How Is a Student Credit Card Different From a Regular Credit Card?

Quick Answer

A student credit card usually has a lower credit limit than a regular credit card and may have different credit score requirements and perks. Student cards also often have different ways of defining income that you earn, which can make it possible for those under age 21 to qualify.

Compared with regular credit cards, student credit cards may have lower credit limits and unique features that are particularly appealing to students.

The requirements to get a student credit card may also be different from those of a traditional credit card. In recognition of students' limited experience with credit, some student cards don't require a credit score. And while you'll need to show that you earn income when you apply for any credit card, student cards have more flexible ways to demonstrate that income.

Here's what to know about student credit cards, and how to decide if getting one is right for you.

What's the Difference Between a Student Credit Card and a Regular Credit Card?

Student credit cards are designed to interest students, who may have less robust credit histories and who have different financial priorities than non-student cardholders. That means you'll likely see the following differences between the two card types:

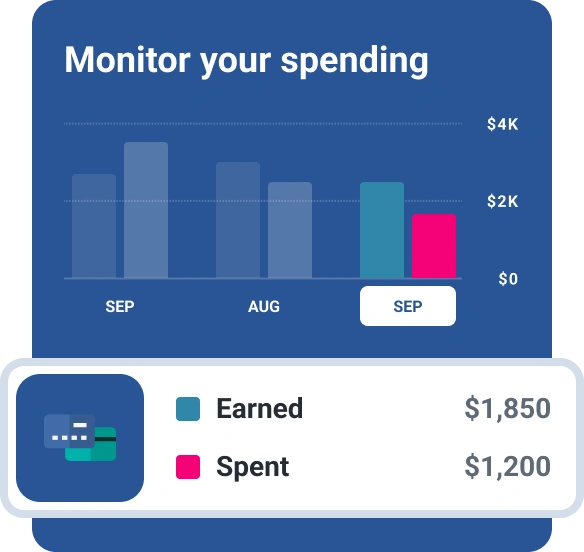

- Credit limits: Student credit cards typically have lower credit limits than traditional cards, since students likely aren't at the top of their earning potential while in school. Your individual credit limit will depend on your income and credit history. But for a student card, it could be as low as $500.

- Fee structure: Student cards, even those that let you earn rewards, often don't have annual fees. Some also waive the first late payment fee, since those new to credit may need time to get used to paying bills regularly.

- Perks: Student cards that offer cash back rewards often have rewards categories that reflect student spending. It's common to earn cash back on streaming services, groceries and gas, for example. Some student cards also have introductory 0% APR offers, which means you won't pay interest on purchases for a certain number of billing cycles. These can be valuable perks, especially for those with little to no credit history. Regular credit cards, however, offer a wider range of reward options to cardholders with good or excellent credit.

Regular vs. Student Credit Card Requirements

One of the biggest differences between student and regular credit cards is how to qualify. Student cards are more limited in their rewards offerings and in the size of the credit line you'll receive, but they may have less stringent credit score requirements than regular cards. Here are the major differences.

- Student status: To get a student card, you may need to prove that you're currently attending a two- or four-year college, or that you've been admitted to one and will start in the next three months.

- Income: According to the Credit CARD Act of 2009, if you're age 18 to 21, you'll need to show that you have independent income, or else use a cosigner, to get a credit card. However, it's no longer common for credit card issuers to allow cosigners. So while it could seem challenging to meet a credit card issuer's income requirements, student cards often allow different sources of income to be included on credit card applications, such as grants, scholarships or a regular allowance from parents.

- Credit score: Student credit card issuers know that student applicants likely won't have long credit histories behind them. Therefore, while you often need good credit to qualify for traditional rewards cards, student cards with cash-back rewards may require either fair credit only or no credit score at all.

Other Ways for College Students to Build Credit

For some college students, a credit card may be out of reach or unappealing. If you don't qualify for a student card or you're worried about making purchases you won't be able to pay off, consider these options:

- Secured credit card: Those new to credit are excellent candidates for secured credit cards, which require a cash deposit that typically becomes your credit limit. If you fail to pay a bill, the issuer uses your deposit to make your payment. Secured cards may be easier to qualify for than student cards since the deposit minimizes risk for the issuer.

- Become an authorized user: You can also ask a friend or family member who uses credit wisely to add you to their account as an authorized user. You'll get access to their credit history, which will populate your credit report, but you won't be legally responsible for making credit card payments.

- Try Experian Go™: If you are completely new to credit, Experian Go can help you establish a credit report and get credit for bills you already pay, such as cellphone, utility, rent, insurance and streaming service bills.

- Make all student loan payments on time: If you have student loans, you already have the opportunity to build credit. When you make every student loan payment on time upon graduation or leaving school, your credit should improve. But that means, while in school, borrowing only what you know you'll be able to afford paying back.

FAQ

The Bottom Line

If you're ready to use credit for the first time, with all the long-term repercussions that entails, a student credit card is a worthwhile option to consider. Compared with traditional credit cards, they may be easier to get and carry less risk in the form of lower credit limits.

But no matter the type of credit card you choose, the best practices are the same: Make all payments on time and keep your spending as low as possible to build credit history that will benefit you for years to come.

Credit cards for students

Looking to build your credit? Browse credit cards and secured credit cards designed for students. Get started with your FICO® Score. for free

See your offersAbout the author

Brianna McGurran is a freelance journalist and writing teacher based in Brooklyn, New York. Most recently, she was a staff writer and spokesperson at the personal finance website NerdWallet, where she wrote "Ask Brianna," a financial advice column syndicated by the Associated Press.

Read more from Brianna