraud in order to best address the problem. The Report to the Nations identifies: how fraud is committed, how it is detected, who commits it and how organizations can protect themselves. One of the key findings is that small businesses lose almost twice as much per fraud incident as larger businesses. Other key findings will be addressed in this article. Experian spoke with Andi McNeal, co-author of the report and ACFE’s Director of Research, to dive deeper into the reports’ findings. How is Occupational Fraud Harmful to Small Businesses? Occupational fraud is when someone steals from their own company. For small businesses, fraud can be more impactful than in large businesses. In the Report to the Nations, small businesses are identified as those with less than 100 employees as compared to larger businesses with 100 or more. According to the report, the median loss for small businesses is $200,000 versus $104,000 for large businesses. With the average amount of each incident nearly double, and with revenues likely much less than in larger businesses, this loss can be quite devastating to the business. ACFE’s Director of Research, Andi McNeal, points out that the report doesn’t necessarily cover all industries, only 23 industry categories are included, so the average amount per industry can vary. However, considering the average size of small businesses, one single employee stealing $200,000 could wipe out the whole company. How is Fraud Committed and Detected? According to McNeal, the report was built on a survey of ACFE fraud examiners sharing case information from the prior 2 years. The current report looked at 2,690 cases of occupational fraud from all over the world, including 28% that were perpetrated in small businesses. The report revealed that fraud is typically found because there are few if any, internal controls to prevent and detect it. In a small business, fraud can be perpetuated by: a co-owner one owner running personal purchases through the company or to family members the person controlling the bank account With the average median duration of a fraud scheme lasting 16 months, corruption is the most common with 70% of cases perpetrated by a business leader. McNeal stated that the lack of internal controls contributed to almost half of all frauds. Most organizations, including those without reporting hotlines, are more than twice as likely to detect fraud only by accident. The unfortunate truth for small businesses is the “risk of fraud can be easily overlooked and quite devastating”. In small businesses, owners are less likely to detect and report fraud. Owners and leaders operate on trust, even when formal policies are in place. Small business leaders are focused on operations and not necessarily concerned that someone is stealing from them. The Report to the Nations states that only 2% of owners will detect and report occupational fraud compared to 53% of employees. So having these conscientious whistleblowers among your ranks is your best line of defense. How Can Small Businesses Protect Themselves from Fraud? McNeal recommended internal controls to prevent and detect fraud. Small businesses have half the implementation rate of internal controls than larger businesses if they have any at all. Some of the internal controls that can help include: A Code of conduct Anti-fraud training Data analytics to control fraud 3rd party audits of financial statements The best way to prevent fraud is to emphasize that fraud will be reported right away. McNeal recommended sitting down with staff to look over the company’s anti-fraud policy. This management procedure sends a strong message to staff to let them know that fraud will be taken seriously. In other cases, employees did have suspicions of fraud but didn’t know what to do about it. Setting up a formal procedure of transparency, including a hotline program, allows employees to know there’s someone they can talk to. Empowered staff will speak up if given a directive of reporting concerning behaviors, including pressure or frustration. Some employees need an outlet instead of resorting to fraud. Build a layer of management review. McNeal stated that if the small business owner opened the monthly bank statements, it could stop most small business fraud. Surprise accounting audits can also ensure the accounting procedures are truthful and accurate. Final Thoughts on Detecting Small Business Fraud Andi McNeal shared that there are many third-party businesses available to help detect fraud. ACFE Membership is made up of anti-fraud professionals, including many boutique firms. Some consultancies specialize in helping small business implement scaled anti-fraud programs. Business owners can decide which firms fit their need or make sense for the number of resources they have available. There are also resources online to help detect fraud and build internal controls. Business owners need a clearer understanding of where their risk is, and which parts of their company are most vulnerable to fraud. Small business needs to pay special attention to their accounting department, including implementing processes and procedures. For instance, McNeal recommends that staff is cross-trained when someone is going on vacation or that more than one person is reviewing the accounting. Surprise audits are most effective. “Also,” said McNeal, “Management behaving in an ethical manner. If employees are watching management making ethical decisions in a grey area, then they may do the same. The tone is set from the top.” Running background checks is also helpful, so small business owners do not hire those who have stolen before. According to McNeal, only 4% of fraudsters have been convicted of fraud prior to the cases in the report. 89% had no criminal background. Unfortunately, after the fraud is detected, fewer organizations are actually prosecuting the fraudsters. So businesses could be hiring first-time offenders or those who simply weren’t prosecuted because of cost if the previous victim was afraid of bad publicity or they believed the internal justice was sufficient. There should be appropriate consequences to help stop the propagation of fraud. You can download this fascinating report from the Association of Certified Fraud Examiners website.

The IRS recently released more details about the Qualified Business Income Deduction, a new tax regulation that will impact small business owners. In this guest post, leading author and tax expert, Barbara Weltman shares first impressions on the regulation and potential impact for small businesses. You can find more blogs by Barbara on her blog Big Ideas for Small Business. If you own a pass-through entity—sole proprietorship, partnership, limited liability company, or S corporation—you may be eligible for a new tax deduction. It is a significant tax reduction for business owners who qualify for it. But it isn’t simple because numerous limitations and acronyms come into play. The following is a brief introduction to the qualified business income deduction. Overview Referred to as the Section 199A deduction (the section in the Tax Code for it), the qualified business income (QBI) deduction runs from 2018 through 2025. You don’t have to expend any capital or take any special action; if you qualify for the deduction you get it. But the bad news is that there’s new terminology and calculations for limitations on the deduction which can be daunting. The deduction does not reduce your business income and does not reduce your net earnings for self-employment tax if you’re self-employed. It does not reduce your gross income as does other business-related expenses, such as retirement plan contributions on your behalf, health insurance for yourself, and one-half of self-employment tax. The deduction comes off your adjusted gross income in the same way as the standard deduction or itemized deductions (there’s a special line for the QBI deduction on Form 1040), effectively reducing the tax rate you pay on your business profits. For example, if you are in the 32% tax bracket and qualify for the deduction without any limitations, the effective tax rate on your QBI becomes 25.6%. What is QBI? The deduction is based on the amount of your qualified business income. This is essentially your profits from a pass-through trade or business. However, QBI does not include certain items that you do factor into your net income for determining what you pay income tax on. Items excluded from QBI are: Capital gains and losses (including Section 1231 gains) Dividend income Interest income Reasonable compensation paid to S corporation owner-employees Guaranteed payments to partners for services rendered to the business What is the QBI deduction? If your taxable income is no more than $157,500 if single or $315,000 if married filing jointly, then your deduction is 20% of QBI. The deduction cannot exceed your taxable income minus any capital gains. For example, if you are a sole proprietor with a net profit of $90,000 (and no excluded items) on your Schedule C and your taxable income is $100,000 (no capital gains), your QBI deduction is $18,000 ($90,000 x 20%). What limitations apply? Once your taxable income is higher than the taxable income threshold for your filing status, then various limitations come into play. The exact formula for determining the deduction (there are special rules for income from REITs and publicly traded partnerships that is not explained here) is the lesser of: 20% of your QBI, or The greater of (a) 50% of W-2 wages or (b) the sum of 25% of W-2 wages plus 2.5% of the unadjusted basis immediately after acquisition (UBIA) of qualified property. In addition to the W-2 limitation and the property limitation, there is a special limitation for a specified service trade or business (defined below). Only a percentage of QBI, W-2 wages, and the unadjusted basis of property can be taken into account. Once an owner of a specified service trade or business has taxable income over $207,500 if single, or $415,000 if married filing jointly, then this limitation means no deduction can be claimed. What are the special terms to know? There are a number of special terms you need to know in order to figure the deduction: W-2 wages. These are wages reported on W-2s to employees (including wages to S corporation owner-employees), plus elective deferral contributions to 401(k)s and similar plans and certain deferred compensation. Specified service trades or businesses (SSTBs). These are any trade or business involving the performance of services in the fields of health, law, accounting, actuarial science, performing arts, consulting, athletics, financial services, brokerage services, or any trade or business where the principal asset of such trade or business is the reputation or skill of one or more of its employees or owners (a catchall category). Architecture and engineering are specifically not included in the list of fields. Fortunately, the IRS has narrowly construed the meaning of the catchall category so that the skill or reputation of an owner will be an SSTB only if the person receives payment for endorsing products or services, licensing the taxpayer’s images, or receiving fees for media appearances. For instance, a chef who owns restaurants and also endorses a line of cookware, only the income from the endorsement will be treated as an SSBT; the income from the restaurants won’t be tainted and subject to the SSBT limitation. Unadjusted basis immediately after acquisition (UBIA) of qualified property. This is essentially the cost of depreciable tangible property as of the date it’s placed in service. So if your sole proprietorship buys a $10,000 machine and begins to use it on March, 1, 2018, you have UBIA of $10,000, even if you write-off the entire cost on your 2018 return. Conclusion If you think the QBI deduction sounds complicated, then you are correct. Fortunately, the actual computation of the deduction is done automatically by software. The important concepts to understand are the overall landscape of the deduction and the new terms that come into play. An upcoming post will provide more guidance on grouping and splitting businesses and other aspects of this complicated but very important deduction. Stay tuned! Attend our webinar