Loan pricing optimization software

Enable personalized pricing to grow your loan portfolio.

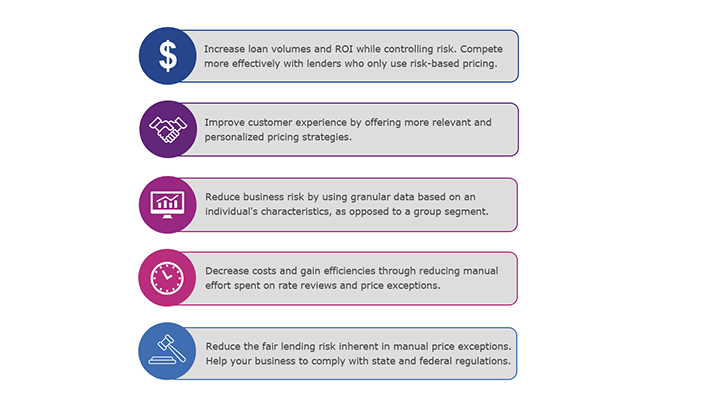

Traditional risk-based pricing strategies do not take a holistic view of each consumer’s risk and price sensitivity, nor do they fully consider price elasticity and competition when setting prices. A profit-based, analytical approach that assesses tradeoffs and optimizes pricing decisions can help you increase take-up rates and maximize profitability.

Loan pricing optimization can help you significantly improve profitability and efficiency while achieving a superior customer experience. It enables you to generate profits while adhering to your business constraints. Our proven combination of sophisticated analytics, flexible optimization software and industry consulting are the basis of an effective loan pricing optimization strategy that can help you design more profitable pricing decisions.