Case Study

Published December 12, 2024

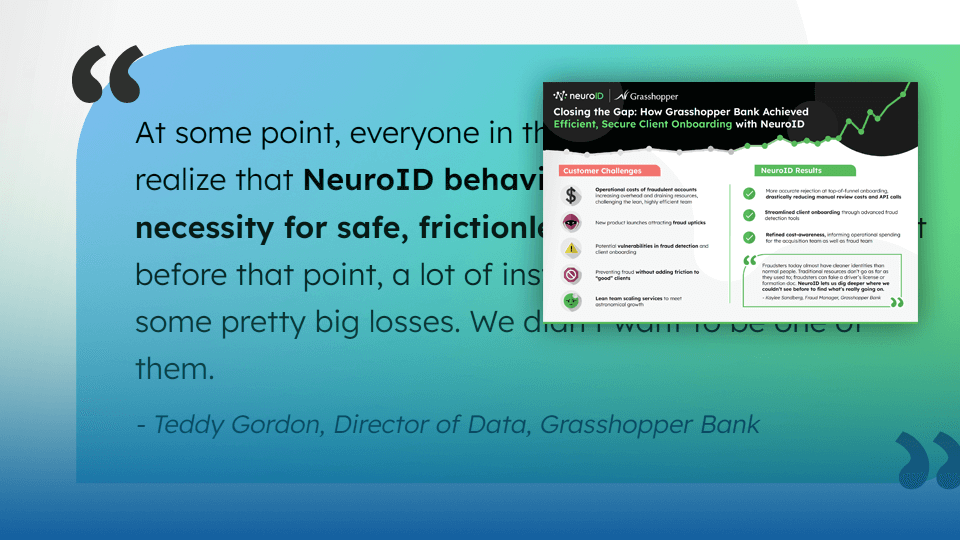

Banks Fraud Management

With behavioral analytics, Grasshopper Bank supercharges their team’s efficiency through improved top-of-funnel fraud detection and better-informed resource allocation.

Key Results:

- More accurate rejection at top-of-funnel onboarding, drastically reducing manual review costs and API calls

- Streamlined client onboarding through advanced fraud detection tools

- Refined cost-awareness, informing operational spending for the acquisition team as well as fraud team

Click the button below to access the case study

View now Infographic

Infographic

2026 Future of Fraud Forecast

Download Experian’s 2026 Future of Fraud Forecast to explore five fraud trends expected to have the biggest impact on businesses and consumers in the coming year, including:

- Agentic AI and machine-to-machine fraud

- Deepfake-driven employment fraud

- Smart home device exploitation

- Website cloning and emotionally intelligent fraud bots

Tip Sheet

Tip Sheet

A companion piece to Bridging the credit divide: income, risk and inclusion in consumer finance

This summary outlines important research findings that help lenders drive a more inclusive environment for customers, while mitigating risk.

A few takeaways:

- Understanding the profiles of who’s more prone to exclusion informs risk management.

- Machine learning techniques can also be deployed to help detect economic interaction effects or shifts.

- Attributes like education level, occupation or rent/utilities payment history have predictive power in credit outcomes.

White Paper

White Paper

Closing the credit gap

Read the latest findings about "Closing the credit gap" white paper, and what they mean for financial inclusion and risk management.

Key insights:

- Income and credit trends reveal significant disparities that impact access to financial products.

- Demographic shifts across gender, household structures, ethnicities, and generations are reshaping borrower profiles.

- Lenders who adapt their strategies and product offerings can expand their customer base, reduce default rates, and lead in inclusive finance.

Report

Report

Identity and fraud insights for merchants

Consumers expect e-commerce experiences to be seamless and secure but, as fraud threats evolve, merchants are struggling to keep pace — and consumers are losing trust in merchants. Drawing on this year’s U.S. identity and fraud insights, this report explores the key factors contributing to the e-commerce trust gap.

You’ll learn:

- What’s driving consumer concerns in e-commerce.

- Consumers’ preferred security methods for seamless, safe transactions

- Actionable recommendations to enhance merchants’ fraud stacks