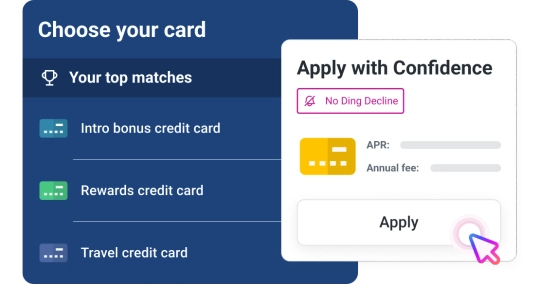

No Ding Decline

Get matched to credit cards that won’t ding your credit scores if you are not approved⊛

- See personalized credit card offers based on your credit profile.

- Find out if you are approved before any impact to your credit scores.

Checking your matched credit cards will NOT hurt your credit scores

More ways to find the right credit card for you

Credit cards matched for you

We work directly with financial institutions to provide your best matches from our partners. These offers are personalized to your credit profile so you’re more likely to qualify.

Pre-approved

Being pre-approved⏃ means you have higher chances of eligibility for a certain offer—check for these offers first when you’re ready for a new credit card.

No Ding Decline

Cards labeled ‘No Ding Decline’ won’t hurt your credit scores if you are not approved.

Why it matters

Experian’s No Ding Decline

When applying for a credit card, most lenders will perform a hard inquiry on your credit report which can negatively impact your credit scores. With Experian’s No Ding Decline, only a soft inquiry is performed when applying for cards labeled ‘No Ding Decline,’ so if you are declined there is no impact to your credit scores.